How to get URL link on X (Twitter) App

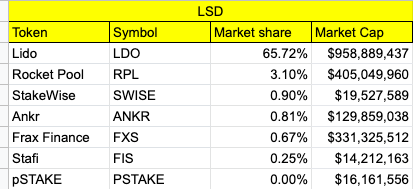

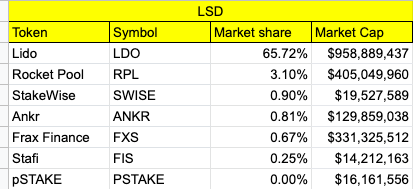

2/ Despite having a considerable market share, Stakewise and Stafi market caps are still under $20m

2/ Despite having a considerable market share, Stakewise and Stafi market caps are still under $20m

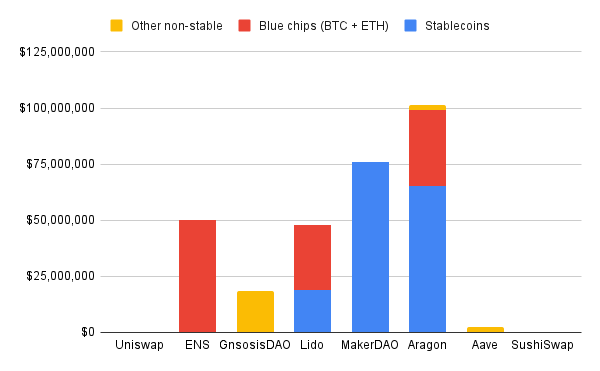

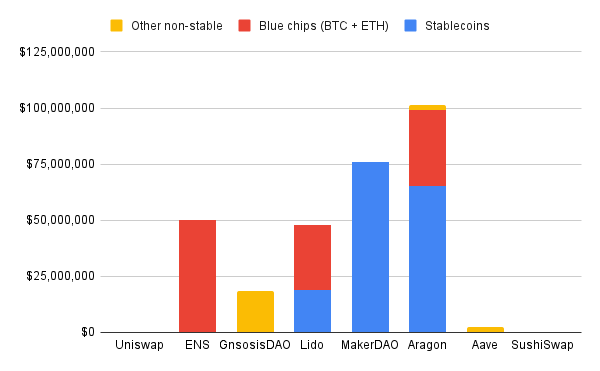

2/ if we consider native tokens, their financial health may look much better, but in reality these protocols aren't able to cash it out since trying to sell as little as 10% of the treasury would make their token crash as far as 90%,so the numbers below are simply a facade

2/ if we consider native tokens, their financial health may look much better, but in reality these protocols aren't able to cash it out since trying to sell as little as 10% of the treasury would make their token crash as far as 90%,so the numbers below are simply a facade