Occasional blogs on econ/finance/development/crypto. Policy Fellow @LSEPublicPolicy. Views my own.

How to get URL link on X (Twitter) App

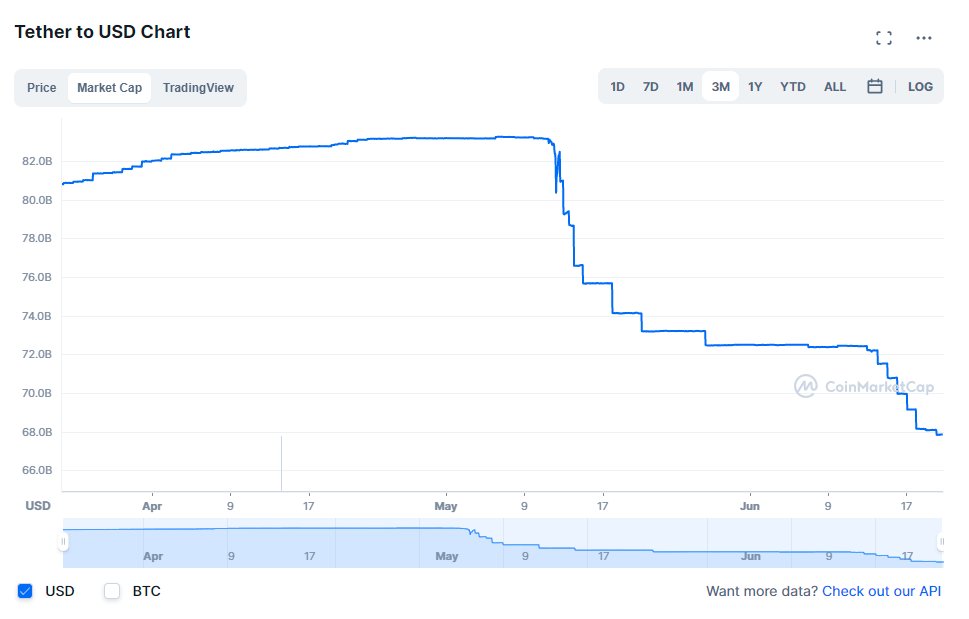

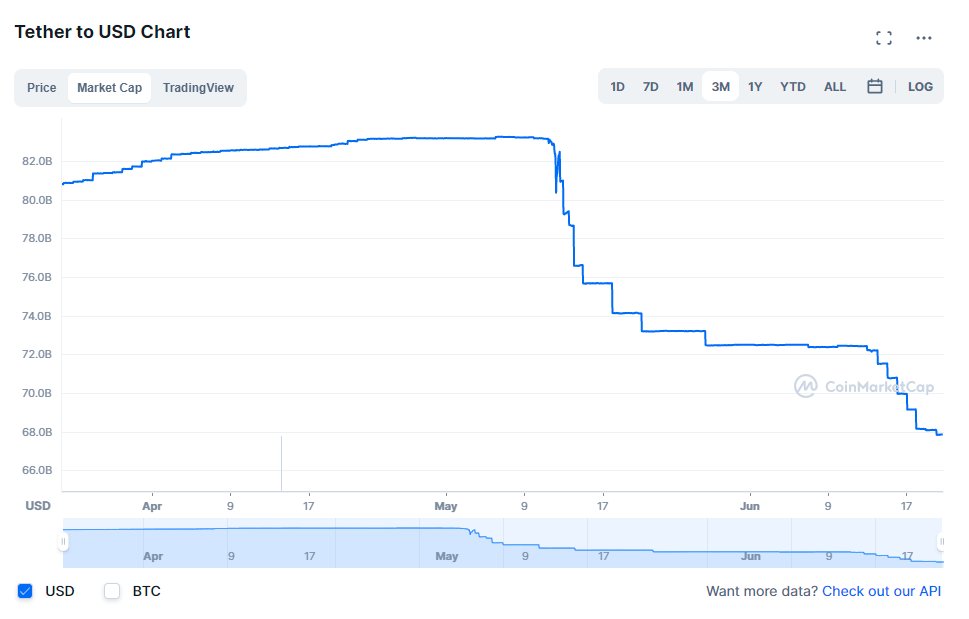

If it isn't, crypto is in for another wipeout, possibly as big as the last 3mo in percentage terms

If it isn't, crypto is in for another wipeout, possibly as big as the last 3mo in percentage termshttps://twitter.com/BitcoinMagazine/status/1509244690419302404?s=20&t=uiGFWnUIQW6pfn6T7EcEiABitcoin as a unit of account is just unworkable. Ask yourself: