Russia & Economics

All views private

German Institute for International and Security Affairs @SWPBerlin

Picture: Tomek Kowalski

7 subscribers

How to get URL link on X (Twitter) App

The EU has to make sure that the money is spent in Europe's and Ukraine's interest. Once we have taken control over it, US and EU interests will align again, because we will use some of it to buy US weapons. Until then, it is an opportunity for US-Russia collusion.

The EU has to make sure that the money is spent in Europe's and Ukraine's interest. Once we have taken control over it, US and EU interests will align again, because we will use some of it to buy US weapons. Until then, it is an opportunity for US-Russia collusion.

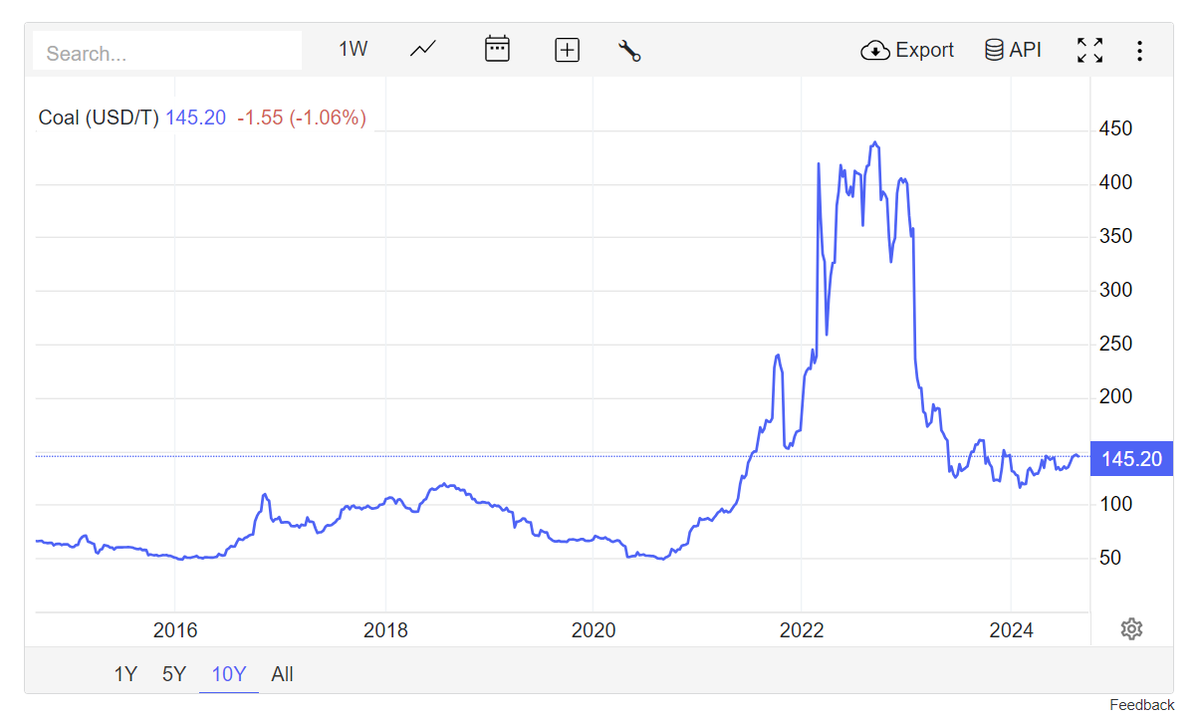

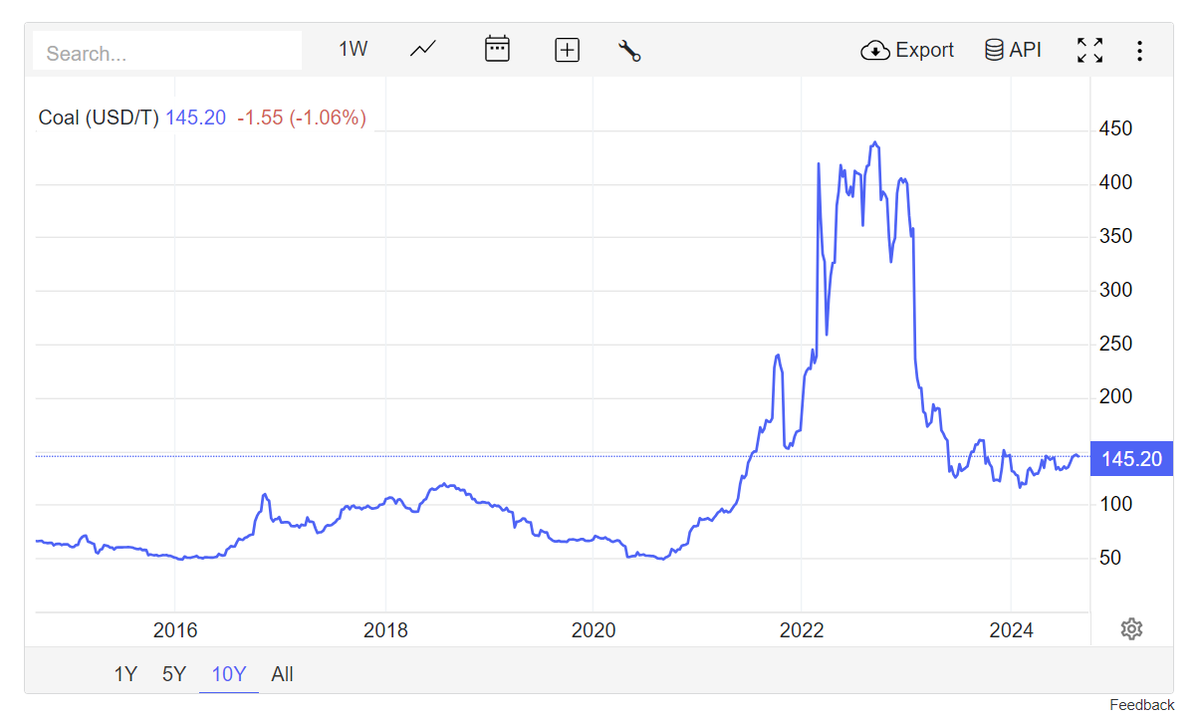

By now, I'm pretty confident that my recruitment estimates based on regional budget data are useful. Over the last 1.5 years, they closely tracked the quarterly results based on federal data (which is always published with a big delay).

By now, I'm pretty confident that my recruitment estimates based on regional budget data are useful. Over the last 1.5 years, they closely tracked the quarterly results based on federal data (which is always published with a big delay).

https://twitter.com/HoansSolo/status/1901914418436526095If anything, these peacekeepers will be an invitation for Russia to test Europeans by attacking them in Ukraine. Are European societies ready to see thousands of their soldiers dying there? Because Putin certainly would be willing to sacrifice his people to expose Europe.

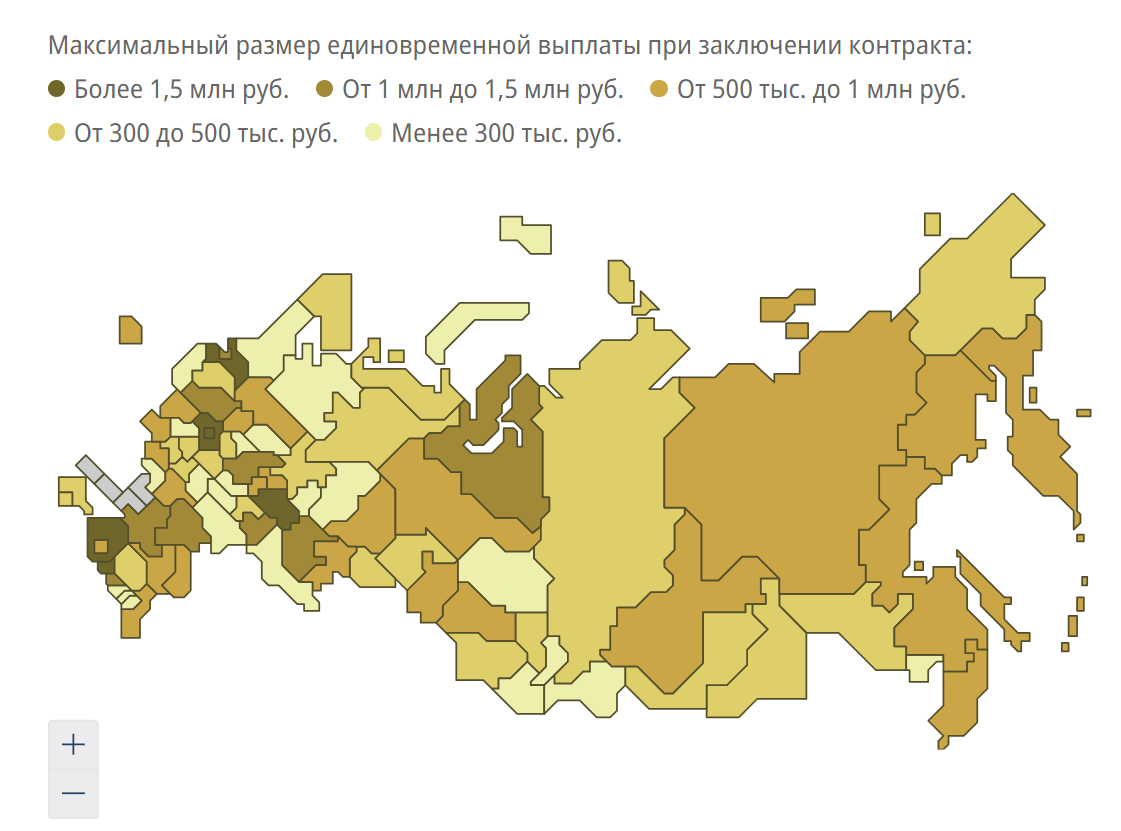

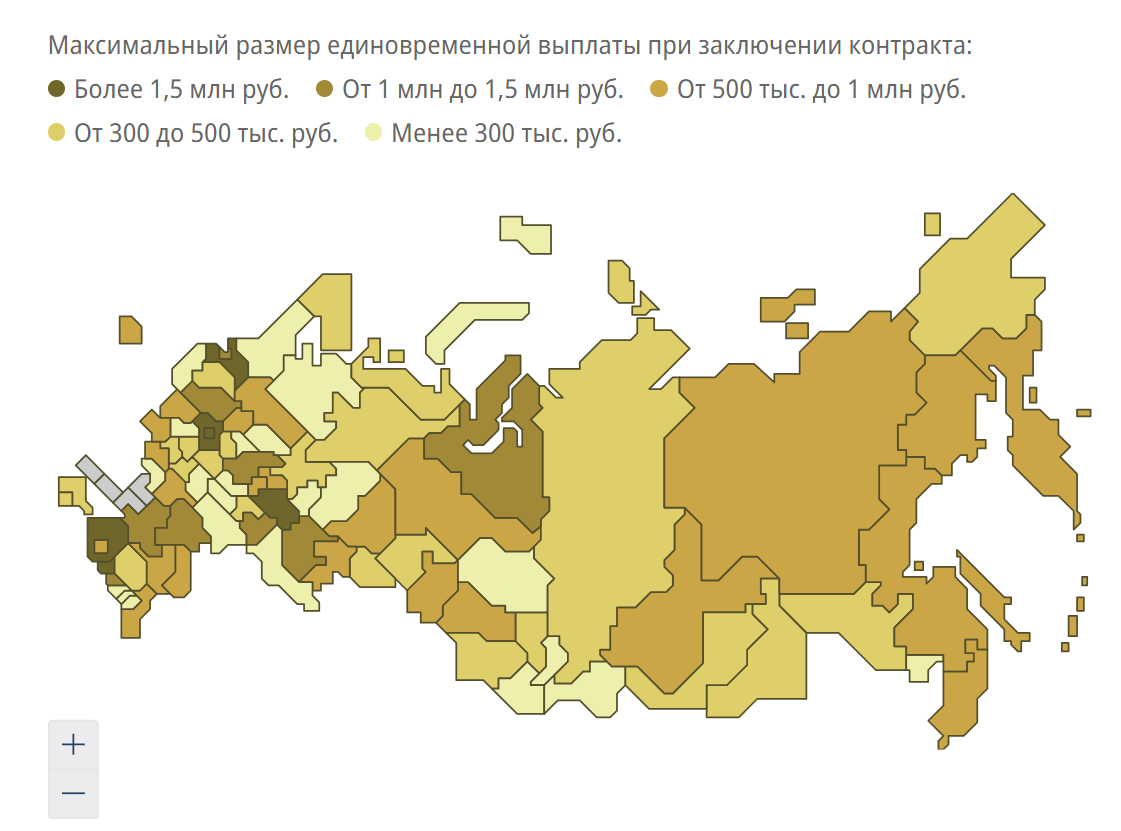

The regions I analyzed are just a small part of Russia, but they are very diverse and from different parts of the country, and they tell a similar story (which may not be that surprising): Offering millions of rubles attracts more recruits.

The regions I analyzed are just a small part of Russia, but they are very diverse and from different parts of the country, and they tell a similar story (which may not be that surprising): Offering millions of rubles attracts more recruits.

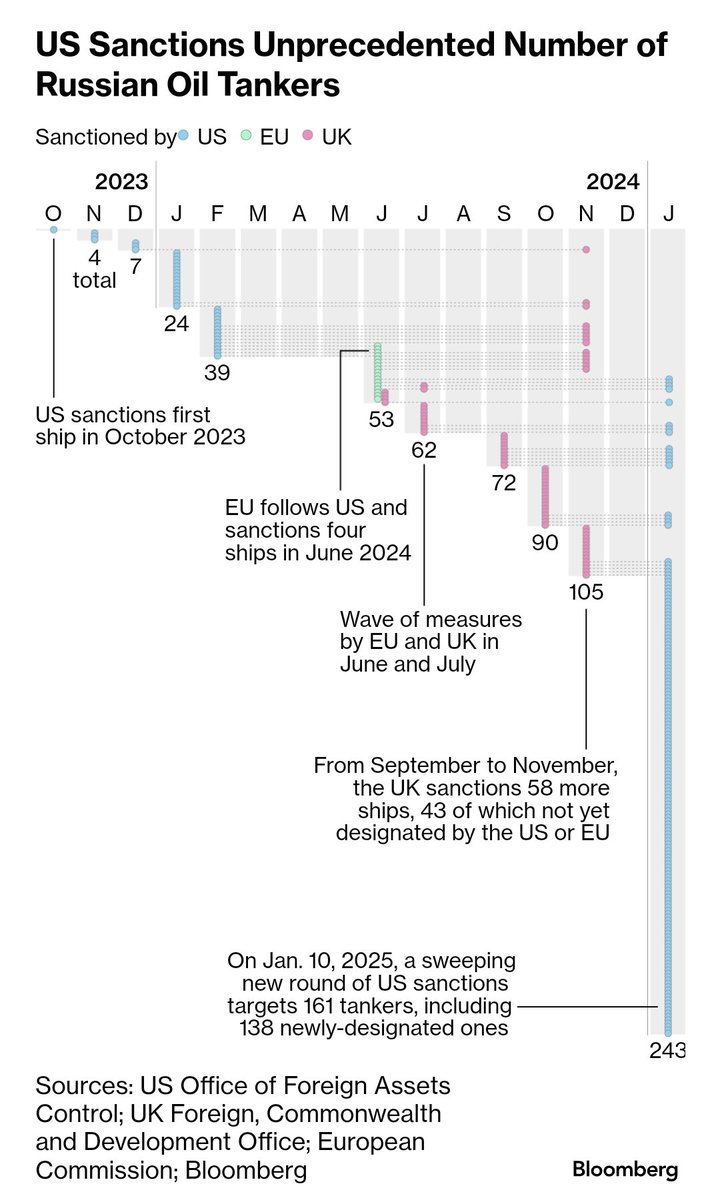

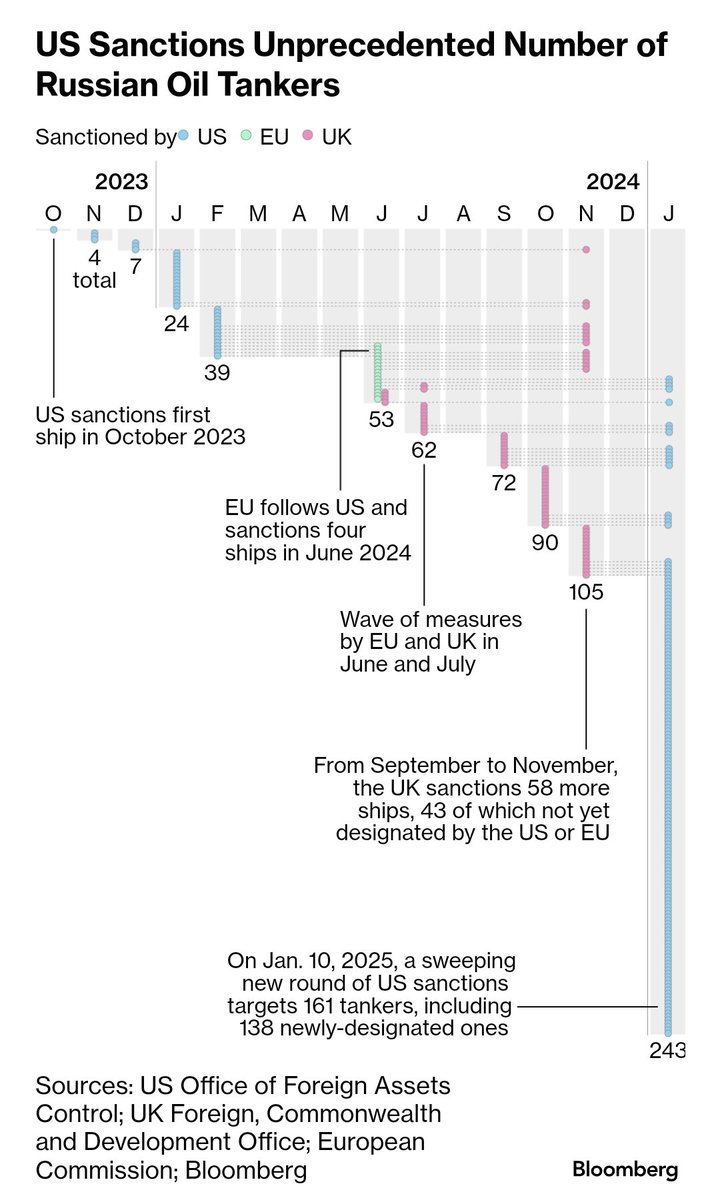

The US did not just target any export volume, but made sure to hit Russia's most profitable export routes the hardest: Oil from Russia's Pacific ports had a small discount and low shipping costs, making it much more profitable then exports from the Baltic/Black Sea to India.

The US did not just target any export volume, but made sure to hit Russia's most profitable export routes the hardest: Oil from Russia's Pacific ports had a small discount and low shipping costs, making it much more profitable then exports from the Baltic/Black Sea to India.

https://twitter.com/jp_koning/status/1870107164913873231Bitcoin doesn't appear to be a Ponzi scheme - because there is no Ponzi! The system is decentralized. In the early years of Bitcoin, there was a lot of talk of possible use cases of Bitcoin. That has almost disappeared, now it is just the hope of the value going up up up.

It is not difficult to find interpretations in the text that I violently disagree with: For example: that the Istanbul negotiations were anywhere close to ending the war. The re-framing of the process as "almost successful" initally began in conspirational corners of the debate.

It is not difficult to find interpretations in the text that I violently disagree with: For example: that the Istanbul negotiations were anywhere close to ending the war. The re-framing of the process as "almost successful" initally began in conspirational corners of the debate.

The authors explain why - in their view - a lot of the earlier predictions for Russia's economy have not come true. It is not just an analysis "in hindsight": Already in March 2022, Dmitry Nekrasov wrote a forecast for Russia's economy that turned out to be very accurate.

The authors explain why - in their view - a lot of the earlier predictions for Russia's economy have not come true. It is not just an analysis "in hindsight": Already in March 2022, Dmitry Nekrasov wrote a forecast for Russia's economy that turned out to be very accurate.

https://twitter.com/francis_scarr/status/1854552763549499472Similarly, Trenin says Russia is first and foremost interested in "the character of Ukraine's future regime and military potential".

When you enlist in the Russian military, your family can expect three different types of payments over the course of your (often literally short-lived) career:

When you enlist in the Russian military, your family can expect three different types of payments over the course of your (often literally short-lived) career:

In some places, the total signing bonus will buy you an apartment. Signing bonuses make up a significant part of the budget: Russia claims it mobilizes 100k soldiers in 3-4 months. If we assume total bonus is 1 mio, this is 400 billion rubles (4.5 billion dollars) per year. 2/4

In some places, the total signing bonus will buy you an apartment. Signing bonuses make up a significant part of the budget: Russia claims it mobilizes 100k soldiers in 3-4 months. If we assume total bonus is 1 mio, this is 400 billion rubles (4.5 billion dollars) per year. 2/4

https://twitter.com/verekerrichard1/status/1814284243465368063All three are not limitless, and the economic consequence of that is inflation. Inflation is the result of urgently ramping up military production, pulling men from the labor market and sending them to the front, and from weakening trade and fiscal balances. 2/5

After two years of unprecedented sanctions, the Russian economy has exceeded expectations. Yes, sanctions have had a clear impact, but they leave Putin with enough resources to militarize Russia in the coming years and turn it into a conventional military threat to Europe. 2/

After two years of unprecedented sanctions, the Russian economy has exceeded expectations. Yes, sanctions have had a clear impact, but they leave Putin with enough resources to militarize Russia in the coming years and turn it into a conventional military threat to Europe. 2/