Full Time Trader since 1999. Mentor at Trading Academy. Daily Live trading at https://t.co/xA35pCeuXs

4 subscribers

How to get URL link on X (Twitter) App

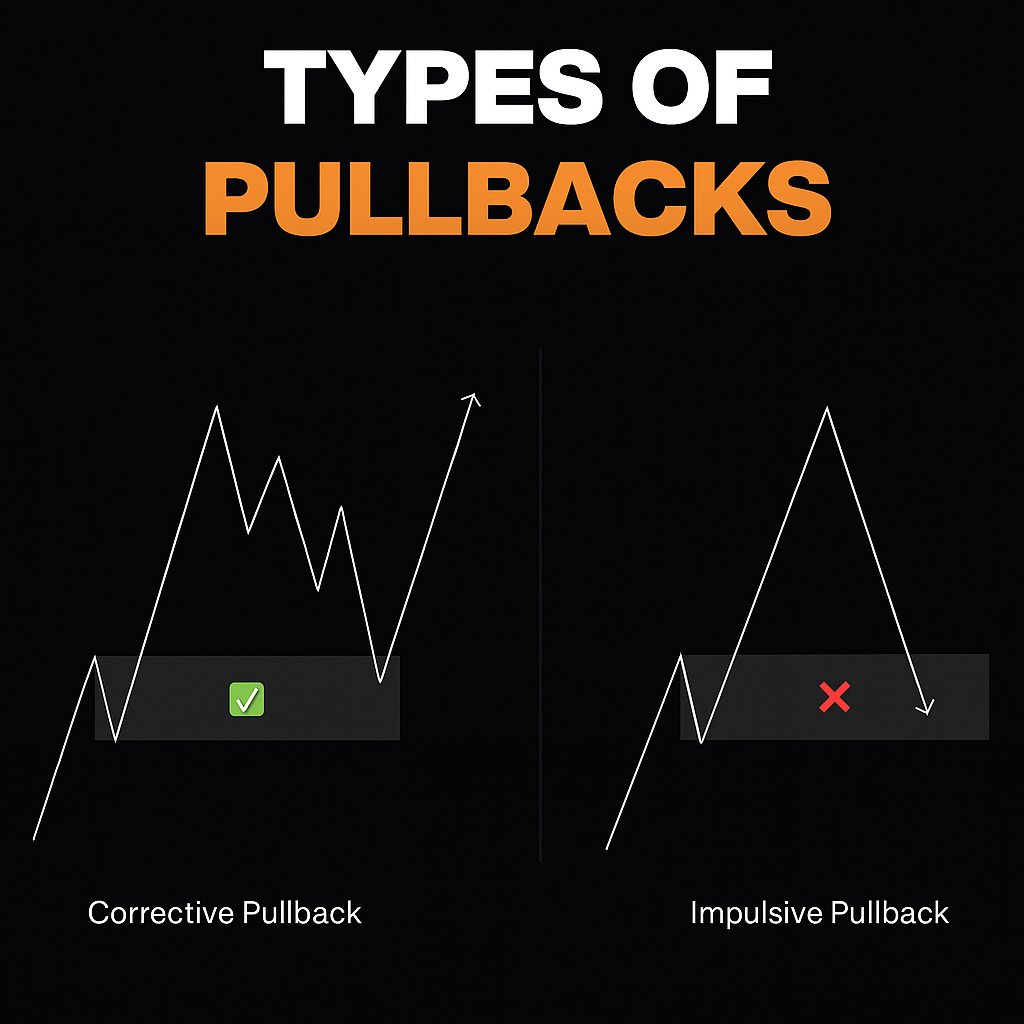

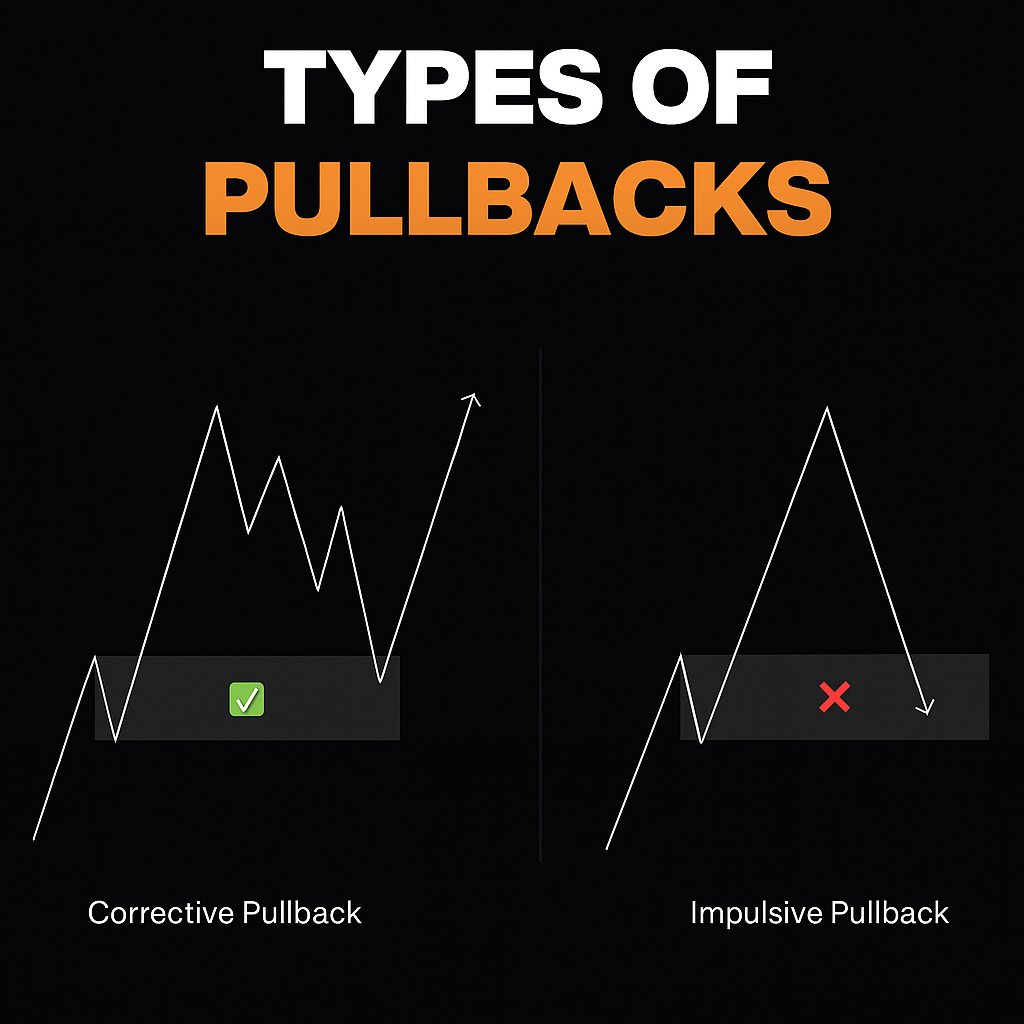

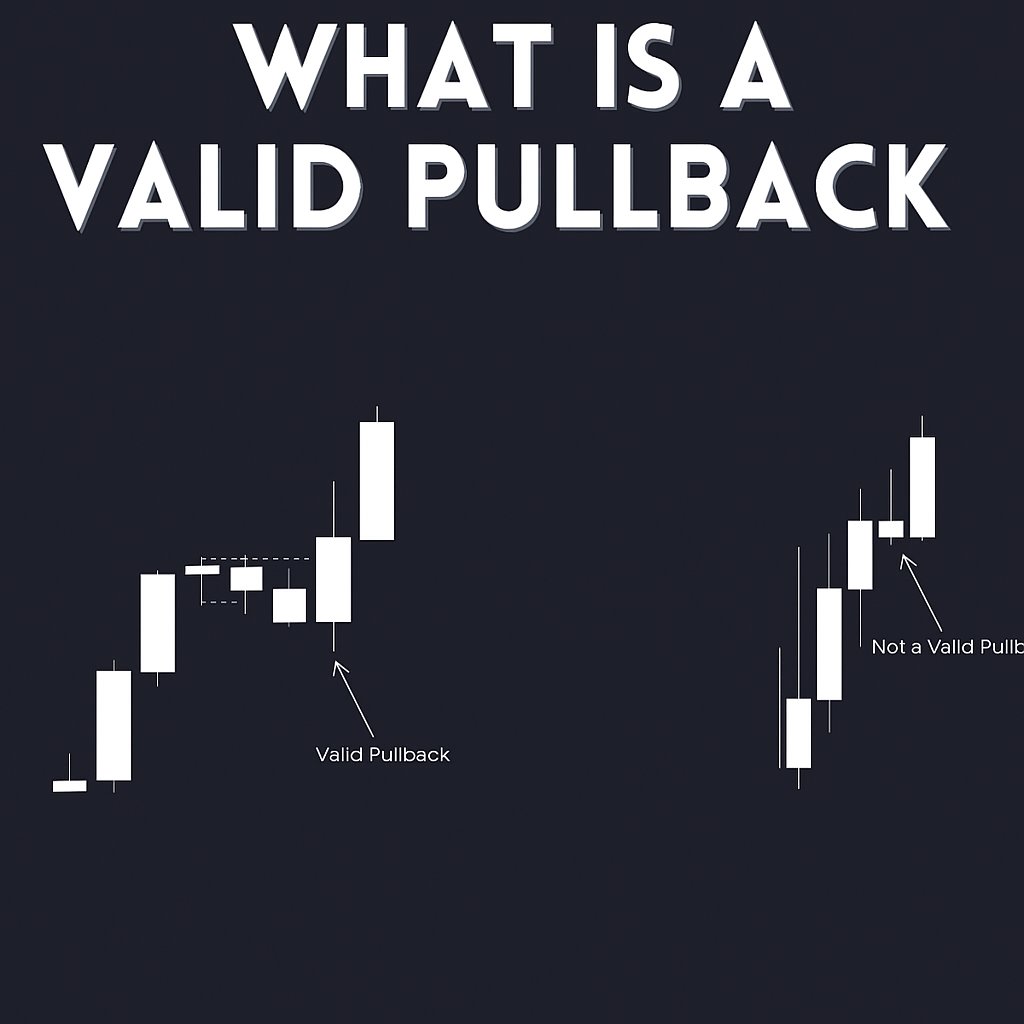

(2/9) What is a Pullback?

(2/9) What is a Pullback?

1. You don’t need 10 setups.

1. You don’t need 10 setups.

1️⃣ ACCEPT THAT BAD DAYS ARE PART OF THE GAME

1️⃣ ACCEPT THAT BAD DAYS ARE PART OF THE GAME

1️⃣ A setup isn’t a strategy

1️⃣ A setup isn’t a strategy

1/ My top pick for the best broker for U.S. traders: Cobra Brokerage @cobra_trading

1/ My top pick for the best broker for U.S. traders: Cobra Brokerage @cobra_trading

1/ Step 1: Master the Basics 📚

1/ Step 1: Master the Basics 📚

1. Retail Traps and Market Maker Tactics

1. Retail Traps and Market Maker Tactics

The market is a jungle.

The market is a jungle.