Investing from 1st principles. These are my personal views & may not necessarily represent the views of my organisation - ABSL AMC

How to get URL link on X (Twitter) App

https://twitter.com/hktg13/status/1778232681677119935

Aggregate market cap of these deciles was 2lakh cr in June 21, which is now 13 lakh crore - close to 6x growth in overall market values in 3+ years

Aggregate market cap of these deciles was 2lakh cr in June 21, which is now 13 lakh crore - close to 6x growth in overall market values in 3+ years

FY24 snapshot of capital efficiency metrics for these segment, earnings hv more than doubled FRM pre Covid levels & presumably FY24 metrics data have benefit of rising tide across segments (these are not cyclically low numbers, & if at all, these tend to overstate base rates)

FY24 snapshot of capital efficiency metrics for these segment, earnings hv more than doubled FRM pre Covid levels & presumably FY24 metrics data have benefit of rising tide across segments (these are not cyclically low numbers, & if at all, these tend to overstate base rates)

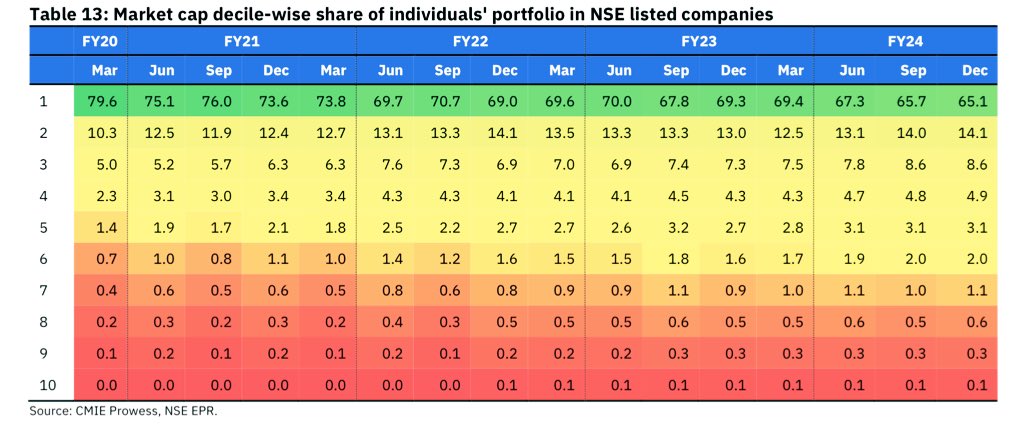

.. and how it has progressed in post Covid for individuals, pre Covid the holding was similar to current DMF with 80pct in 1st decile - big shift as investors have embraced the size effect

.. and how it has progressed in post Covid for individuals, pre Covid the holding was similar to current DMF with 80pct in 1st decile - big shift as investors have embraced the size effect

...though from a trendline and anomaly pov, rest of world seems to have it worse...

...though from a trendline and anomaly pov, rest of world seems to have it worse...

https://twitter.com/moneycontrolcom/status/1653619370612932608...how the base rates have moved over time, the key sectors where these super-compounders have been present in (and how they hv changed with time), & how companiess in otherwise "boring" sectors have compounded their profit n revenue pools, often without raising external equity!

Universe is Top 200 Indian stocks at any point, monthly rebalanced of Top Quintile Equal Weighted long-only portfolios of composite growth & composite value.These are theoretical portfolios with no impact cost,high churn etc,but can help in providing sense on broader style perf

Universe is Top 200 Indian stocks at any point, monthly rebalanced of Top Quintile Equal Weighted long-only portfolios of composite growth & composite value.These are theoretical portfolios with no impact cost,high churn etc,but can help in providing sense on broader style perf

https://twitter.com/hktg13/status/1503679240406982656?t=LKl40guE9PFqUhy3m26ogQ&s=08

https://twitter.com/hktg13/status/1606839007358640128

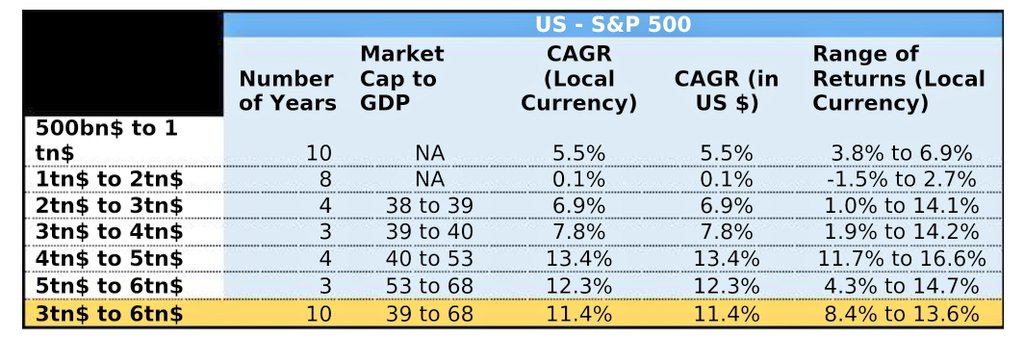

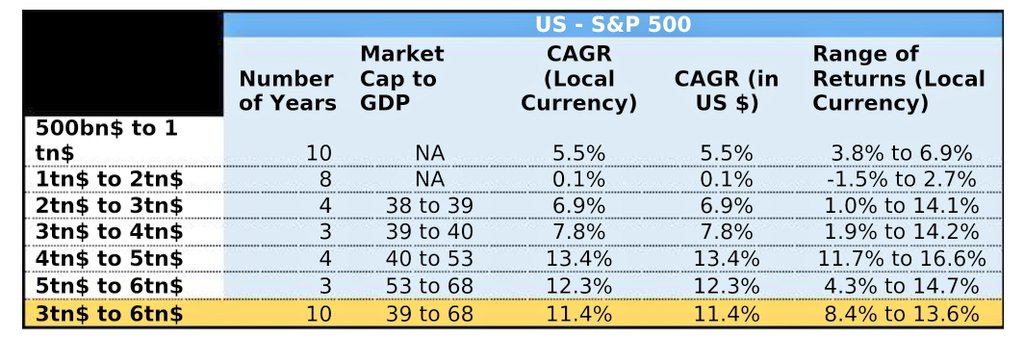

Returns in US (period from 1959, when it crossed 500bn$ to 1991, when it crossed 6tn$). Broadly, returns have improved as US moved from 3 to 6tn$, giving good double digit returns.

Returns in US (period from 1959, when it crossed 500bn$ to 1991, when it crossed 6tn$). Broadly, returns have improved as US moved from 3 to 6tn$, giving good double digit returns.

While it is anyone's guess if these projections for India will hold true,few intrstg points

While it is anyone's guess if these projections for India will hold true,few intrstg points

Puzzled that two sectors of inland transportation and restaurant & hotels are sectors where digital linkages hv declined over time (given the uber/ola/Zomato/swiggy) as some areas which mainstreamed during this period🤔

Puzzled that two sectors of inland transportation and restaurant & hotels are sectors where digital linkages hv declined over time (given the uber/ola/Zomato/swiggy) as some areas which mainstreamed during this period🤔

https://twitter.com/ruima/status/1508775855106899968Will be interesting to see how India stacks up here, our median wealth to income is much smaller than developed world or china, & our spends on education per capita hv grown almost 9x in last 20 years (govt+private spends) compared to almost 6.7x growth in GDP per capita

India is small drop in ocean of financial markets - 3% of world market cap share,& even within EM,its share in MSCI has been 7-8% till the recent surge to 12%.Despite being such a small fraction of EM,cumulative flows hv been large positive all through n more than all EM-ex India

India is small drop in ocean of financial markets - 3% of world market cap share,& even within EM,its share in MSCI has been 7-8% till the recent surge to 12%.Despite being such a small fraction of EM,cumulative flows hv been large positive all through n more than all EM-ex India

https://twitter.com/EconomPic/status/1503551791031414785

While returns have been anaemic, what is incredible is the drawdown chart of MSCI China over these 30 years! Almost every year a 40 to 50% drawdown in index with nothing much to show in terms of returns over so long a period...phew!

While returns have been anaemic, what is incredible is the drawdown chart of MSCI China over these 30 years! Almost every year a 40 to 50% drawdown in index with nothing much to show in terms of returns over so long a period...phew!

Without passing any judgement on the "suitability" of such companies to be in indices etc, think it is important to see if valuation ratio (say P/E) can dramatically change due to such changes, and more importantly the need to look under the hood than just rely on headline ratios

Without passing any judgement on the "suitability" of such companies to be in indices etc, think it is important to see if valuation ratio (say P/E) can dramatically change due to such changes, and more importantly the need to look under the hood than just rely on headline ratios

Price to sale>10x is just one number, thr is no 'lakshman rekha' tht it can't be crossed etc,but across cycles and multiple markets, price to sales>10x has been a barometer of high valuations.(Over simplified by Sun Microsystems CEO-Scott Mcnealy in interview post dotcom crash)

Price to sale>10x is just one number, thr is no 'lakshman rekha' tht it can't be crossed etc,but across cycles and multiple markets, price to sales>10x has been a barometer of high valuations.(Over simplified by Sun Microsystems CEO-Scott Mcnealy in interview post dotcom crash)

First, overall energy mix over the last few decades has shown a shift towards electricity compared to oil based energy. Needless to say, our sources of electricity are more local (coal, renewable) while oil/gas is primarily hostage to world prices n vagaries of world supplies

First, overall energy mix over the last few decades has shown a shift towards electricity compared to oil based energy. Needless to say, our sources of electricity are more local (coal, renewable) while oil/gas is primarily hostage to world prices n vagaries of world supplies

-10% RoE itself is reasonably low threshold, so gives a sense of odds of identifying franchises tht accrete value over time

-10% RoE itself is reasonably low threshold, so gives a sense of odds of identifying franchises tht accrete value over time

Above chart from Citi, on YoY profit growth in various regions for June qtr. For India from June 2020, profits hv more than doubled (base qtr impacted by Covid almost everywhere).

Above chart from Citi, on YoY profit growth in various regions for June qtr. For India from June 2020, profits hv more than doubled (base qtr impacted by Covid almost everywhere).

While energy efficiency has improved across the board, the shape of fall in Indian energy intensity, despite such relative poor per capita consumption n incomes is staggering. Barring a few years, india energy intensity is lower than even US across the last 30 years!

While energy efficiency has improved across the board, the shape of fall in Indian energy intensity, despite such relative poor per capita consumption n incomes is staggering. Barring a few years, india energy intensity is lower than even US across the last 30 years!

US S&P500 (ex fin) capex to sales has also been in a narrow band of 6-7% (post dotcom bust), however proportion of spends on R& D hv gone up materially. For eg, Apple Inc has taken R&D to sales from 2%(2011) to 8% (2020)

US S&P500 (ex fin) capex to sales has also been in a narrow band of 6-7% (post dotcom bust), however proportion of spends on R& D hv gone up materially. For eg, Apple Inc has taken R&D to sales from 2%(2011) to 8% (2020)

https://twitter.com/hktg13/status/1414943961953701888

Are bond mkts signalling tht recovery ahead will be even more anaemic than previous decade (this cycle so far topping at 150bps as against 300 bps usually)? More imp,in the last few sessions, US2/10 has fallen below 100bps.Are we in for a muddle-through economy in decade ahead?

Are bond mkts signalling tht recovery ahead will be even more anaemic than previous decade (this cycle so far topping at 150bps as against 300 bps usually)? More imp,in the last few sessions, US2/10 has fallen below 100bps.Are we in for a muddle-through economy in decade ahead?