I post on Hinduism Culture History based on my studies| Geopolitics enthusiast #contentwriter #Storyteller | Associate at Vibe Gurukul & Swastik production|

13 subscribers

How to get URL link on X (Twitter) App

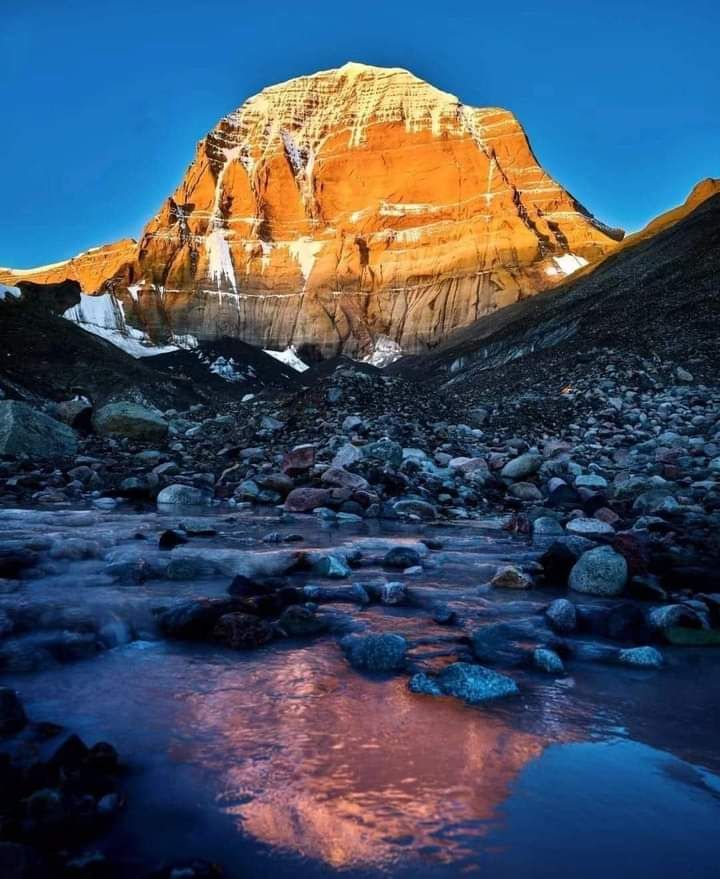

For decades, Mount Kailash has stood apart from the modern world, unclimbed, unconquered, and untouched by human ambition. Revered by Hindus, Buddhists, Jains, and followers of Bon, it is believed to be the abode of Bhagawan Shiva.

For decades, Mount Kailash has stood apart from the modern world, unclimbed, unconquered, and untouched by human ambition. Revered by Hindus, Buddhists, Jains, and followers of Bon, it is believed to be the abode of Bhagawan Shiva.

Some films end with a climax.

Some films end with a climax.

The chain reaction started in Dhaka’s Westin Hotel, Room 808.

The chain reaction started in Dhaka’s Westin Hotel, Room 808.

This is NOT just about one raid.

This is NOT just about one raid.

What’s a NOTAM?

What’s a NOTAM?

Something big is moving.

Something big is moving.

When trade tensions between India and the US first began, President Trump had infamously dismissed India as a “dead economy.”

When trade tensions between India and the US first began, President Trump had infamously dismissed India as a “dead economy.”

The Origin of Guliga Deva

The Origin of Guliga Deva

In a moment thick with symbolism and irony, British Prime Minister Keir Starmer has landed in Mumbai for a two-day visit to India, accompanied by a 100-member trade delegation, including top UK industrialists and corporate heads.

In a moment thick with symbolism and irony, British Prime Minister Keir Starmer has landed in Mumbai for a two-day visit to India, accompanied by a 100-member trade delegation, including top UK industrialists and corporate heads.

First of all, the Court has refused to strike down or stay the Act, reaffirming the doctrine of “presumption of constitutionality.” Once a law is passed by Parliament, the judiciary assumes it to be valid unless challengers prove that it violates the core pillars of the Constitution.

First of all, the Court has refused to strike down or stay the Act, reaffirming the doctrine of “presumption of constitutionality.” Once a law is passed by Parliament, the judiciary assumes it to be valid unless challengers prove that it violates the core pillars of the Constitution.

How Did Nepal Reach Here?

How Did Nepal Reach Here?

President Donald Trump and his administration may say whatever they like about the Indian economy. They may try to pressure New Delhi with tariffs or rhetoric. But one truth remains undeniable: India’s growth story and its massive consumption market simply cannot be ignored.

President Donald Trump and his administration may say whatever they like about the Indian economy. They may try to pressure New Delhi with tariffs or rhetoric. But one truth remains undeniable: India’s growth story and its massive consumption market simply cannot be ignored.

For decades, India and the United States have shared a relationship that thrived on technology, talent, and trade. At the heart of this partnership stood India’s IT sector, generating billions of dollars in revenue and employing millions of skilled professionals—many of them working indirectly for American corporations. But Washington’s latest move threatens to tear this bond apart.

For decades, India and the United States have shared a relationship that thrived on technology, talent, and trade. At the heart of this partnership stood India’s IT sector, generating billions of dollars in revenue and employing millions of skilled professionals—many of them working indirectly for American corporations. But Washington’s latest move threatens to tear this bond apart.

If international diplomacy were a stage play, Donald Trump would be its most unpredictable actor — a man who can deliver heartbreak monologues one night and sing love ballads the next.

If international diplomacy were a stage play, Donald Trump would be its most unpredictable actor — a man who can deliver heartbreak monologues one night and sing love ballads the next.

It all began when President Donald Trump, under his America First policy, delivered a shocking ultimatum. He openly warned America’s biggest tech giants: “Stop hiring Indians.” And this was no offhand remark but it was a deliberate warning, repeated twice, meant to send a message to the world that America decides, and others follow. Trump wanted to choke India’s IT and startup ecosystem by cutting off opportunities for Indian professionals.

It all began when President Donald Trump, under his America First policy, delivered a shocking ultimatum. He openly warned America’s biggest tech giants: “Stop hiring Indians.” And this was no offhand remark but it was a deliberate warning, repeated twice, meant to send a message to the world that America decides, and others follow. Trump wanted to choke India’s IT and startup ecosystem by cutting off opportunities for Indian professionals.

Renowned geo-economist Matteo Maggiori, a Stanford Graduate School of Business scholar with over 6,500 research citations, recently told The Economic Times that India and China are developing alternative payment systems to the U.S. dollar. Globally respected in the field of geoeconomics, his remarks carry serious weight.

Renowned geo-economist Matteo Maggiori, a Stanford Graduate School of Business scholar with over 6,500 research citations, recently told The Economic Times that India and China are developing alternative payment systems to the U.S. dollar. Globally respected in the field of geoeconomics, his remarks carry serious weight.

China, Islamabad’s self-proclaimed “all-weather” partner, has quietly walked away from financing the Main Line-1 (ML-1) railway project—the crown jewel of the China-Pakistan Economic Corridor (CPEC).

China, Islamabad’s self-proclaimed “all-weather” partner, has quietly walked away from financing the Main Line-1 (ML-1) railway project—the crown jewel of the China-Pakistan Economic Corridor (CPEC).

The dramatic GST rate cuts announced in India for September 2025 mark a turning point for economic policy and household spending, promising direct benefits to Indian consumers and businesses while strategically responding to international trade tensions and internal political dynamics

The dramatic GST rate cuts announced in India for September 2025 mark a turning point for economic policy and household spending, promising direct benefits to Indian consumers and businesses while strategically responding to international trade tensions and internal political dynamics

Narendra Modi has been serving China a series of shocks that no one saw coming. The latest? Singapore — once considered Beijing’s secure backyard — is tilting toward India. This is not a coincidence; it is a calculated geopolitical move, and its timing is flawless.

Narendra Modi has been serving China a series of shocks that no one saw coming. The latest? Singapore — once considered Beijing’s secure backyard — is tilting toward India. This is not a coincidence; it is a calculated geopolitical move, and its timing is flawless.