How to get URL link on X (Twitter) App

Our quarterly reports looks at 5 main things:

Our quarterly reports looks at 5 main things:

2/ On the yield aggregator side, the team has already proved that it can move fast, having already integrated with @AaveAave, @compoundfinance, @saffronfinance_, @dydxprotocol, @mstable_

2/ On the yield aggregator side, the team has already proved that it can move fast, having already integrated with @AaveAave, @compoundfinance, @saffronfinance_, @dydxprotocol, @mstable_

@nic__carter 2) First of all, I want to link to @nic__carter’s amazing master’s thesis, coinmetrics.io/papers/dissert…. Even though many things have evolved since he published it in 2017, it stays one of the most detailed, structured and broad report on cryptoassets I’ve read to date.

@nic__carter 2) First of all, I want to link to @nic__carter’s amazing master’s thesis, coinmetrics.io/papers/dissert…. Even though many things have evolved since he published it in 2017, it stays one of the most detailed, structured and broad report on cryptoassets I’ve read to date.

One of the key findings was that the real 6-months inflation (from October 2018 to March 2019), based on on-chain analysis, was likely to be 11.6%, compared to 4.5% reported by Ripple’s API.

One of the key findings was that the real 6-months inflation (from October 2018 to March 2019), based on on-chain analysis, was likely to be 11.6%, compared to 4.5% reported by Ripple’s API.

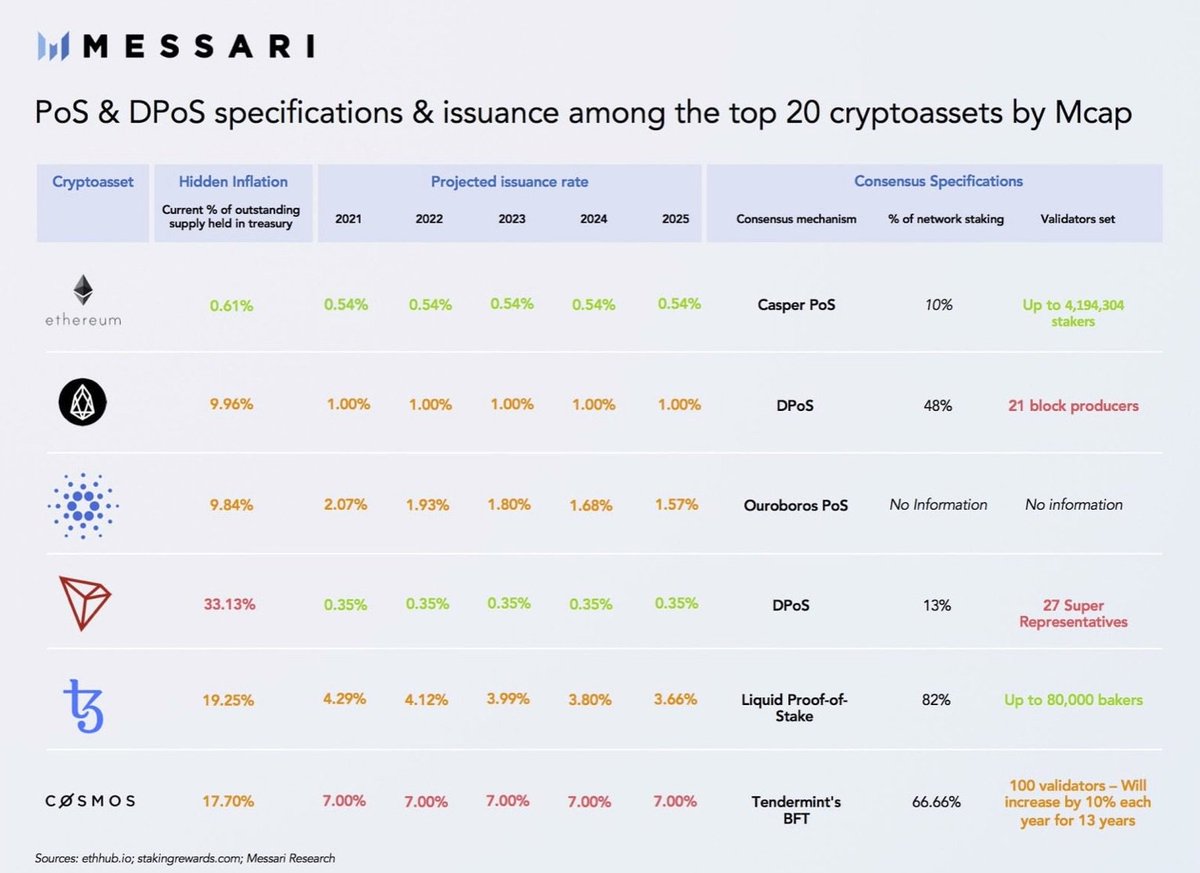

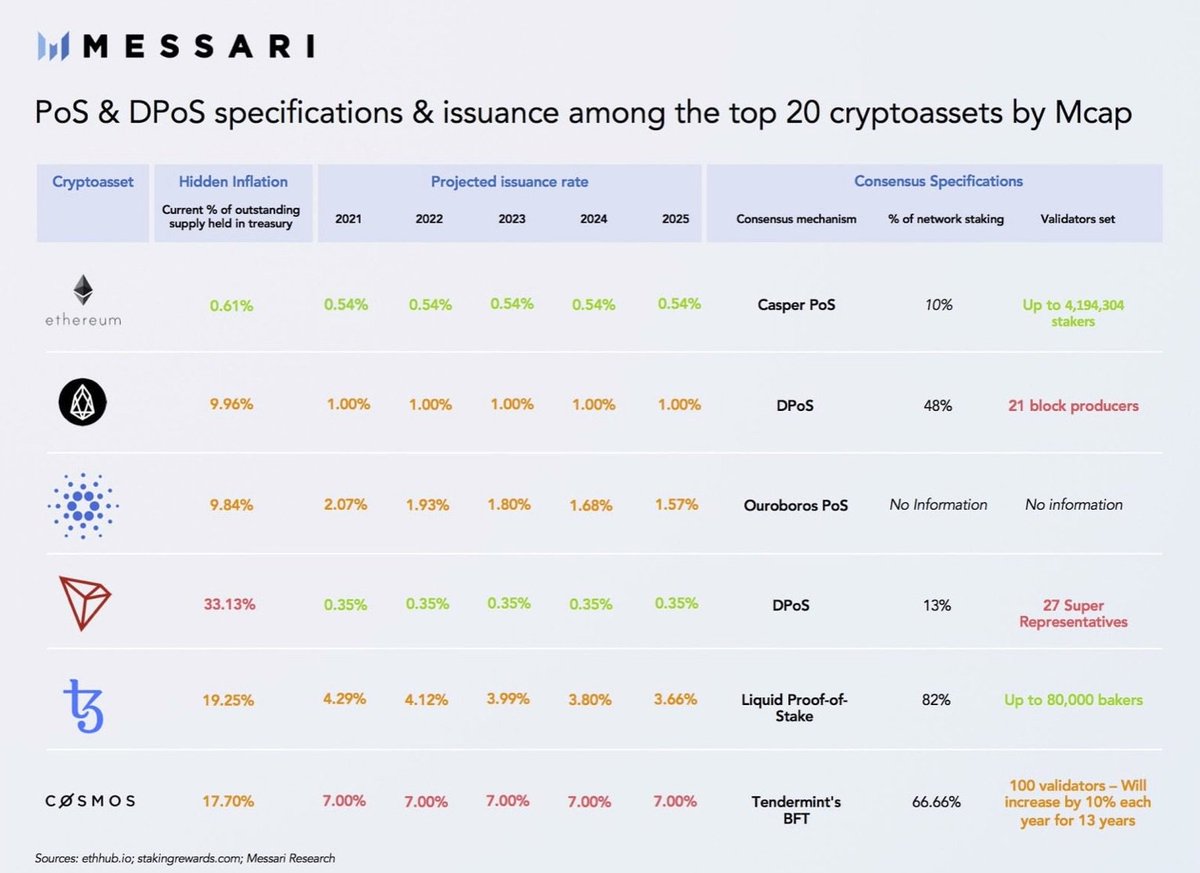

Staking yields are usually calculated by taking into account network issuance and staking participation. Network issuance itself may take many different forms in the case of staked-based protocols. Let’s first take a look at 6 models currently used for issuance:

Staking yields are usually calculated by taking into account network issuance and staking participation. Network issuance itself may take many different forms in the case of staked-based protocols. Let’s first take a look at 6 models currently used for issuance: