Chartered Accountant in Practice|| Tax Advisor || Business and Start-up Consultant || Simplifying Finance for Everyone

2 subscribers

How to get URL link on X (Twitter) App

🔸Default Tax Regime

🔸Default Tax Regime

1. Tax on Gains from Sale of Foreign Shares

1. Tax on Gains from Sale of Foreign Shares

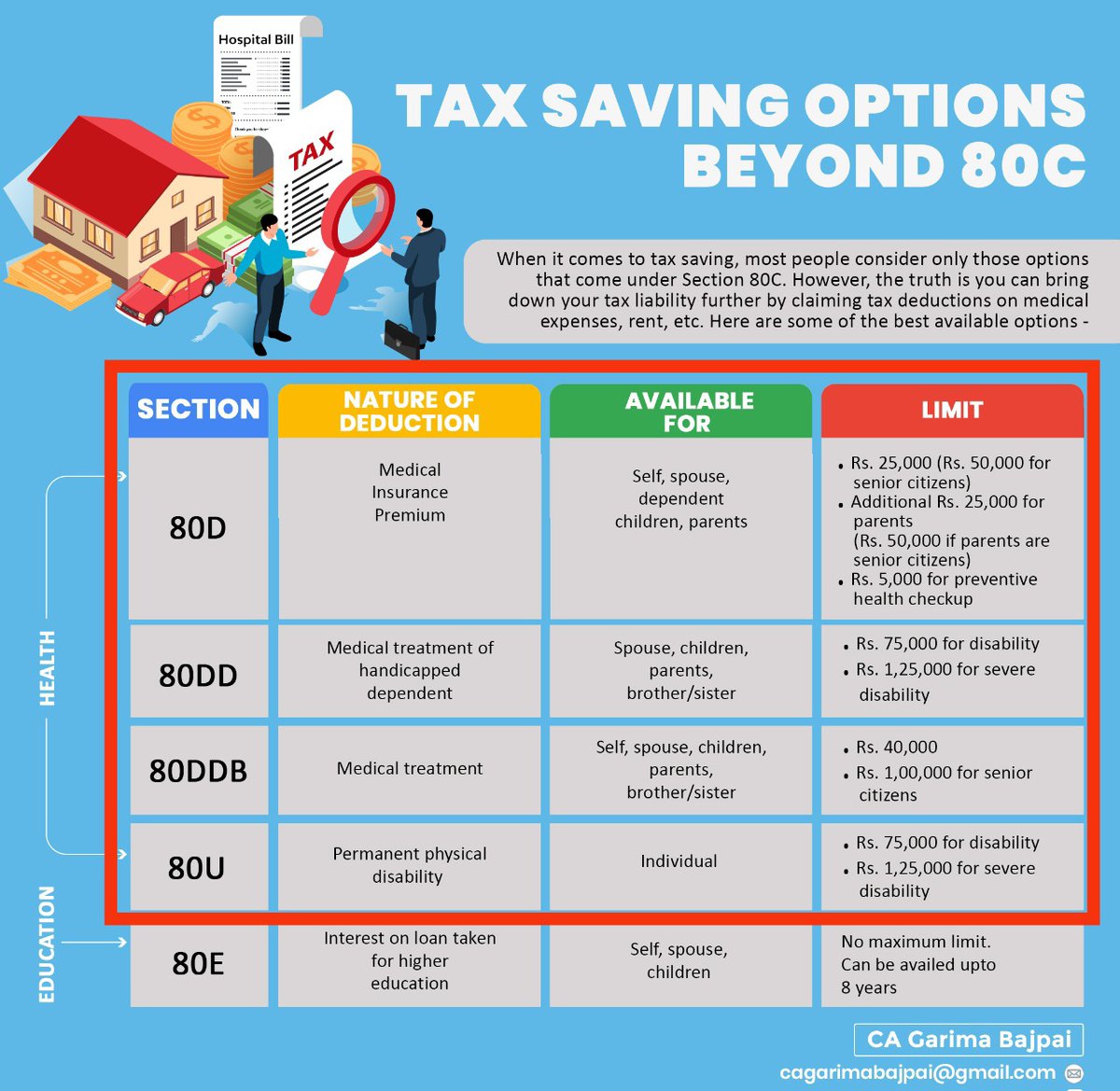

🔸Deductions on Investment: Section 80C, 80CCC, 80CCD(1)

🔸Deductions on Investment: Section 80C, 80CCC, 80CCD(1)

🔹What is Form 16?

🔹What is Form 16?

Can an Indian Citizen Register a Company in the USA? 🤔

Can an Indian Citizen Register a Company in the USA? 🤔

🔸The drawback of using Rule of Thumb 🚫

🔸The drawback of using Rule of Thumb 🚫

🔸Save Taxes on Sale of Residential Property - Section 54🏠

🔸Save Taxes on Sale of Residential Property - Section 54🏠

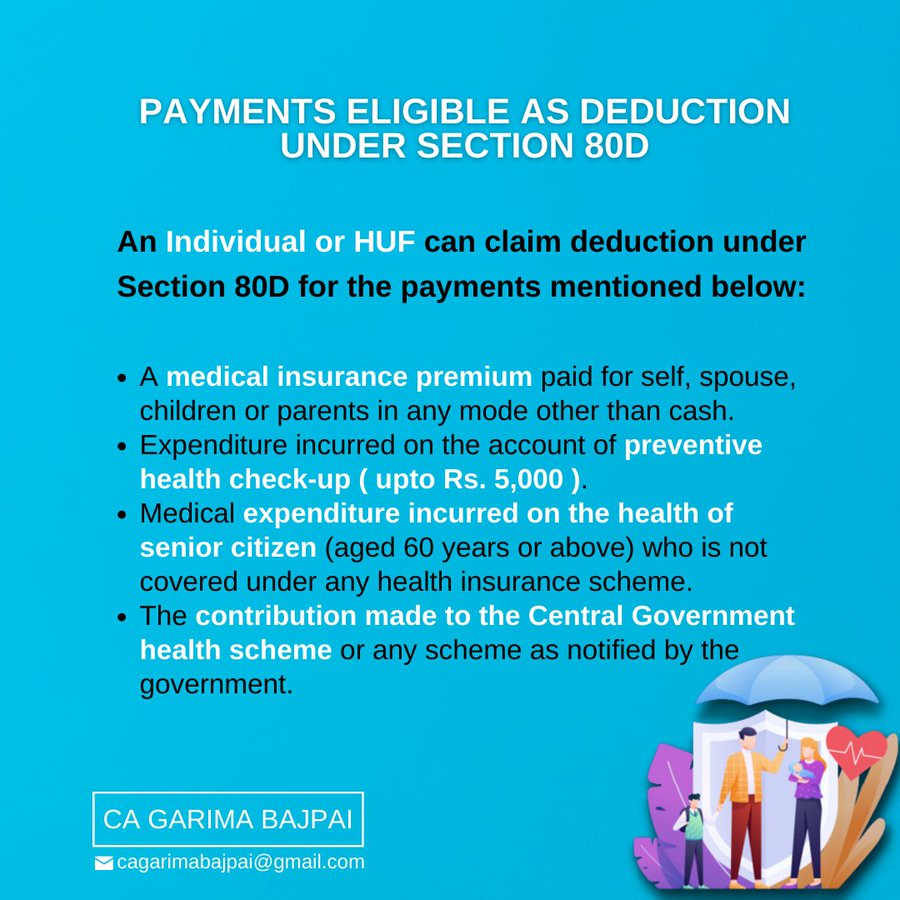

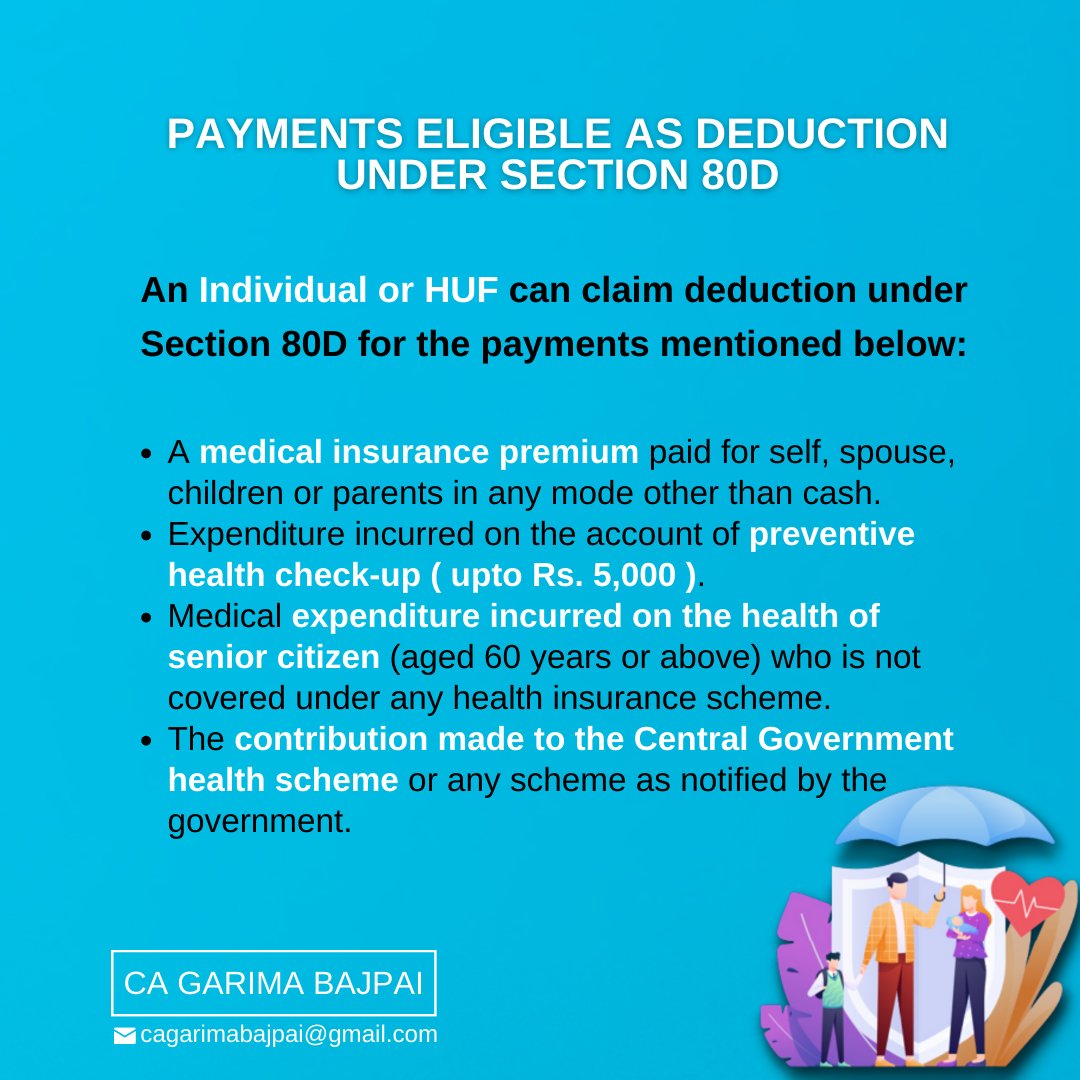

🔹Deduction for Medical Insurance (Section 80D)

🔹Deduction for Medical Insurance (Section 80D)

1⃣ Net Profit Margin

1⃣ Net Profit Margin

🔹Deduction for Medical Insurance (Section 80D)

🔹Deduction for Medical Insurance (Section 80D)

🔸What is Term Insurance?

🔸What is Term Insurance?

🔸What are SGBs?

🔸What are SGBs?

▪️ Deposits can be made in a Lumpsum or in Instalments.

▪️ Deposits can be made in a Lumpsum or in Instalments.

🔸Income Tax on Freelance Income

🔸Income Tax on Freelance Income

✳️First, we need to understand what LTCG is?

✳️First, we need to understand what LTCG is?