Chief Legal Officer @coinbase. I talk a little crypto, a lot of law, and way too much Ohio sports.

5 subscribers

How to get URL link on X (Twitter) App

Tl; dr: FDIC lied. I don't say that lightly. But the redactions clearly weren’t about protecting confidential supervisory information. They were about covering up evidence that they tried to kill BTC transactions, the development of blockchain tech, and even a bank account for stablecoin reserves. 2/6

Tl; dr: FDIC lied. I don't say that lightly. But the redactions clearly weren’t about protecting confidential supervisory information. They were about covering up evidence that they tried to kill BTC transactions, the development of blockchain tech, and even a bank account for stablecoin reserves. 2/6

https://twitter.com/tp8815/status/1764426758030254492Default judgments aren’t contested. The whole point is that the defendant didn’t show up from his hideout in India or wherever to contest anything. So the judge literally has the SEC on one side and no one on the other. 2/6

https://twitter.com/CoinDesk/status/1756315732378300762But rather than immediately pulling its order after admitting that it deceived the Court, the SEC sat silently. So rather than continue this injustice, we then told the SEC we wouldn't comply further unless they explained why we should. 2/5

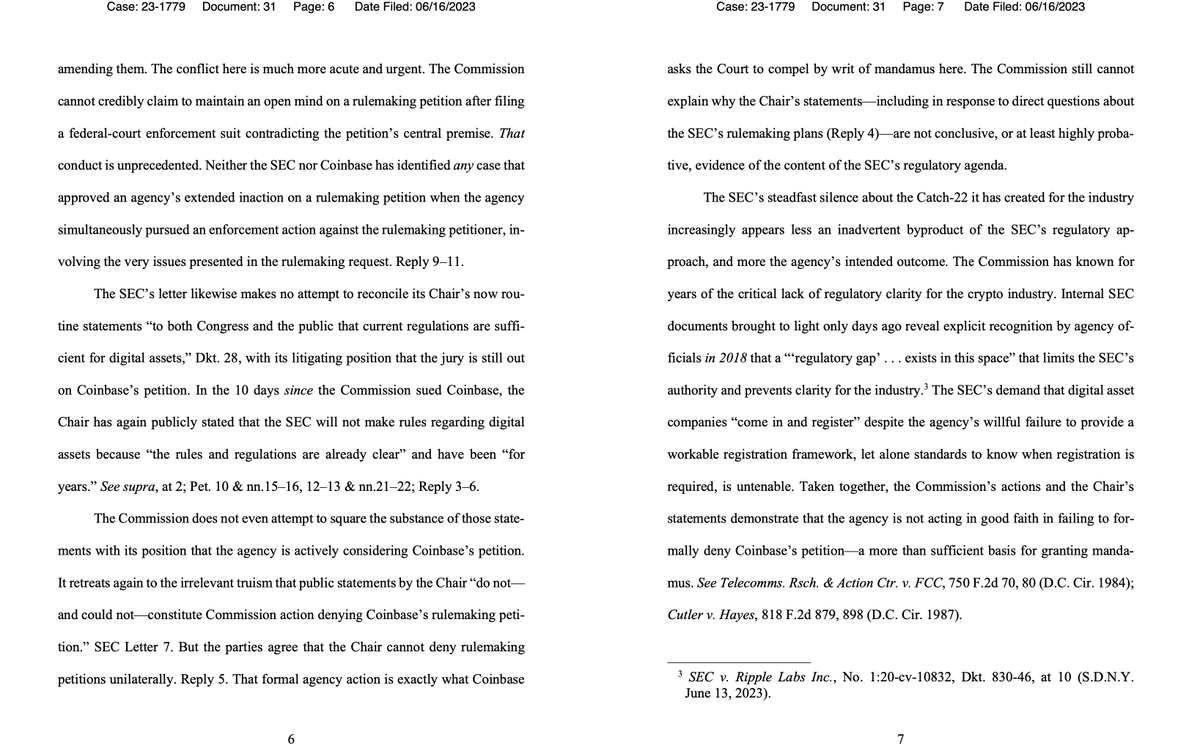

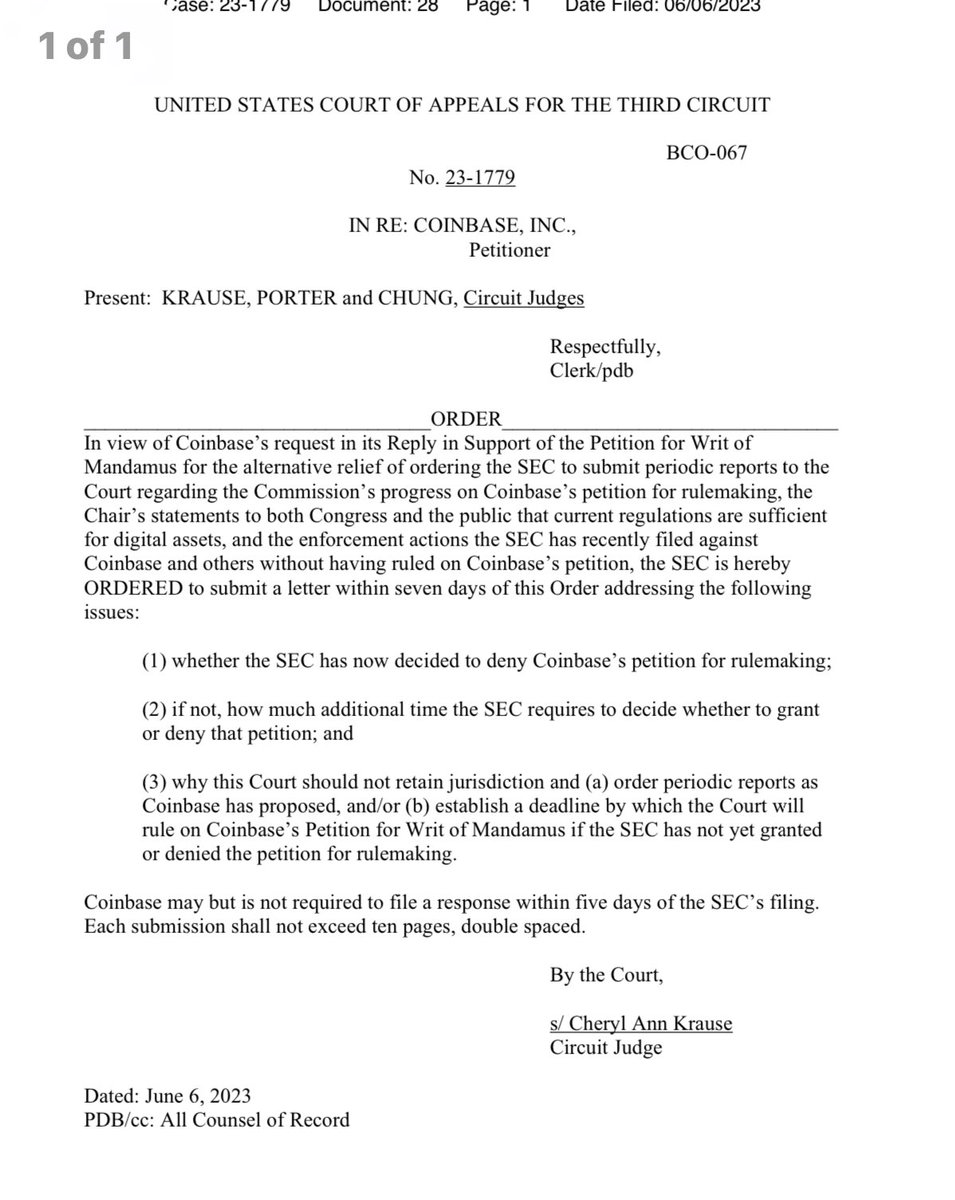

The Court should grant mandamus now because the Commission has decided not to grant Coinbase’s rulemaking petition and Is actively harming the industry. 2/5

The Court should grant mandamus now because the Commission has decided not to grant Coinbase’s rulemaking petition and Is actively harming the industry. 2/5

We continue to believe that the SEC could not be proceeding with litigation against our industry, like the case filed against us today, if the SEC had not already decided to deny our petition for rulemaking.

We continue to believe that the SEC could not be proceeding with litigation against our industry, like the case filed against us today, if the SEC had not already decided to deny our petition for rulemaking.