How to get URL link on X (Twitter) App

[1] How Invoice Discounting Works?

[1] How Invoice Discounting Works?

[1] What are Real Estate Investment Trusts (REITs)

[1] What are Real Estate Investment Trusts (REITs)

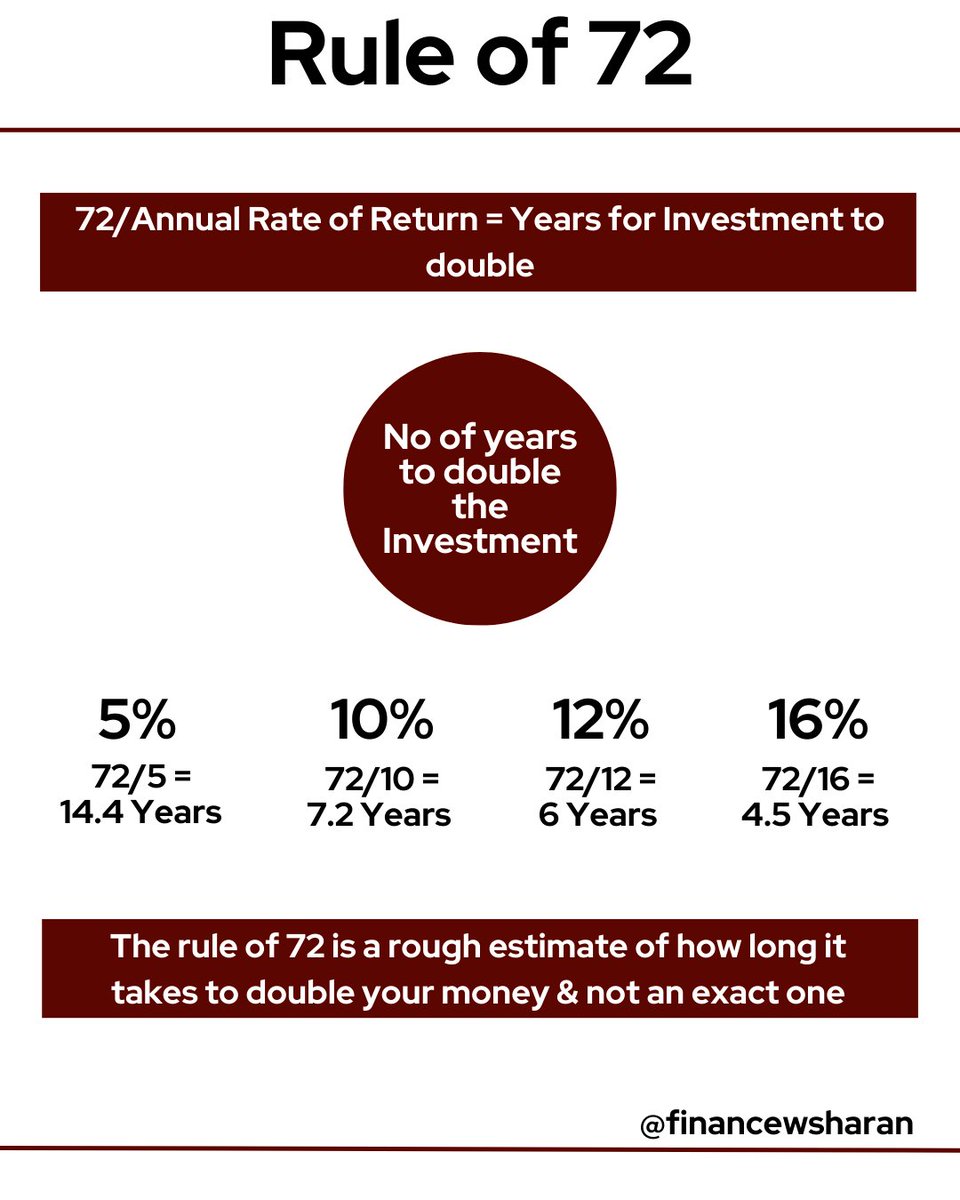

[1] Rule of 72

[1] Rule of 72

[1] What is 80C?

[1] What is 80C?