Insights on Investing, Finance, & Stocks | As Seen in Yahoo Finance and Bloomberg

8 subscribers

How to get URL link on X (Twitter) App

1. Overestimating

1. Overestimating

1. Revenue can lie

1. Revenue can lie

1. Declining revenues

1. Declining revenues

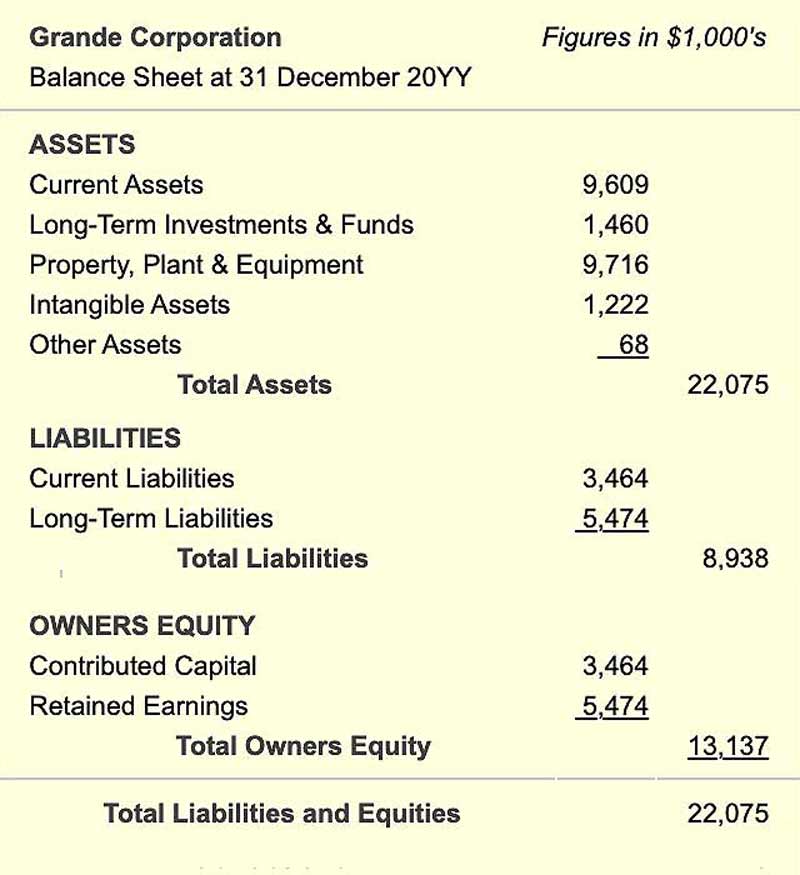

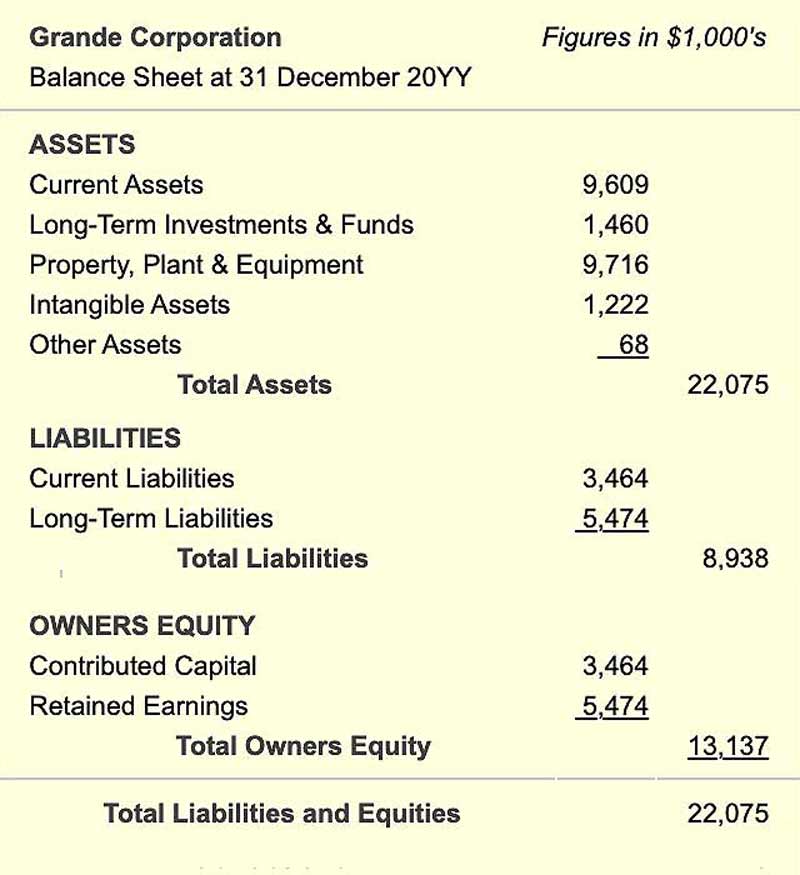

1. High Debt Levels

1. High Debt Levels

1. Invest in "inevitable" companies

1. Invest in "inevitable" companies

1/ The DRD lets companies deduct a portion of the dividends they receive from other companies, which reduces the taxable income and results in significant tax savings

1/ The DRD lets companies deduct a portion of the dividends they receive from other companies, which reduces the taxable income and results in significant tax savings

1/ The Bank of Japan raised interest rates to around 0.25% which ended their long-standing policy of near-zero interest rates

1/ The Bank of Japan raised interest rates to around 0.25% which ended their long-standing policy of near-zero interest rates