I buy really good companies.

600,000+ subscribers on YouTube. Follow The Joseph Carlson Show.

2 subscribers

How to get URL link on X (Twitter) App

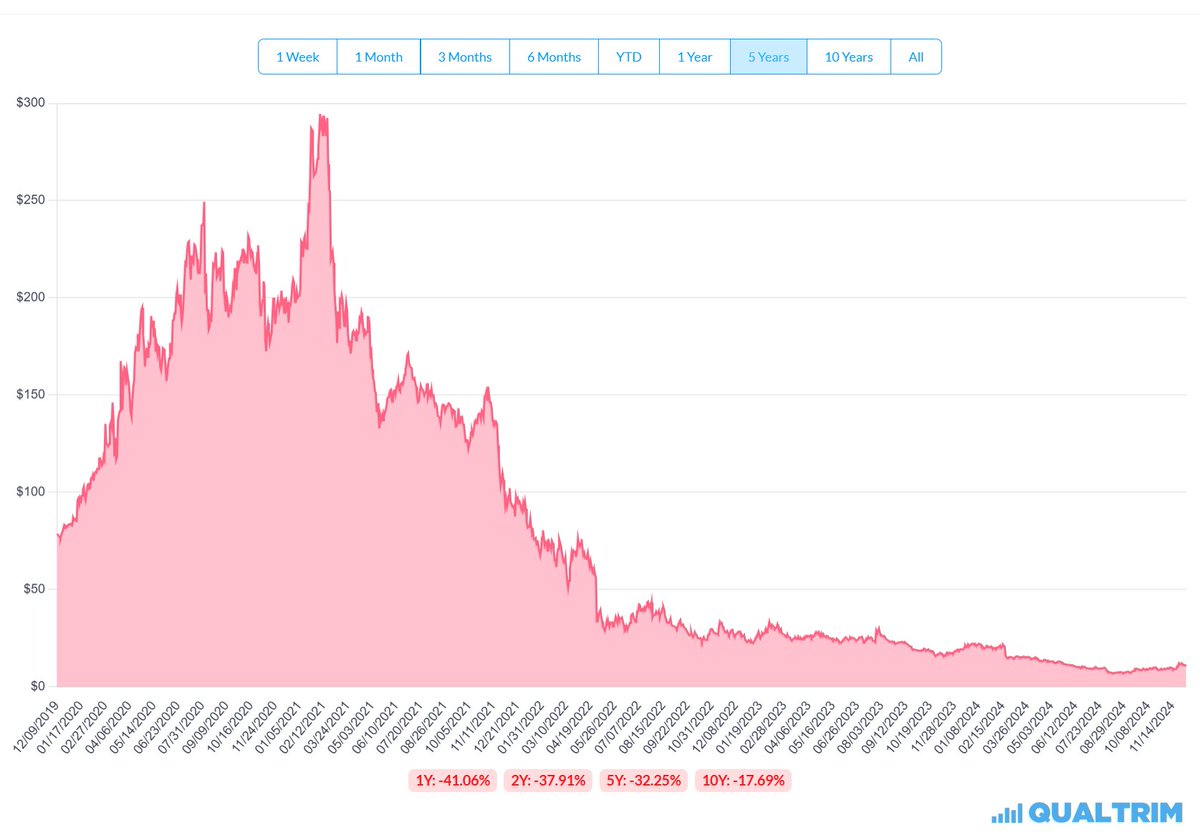

Next up, Teladoc $TDOC. This was the company that would revolutionize healthcare by making it so you no longer had to visit the doctor. Went from $290 to now $11.

Next up, Teladoc $TDOC. This was the company that would revolutionize healthcare by making it so you no longer had to visit the doctor. Went from $290 to now $11.

Compounders are highly predictable money making machines. They are defined by their many attractive attributes and lack of unattractive attributes

Compounders are highly predictable money making machines. They are defined by their many attractive attributes and lack of unattractive attributes

Costco will never put its employees, customers, or shareholders, at risk. For over 20 years they have had more cash than debt and capital leases. Their growth has been without using financial leverage.

Costco will never put its employees, customers, or shareholders, at risk. For over 20 years they have had more cash than debt and capital leases. Their growth has been without using financial leverage.

First: Why focus on compounders?

First: Why focus on compounders?