Margin, PE, Vol 🗜 / Wait for the Fed to over-tighten, Un-inversion is the 🪧 / 👀 Neon 🦢 / 🇨🇦🛢⛽️ / 💭:🖍, 🍋, 🏋🏼♂️⚙️, 🥐🌊🦍👸🏼🦥🐠🏔 / #PTI 🏏

How to get URL link on X (Twitter) App

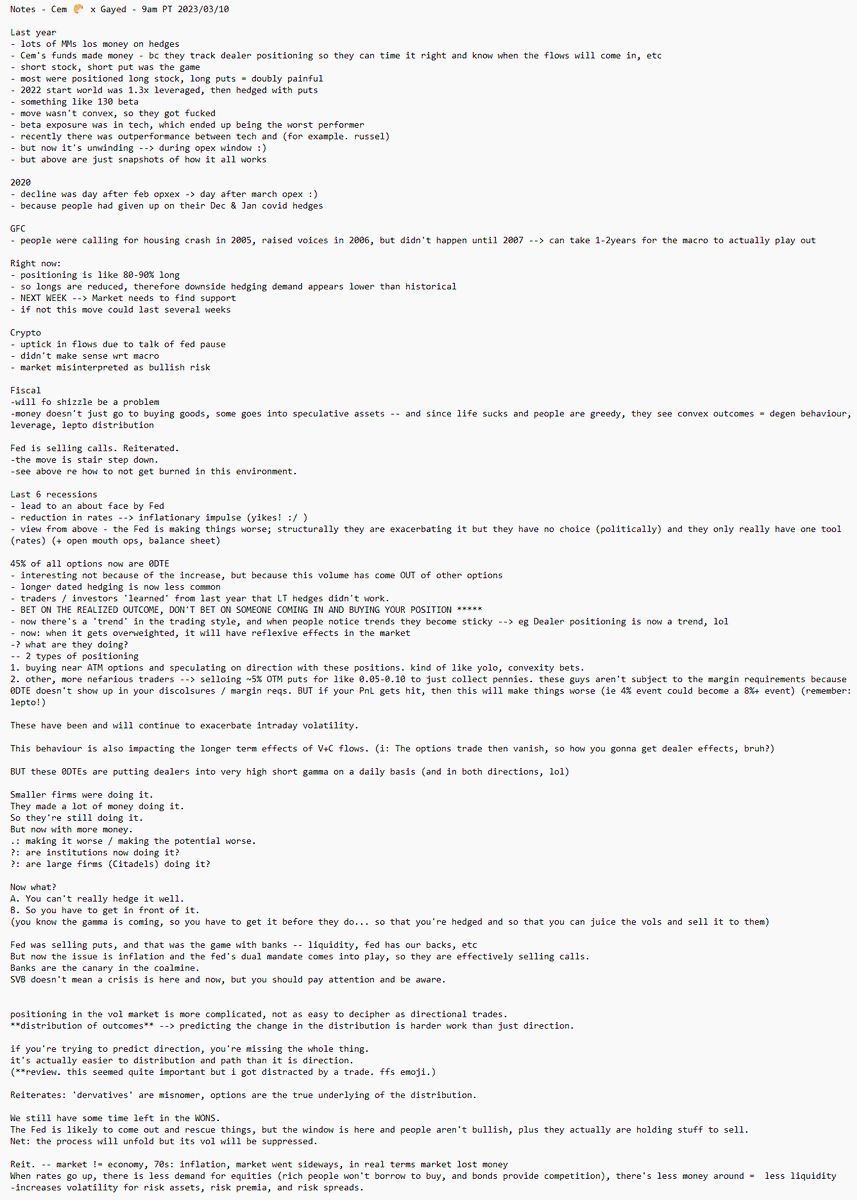

https://twitter.com/hyperconvexity/status/1634247699842342913- short stock, short put was the game

https://twitter.com/hyperconvexity/status/1633409371135934464And they’ll have Seema somewhere in there, too… 🤯

https://twitter.com/jam_croissant/status/1295790655055298562?s=20

https://twitter.com/lisaabramowicz1/status/1632727640514650112