Security analysis, investing news, reports, shareholders' letters and investment thesis.

Tweets are never investment advices

https://t.co/JX6NBqxzf1

How to get URL link on X (Twitter) App

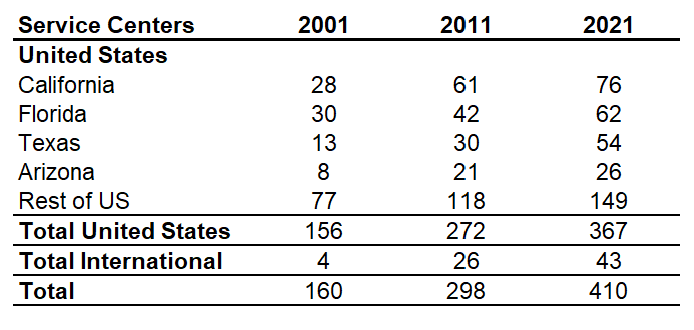

2. Evidence of real synergies and economies of scale: best acquirers are those that are able to add value to the target company.

2. Evidence of real synergies and economies of scale: best acquirers are those that are able to add value to the target company.

$POOL successful strategy is based mainly on two pillars:

$POOL successful strategy is based mainly on two pillars:

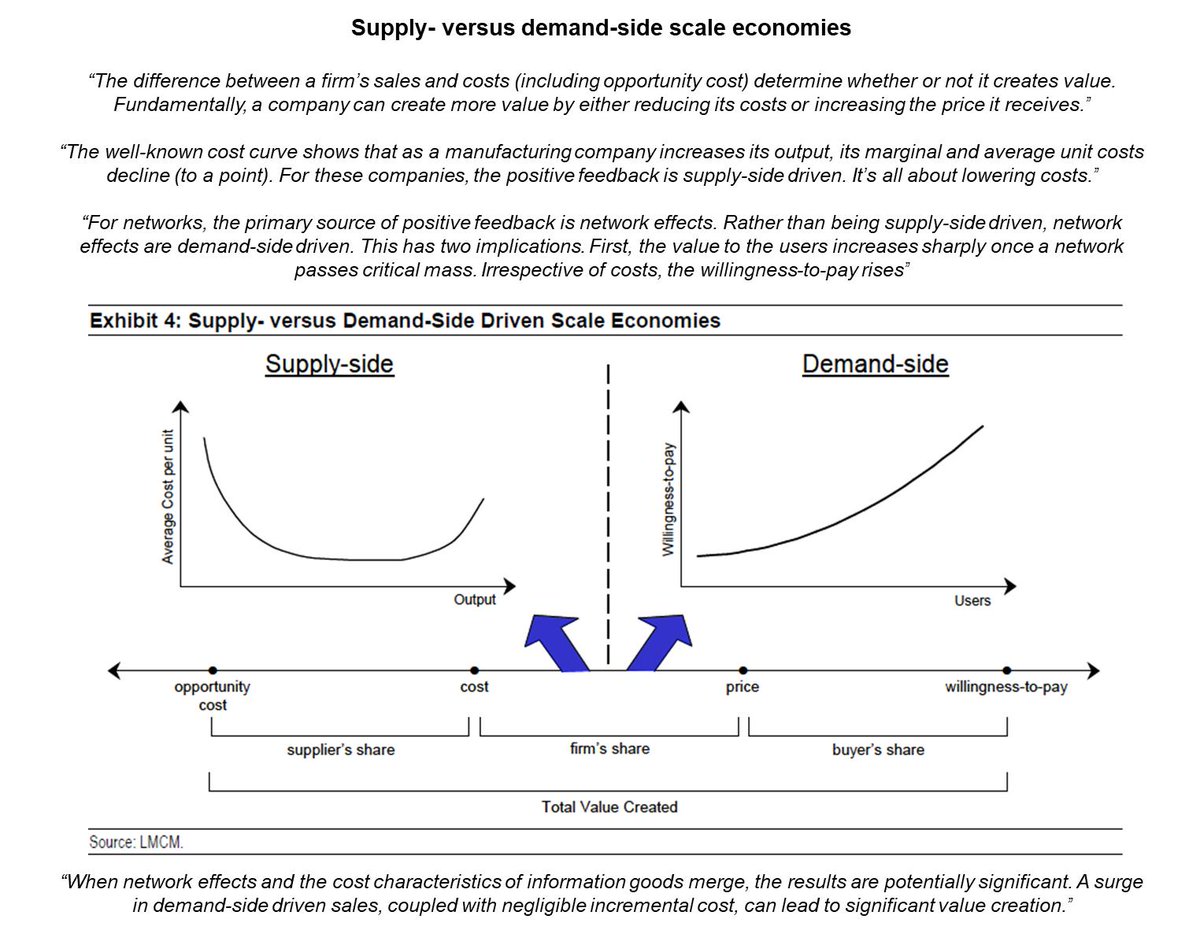

2) Supply- versus demand-side scale economies

2) Supply- versus demand-side scale economies

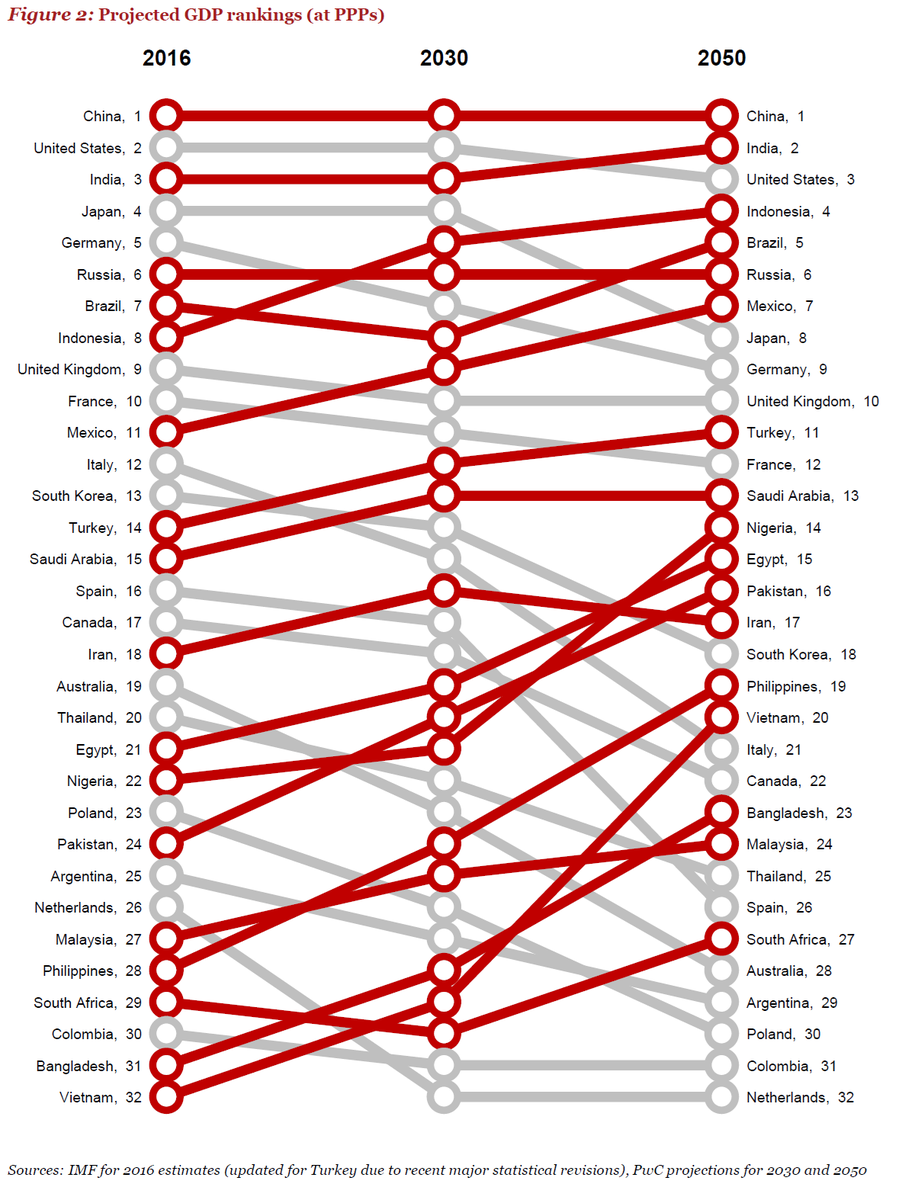

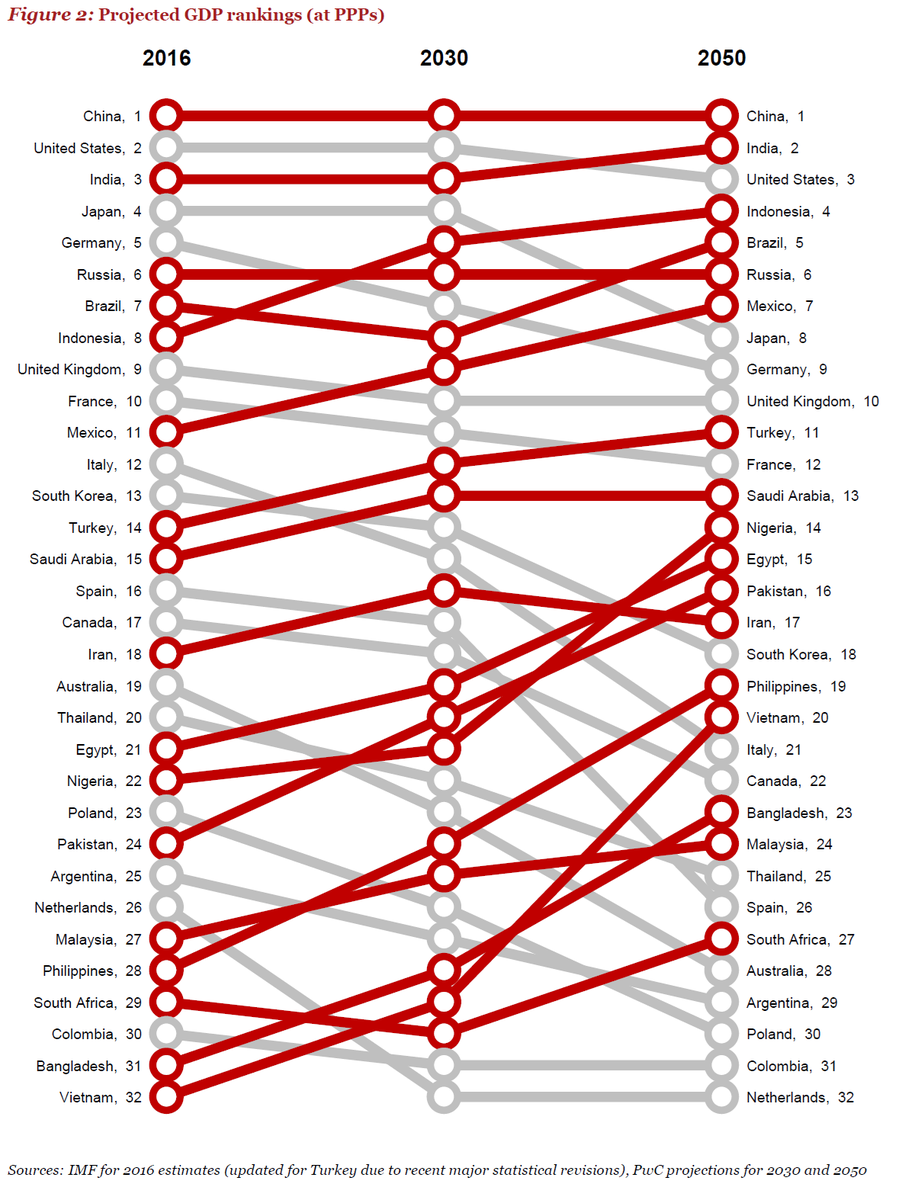

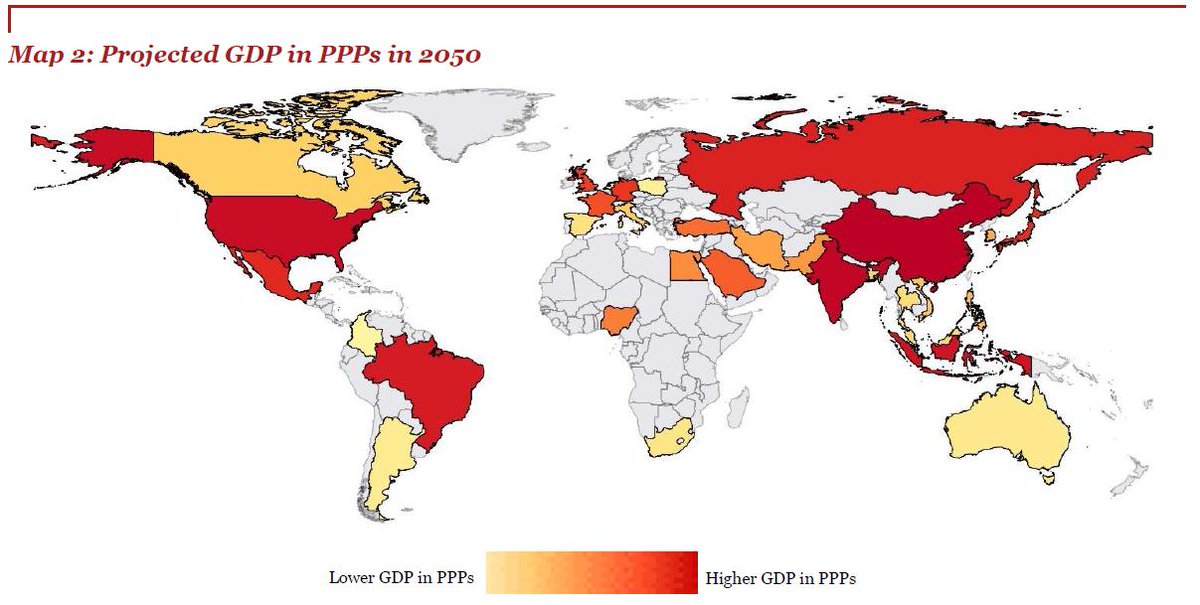

2) Emerging markets will dominate the world’s top 10 economies in 2050 (GDP at PPPs)

2) Emerging markets will dominate the world’s top 10 economies in 2050 (GDP at PPPs)

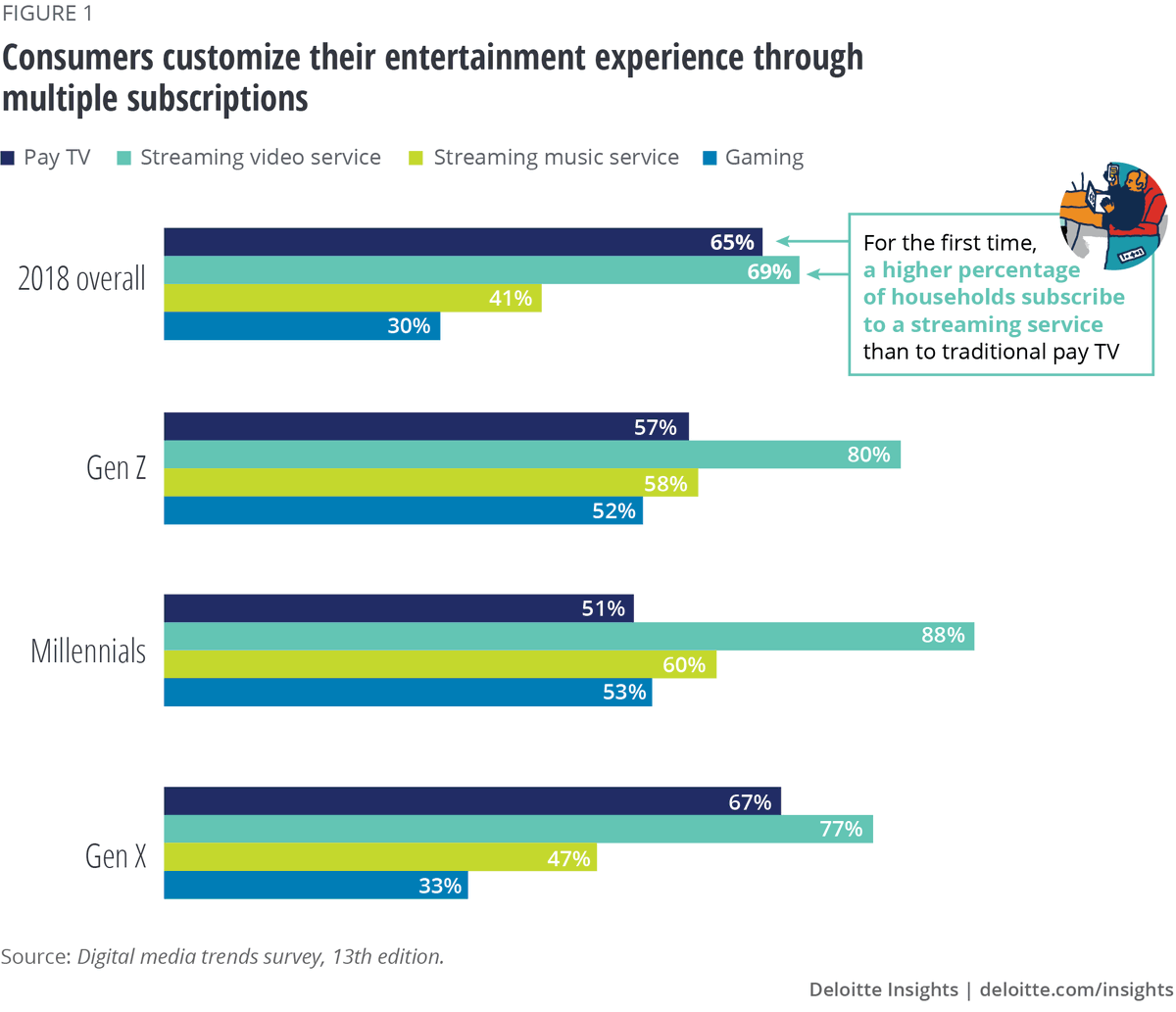

- Gaming is competing with other forms of entertainment, especially among new generations, and not only in time spent but also in the way gaming platforms engage fans. The survey found that it is not only playing videogames: 32% of respondents watch eSports on a weekly basis!!

- Gaming is competing with other forms of entertainment, especially among new generations, and not only in time spent but also in the way gaming platforms engage fans. The survey found that it is not only playing videogames: 32% of respondents watch eSports on a weekly basis!!