VP Sales @FlipsideCrypto

fmr OG @MessariCrypto

Writer | A Life Examined newsletter

How to get URL link on X (Twitter) App

Mindfulness is thrown around a lot nowadays, often without much substance.

Mindfulness is thrown around a lot nowadays, often without much substance.https://twitter.com/francisgowen/status/1638559728174235649For example, we have a traditional SaaS biz we make money from

For starters this is my fault. Not the Euler teams. Not the hackers.

For starters this is my fault. Not the Euler teams. Not the hackers.

Back in 2019, the Helium network went live with a relatively "fair launch" - i.e. no pre-mine

Back in 2019, the Helium network went live with a relatively "fair launch" - i.e. no pre-mine

For a little bit of background...On Oct. 5th Aragon One proposed a token swap for Aragon Court (ANJ) to the native ANT at a ratio of 1-->0.15

For a little bit of background...On Oct. 5th Aragon One proposed a token swap for Aragon Court (ANJ) to the native ANT at a ratio of 1-->0.15

Going back to the hunter/gatherer days, you relied on your tribe for survival

Going back to the hunter/gatherer days, you relied on your tribe for survival

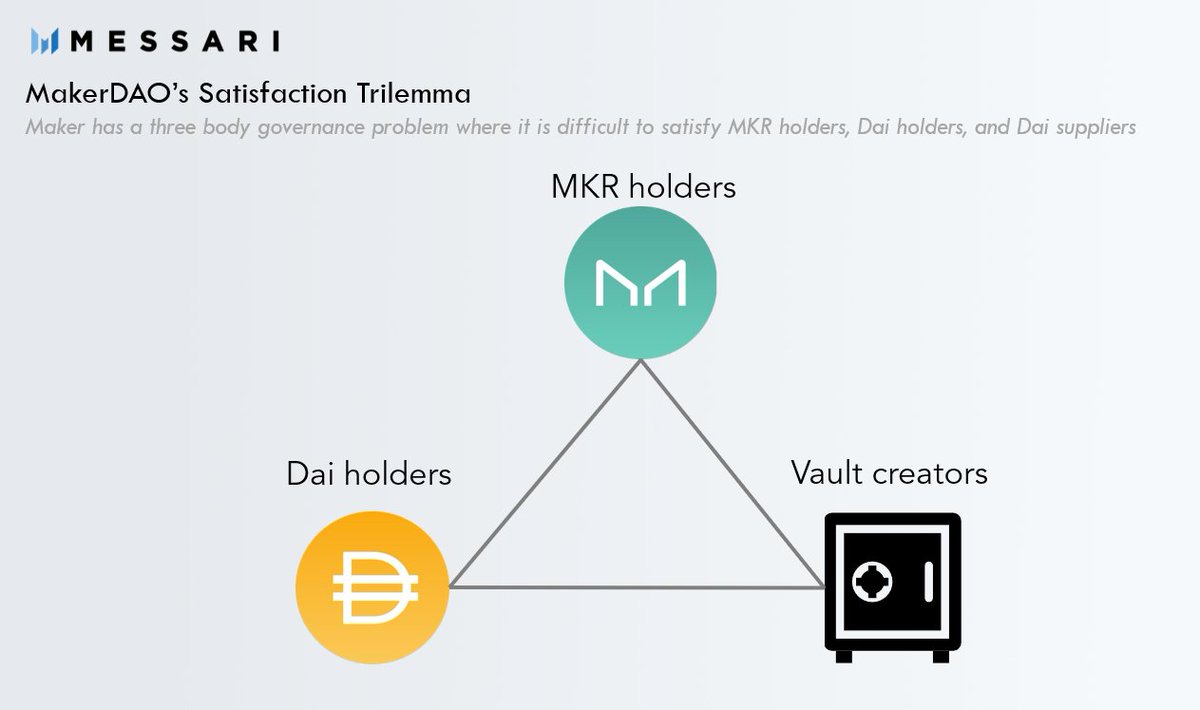

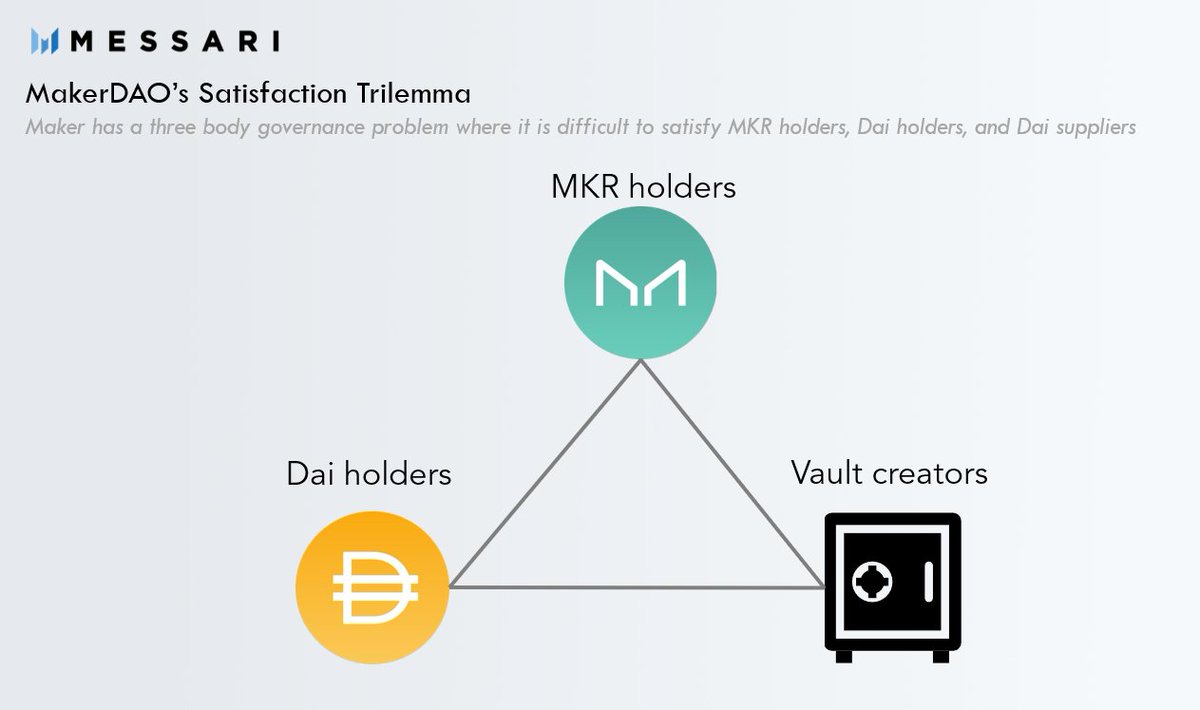

To start there is the Dai user

To start there is the Dai user

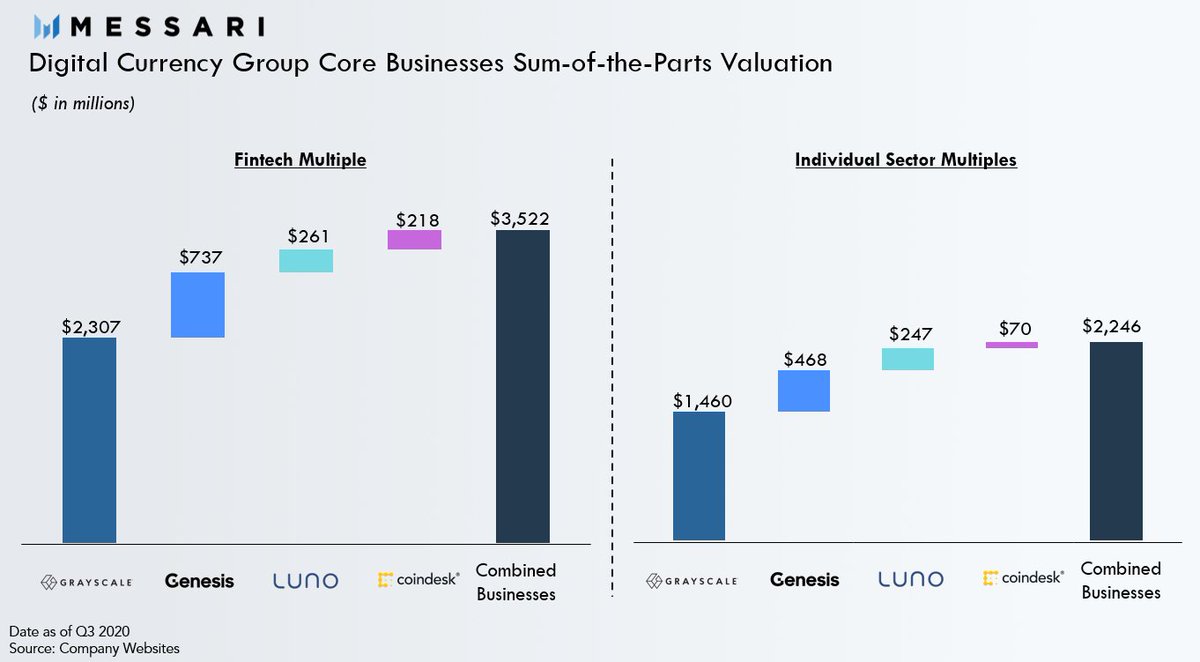

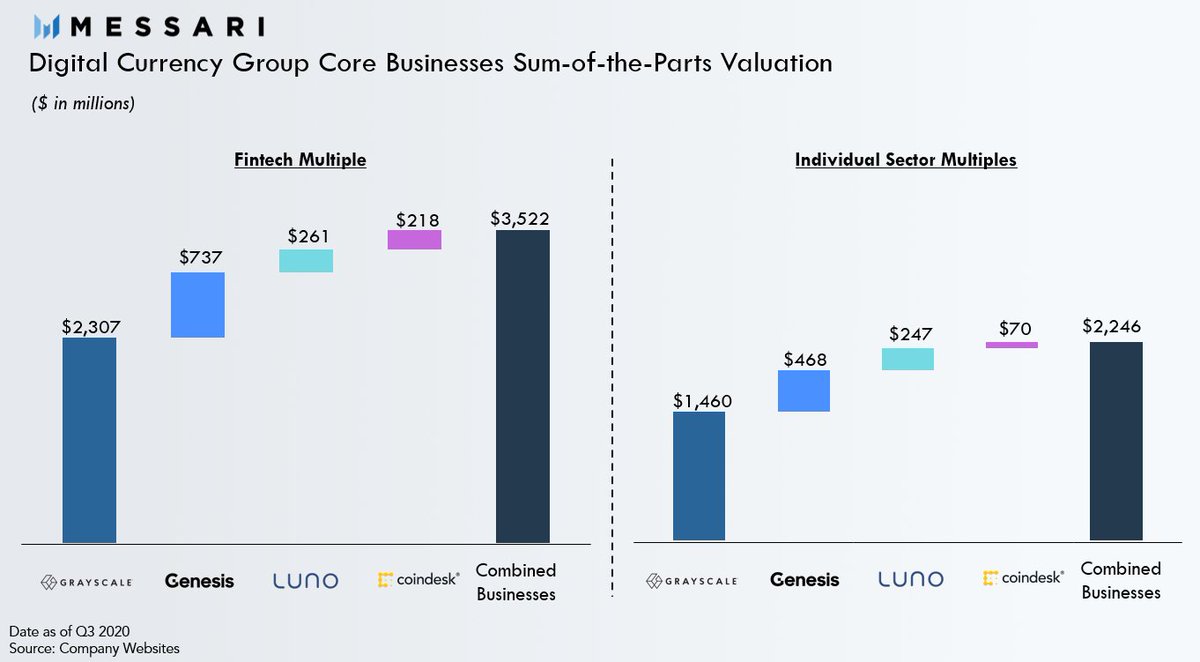

Using financial information from quarterly reports/other public sources to come up with an estimated revenue of each of their business lines...

Using financial information from quarterly reports/other public sources to come up with an estimated revenue of each of their business lines...

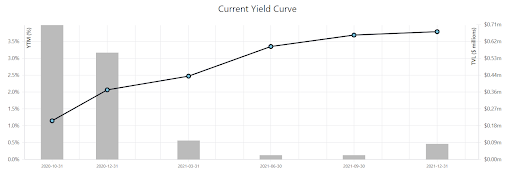

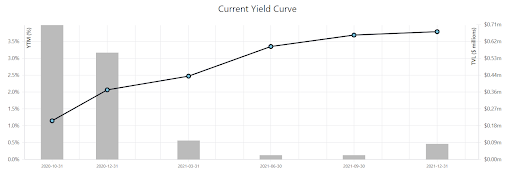

Not only do these instruments provide certainty for lenders/borrowers looking to accurately forecast their cost/return on capital

Not only do these instruments provide certainty for lenders/borrowers looking to accurately forecast their cost/return on capital

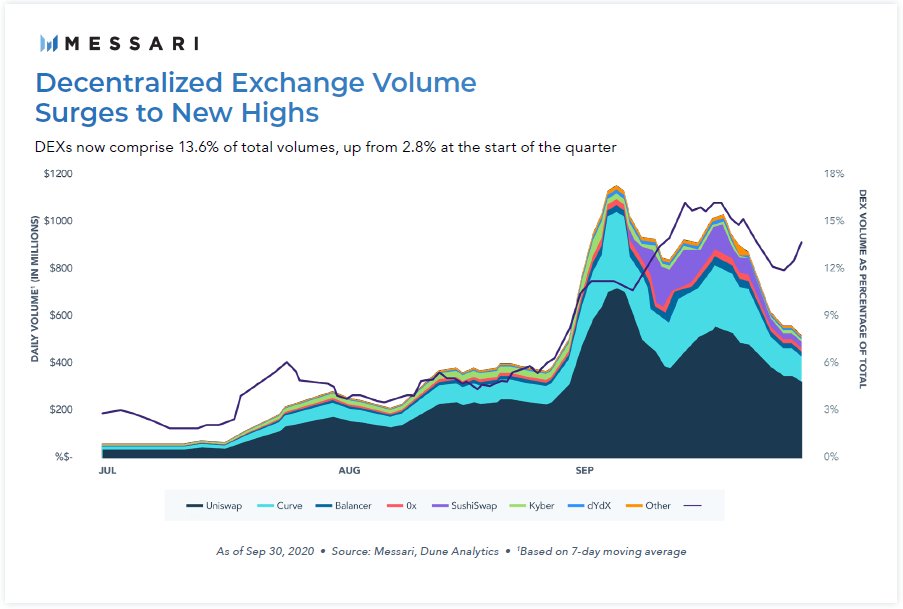

For the first time ever DEXs are being taken seriously as legitimate competitors to centralized exchanges

For the first time ever DEXs are being taken seriously as legitimate competitors to centralized exchanges

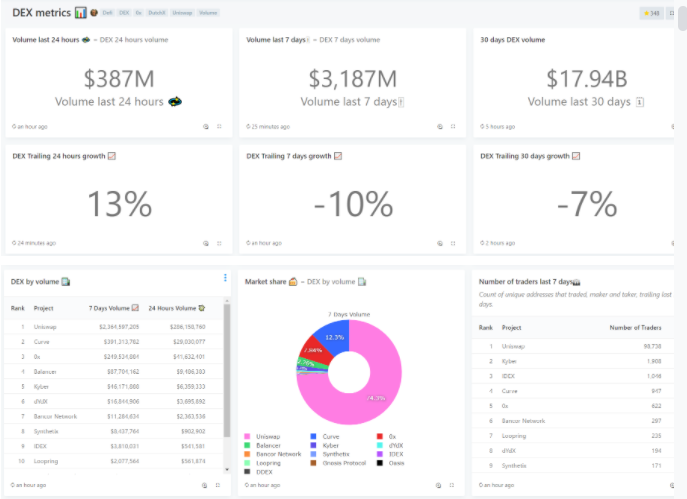

#1 @DuneAnalytics is my go-to for all DeFi research

#1 @DuneAnalytics is my go-to for all DeFi research

However, newly proposed MIP7 revamps its token economics

However, newly proposed MIP7 revamps its token economics

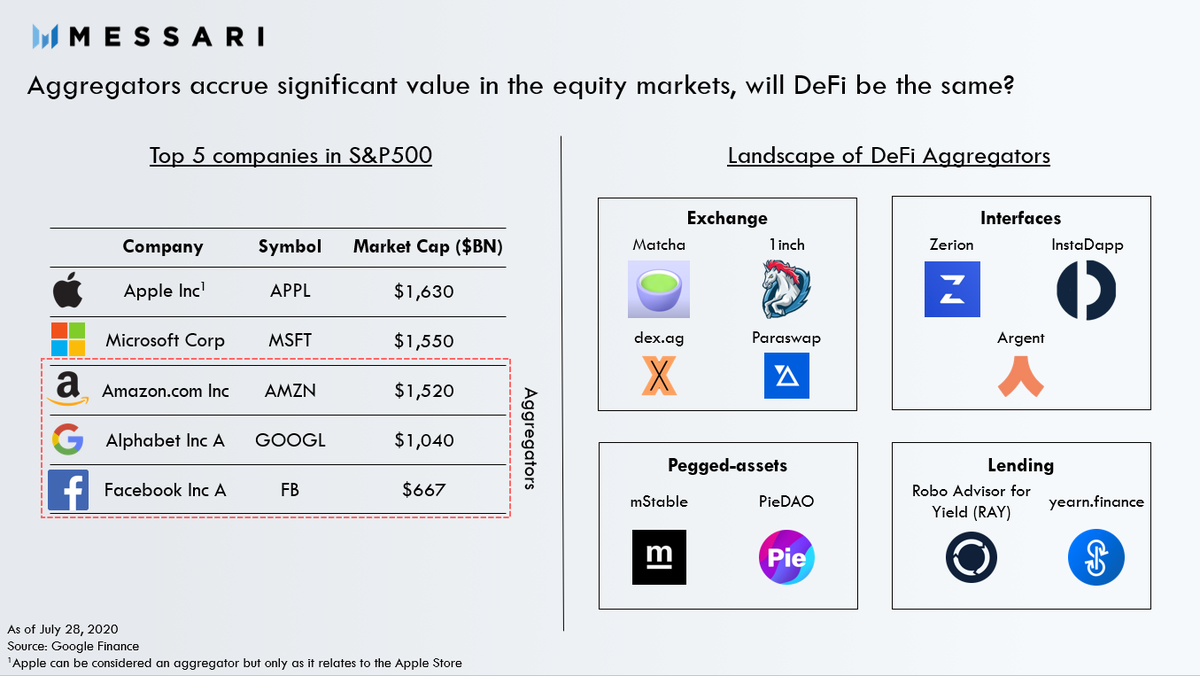

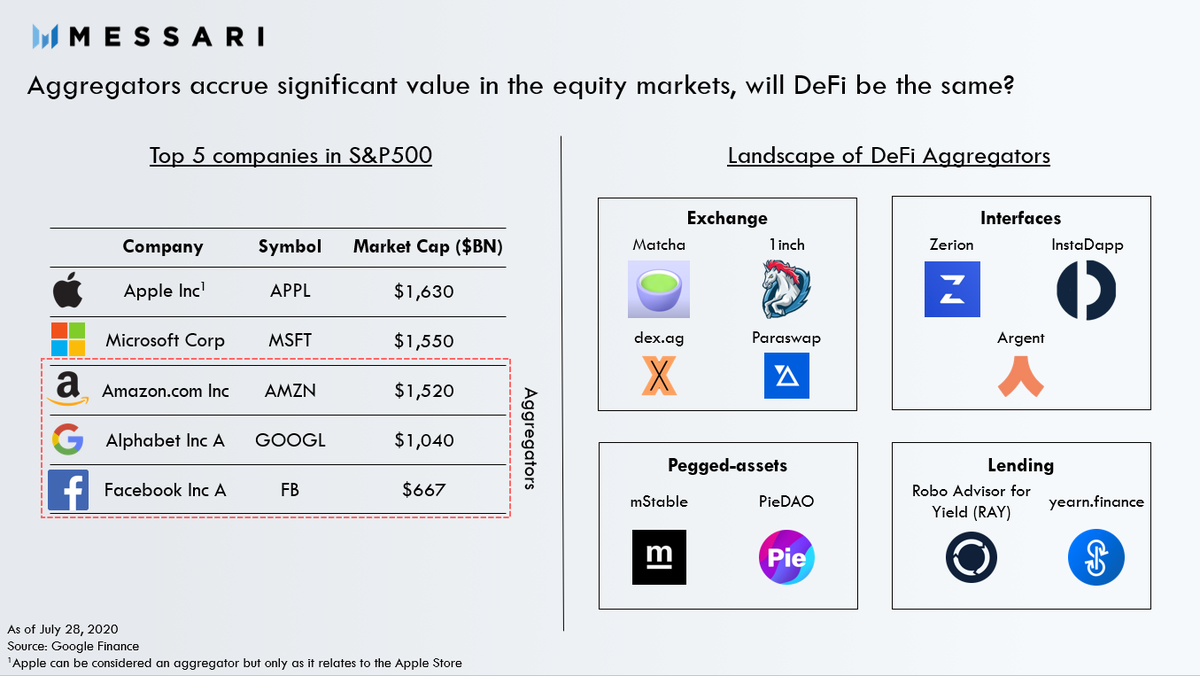

In order to be considered an “aggregator” as the term is typically used, there are 3 requirements

In order to be considered an “aggregator” as the term is typically used, there are 3 requirements

With tokens pegged to external assets there is a fundamental tradeoff:

With tokens pegged to external assets there is a fundamental tradeoff:

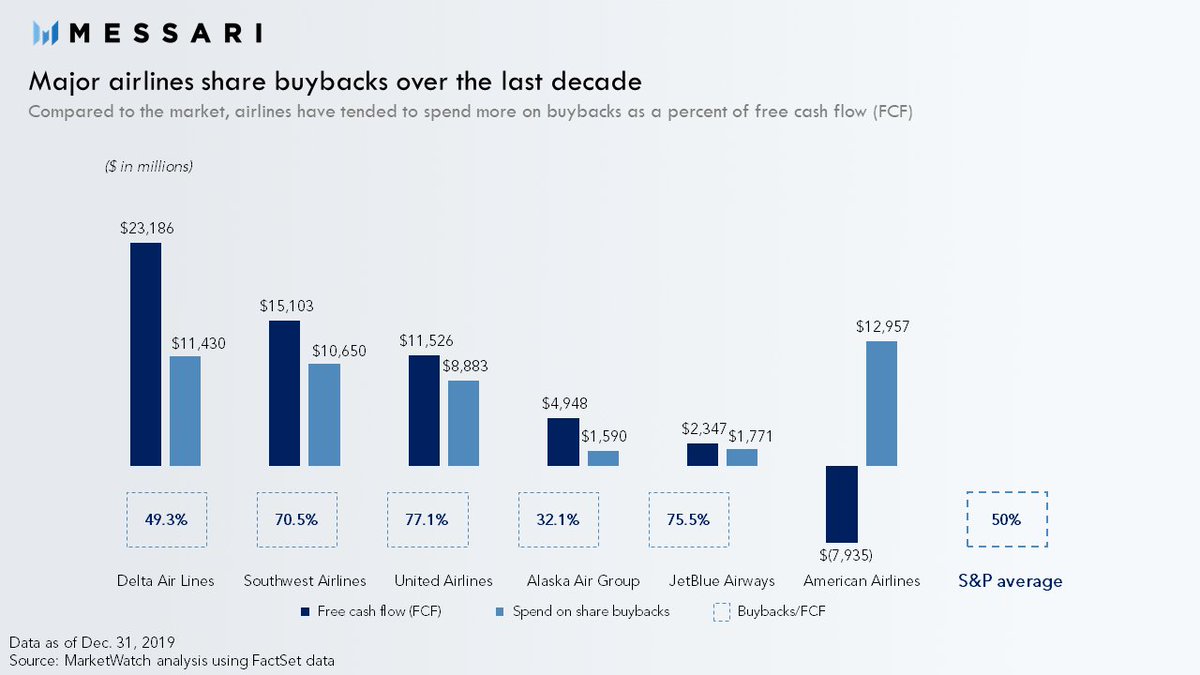

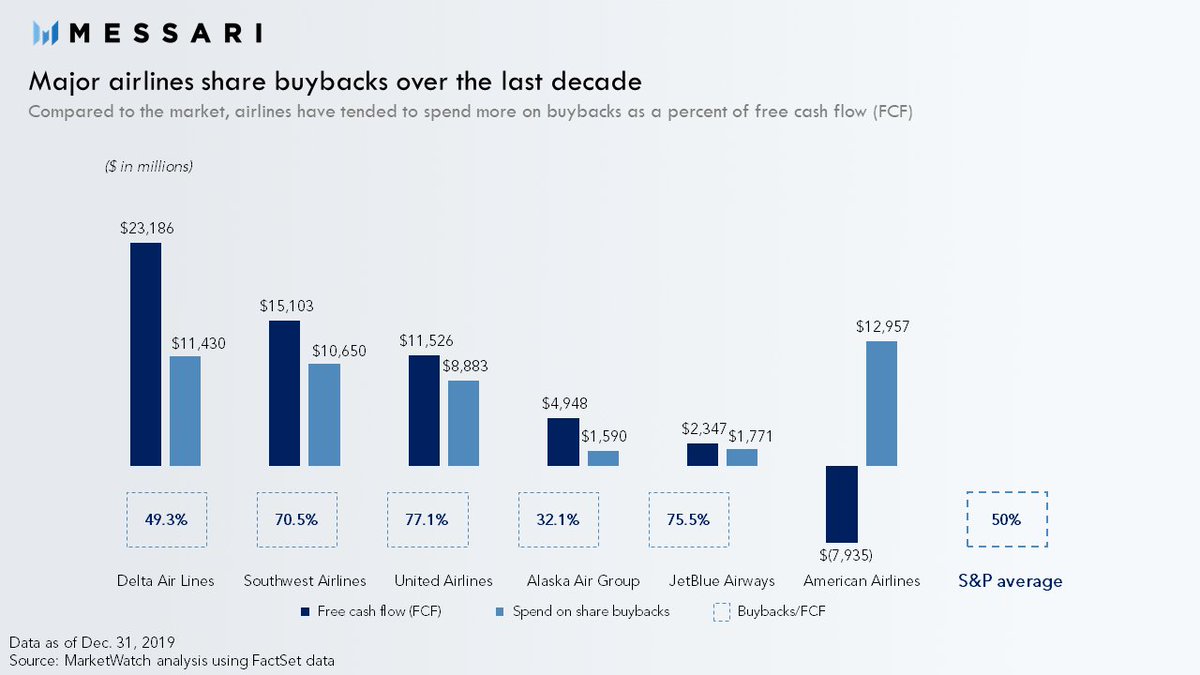

2/ Rather than, I don't know, maybe buying pandemic insurance to protect your business from complete implosion

2/ Rather than, I don't know, maybe buying pandemic insurance to protect your business from complete implosion