"Realize that everything connects to everything else."

Mathematics, statistics of extremes, Metacrisis.

Energy, finance, geopolitics, ecology & economics.

How to get URL link on X (Twitter) App

2/11 A one-time experiment at a planetary scale vs debating about the economics. Especially when considering the following.

2/11 A one-time experiment at a planetary scale vs debating about the economics. Especially when considering the following.https://twitter.com/theresphysics/status/1551462989596921857

https://twitter.com/TheBondFreak/status/1562547796414459904

2/25 Chimerica & Eurussia symbiotic relationship is becoming (China + Russia) vs the West.

2/25 Chimerica & Eurussia symbiotic relationship is becoming (China + Russia) vs the West.

https://twitter.com/zerohedge/status/15555296184673075212/6 "90% of people in most professions don’t know what they are doing. Worse, 90% of those who don’t know what they are doing don’t know that they don’t know what they are doing."

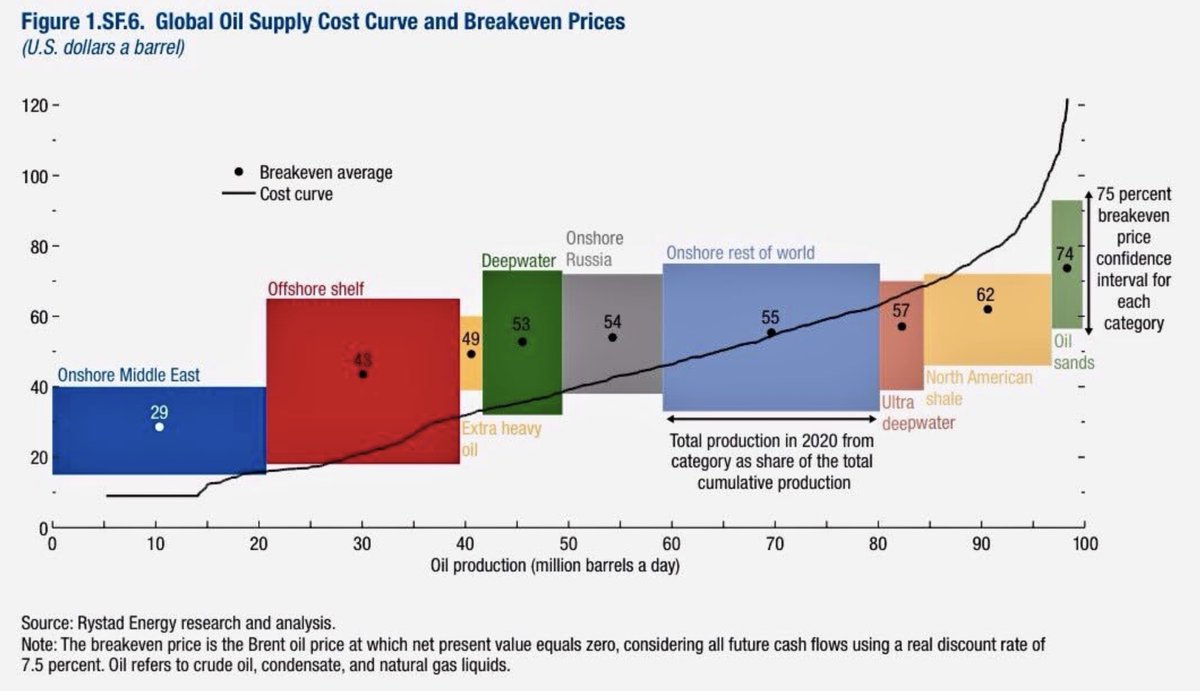

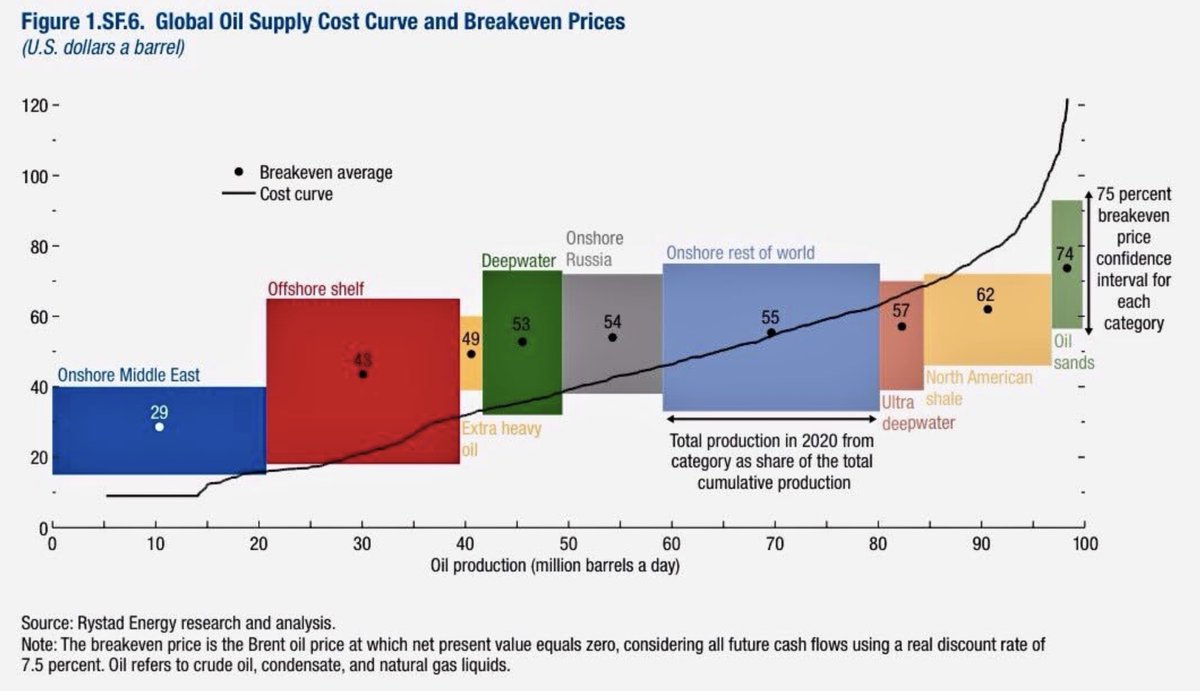

2/11 Cheapest oil to produce is in the Middle East, most expensive in North America. With oil here = world liquid fuels, which have a nice round number for their production of ~100 million barrels per day (mmb/d). (Forget oil grades for now.)

2/11 Cheapest oil to produce is in the Middle East, most expensive in North America. With oil here = world liquid fuels, which have a nice round number for their production of ~100 million barrels per day (mmb/d). (Forget oil grades for now.)

https://twitter.com/zerohedge/status/15352686629234319362/6 Isreal vs Iran war next? #WW3

https://twitter.com/BurggrabenH/status/15209242608894115852/4 If an oil embargo is enacted ("late summer"?), then scenario #2 below is likely to follow, i.e. -3/4 mmb/d going offline. Quite a few dominos to fall or hopefully an end to the war? Even then, Russia's trust may still be shattered.

https://twitter.com/gordonschuecker/status/1520902117828956160

https://twitter.com/zerohedge/status/1521139091252912131

2/4 "State TV is pushing a nuclear attack on the UK, or setting off an underwater nuke to wipe out the British Isles with a tsunami."

2/4 "State TV is pushing a nuclear attack on the UK, or setting off an underwater nuke to wipe out the British Isles with a tsunami."https://twitter.com/the_real_fly/status/1520848375595294722?s=21

https://twitter.com/TheBondFreak/status/1520204172024594433

2/9 "I continue to believe that STIR traders [or every human being?] will benefit from increased literacy about the world of commodities trading and the workings of commodity derivatives."

2/9 "I continue to believe that STIR traders [or every human being?] will benefit from increased literacy about the world of commodities trading and the workings of commodity derivatives."

2/9 Marginal cost curves for more or less unrestricted systems.

2/9 Marginal cost curves for more or less unrestricted systems.

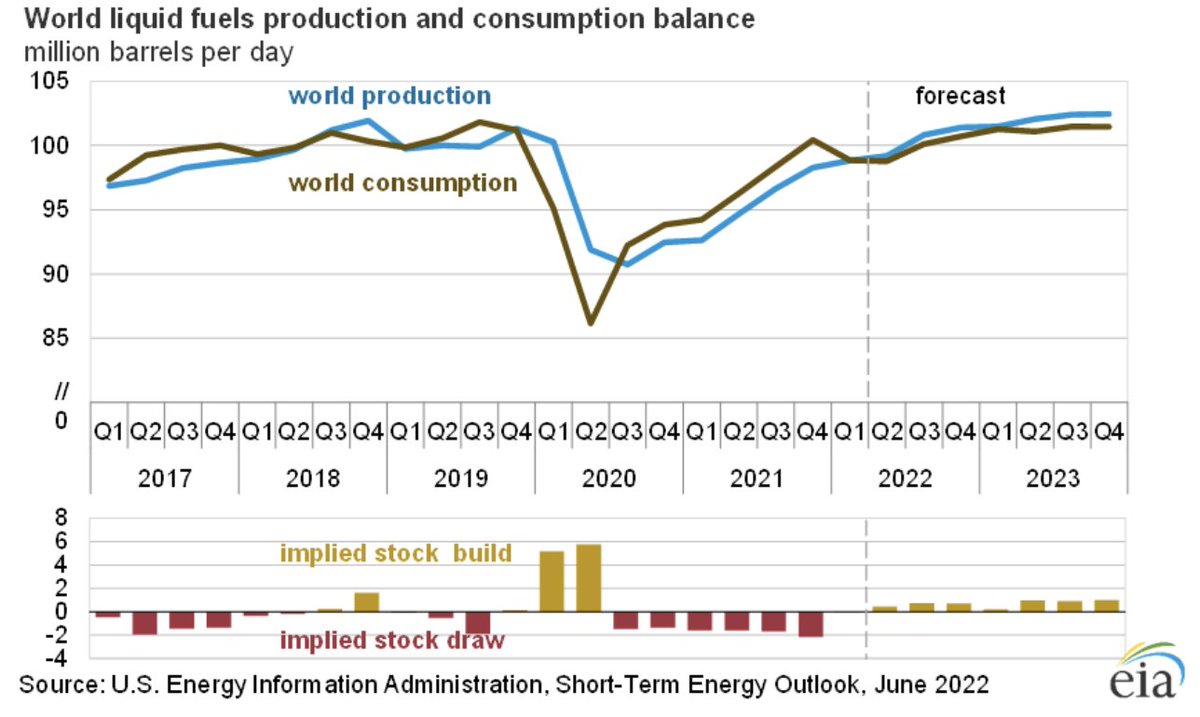

2/13 How flawed this modeling of the economy is well explained in @CareyWKing's book, so I will extensively quote from it here (and is too important to bury in my notes below).

2/13 How flawed this modeling of the economy is well explained in @CareyWKing's book, so I will extensively quote from it here (and is too important to bury in my notes below).https://twitter.com/gordonschuecker/status/1426839840956506114

2/25 TL;DR:

2/25 TL;DR:

https://twitter.com/zerohedge/status/1430828684722720769

And from the conclusion:

And from the conclusion:

https://twitter.com/cleantechnica/status/1421108595492638720

This article goes more into depth (but in German):

This article goes more into depth (but in German):

https://twitter.com/gordonschuecker/status/14098967893024686102/5 "Part of the readership of this book might confirm the pervasiveness of Bios. Sometimes, one is reminded of this world of opportunity and positivity when scrolling through the bestsellers for businessmen at the airport bookstore. It is as if they belong to a different world."

https://twitter.com/gordonschuecker/status/1297339361646776321@rustneversleepz @ProfSteveKeen @RichardTol 2/9 Just a few things mainstream economics gets wrong:

https://twitter.com/gordonschuecker/status/1264333112881840130

2/60 Abstract:

2/60 Abstract:

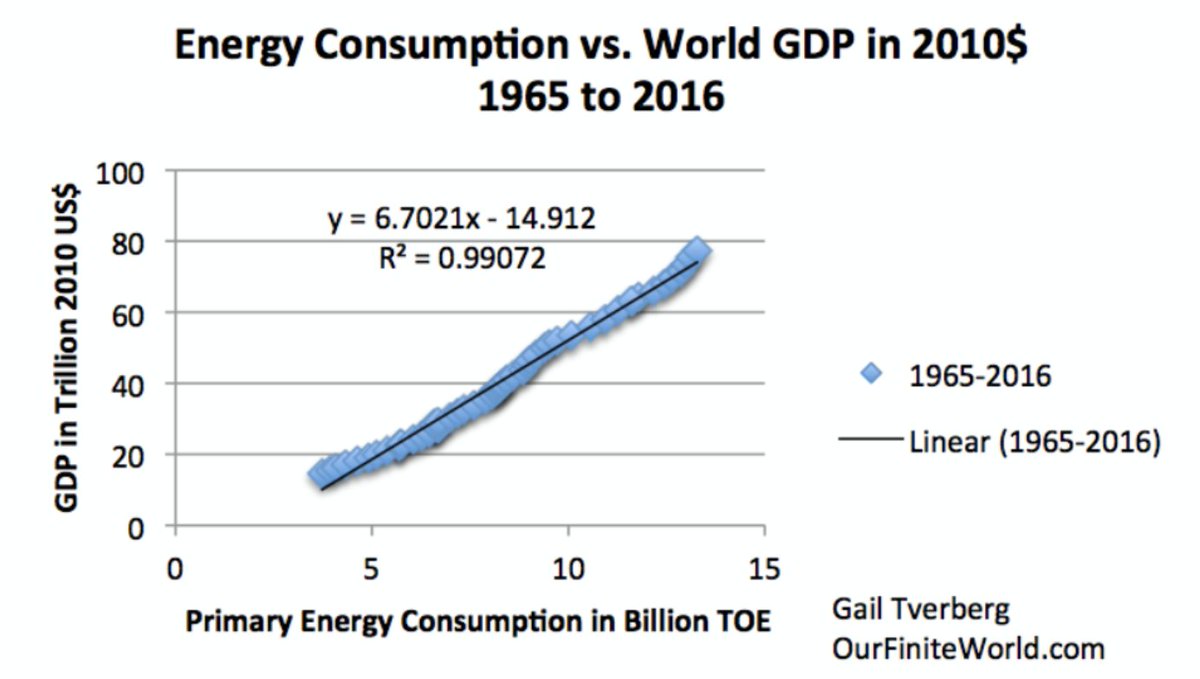

2/20 In fact, energy consumption and GDP are highly correlated for the world as a whole. And correlation 𝘪𝘴 causation here.

2/20 In fact, energy consumption and GDP are highly correlated for the world as a whole. And correlation 𝘪𝘴 causation here.