Global macro and currencies • Trader 40+ yrs (age... or experience?) • DMs closed due to spam • Free weekly newsletter on Substack

3 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/fxmacroguy/status/17034050411290339361️⃣ Let's get the nerdy part out of the way first: there are futures with no volume traded or even no open interest, yet they have a price, see this chart of NG as an example. How does that work?

1️⃣ Futures have an expiration date. Plotting the price of each expiration for a given day will show the term structure. See the chart for crude oil $CL_F on August 8, 2022, as an example: further-dated expirations were cheaper than nearer-dated ones.

1️⃣ Futures have an expiration date. Plotting the price of each expiration for a given day will show the term structure. See the chart for crude oil $CL_F on August 8, 2022, as an example: further-dated expirations were cheaper than nearer-dated ones.

📊 Econ Data: Another CPI surprise out of Japan 🇯🇵 early in the morning. The BOJ Core CPI is now at 3.1%.

📊 Econ Data: Another CPI surprise out of Japan 🇯🇵 early in the morning. The BOJ Core CPI is now at 3.1%.

📰 Overnight headlines

📰 Overnight headlines

📊 Econ Data: The CB Leading Economic Index for the US 🇺🇸 declined further.

📊 Econ Data: The CB Leading Economic Index for the US 🇺🇸 declined further.

📰 Overnight headlines

📰 Overnight headlines

📊 Econ Data: University of Michigan Consumer Sentiment has been improving quite steadily since it made its low in June last year. 2/6

📊 Econ Data: University of Michigan Consumer Sentiment has been improving quite steadily since it made its low in June last year. 2/6

👉 Let's look at stocks first with the $ES

👉 Let's look at stocks first with the $ES

📊 Econ Data: The ISM Services PMI disappointed significantly but the comments sound relatively upbeat.

📊 Econ Data: The ISM Services PMI disappointed significantly but the comments sound relatively upbeat.

📰 Overnight headlines

📰 Overnight headlines

📊 Econ Data:

📊 Econ Data:

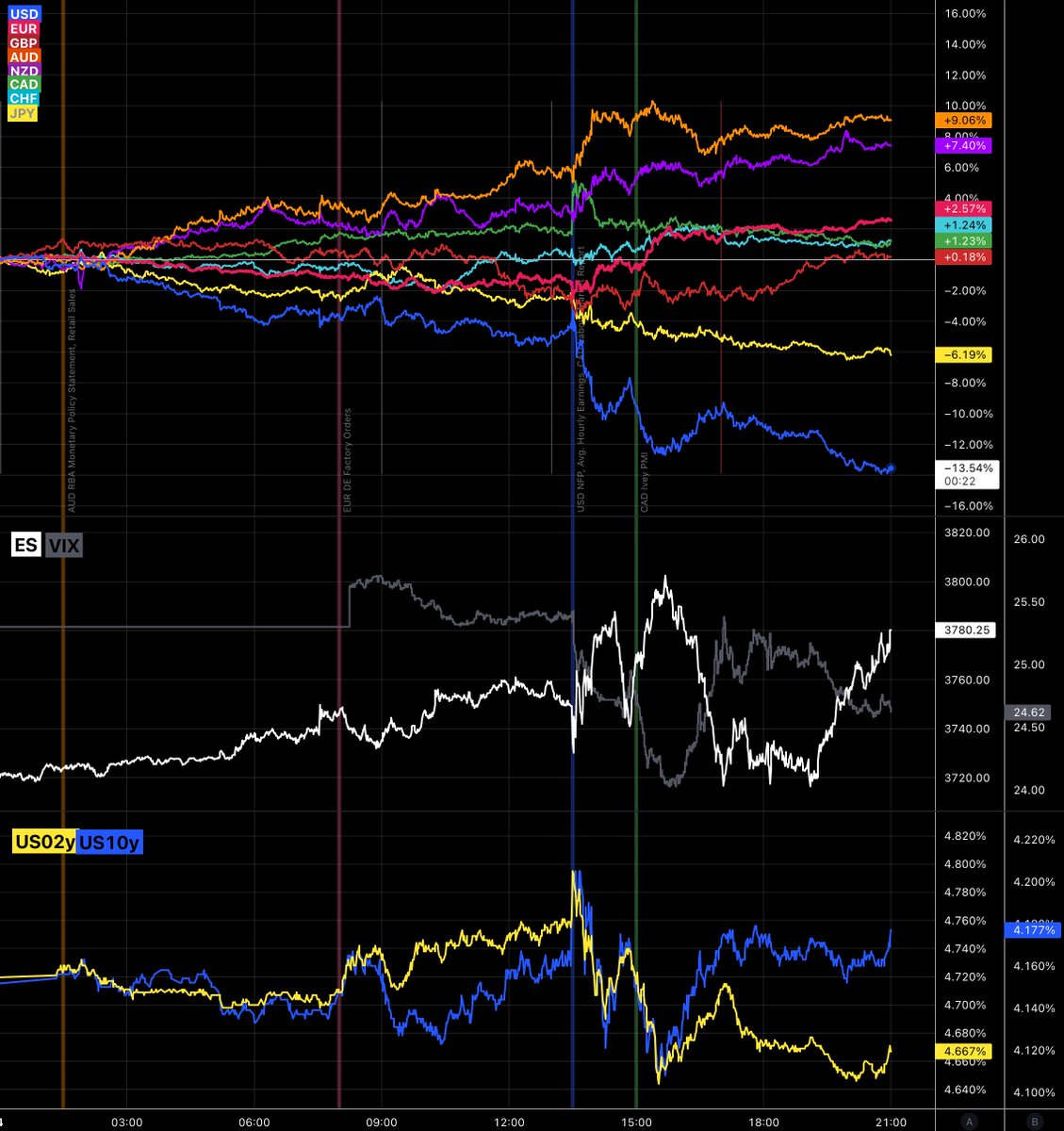

📊 Dollar weaker on a surprise in Non-Farm Payrolls and Avg. Hourly Earnings (not sure why, though...), hot Canadian labour data only impressed CAD for a very short while, AUD and NZD are the strongest currencies for the day. Stocks and bonds: mostly sideways. 2/18

📊 Dollar weaker on a surprise in Non-Farm Payrolls and Avg. Hourly Earnings (not sure why, though...), hot Canadian labour data only impressed CAD for a very short while, AUD and NZD are the strongest currencies for the day. Stocks and bonds: mostly sideways. 2/18

🏦 🇺🇸 FOMC Statement:

🏦 🇺🇸 FOMC Statement:

🏦 🇦🇺 RBA Rate Statement: hike 25 bps as expected

🏦 🇦🇺 RBA Rate Statement: hike 25 bps as expected

📊 Eurozone CPI came in hot again at 10.7% y/y. Core CPI also surprised to the upside. All of that despite the recent fall in energy prices. 2/9

📊 Eurozone CPI came in hot again at 10.7% y/y. Core CPI also surprised to the upside. All of that despite the recent fall in energy prices. 2/9