"I saw under the sun that the race goes not to the swift, nor the battle to the strong, nor favor to men of skill; for a time of misfortune comes to all alike."

How to get URL link on X (Twitter) App

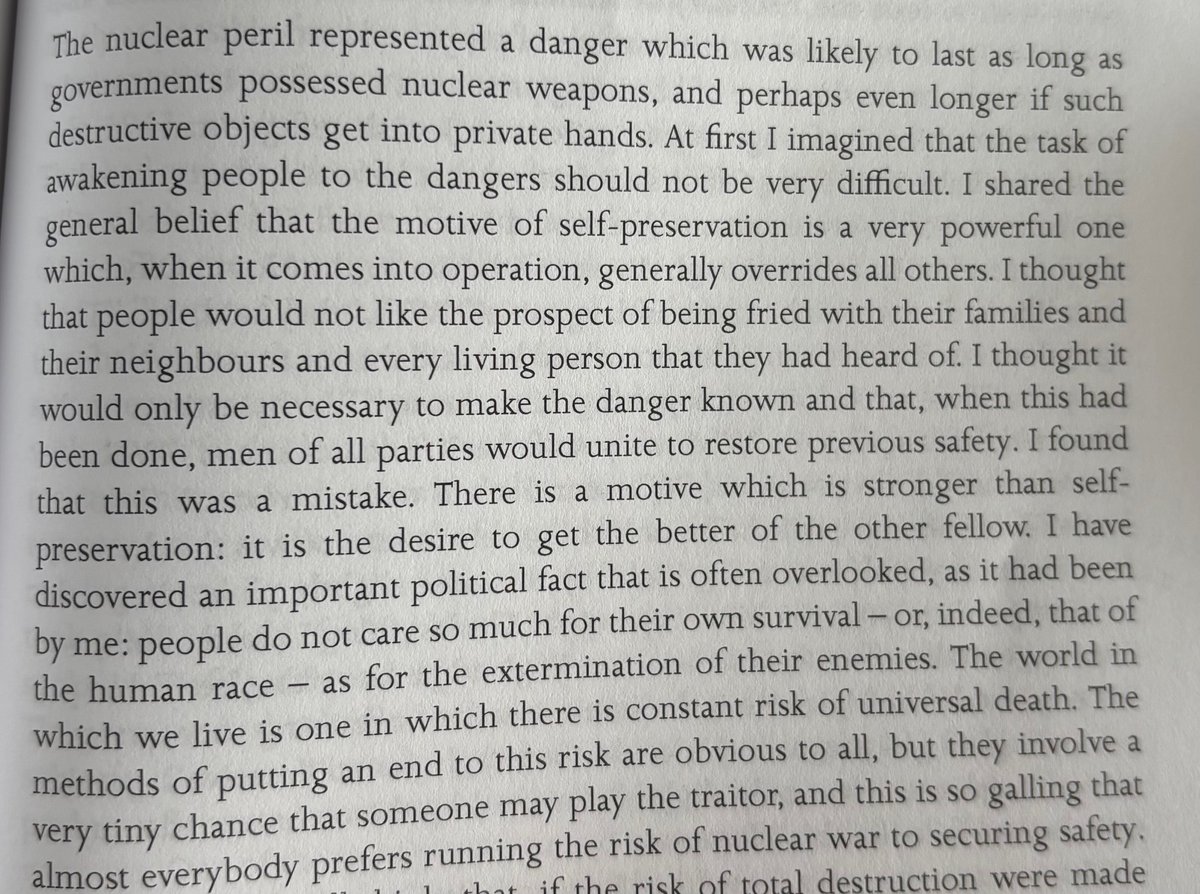

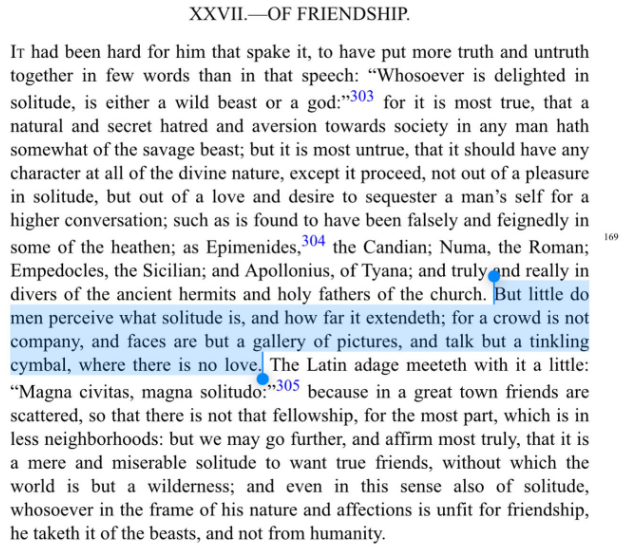

https://twitter.com/gregoryblotnick/status/1980685049084408159(1/10) from Bacon's Essays -

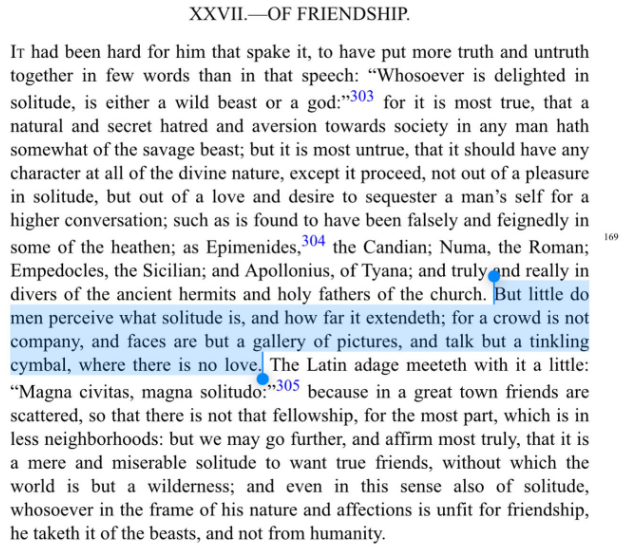

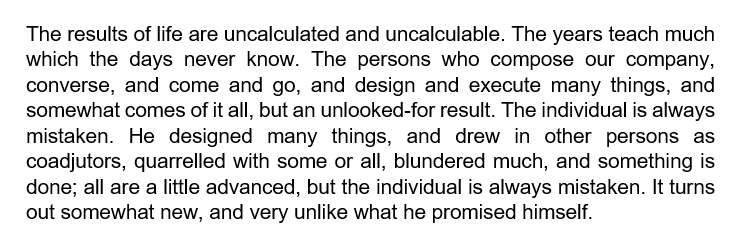

https://twitter.com/gregoryblotnick/status/1968775003630866832(1/10) "The years teach much which the days never know." --from Emerson's "Experience"...one of the finest paragraphs ever written

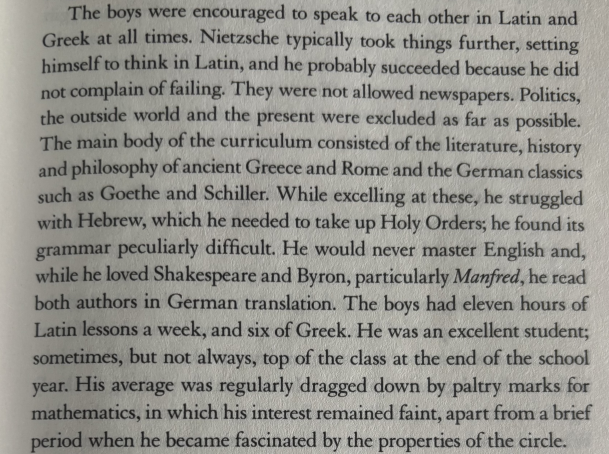

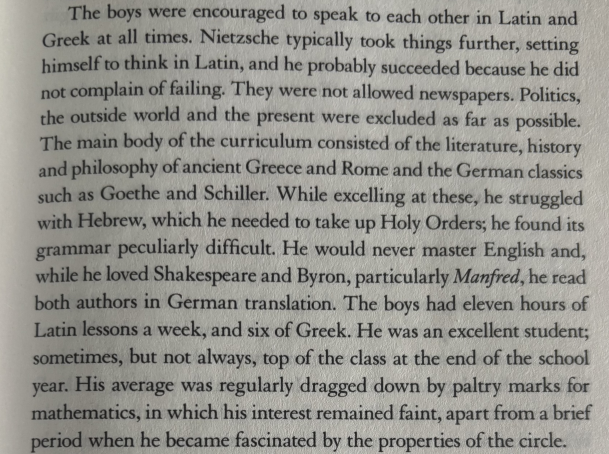

https://twitter.com/gregoryblotnick/status/19586087369073339381/10 - The decline of modern education (from Prideaux's Nietzche bio)