Trader and Educator Simplifying ICT Concepts | MMXM Trader | NFA

3 subscribers

How to get URL link on X (Twitter) App

1️⃣ The easiest way to get acquainted with ICT concepts is going through the 2022 Mentorship on YouTube where you will also learn a baseline model to back test and forward test.

1️⃣ The easiest way to get acquainted with ICT concepts is going through the 2022 Mentorship on YouTube where you will also learn a baseline model to back test and forward test.

Determining HTF Draw on Liquidity:

Determining HTF Draw on Liquidity:

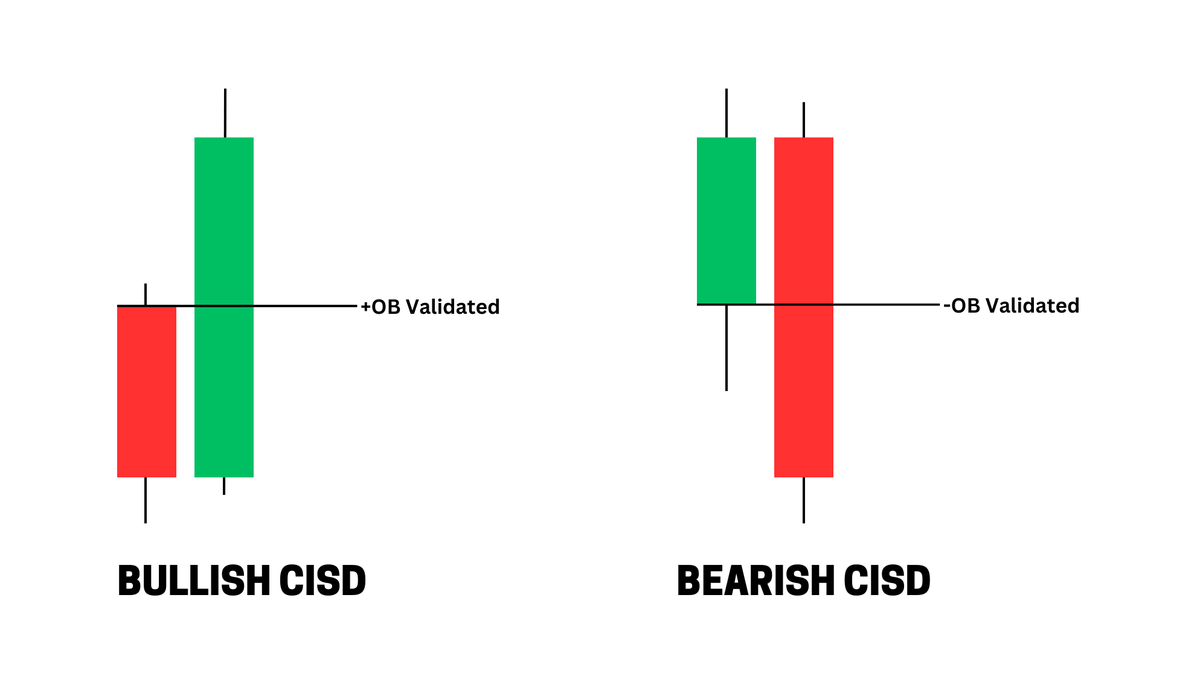

In the words of ICT "An Orderblock is defined as a Change in the State of Delivery".

In the words of ICT "An Orderblock is defined as a Change in the State of Delivery".

1/5

1/5https://x.com/innercircle_ary/status/1808179805969698994

Step 1: Selecting a trading pair which has tagged an HTF (Daily/Weekly) Liquidity pool and has a clear draw on liquidity;

Step 1: Selecting a trading pair which has tagged an HTF (Daily/Weekly) Liquidity pool and has a clear draw on liquidity;