How to get URL link on X (Twitter) App

Aggregate output (Y) is the sum of all the goods and services produced in an economy over a certain period of time. GDP is its most commonly reported measure. 2/10

Aggregate output (Y) is the sum of all the goods and services produced in an economy over a certain period of time. GDP is its most commonly reported measure. 2/10

https://twitter.com/dgwbirch/status/1501851900215496704Bitcoin is often assimilated to money, but it has very different properties. Unlike money, it is a relatively illiquid medium of exchange, not demanded by most people —due to the volatility inherent to its deterministic supply— and hence not convenient for regular payments. 2/5

2/ But no Bitcoin blocks need to be reorged in order to reorg a merge-mined chain. It will suffice that Bitcoin miners find a greater incentive to reorg that chain than the worth of the AC rewards they would otherwise earn.

2/ But no Bitcoin blocks need to be reorged in order to reorg a merge-mined chain. It will suffice that Bitcoin miners find a greater incentive to reorg that chain than the worth of the AC rewards they would otherwise earn.

@Mario_Gibney 6. Altcoins like ether are pseudo-liabilities, not a real asset like bitcoin, as most of their value depends on a few guys delivering on their promises of future features not yet implemented and their governance (e.g. arbitrary emission changes).

@Mario_Gibney 6. Altcoins like ether are pseudo-liabilities, not a real asset like bitcoin, as most of their value depends on a few guys delivering on their promises of future features not yet implemented and their governance (e.g. arbitrary emission changes). https://twitter.com/fnietom/status/1035844401103286272

2/ Financial assets could potentially achieve nearly zero friction but, having no trust-minimized competitor better than gold (~2% annual erosion) and being vulnerable to state coercion, they hardly achieve erosions lower than 2% (i.e. >3% risk-adjusted nominal returns).

2/ Financial assets could potentially achieve nearly zero friction but, having no trust-minimized competitor better than gold (~2% annual erosion) and being vulnerable to state coercion, they hardly achieve erosions lower than 2% (i.e. >3% risk-adjusted nominal returns).

There are multiple reasons to sell BTC futures, pushing their price down:

There are multiple reasons to sell BTC futures, pushing their price down:

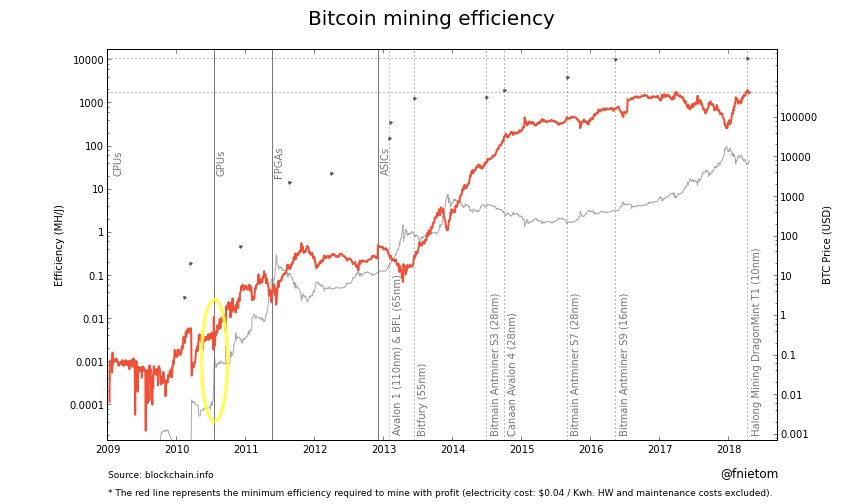

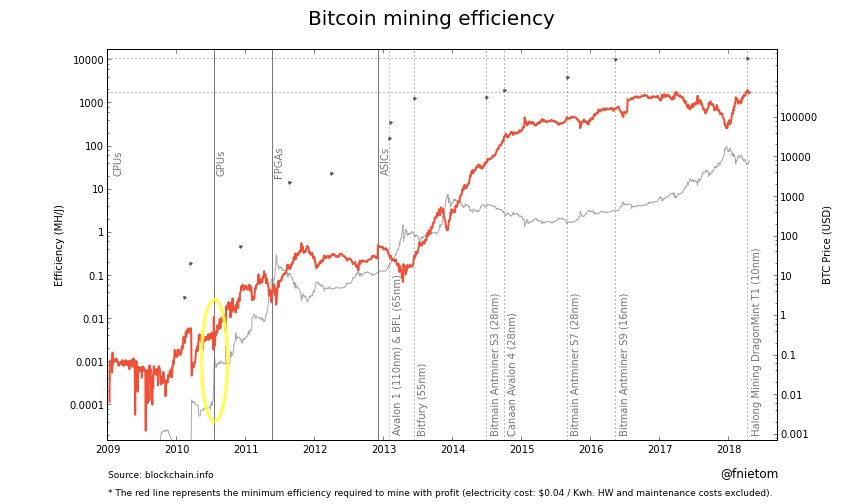

The subjective theory of value states that the value of a good is determined by the importance an acting individual places on it. ArtForz was not selling, so he restricted the offer forcing buyers to reconsider the subjective value of bitcoin and buy at CPU miners price.

The subjective theory of value states that the value of a good is determined by the importance an acting individual places on it. ArtForz was not selling, so he restricted the offer forcing buyers to reconsider the subjective value of bitcoin and buy at CPU miners price.