Trader in stock market/ Technical Analysis Trainer / https://t.co/NUKa5WSTnr https://t.co/CiufCdkXGt https://t.co/GtoFSA0b9L

14 subscribers

How to get URL link on X (Twitter) App

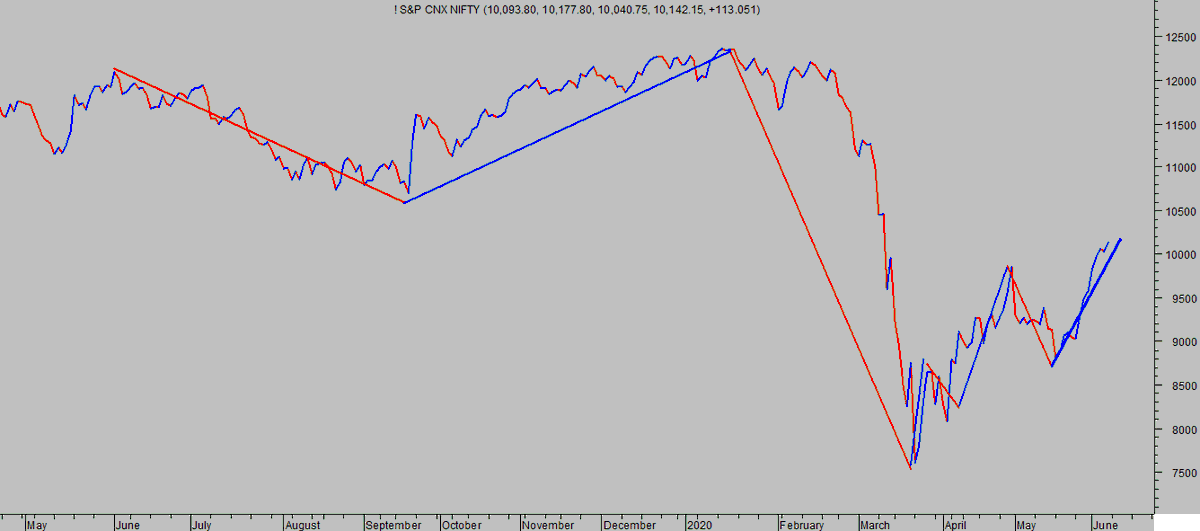

This level may change in coming days if swing in market change. (This is as per Dow theory, whose major drawback is signal generated is too late)

This level may change in coming days if swing in market change. (This is as per Dow theory, whose major drawback is signal generated is too late)

.... This level may change in coming days if swing in market change. (This is as per Dow theory, whose major drawback is signal generated is too late)

.... This level may change in coming days if swing in market change. (This is as per Dow theory, whose major drawback is signal generated is too late)

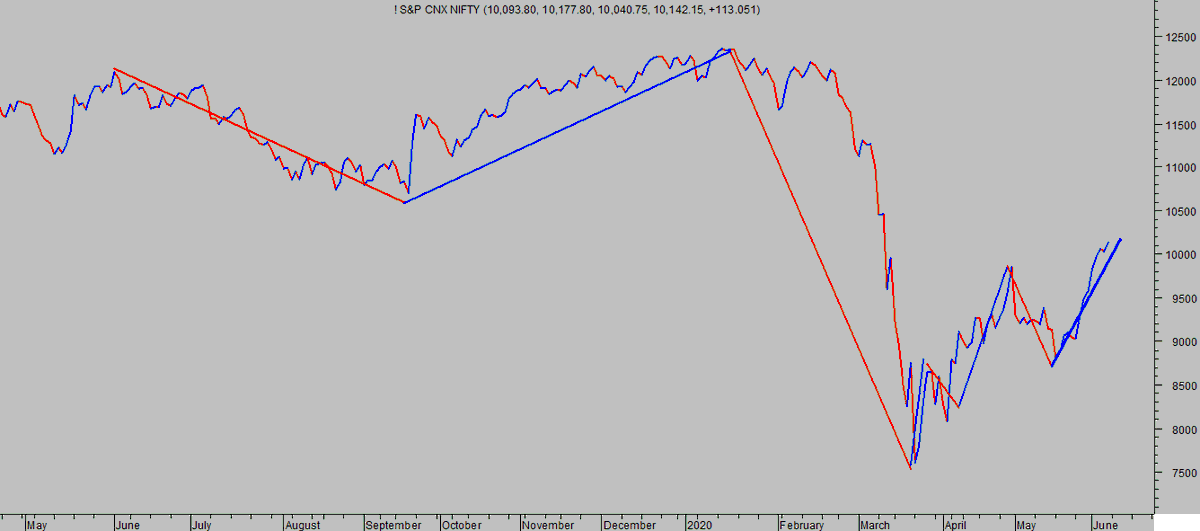

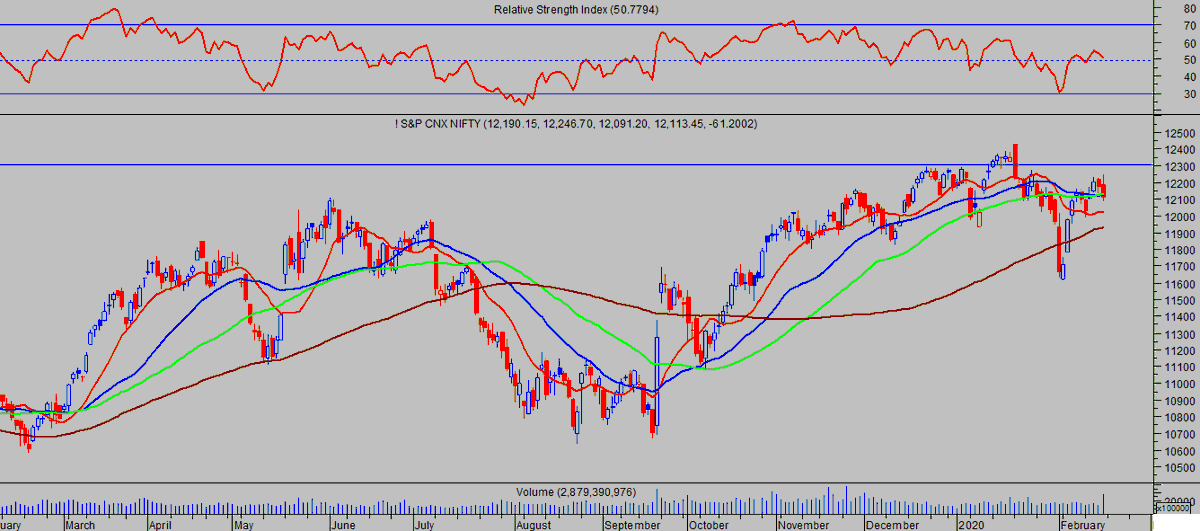

2. The index has crossed the 13 (red 9138) 30 (blue 9229) and 50 (green 8986) period SMA in the previous week.

2. The index has crossed the 13 (red 9138) 30 (blue 9229) and 50 (green 8986) period SMA in the previous week.

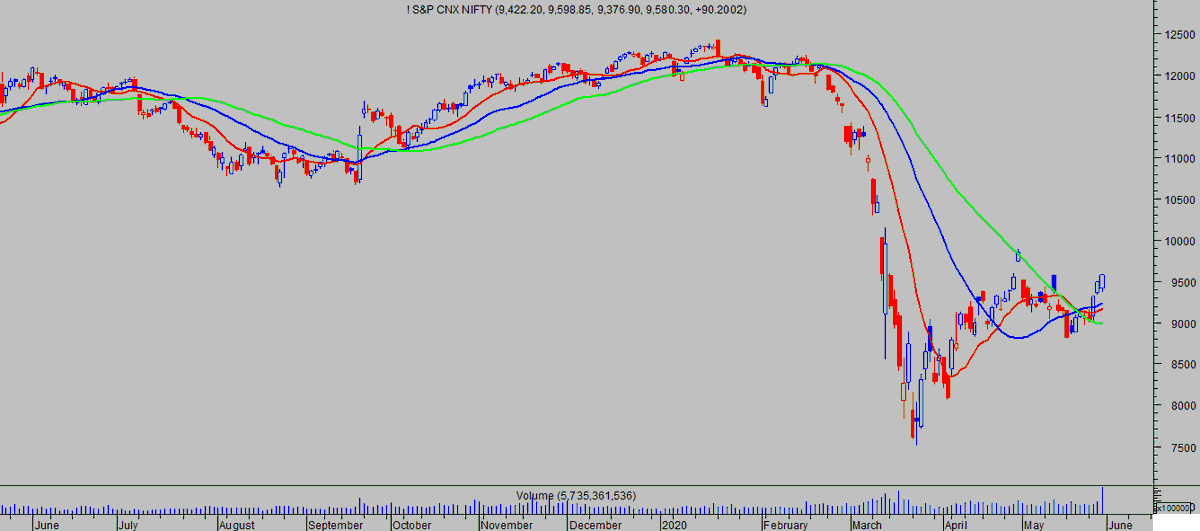

2.The RSI is just below the equilibrium line. The indicator is hovering in zone of 40 to 60 for more than a month. The next move will be crucial.

2.The RSI is just below the equilibrium line. The indicator is hovering in zone of 40 to 60 for more than a month. The next move will be crucial.

We need to understand how things unfolded in next ten to twenty odd trading sessions post the circuit filters were triggered.

We need to understand how things unfolded in next ten to twenty odd trading sessions post the circuit filters were triggered.

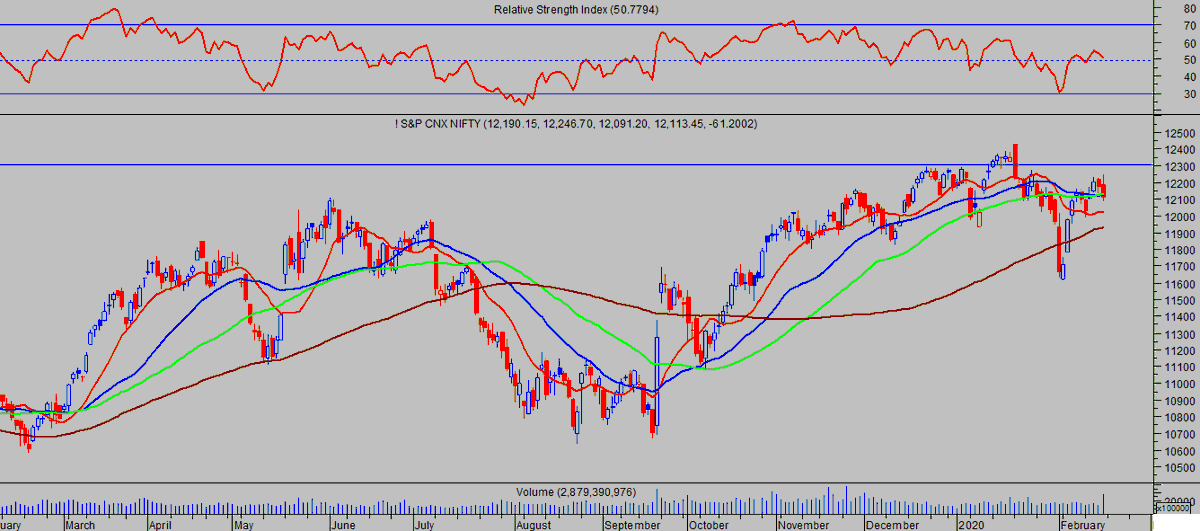

On weekly time frame Nifty has broken below the all important 100 week SMA. This average had provided reliable support to the index

On weekly time frame Nifty has broken below the all important 100 week SMA. This average had provided reliable support to the index

In coming week there is a high probability that the index may open downwards and try to test the 100 day SMA again.

In coming week there is a high probability that the index may open downwards and try to test the 100 day SMA again.

A common myth associated with gap is that it is always filled. Waiting for gap to be filled can at time prove too costly for a trader.

A common myth associated with gap is that it is always filled. Waiting for gap to be filled can at time prove too costly for a trader.

The RSI (14) continues to hover at the equilibrium zone. The sharpness of rise in RSI (14) a week before is indicating dips should be utilized to enter long. However no price confirmation is seen on the charts.

The RSI (14) continues to hover at the equilibrium zone. The sharpness of rise in RSI (14) a week before is indicating dips should be utilized to enter long. However no price confirmation is seen on the charts.

New products and technologies included Automobiles, radios, cinema, sound movies, washing machines and Air conditioners.

New products and technologies included Automobiles, radios, cinema, sound movies, washing machines and Air conditioners.

First two lows of the trendlines make it and the third point validates it. (2/n)

First two lows of the trendlines make it and the third point validates it. (2/n)