Generative AI tutorials, news & crazy creations.

Founder @Magnific_AI (acq. by @freepik). Mystic designer.

🎬 YouTube: https://t.co/Wy91d2BwQh

15 subscribers

How to get URL link on X (Twitter) App

https://x.com/fofrAI/status/2016936855607136506

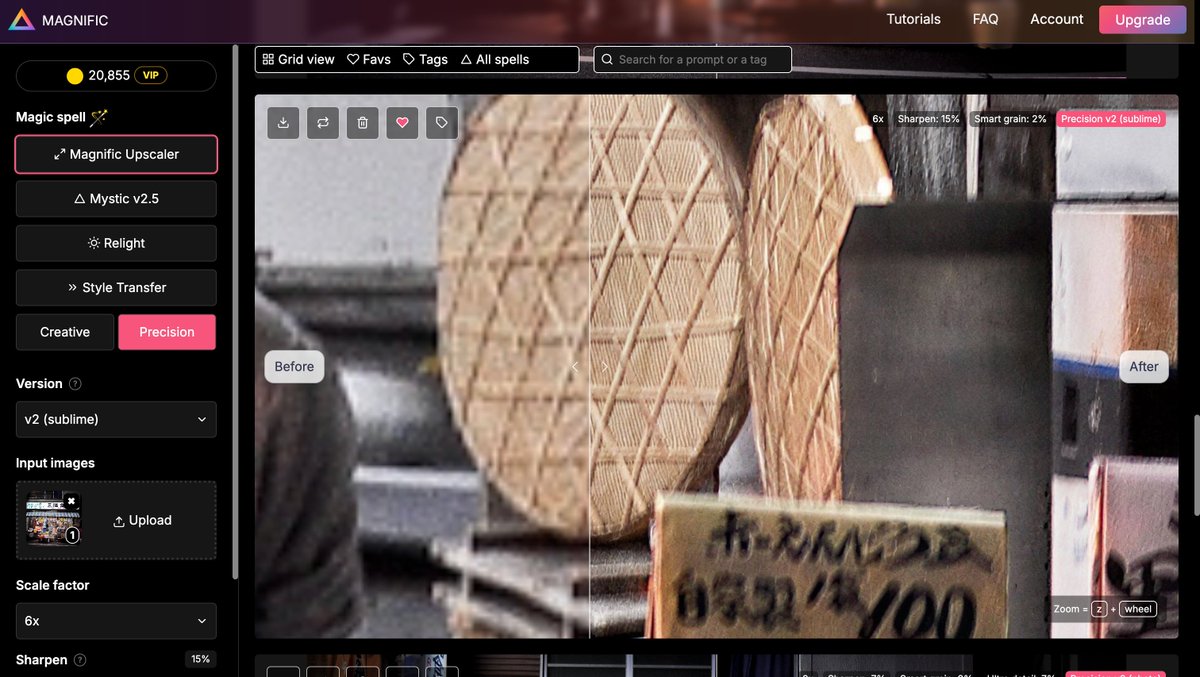

First of all, if you can't wait, here you have the link! AVAILABLE NOW on Magnific & rolling out to Freepik users today!

First of all, if you can't wait, here you have the link! AVAILABLE NOW on Magnific & rolling out to Freepik users today!

We’ve been secretly working on this for months! It feels good to finally share it!

We’ve been secretly working on this for months! It feels good to finally share it!

Link to my portfolio:

Link to my portfolio:

Style: "Retro tech-noir anime, like Akira, Ghost in the Shell, or Cyber City Oedo 808: cool tones and neon lights, strong shadows, intense expressions, and a futuristic, dark, and dramatic atmosphere."

Style: "Retro tech-noir anime, like Akira, Ghost in the Shell, or Cyber City Oedo 808: cool tones and neon lights, strong shadows, intense expressions, and a futuristic, dark, and dramatic atmosphere."

Index – In case you want to jump straight to a section:

Index – In case you want to jump straight to a section:

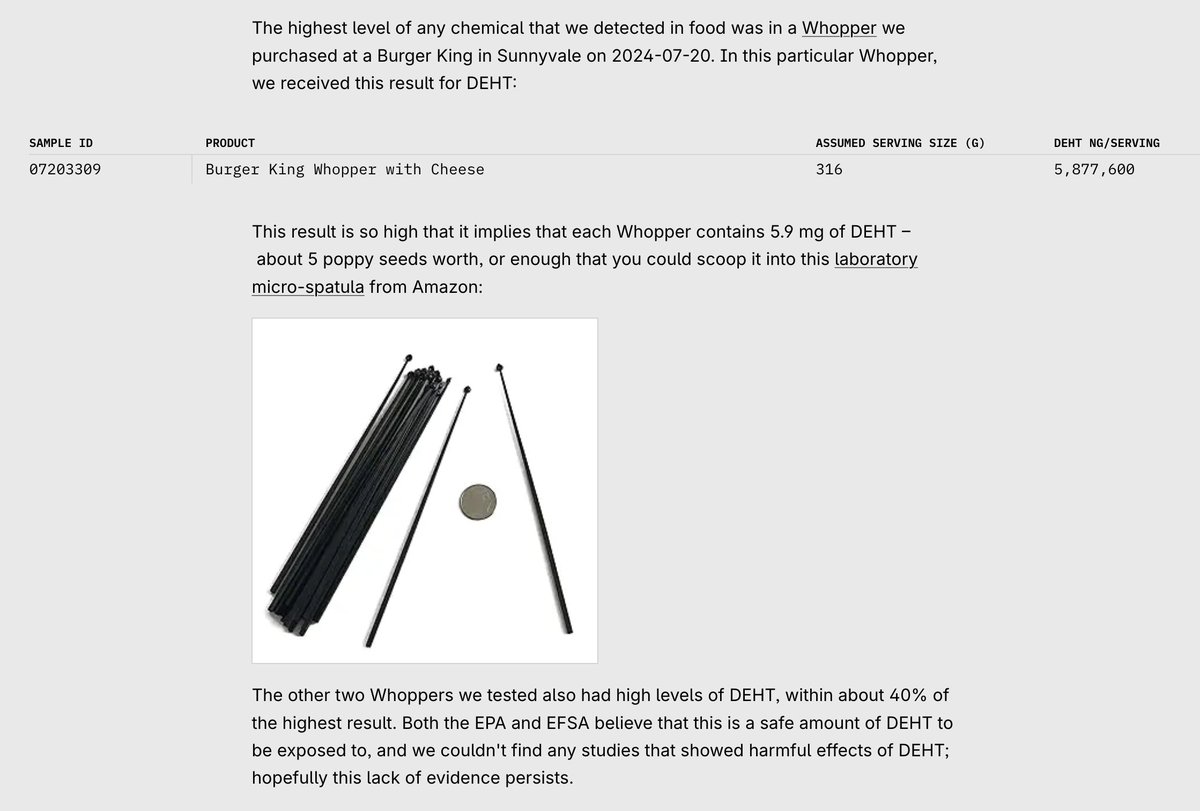

Here you have the full report and the story behind it:

Here you have the full report and the story behind it: https://x.com/javilopen/status/1719363262179938401

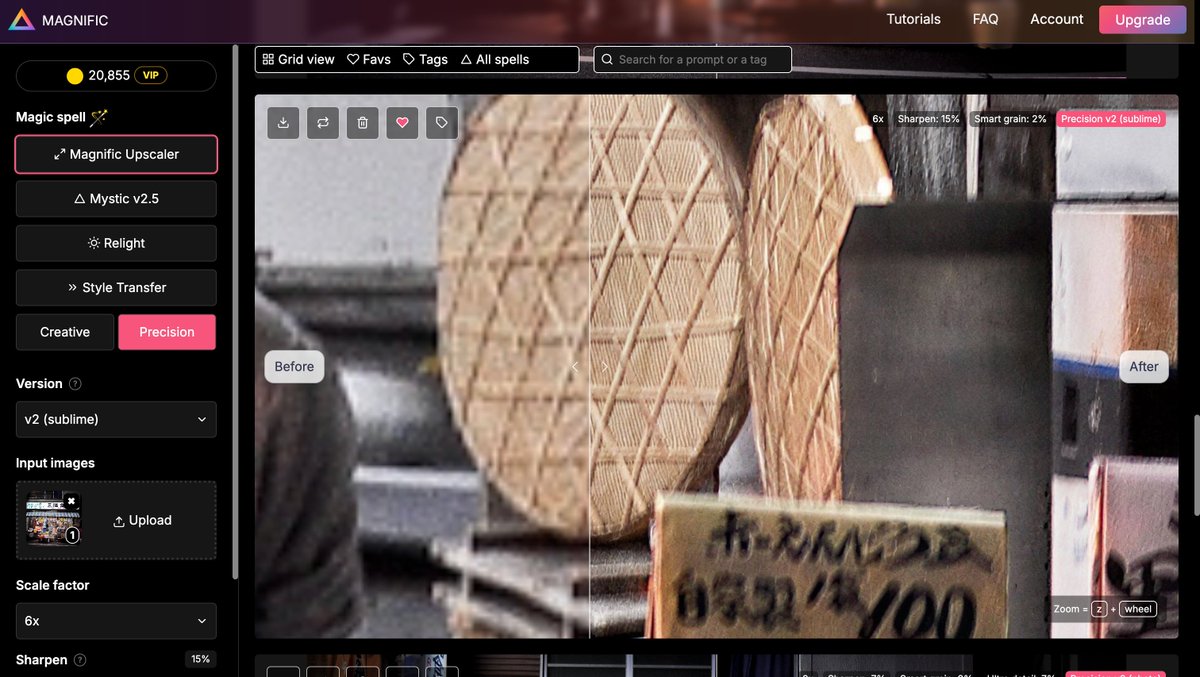

This is tutorial 1/20 of the #mystic exploration series I'm planning to do in which I will cover the main categories of image generation that any professional might need. Follow me at @javilopen so you don’t miss them!

This is tutorial 1/20 of the #mystic exploration series I'm planning to do in which I will cover the main categories of image generation that any professional might need. Follow me at @javilopen so you don’t miss them!