How to get URL link on X (Twitter) App

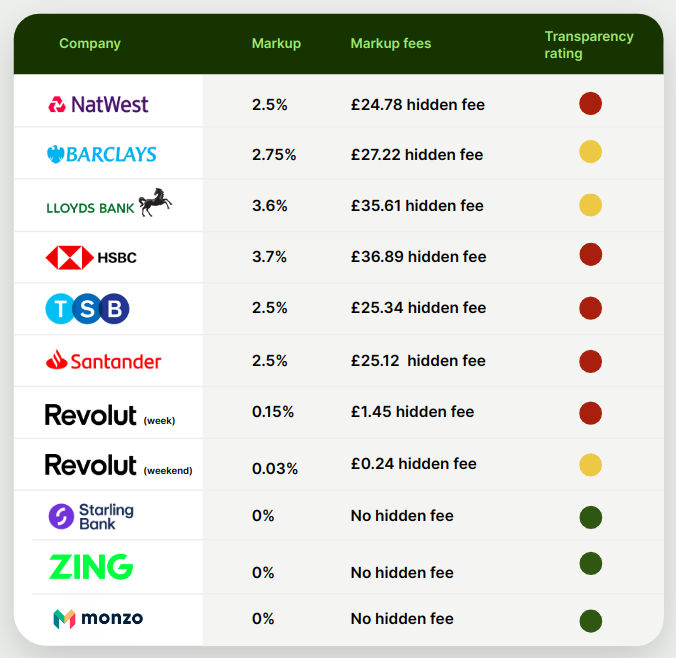

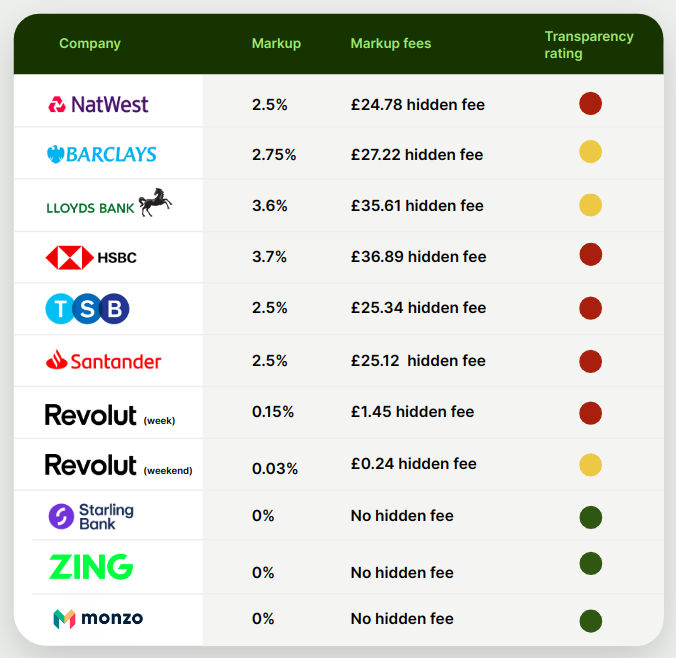

1/ Let's start with the ones who are making an effort!

1/ Let's start with the ones who are making an effort!

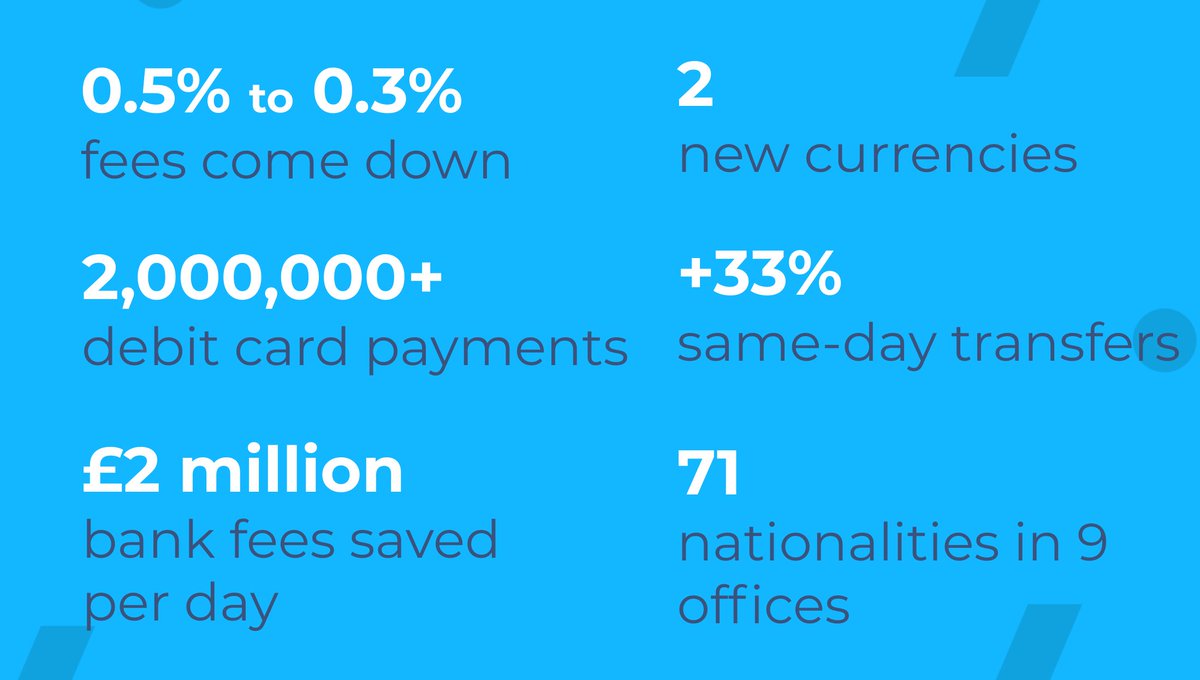

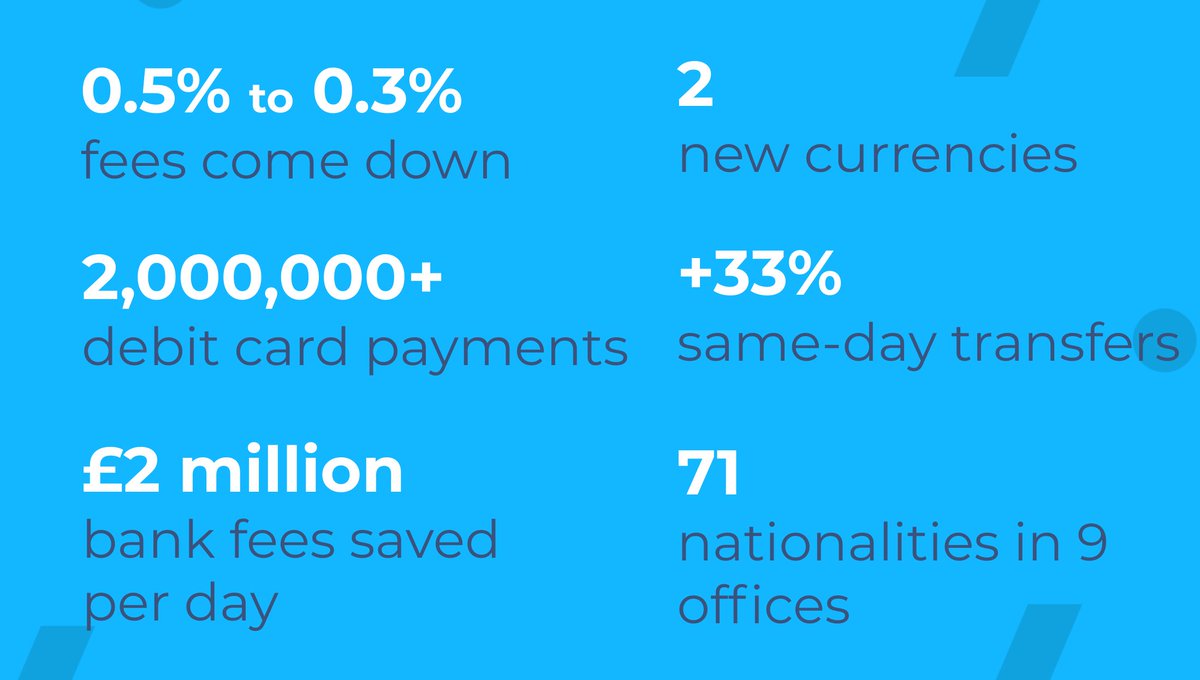

2/ We pushed the fees down 💰

2/ We pushed the fees down 💰

2/ Banking in Brazil is expensive.

2/ Banking in Brazil is expensive.

2/ Before I introduce Ling and Clare - let me take share how we built our board from the early days.

2/ Before I introduce Ling and Clare - let me take share how we built our board from the early days.

2/ This is not about the pandemic. Yet it shows us that nothing’s more important than our health. Money included.

2/ This is not about the pandemic. Yet it shows us that nothing’s more important than our health. Money included.https://twitter.com/TransferWise/status/1239935660473139205

2/ Our research across the European ATMs showed the average hidden fee of 8%. Top 3 DCC contributors:

2/ Our research across the European ATMs showed the average hidden fee of 8%. Top 3 DCC contributors:

1/ Most of the world's money lives on accounts in 26,000 banks. "Speed" means how fast it can move from my account to your account. To another bank, often in another country.

1/ Most of the world's money lives on accounts in 26,000 banks. "Speed" means how fast it can move from my account to your account. To another bank, often in another country.

2/ Reminder. The TransferWise mission is money without borders — instant, convenient, transparent and eventually free. To pay, to get paid, to spend, in any currency, wherever you are, whatever you’re doing. 💰 + ⚡ + 💳 + 🌍.

2/ Reminder. The TransferWise mission is money without borders — instant, convenient, transparent and eventually free. To pay, to get paid, to spend, in any currency, wherever you are, whatever you’re doing. 💰 + ⚡ + 💳 + 🌍.

2/ The TransferWise mission: money without borders — convenient, instant, and eventually free. To pay, to get paid, to spend like a local, anywhere in the world. 💰 + ⚡ + 💳 + 🌍.

2/ The TransferWise mission: money without borders — convenient, instant, and eventually free. To pay, to get paid, to spend like a local, anywhere in the world. 💰 + ⚡ + 💳 + 🌍.