Founder CEO @Buffer. Building a long term, independent, profitable business with big ambitions. Love building for entrepreneurs and small businesses.

2 subscribers

How to get URL link on X (Twitter) App

Back when I launched Buffer in late 2010, Hootsuite was really the only other player in the space. And they were a product and company I really looked up to. I was a Hootsuite user well before I started Buffer.

Back when I launched Buffer in late 2010, Hootsuite was really the only other player in the space. And they were a product and company I really looked up to. I was a Hootsuite user well before I started Buffer.

https://twitter.com/trappology/status/1340110249047552002I do not recommend unlimited vacation. There are problems with it. The most clear, for us, was that with unlimited vacation, the team did not take enough vacation.

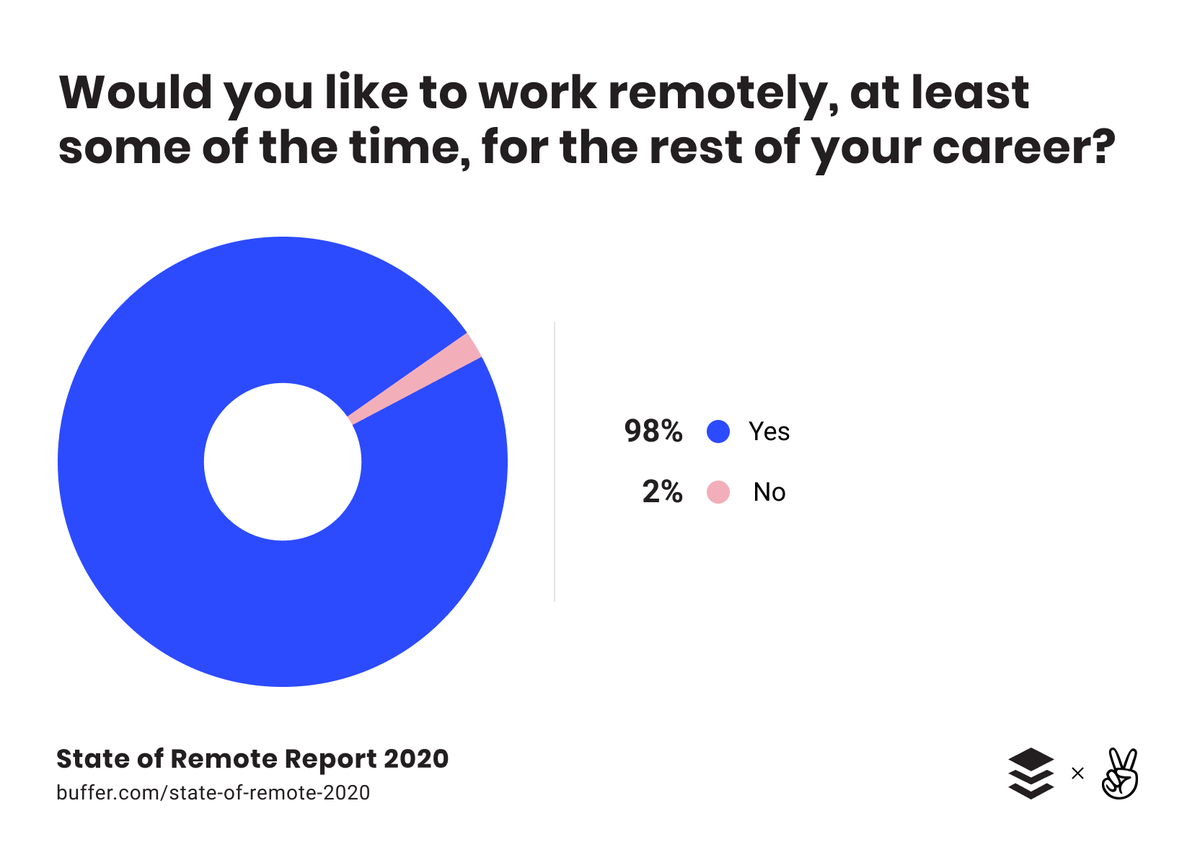

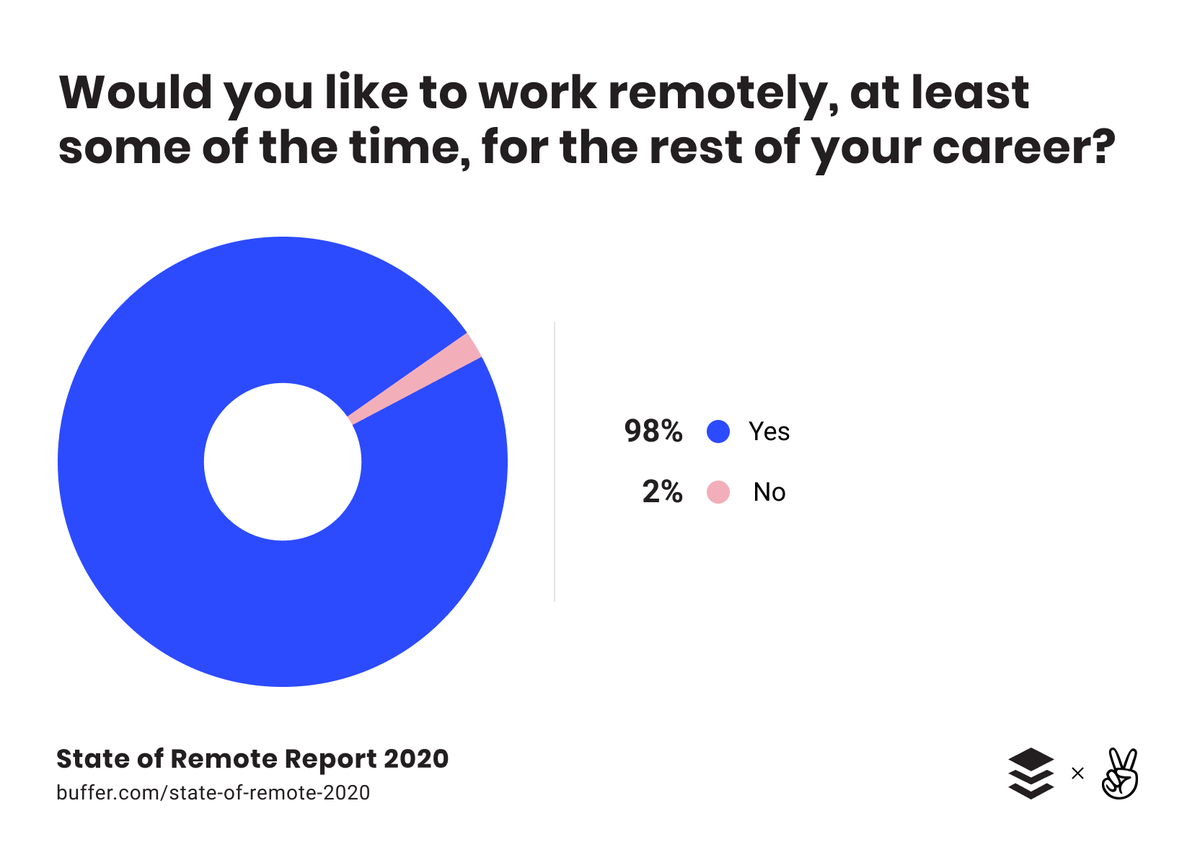

The next highest statistic shows how likely remote workers are to recommend remote work to others:

The next highest statistic shows how likely remote workers are to recommend remote work to others:

https://twitter.com/awilkinson/status/1211440446590734336Andrew has consistently been one of the most helpful shareholders we have, ever since that investment. I don't say this lightly, as we've had many unhelpful investors over that time period too. Case in point, we've spent $7m+ buying back stock since 2017. open.buffer.com/buying-out-inv…

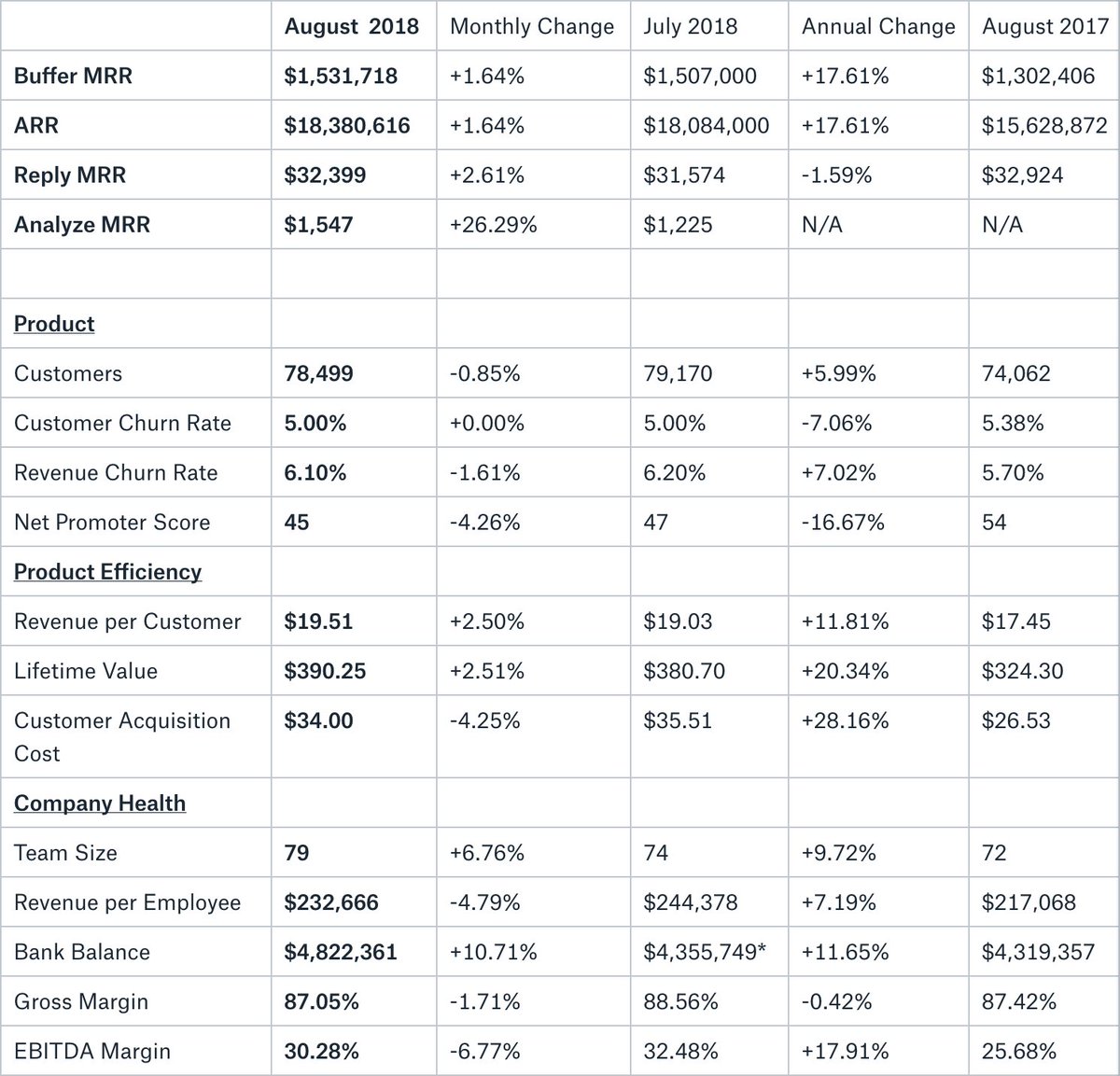

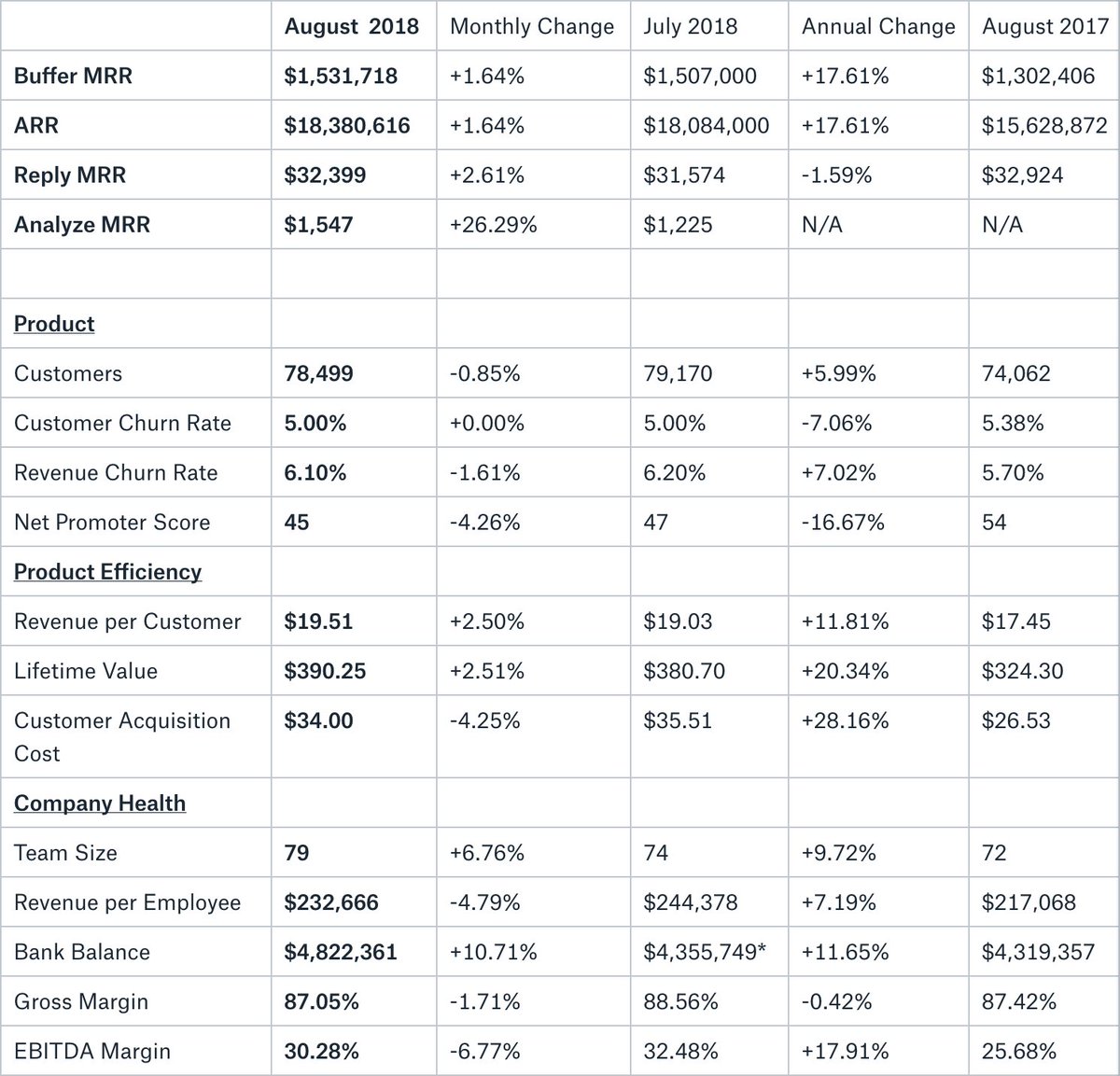

We had great growth due to a couple of factors in particular:

We had great growth due to a couple of factors in particular:

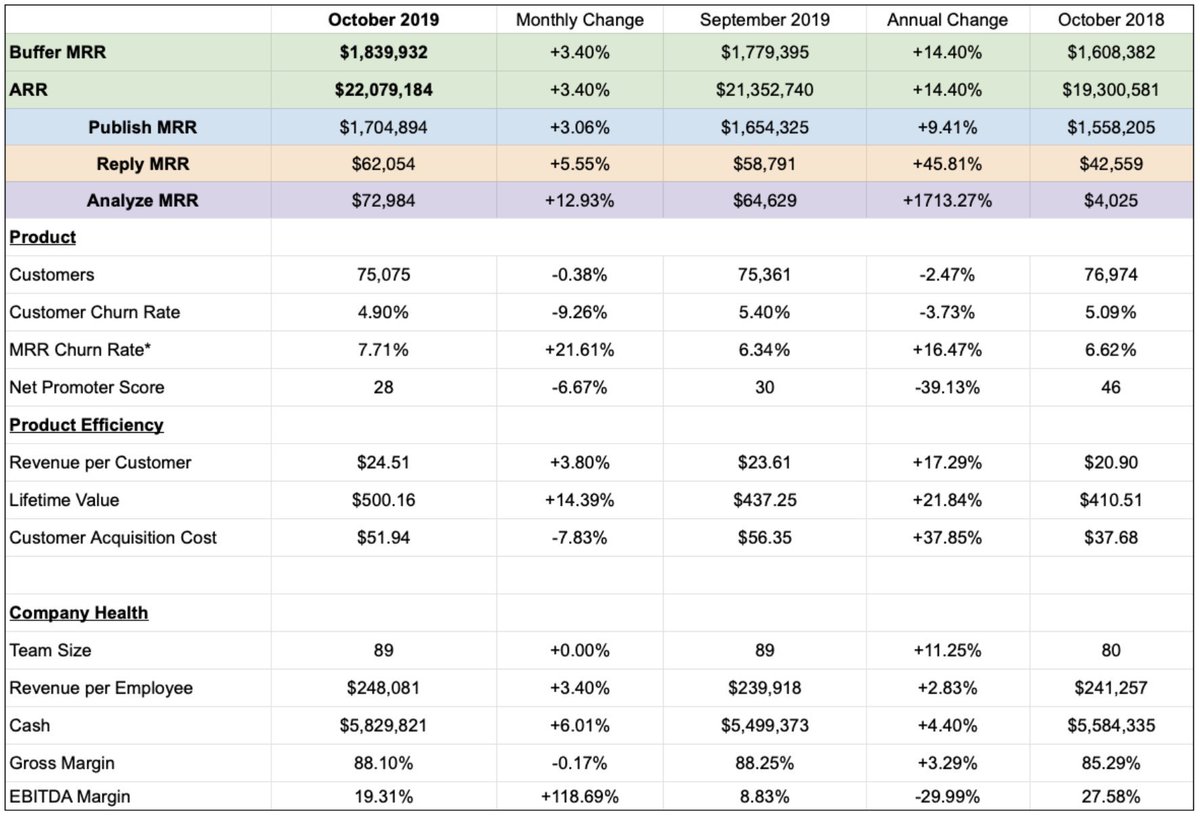

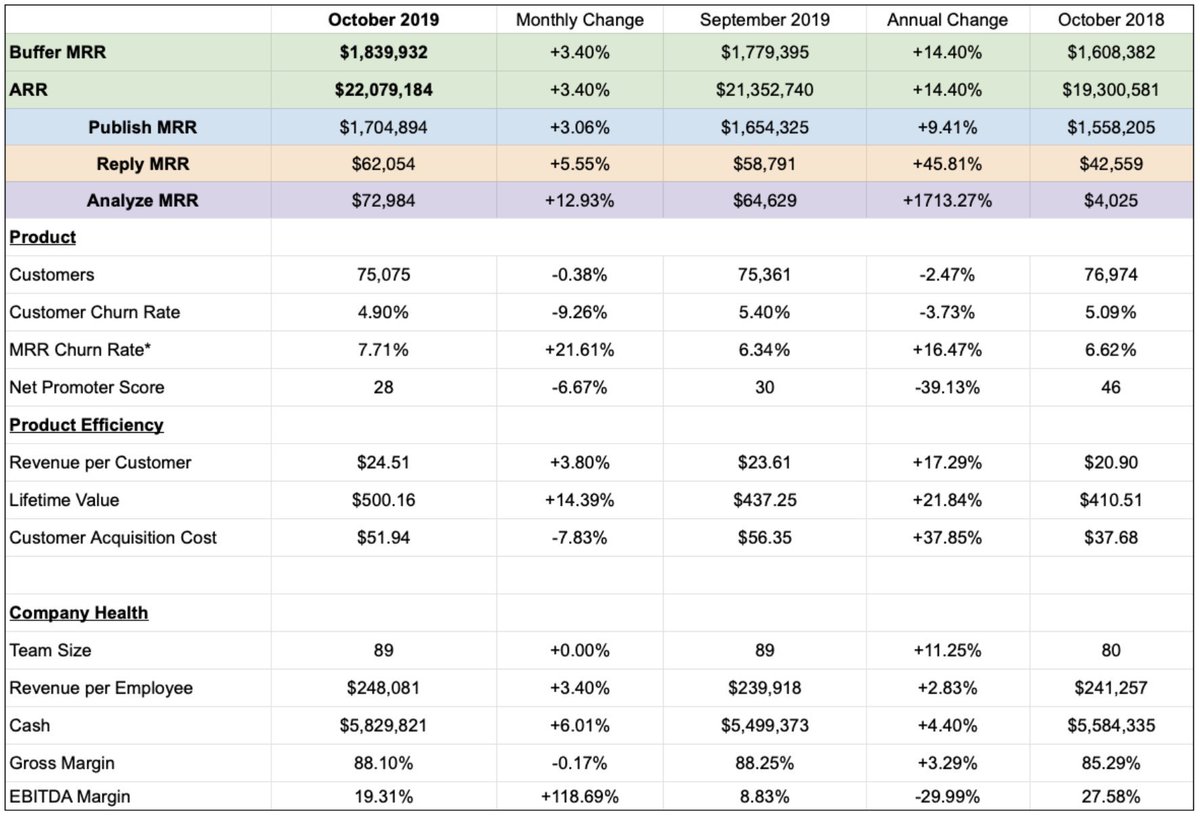

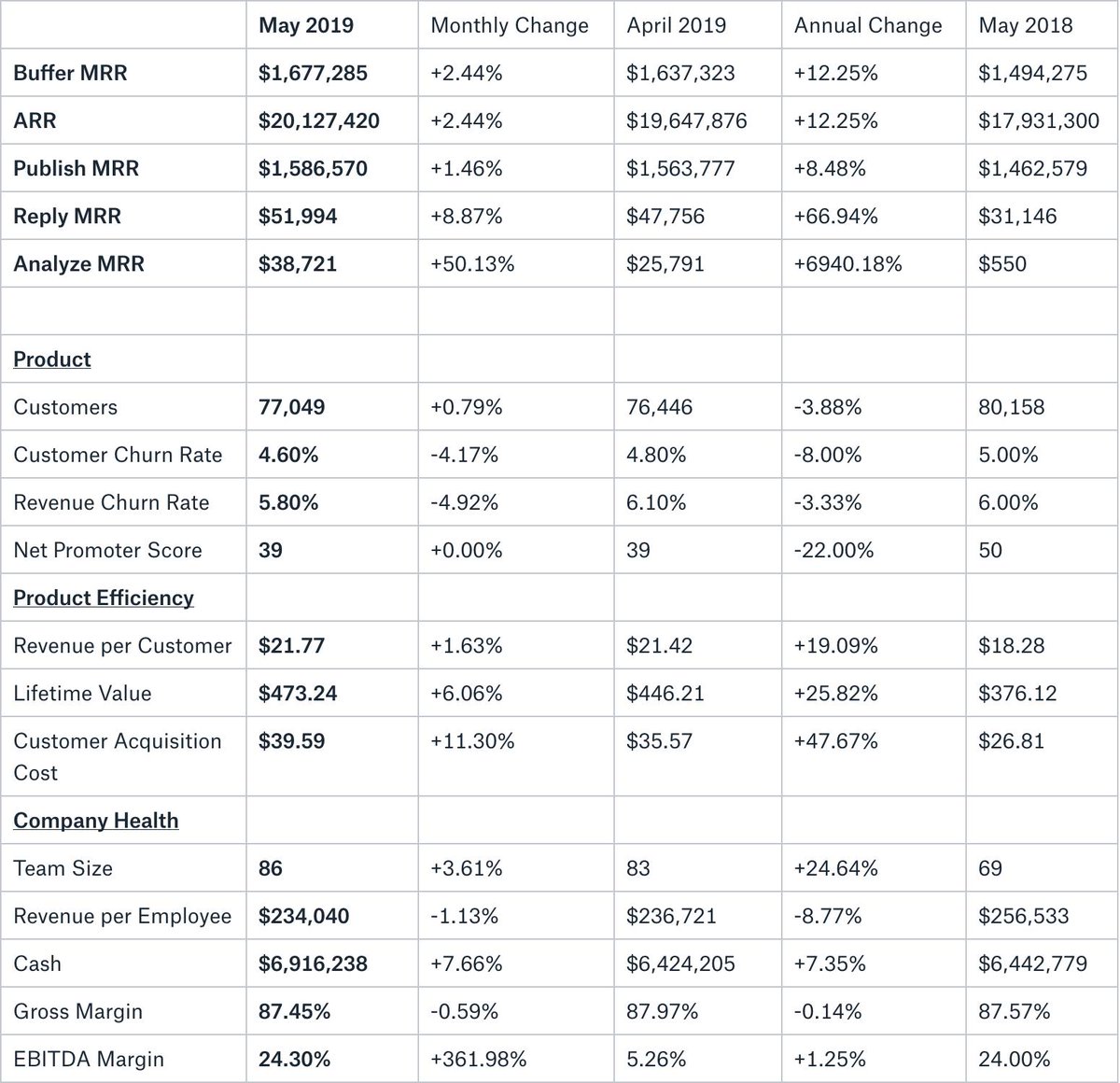

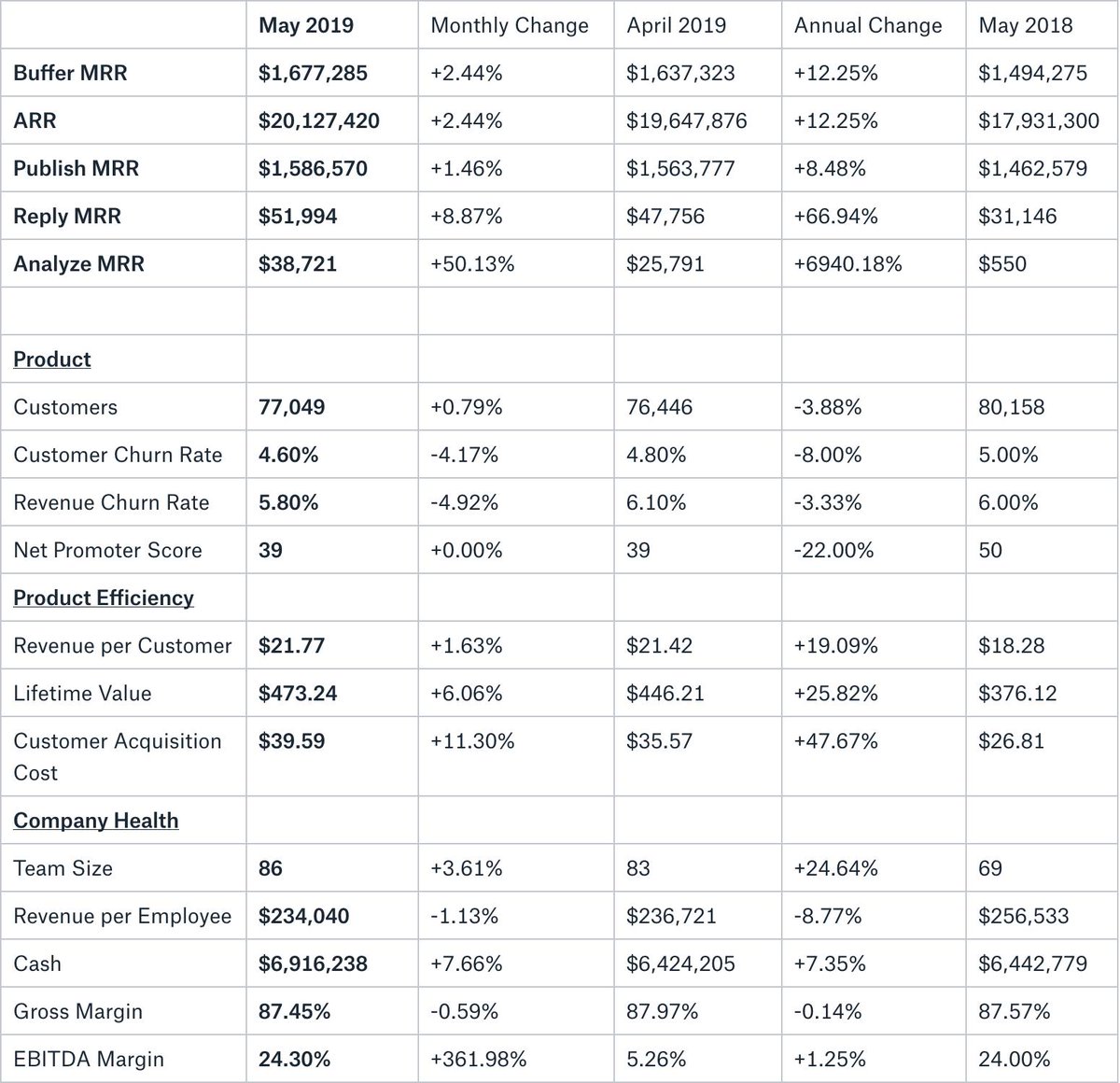

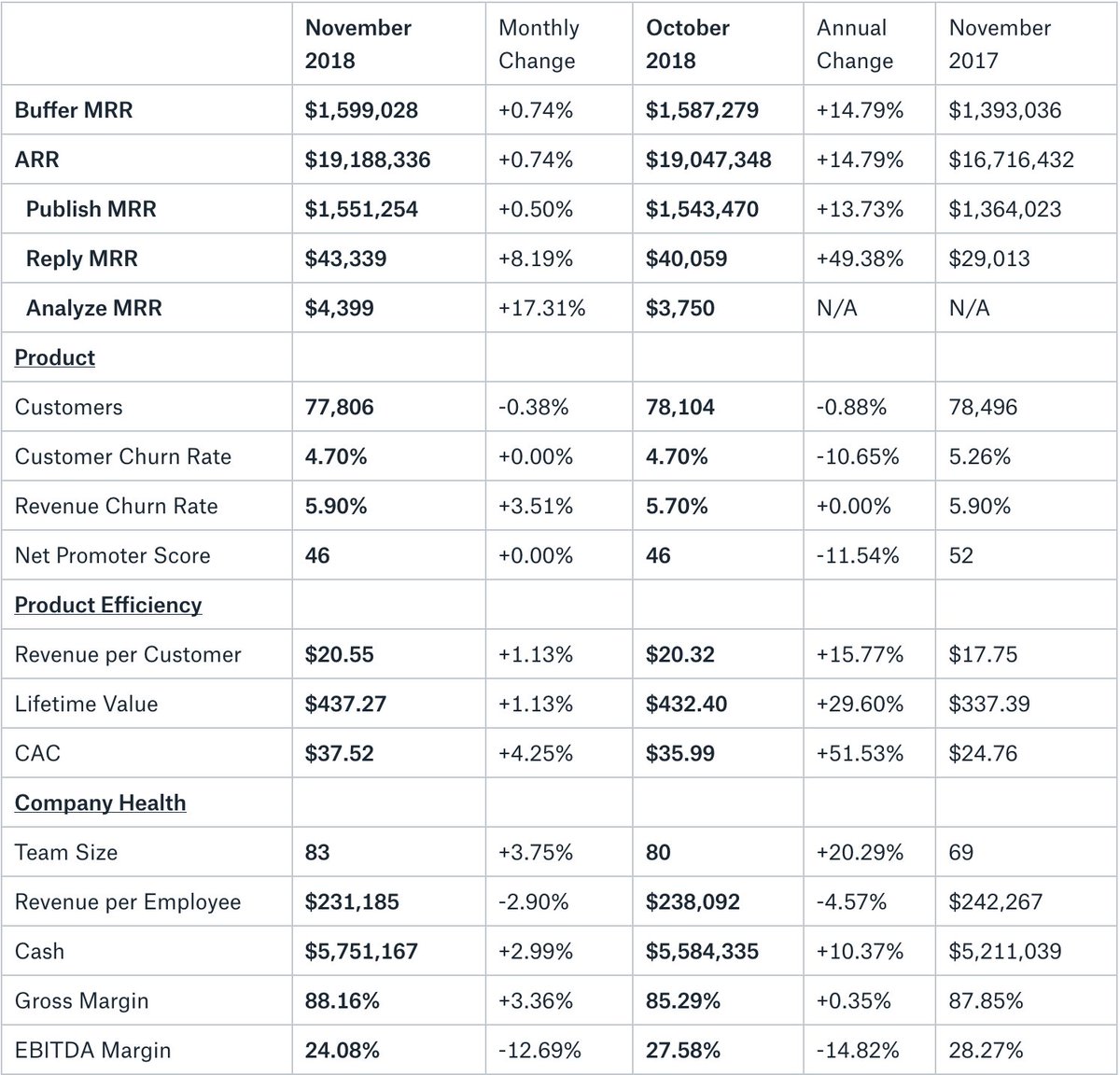

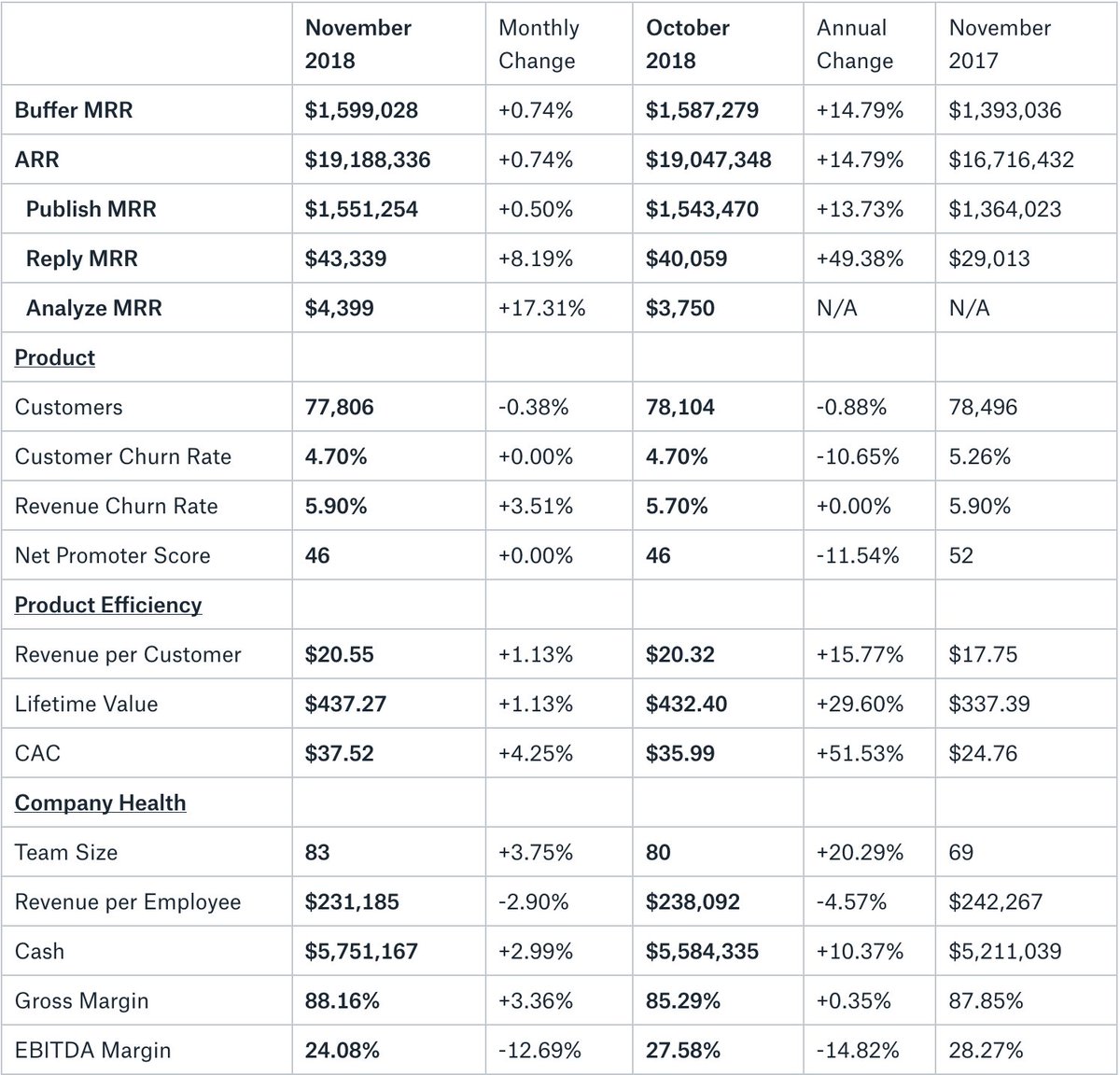

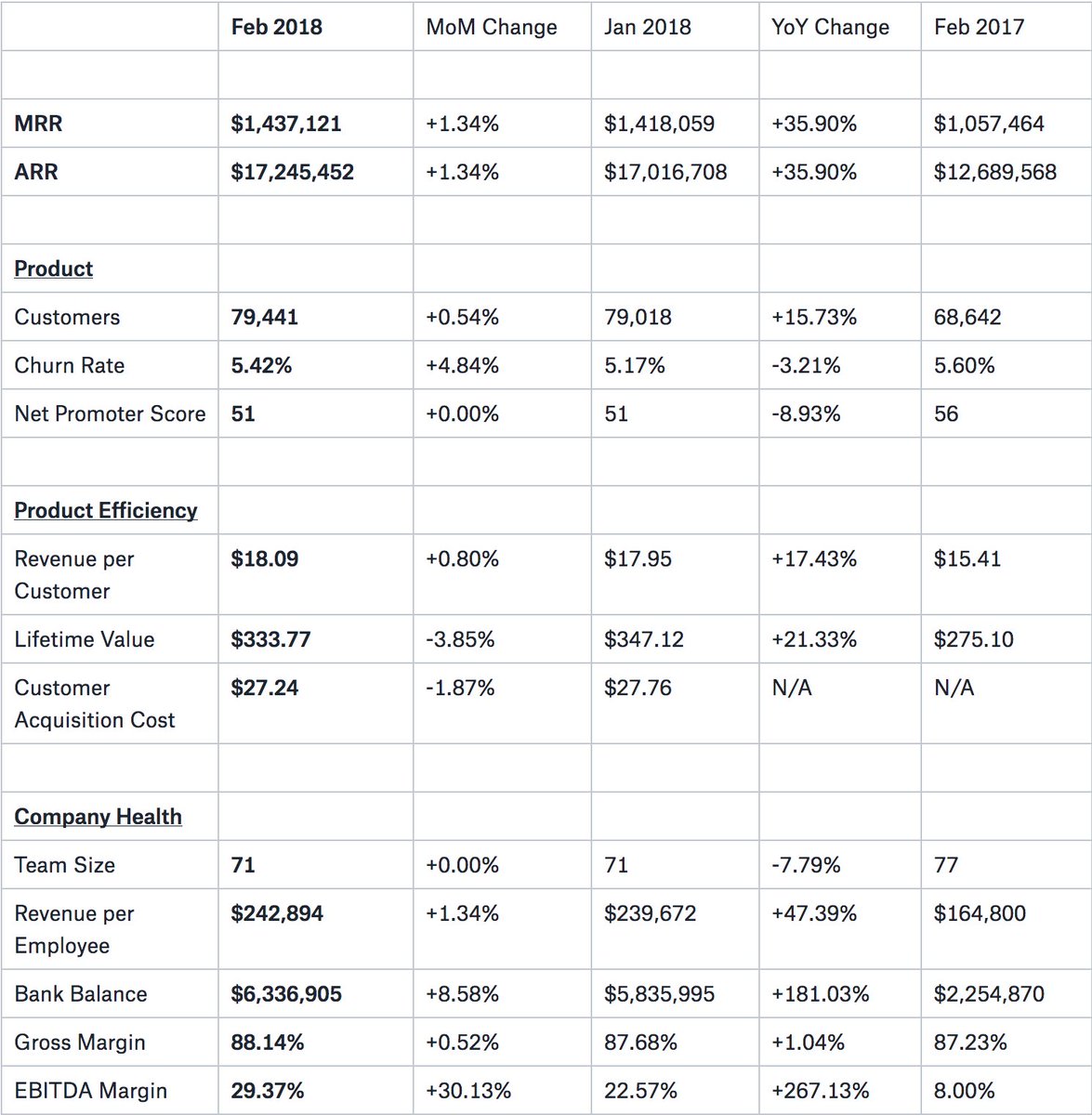

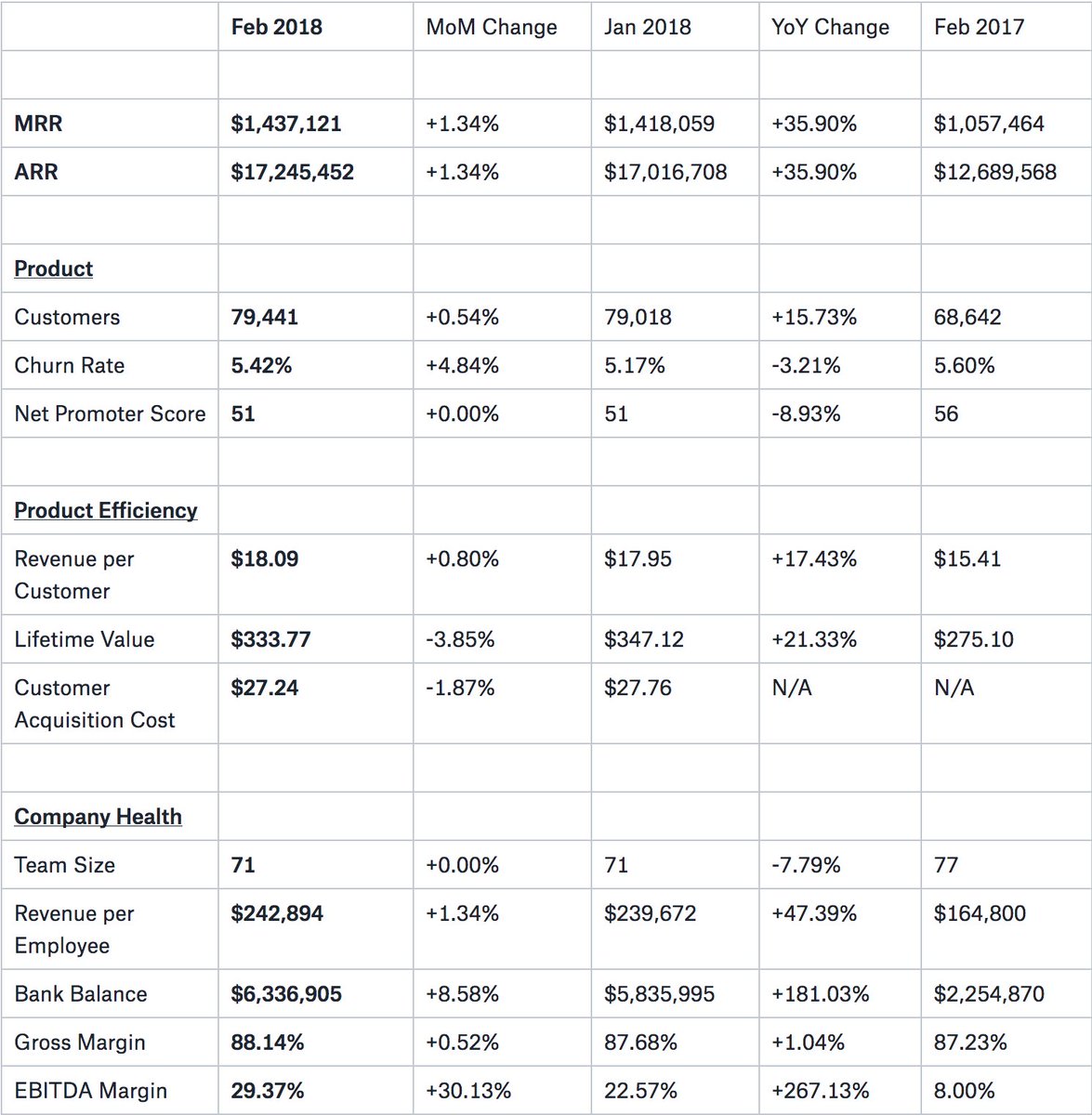

Reaching $20m ARR is a huge milestone for the whole team, I’m so proud of everyone.

Reaching $20m ARR is a huge milestone for the whole team, I’m so proud of everyone.

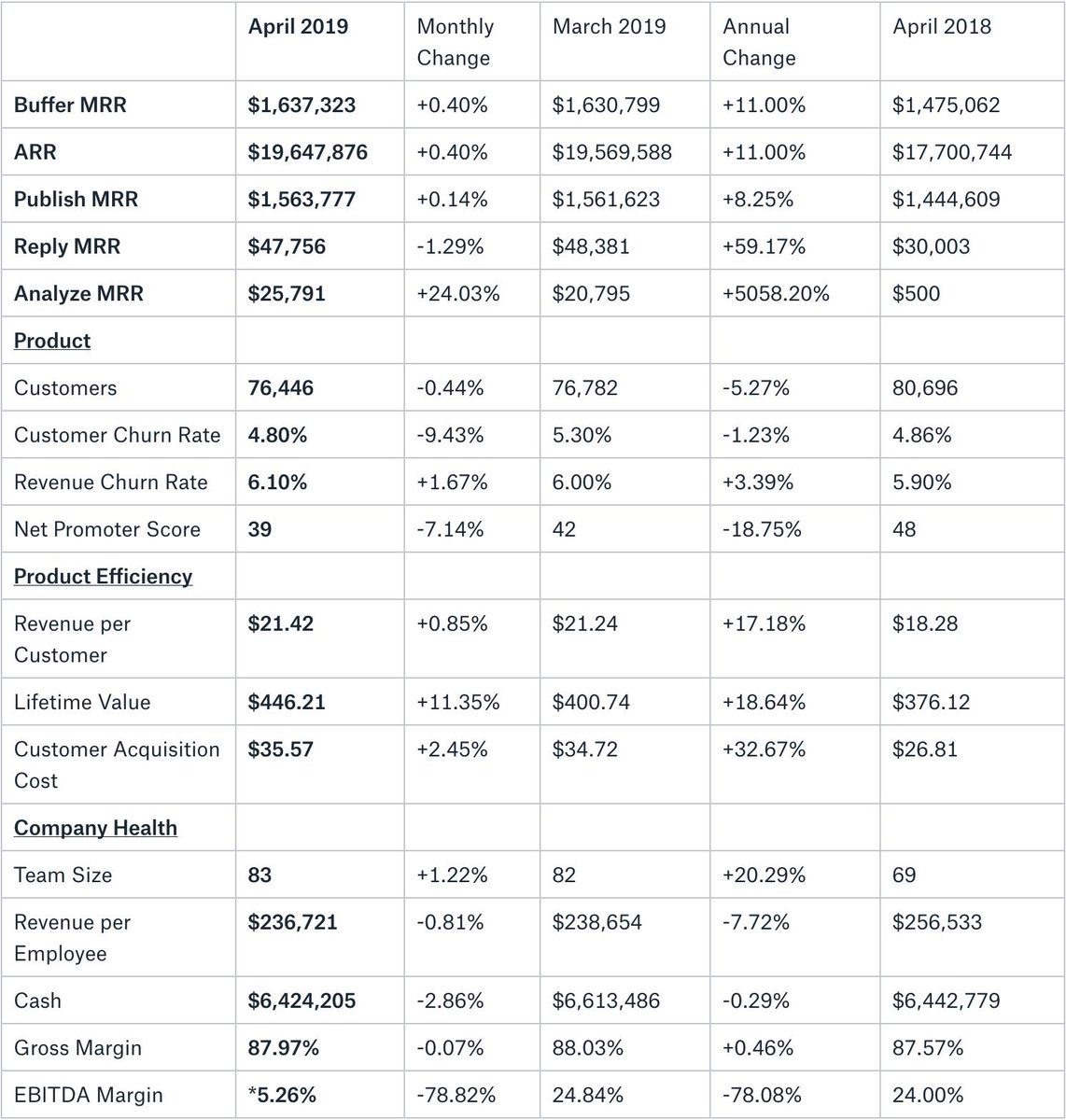

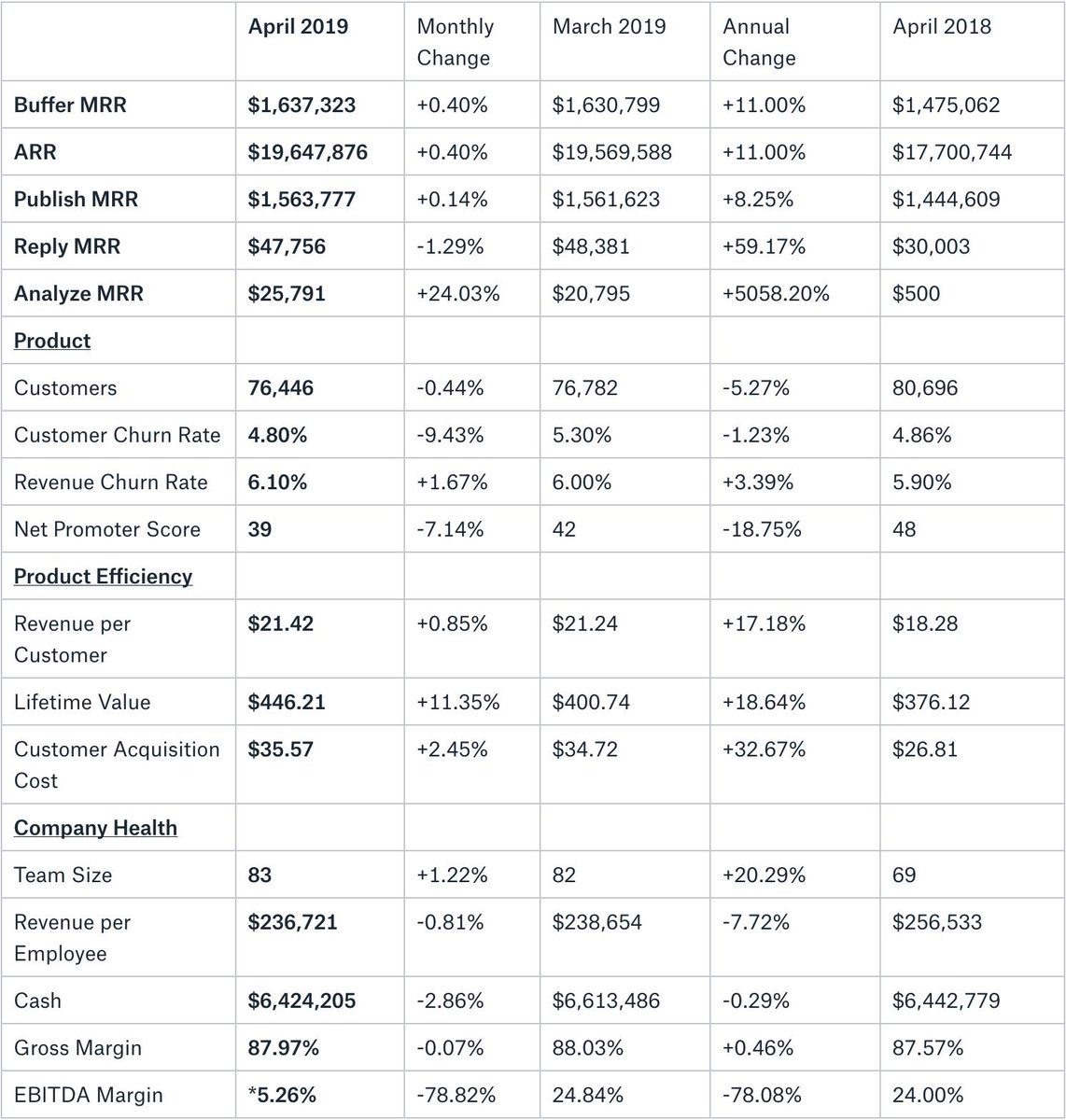

*A note on the EBITDA margin: In April, we had our annual company-wide retreat. Taking that cost into account, our EBITDA margin was reduced to 5.26%. Our EBITDA margin not including retreat costs was 26.99%, and consistent with numbers from previous months.

*A note on the EBITDA margin: In April, we had our annual company-wide retreat. Taking that cost into account, our EBITDA margin was reduced to 5.26%. Our EBITDA margin not including retreat costs was 26.99%, and consistent with numbers from previous months.

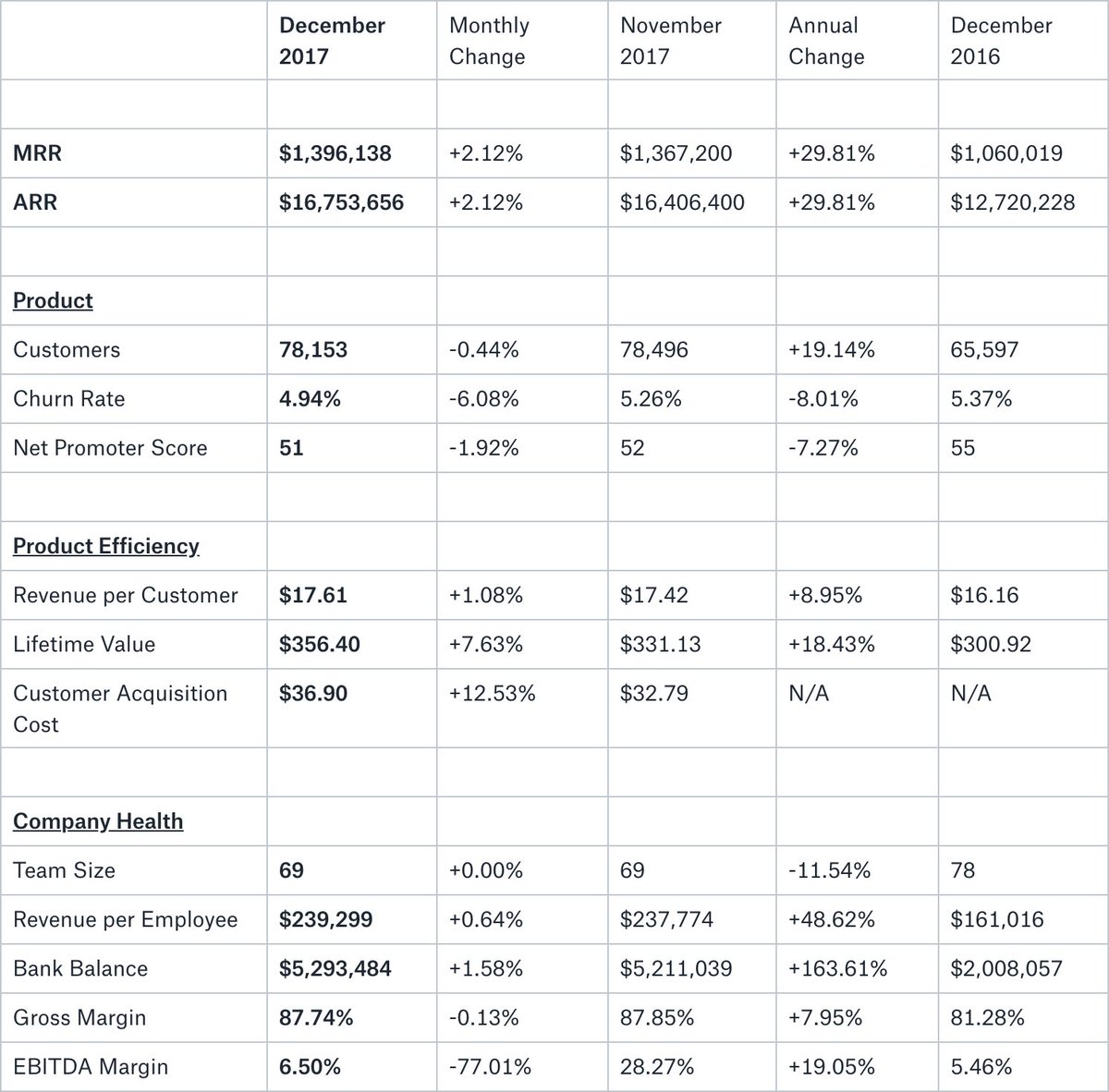

We're almost at the end of the year, and there are things to celebrate and things to look back on as big improvement areas.

We're almost at the end of the year, and there are things to celebrate and things to look back on as big improvement areas.

We're working hard to grow out a bundle of products, to solve different jobs for customers. We're expanding from "Buffer" to three separate products: Buffer Publish, Buffer Reply and Buffer Analyze.

We're working hard to grow out a bundle of products, to solve different jobs for customers. We're expanding from "Buffer" to three separate products: Buffer Publish, Buffer Reply and Buffer Analyze.

I have many updates and reflections to share on these numbers, hopefully they are interesting for people! Keep reading this thread 👇

I have many updates and reflections to share on these numbers, hopefully they are interesting for people! Keep reading this thread 👇

We grew our bank balance by over $3.3m in 2017, starting at around $2m. This was a huge accomplishment for the whole team. In addition, we had net income (profit) of over $2.5m, turning things around completely from a loss in 2016. Couldn't be more proud of this team.

We grew our bank balance by over $3.3m in 2017, starting at around $2m. This was a huge accomplishment for the whole team. In addition, we had net income (profit) of over $2.5m, turning things around completely from a loss in 2016. Couldn't be more proud of this team.