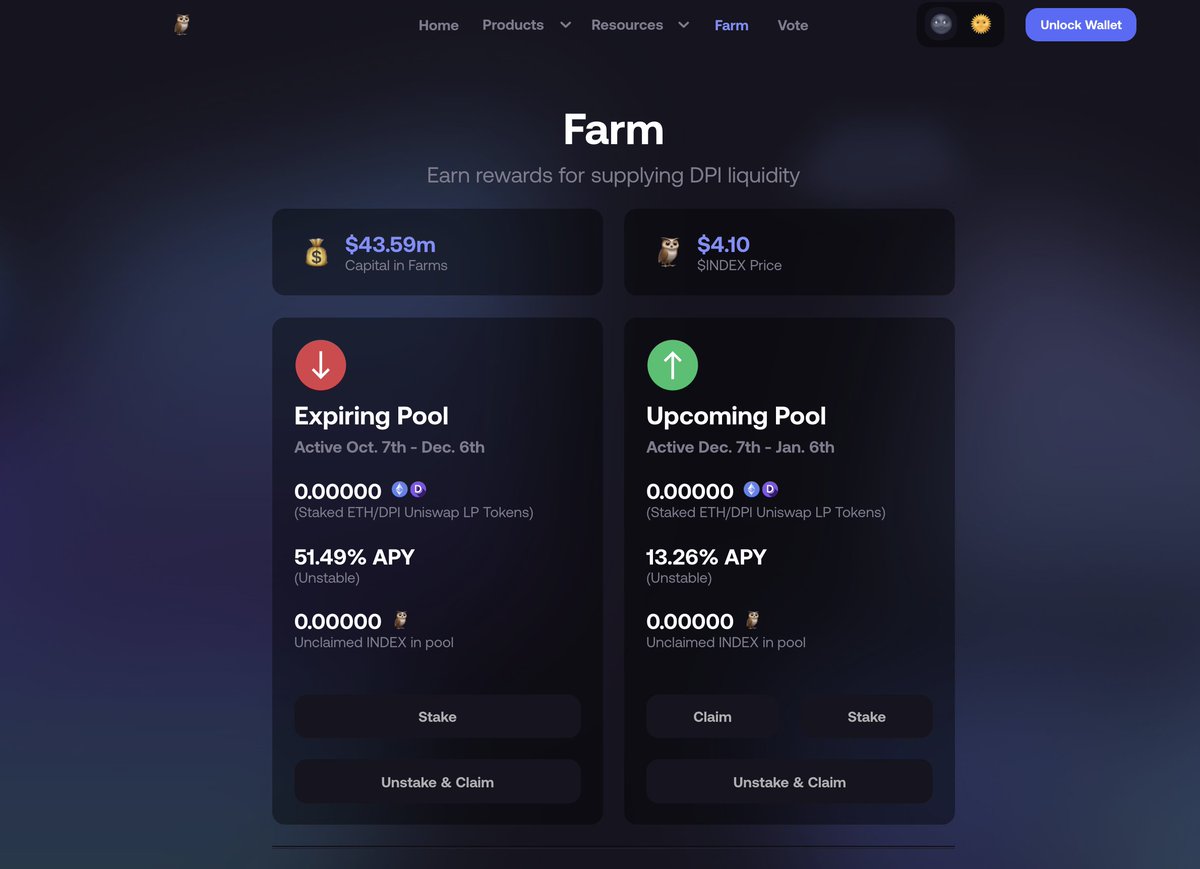

The Index Coop builds decentralized structured products that make crypto simple, accessible, and secure 🦉

How to get URL link on X (Twitter) App

~$7.7B worth of ETH currently exists in liquid staking pools, representing almost 1/3 of all staked $ETH

~$7.7B worth of ETH currently exists in liquid staking pools, representing almost 1/3 of all staked $ETH

Read our blog on the benefits of on-chain structured products like $icETH 🧊

Read our blog on the benefits of on-chain structured products like $icETH 🧊

https://twitter.com/indexcoop/status/1511506573495087106

2/

2/

2/

2/