How to get URL link on X (Twitter) App

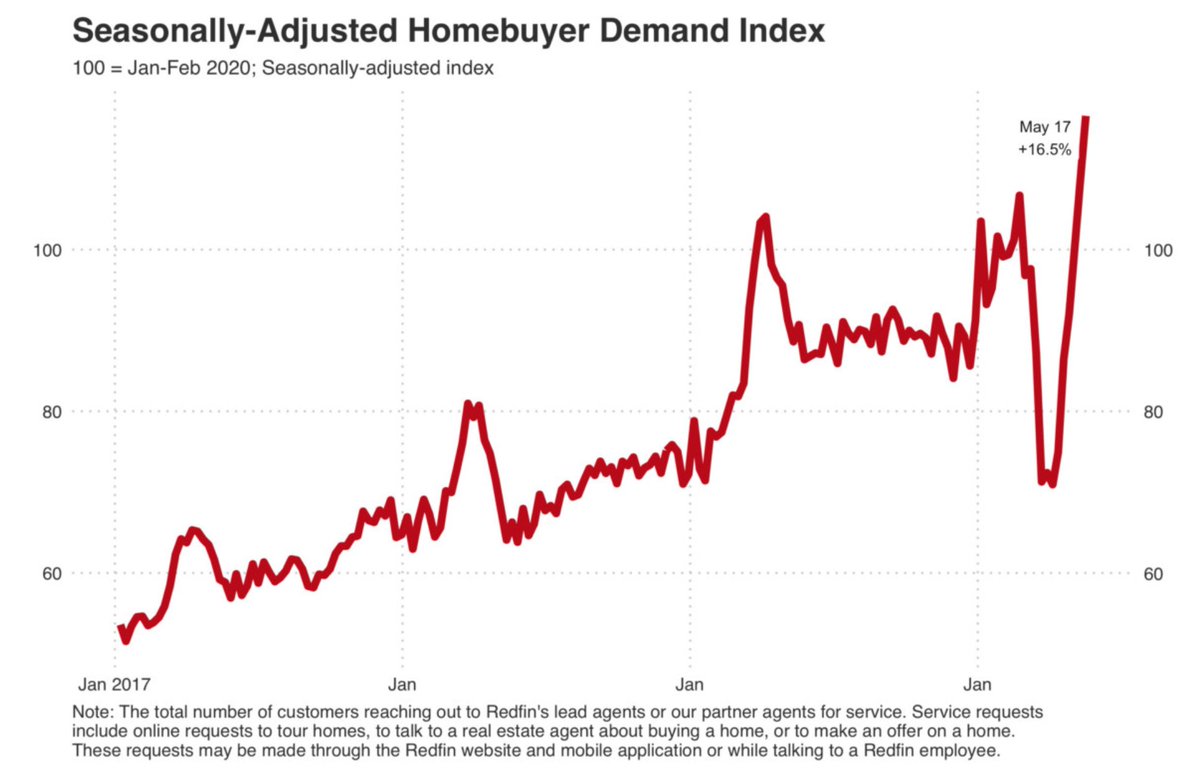

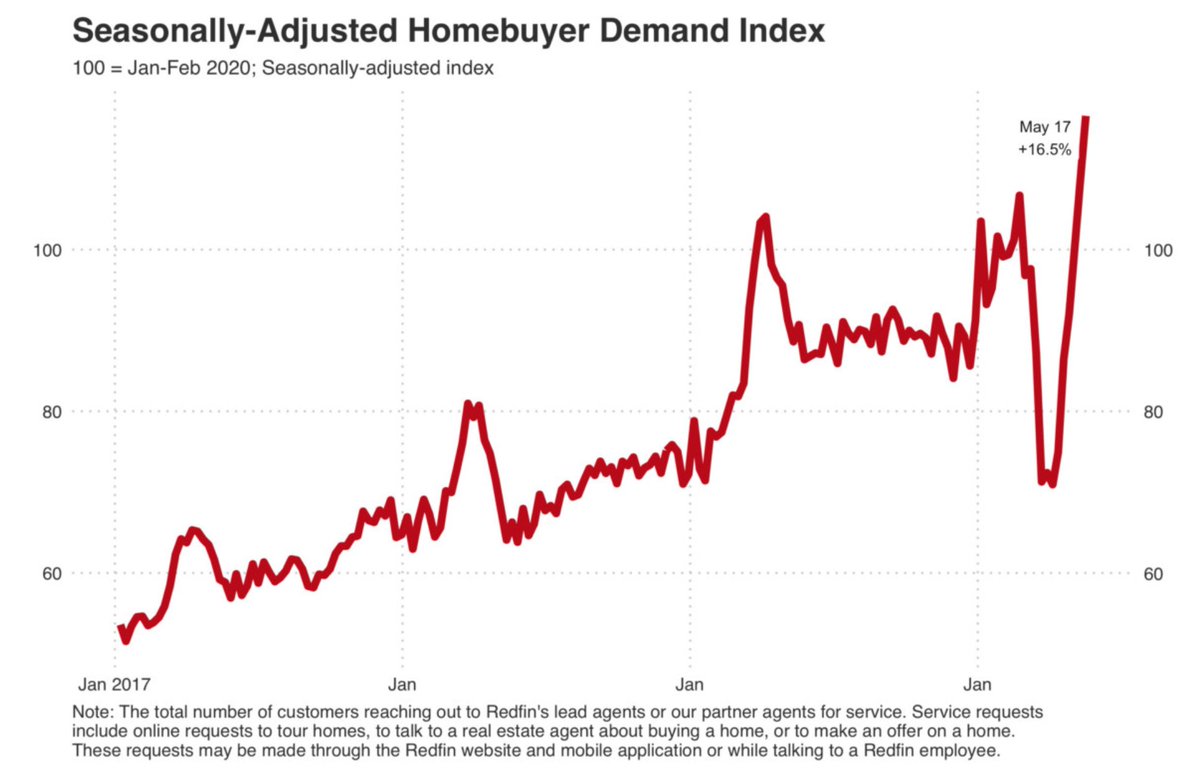

2 of 6: Inventory's an x-factor. Last week, listings were still down 23%. Some @Redfin agents say sellers will soon start listing more homes. Others say sellers worry about a second wave of infections. We’ve gotten more confident we can sell homes while sheltering in place.

2 of 6: Inventory's an x-factor. Last week, listings were still down 23%. Some @Redfin agents say sellers will soon start listing more homes. Others say sellers worry about a second wave of infections. We’ve gotten more confident we can sell homes while sheltering in place.