Principal Economist at the Bank for International Settlements. Views are my own, so is the silly sense of humor. RT/like = bookmark.

How to get URL link on X (Twitter) App

https://twitter.com/i_aldasoro/status/1725496730907480105For us, on-chain is like offshore: each term identifies a particular institutional boundary. Payment on either side of that boundary is comparatively easy; moving funds across the boundary—back off-chain, or back onshore—is comparatively difficult.

We first establish that non-banks reduce their credit to non-financial firms by substantially more than banks when faced with a financial shock in the borrower country. By how much? Non-banks cut lending by about 50% more than banks.

We first establish that non-banks reduce their credit to non-financial firms by substantially more than banks when faced with a financial shock in the borrower country. By how much? Non-banks cut lending by about 50% more than banks.

https://twitter.com/TheStalwart/status/1587436938449063941First, two seminal papers by V. Bruno and @HyunSongShin:

Cyber costs are higher for larger firms and for incidents that impact several organisations simultaneously. Events with malicious intent (i.e. cyber attacks) tend to be less costly, unless they are on the

Cyber costs are higher for larger firms and for incidents that impact several organisations simultaneously. Events with malicious intent (i.e. cyber attacks) tend to be less costly, unless they are on the

We find that differences in borrower characteristics account for around half of the additional decline in non-bank versus bank lending. We then present evidence that non-banks' more volatile funding explains the remaining difference. 2/

We find that differences in borrower characteristics account for around half of the additional decline in non-bank versus bank lending. We then present evidence that non-banks' more volatile funding explains the remaining difference. 2/

https://twitter.com/i_aldasoro/status/1401868358031654918The first graph provides a big picture view of NFC debt, considering NFCs as ultimate issuers (that is, including issuance done by affiliates of said NFC which may not be NFCs themselves). It is a movie of amounts outstanding over time & you can select/unselect country groups 2/

TL;DR --> Higher geographic complexity heightens banks’ capacity to absorb local economic shocks, reducing their risk. However, it can also help banks soften the impact of prudential regulation, increasing their risk. Bank geographic complexity therefore has a Janus face.

TL;DR --> Higher geographic complexity heightens banks’ capacity to absorb local economic shocks, reducing their risk. However, it can also help banks soften the impact of prudential regulation, increasing their risk. Bank geographic complexity therefore has a Janus face.

https://twitter.com/BIS_org/status/1366361832018108418During the first 3 quarters of 2020 the on-balance sheet USD funding of non US banks in fact *grew*, contrary to what happened around other periods of severe stress like the GFC. 2/

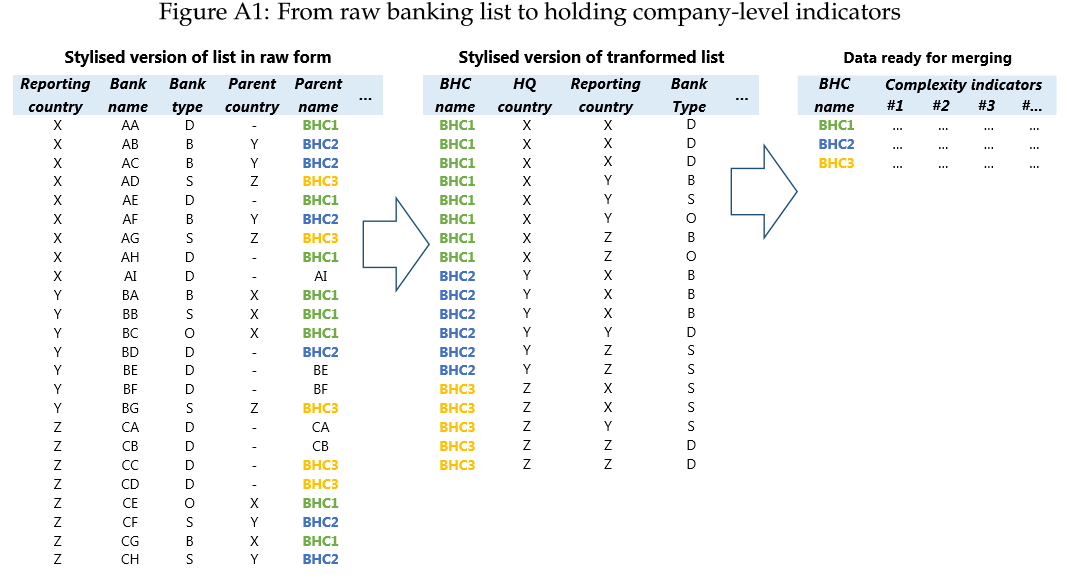

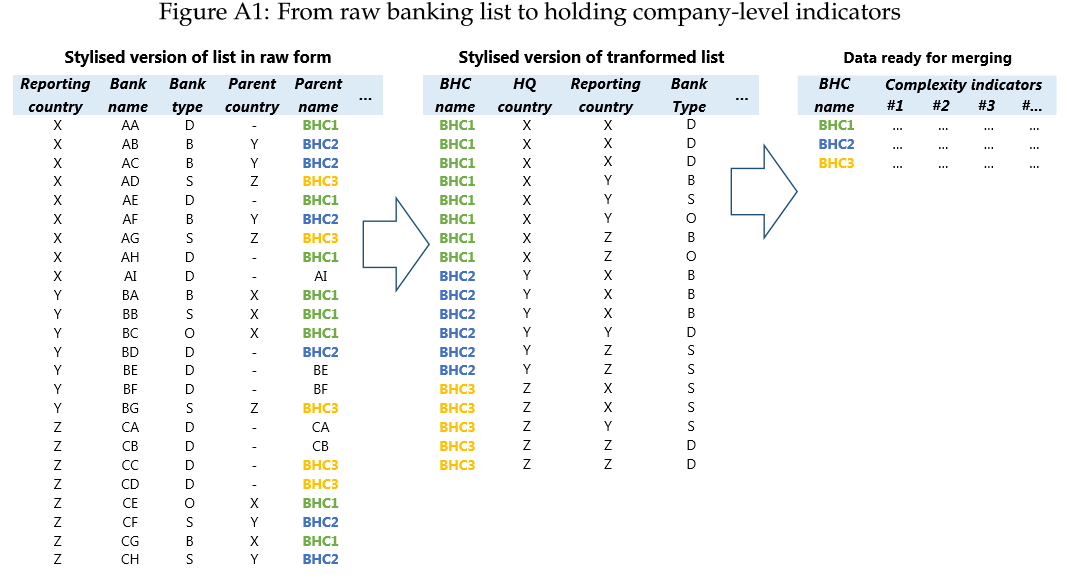

https://twitter.com/BIS_org/status/1252142987762716673We use the BIS banking list to construct a Herfindahl-Hirschman(*) measure of geographic representation and complexity at the Bank Holding Company-year level, for 96 large internationally active BHCs. The banking list collects info on the banking entities reporting to BIS stats

https://twitter.com/i_aldasoro/status/1133038625137016833

European banks fundamentally changed their operations in the US since 2011, towards short term arbitrage; Japanese banks continued to expand their dollar loan books 3/

European banks fundamentally changed their operations in the US since 2011, towards short term arbitrage; Japanese banks continued to expand their dollar loan books 3/