Chasing wealth and income, present and past, onshore and offshore.

https://t.co/jdQVD5ruAI (en Français)

https://t.co/IpQJX9eXvQ (in English)

13 subscribers

How to get URL link on X (Twitter) App

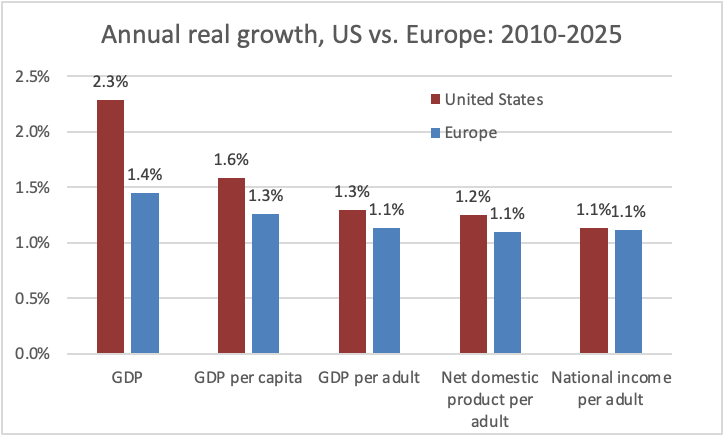

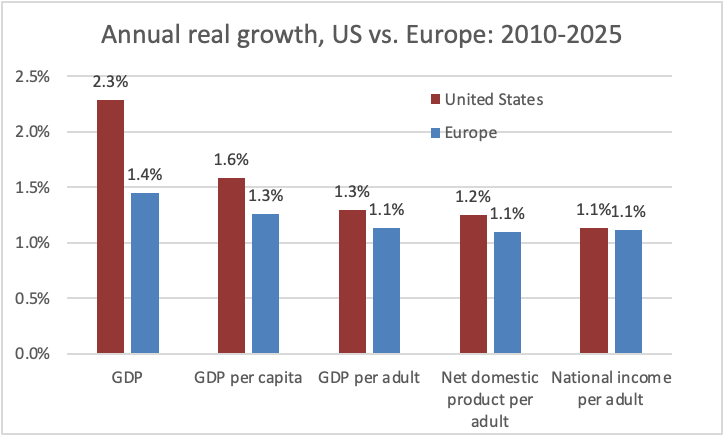

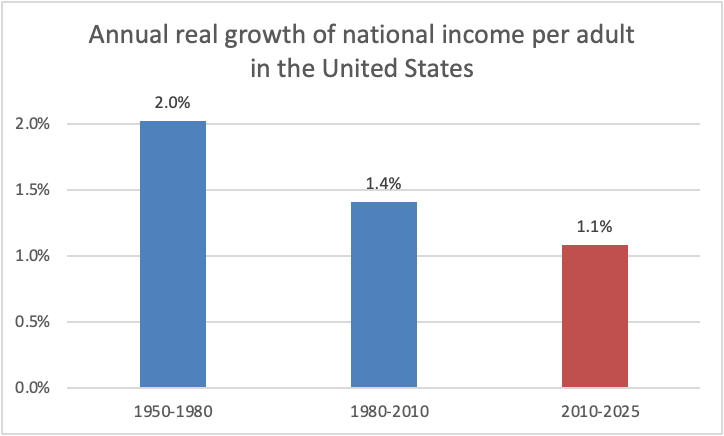

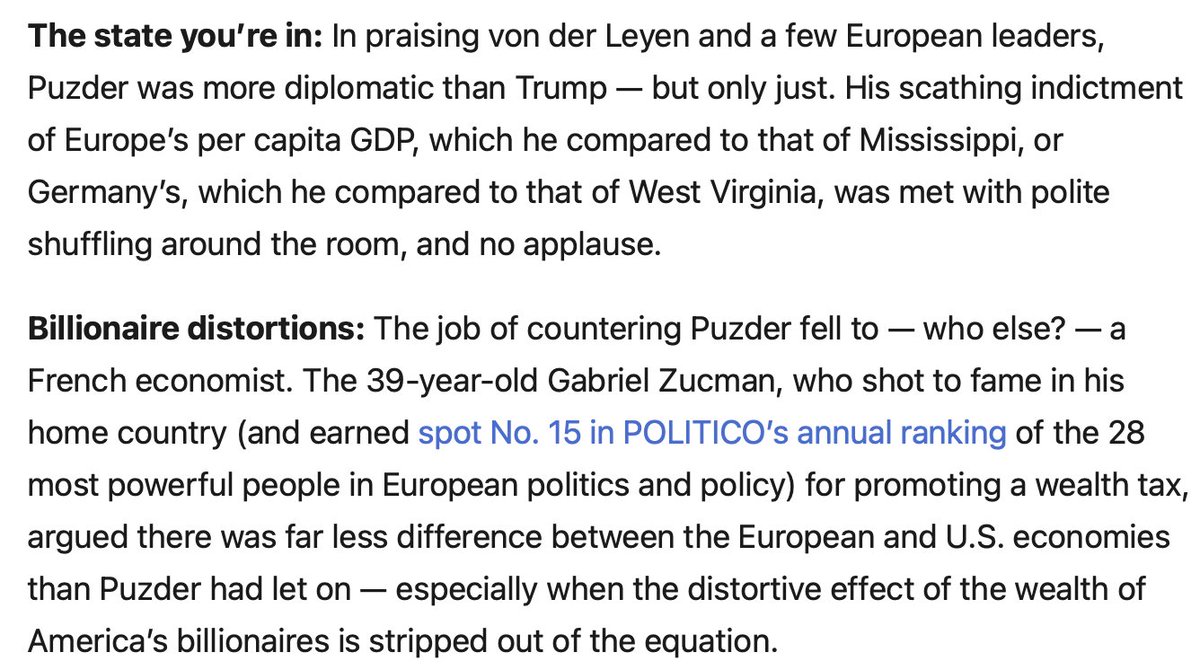

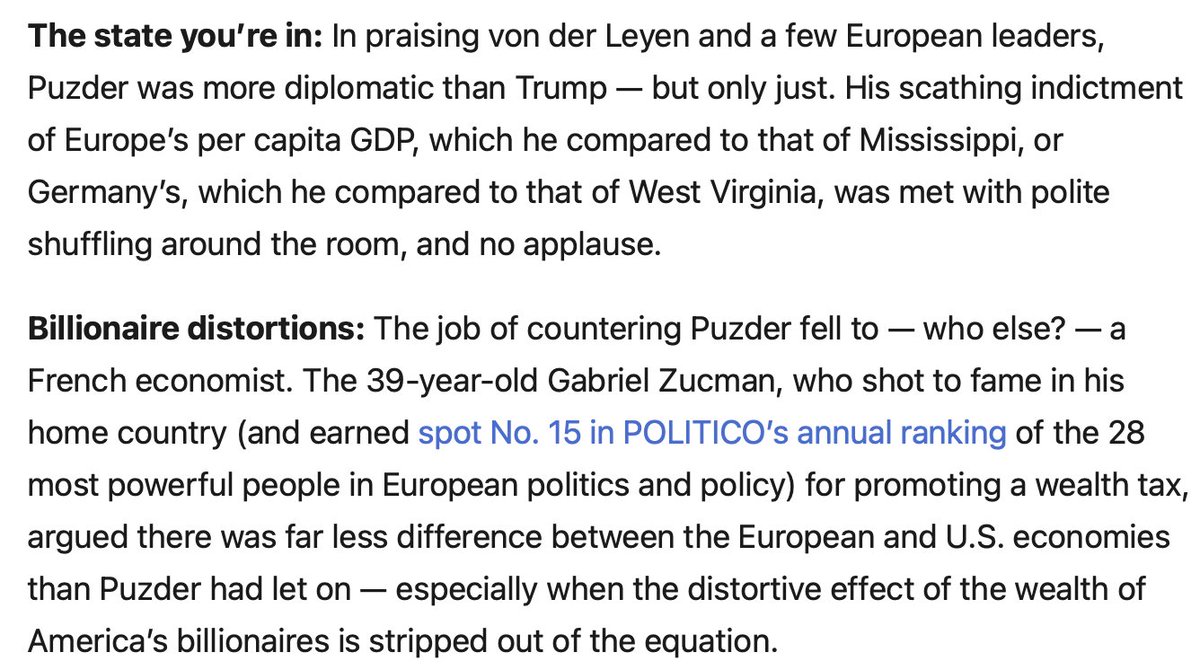

In a previous thread I focused on US growth

In a previous thread I focused on US growthhttps://x.com/gabriel_zucman/status/2013715708471812561

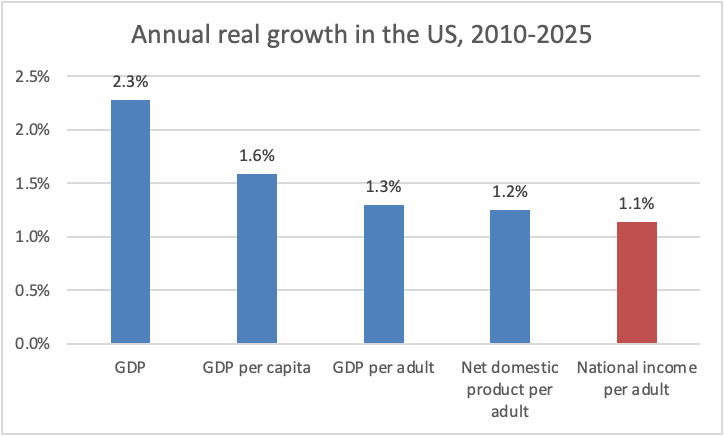

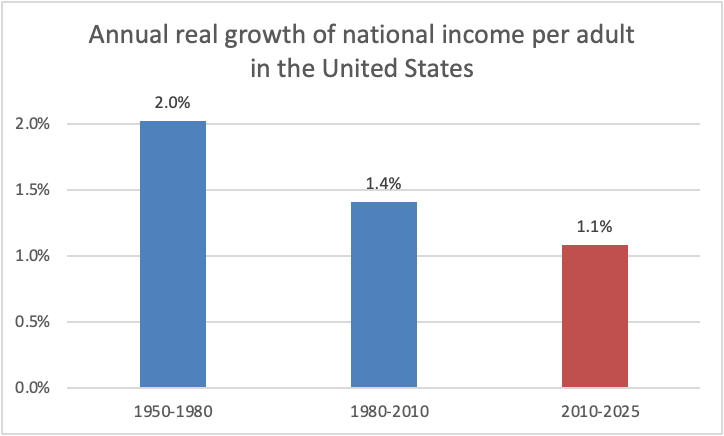

I’m going to focus on the most basic macroeconomic statistics of the US.

I’m going to focus on the most basic macroeconomic statistics of the US.

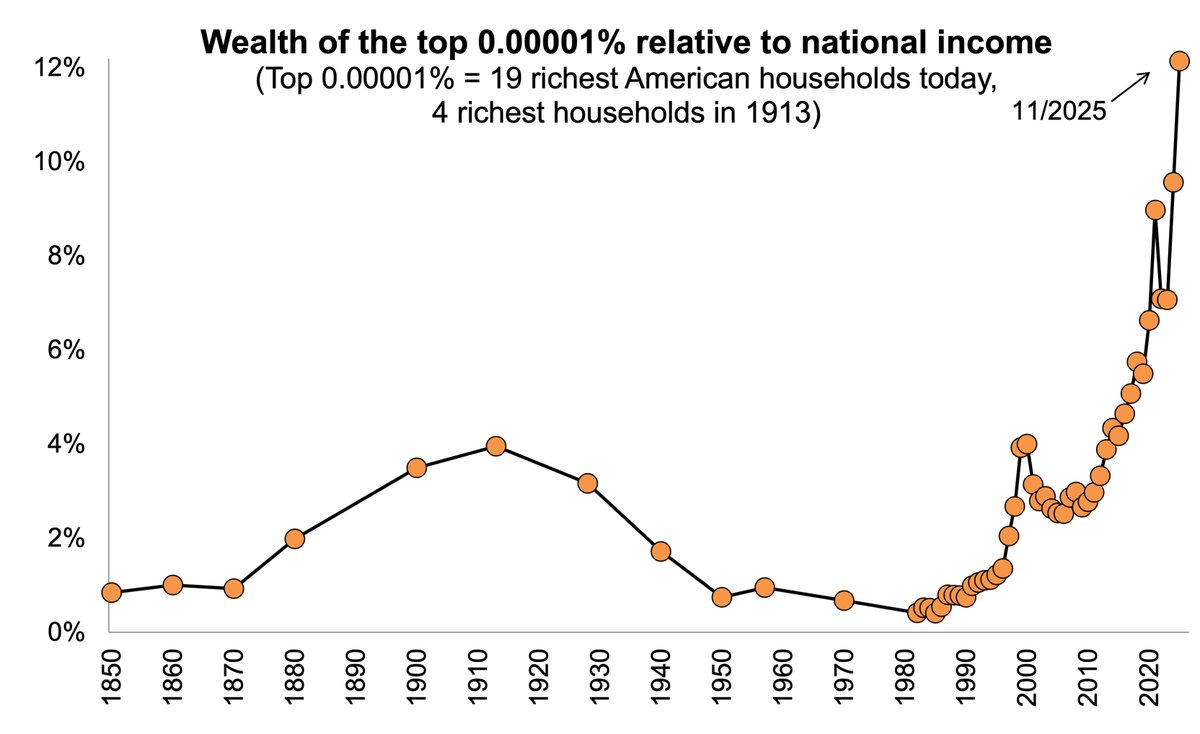

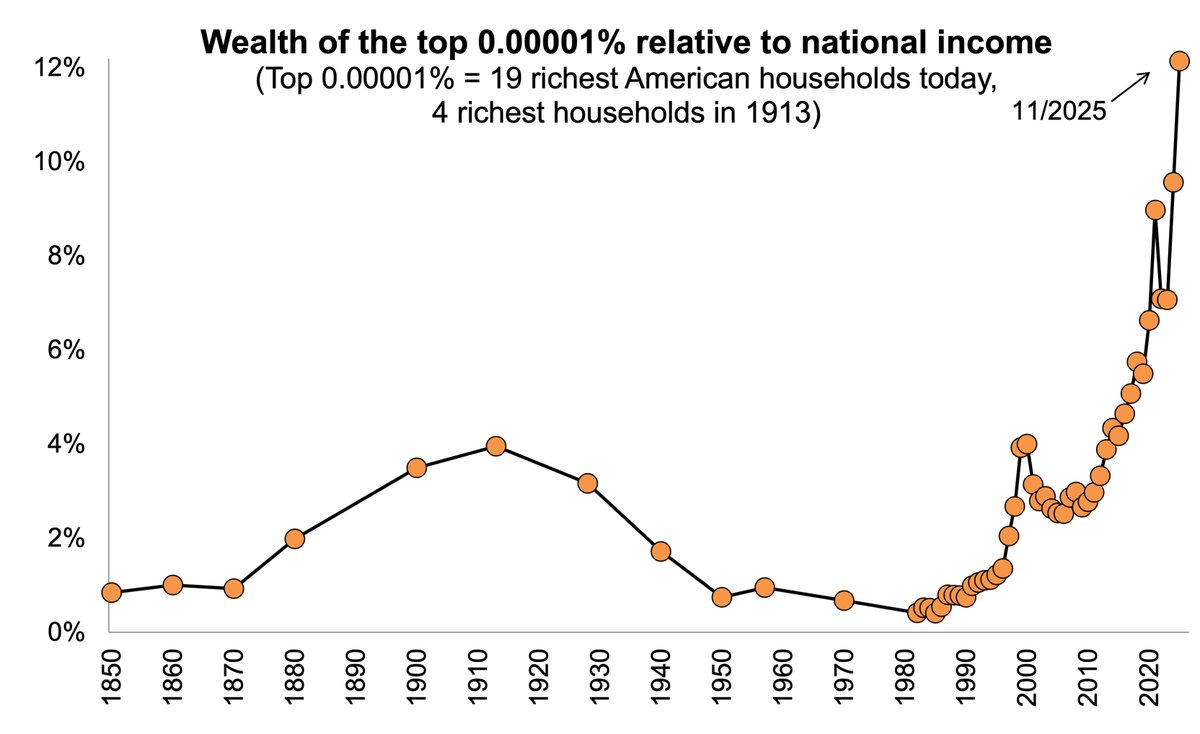

These series update and extend those presented in Figure 3 of this paper:

These series update and extend those presented in Figure 3 of this paper:

In 2021, more than 130 countries agreed to tax large corporations at a minimum rate of 15%.

In 2021, more than 130 countries agreed to tax large corporations at a minimum rate of 15%.

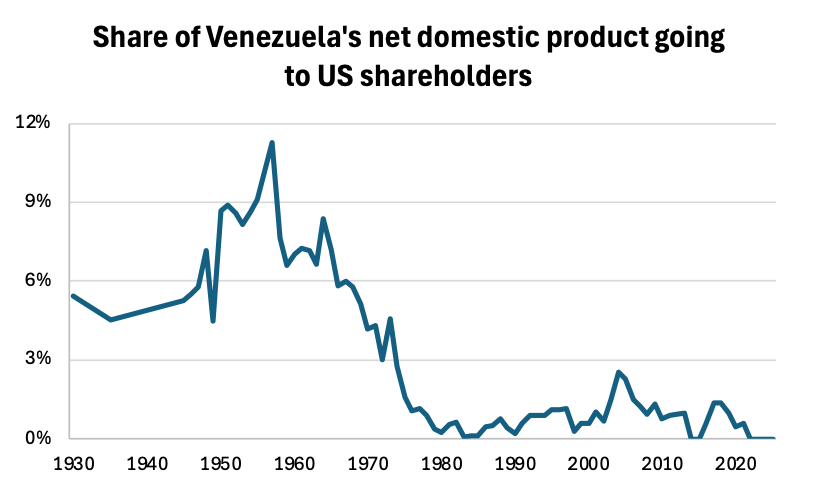

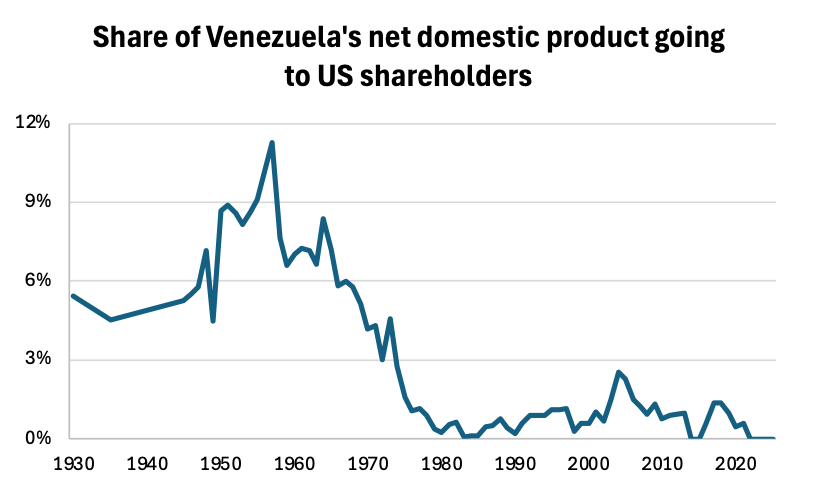

Maduro was of course a brutal and corrupt autocrat.

Maduro was of course a brutal and corrupt autocrat.

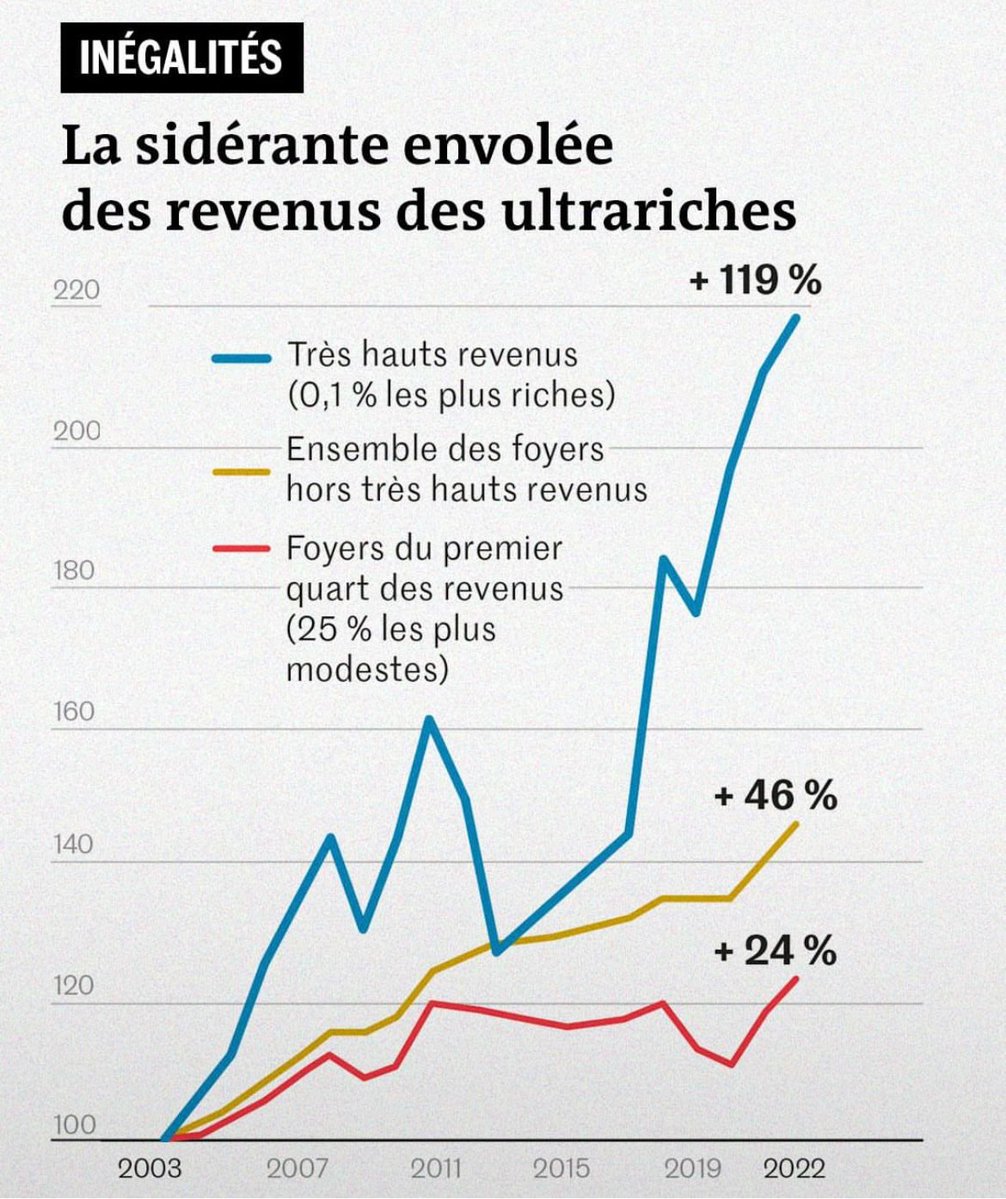

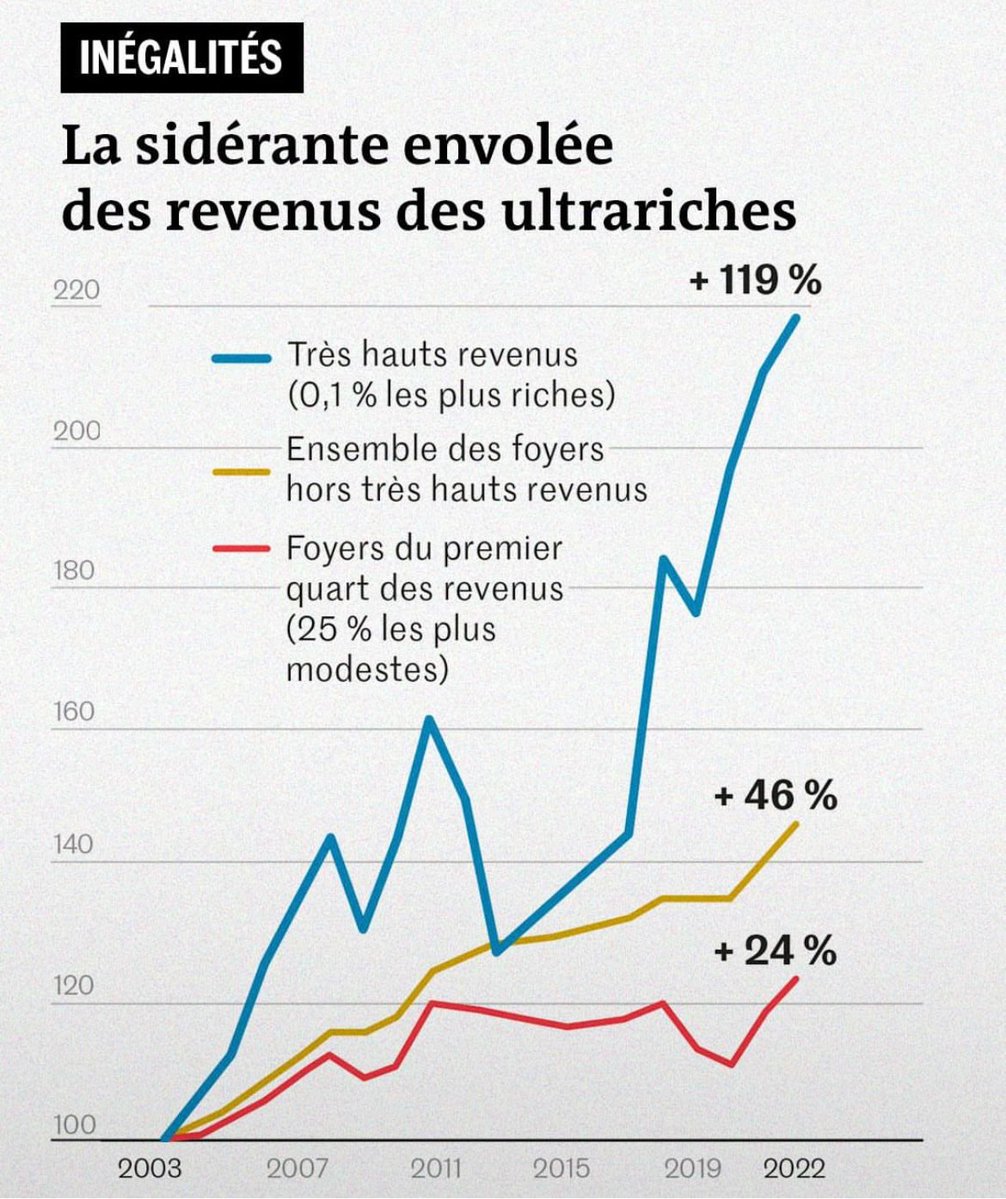

Les révélations de Cash Investigation viennent confirmer ce que les travaux universitaires, portant sur l’ensemble des milliardaires, ont établi :

Les révélations de Cash Investigation viennent confirmer ce que les travaux universitaires, portant sur l’ensemble des milliardaires, ont établi :

Premier constat : la prospérité des 0,1% les plus riches

Premier constat : la prospérité des 0,1% les plus riches

https://x.com/MaudBregeon/status/1968931686390861851Le mécanisme que je propose concerne les seules personnes physiques – pas les entreprises – dont la fortune personnelle dépasse les 100 millions d’euros.

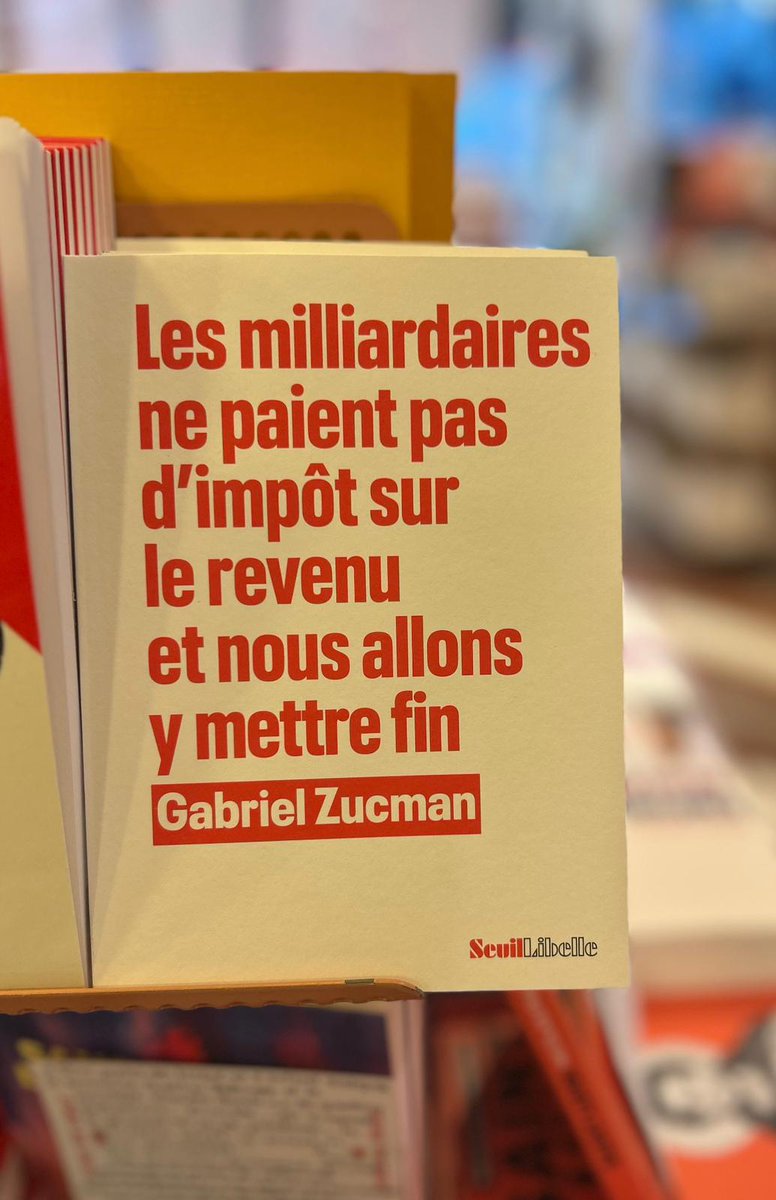

Je l’ai écrit pour toutes ces Françaises et tous ces Français qui ont été intrigués par l’impôt plancher de 2% que je défends, pour certains se sont même passionnés pour le sujet, et veulent s'armer intellectuellement pour ce débat qui ne fait que commencer

Je l’ai écrit pour toutes ces Françaises et tous ces Français qui ont été intrigués par l’impôt plancher de 2% que je défends, pour certains se sont même passionnés pour le sujet, et veulent s'armer intellectuellement pour ce débat qui ne fait que commencer

https://x.com/LCP/status/1980626529206874572Les raisons de cet échec sont connues : exonération, dans le dispositif que vous proposez, des biens professionnels (qui correspondent aux actions détenues par les milliardaires dans leurs groupes) ; multiplication des niches, j’en parlais déjà ici ⬇️

https://x.com/gabriel_zucman/status/1978015255478292808

C’est une histoire édifiante qui débute en 1981

C’est une histoire édifiante qui débute en 1981

Je remercie @C_deCourson et @ericcoquerel, respectivement rapporteur général et président de la Commission des Finances – qui portent des visions différentes sur cette proposition – d’avoir organisé ce débat de qualité

Je remercie @C_deCourson et @ericcoquerel, respectivement rapporteur général et président de la Commission des Finances – qui portent des visions différentes sur cette proposition – d’avoir organisé ce débat de qualité

À 21 ans j’épluchais les archives des banques suisses, je me plongeais dans les balances des paiements des pays, avec un but:

À 21 ans j’épluchais les archives des banques suisses, je me plongeais dans les balances des paiements des pays, avec un but: