How to get URL link on X (Twitter) App

The $45B headline that fooled the world

The $45B headline that fooled the world

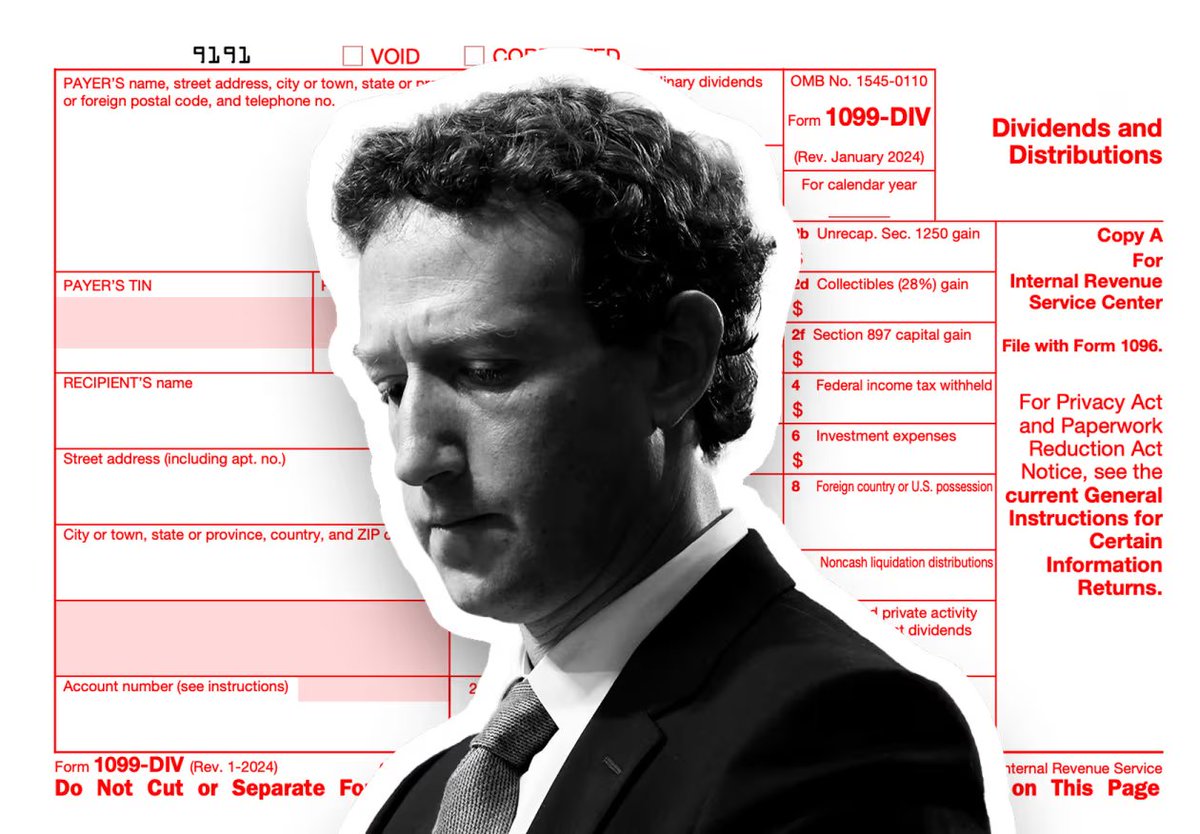

In the early 1600s, the Netherlands was the richest country on Earth.

In the early 1600s, the Netherlands was the richest country on Earth.

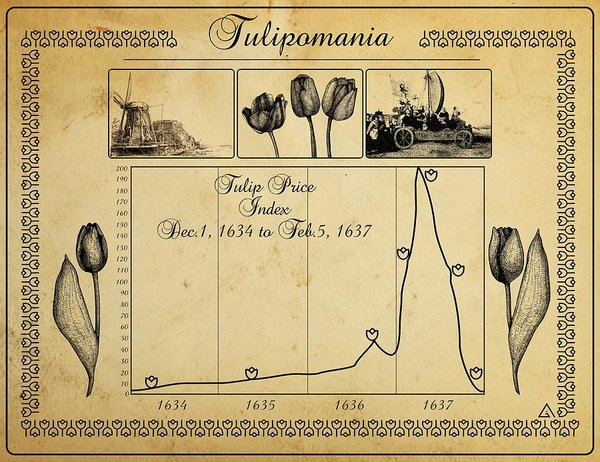

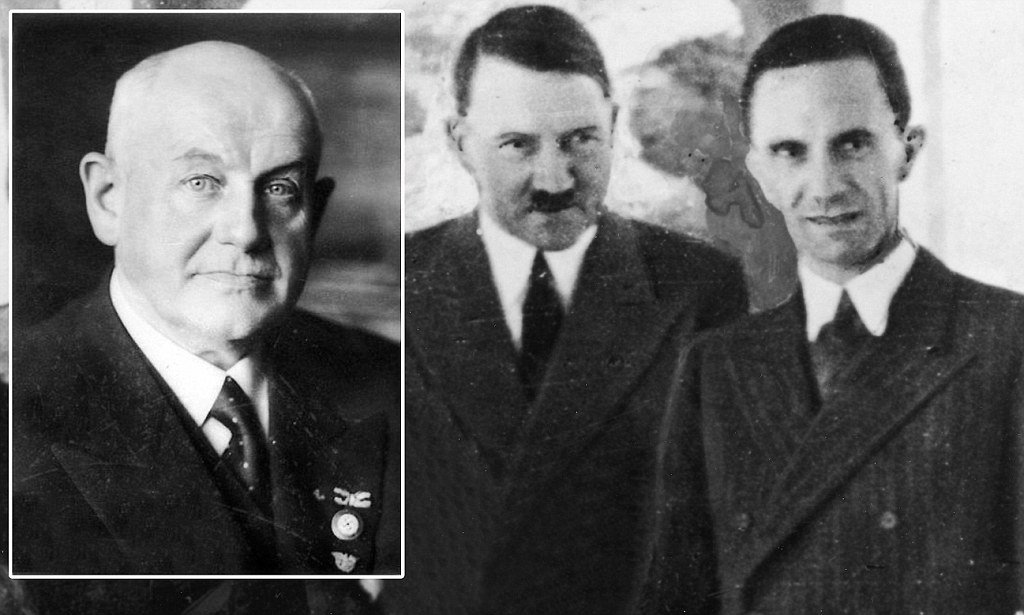

The story starts with Günther Quandt.

The story starts with Günther Quandt.

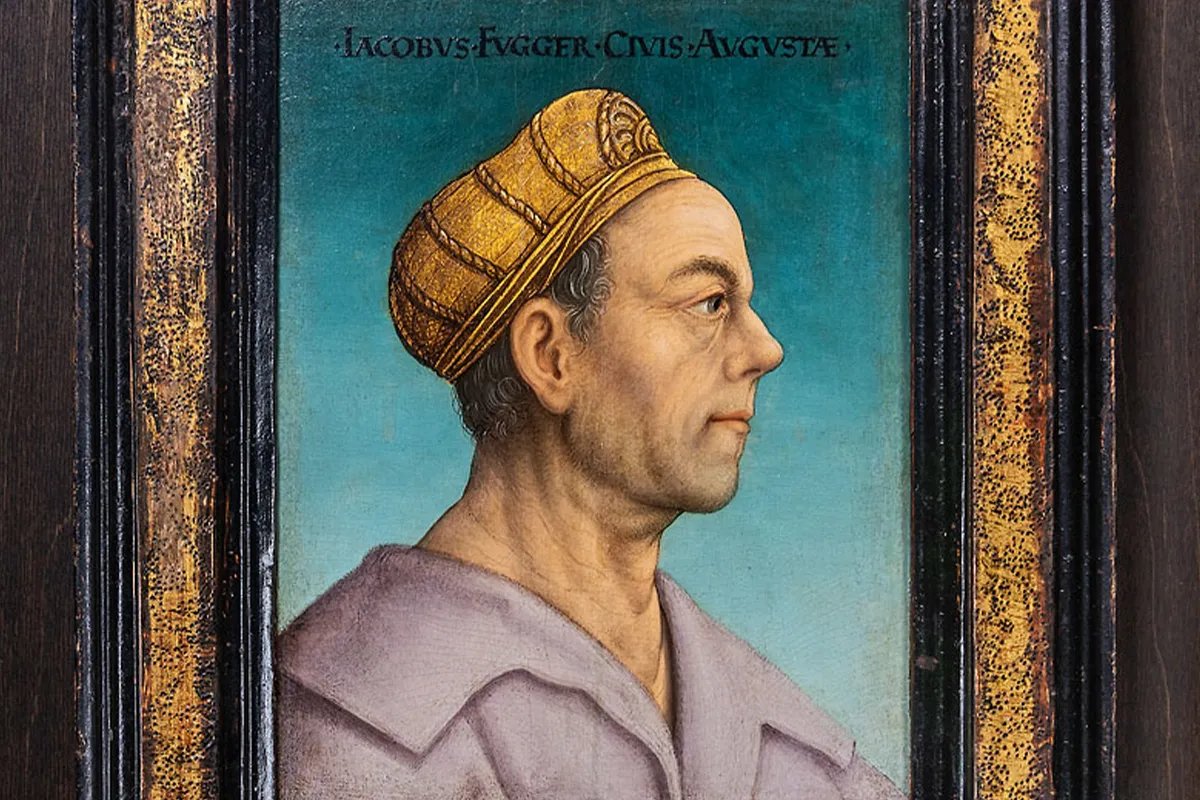

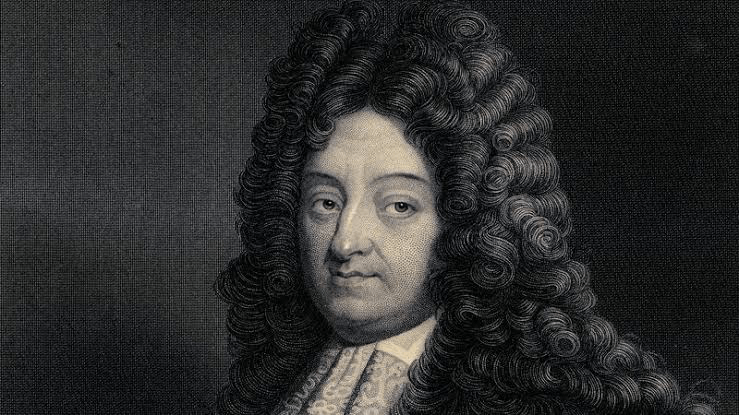

His name is Jakob Fugger.

His name is Jakob Fugger.

“Don’t overthink it.”

“Don’t overthink it.”

Why Big Tech wants to be a bank without calling itself one

Why Big Tech wants to be a bank without calling itself one

1. The secret: Borrow, don’t sell

1. The secret: Borrow, don’t sell

Between 1800 & 1910, America’s banking system was broken:

Between 1800 & 1910, America’s banking system was broken:

1. Stop making minimum payments

1. Stop making minimum payments

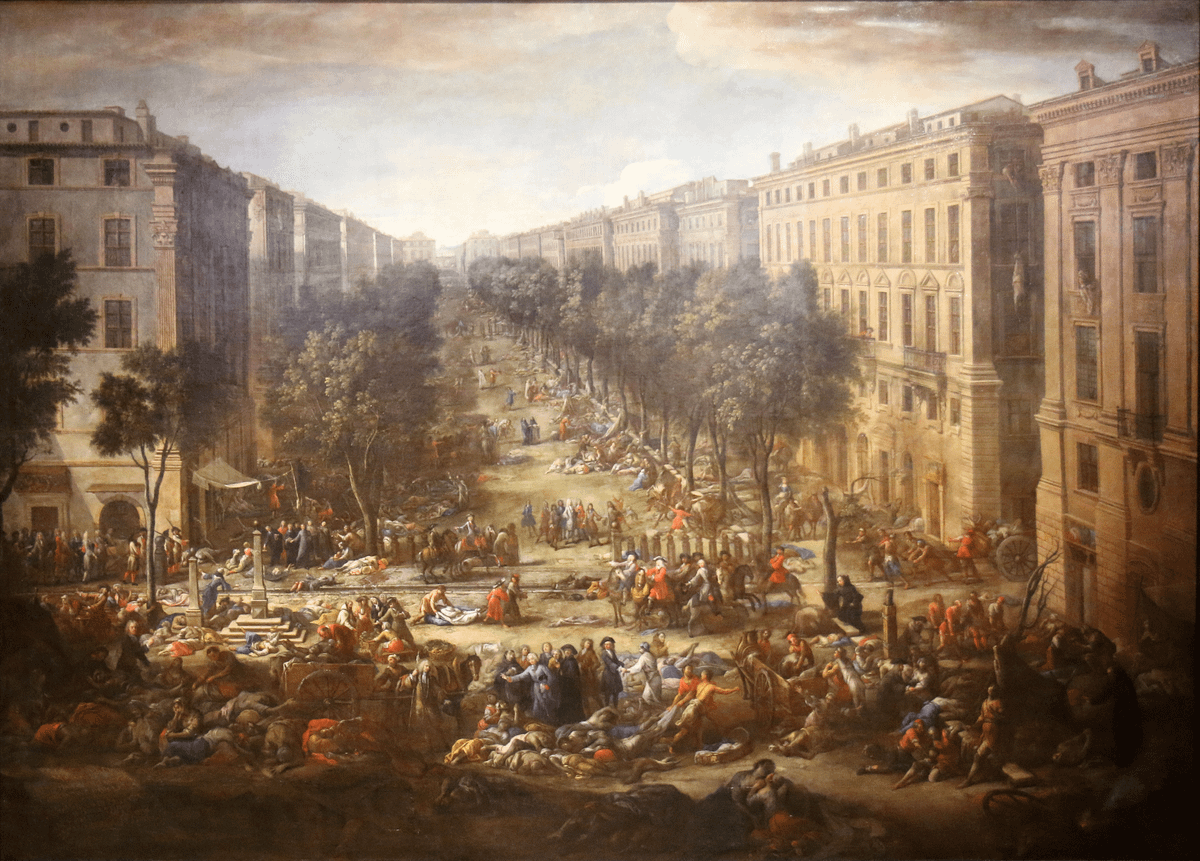

In 1715, France was on the verge of collapse.

In 1715, France was on the verge of collapse.

Between 2006–2018, Jeff Bezos’s wealth grew by $127 billion.

Between 2006–2018, Jeff Bezos’s wealth grew by $127 billion.

Let’s start with the theory.

Let’s start with the theory.

1. Float Like a Pro

1. Float Like a Pro