Founded in 2011 by @EkanshMittal_KW (SEBI RA - INH100001690) | Small & Midcap Recommendations | Premium offerings - https://t.co/xT1XOGFEpv

2 subscribers

How to get URL link on X (Twitter) App

SMA - Special Mention Accounts

SMA - Special Mention Accounts

Indian tiles, sanitary ware and bathroom fittings market reached a value of ₹ 60,128 Crore in 2021

Indian tiles, sanitary ware and bathroom fittings market reached a value of ₹ 60,128 Crore in 2021

Classification of Sea food:

Classification of Sea food:

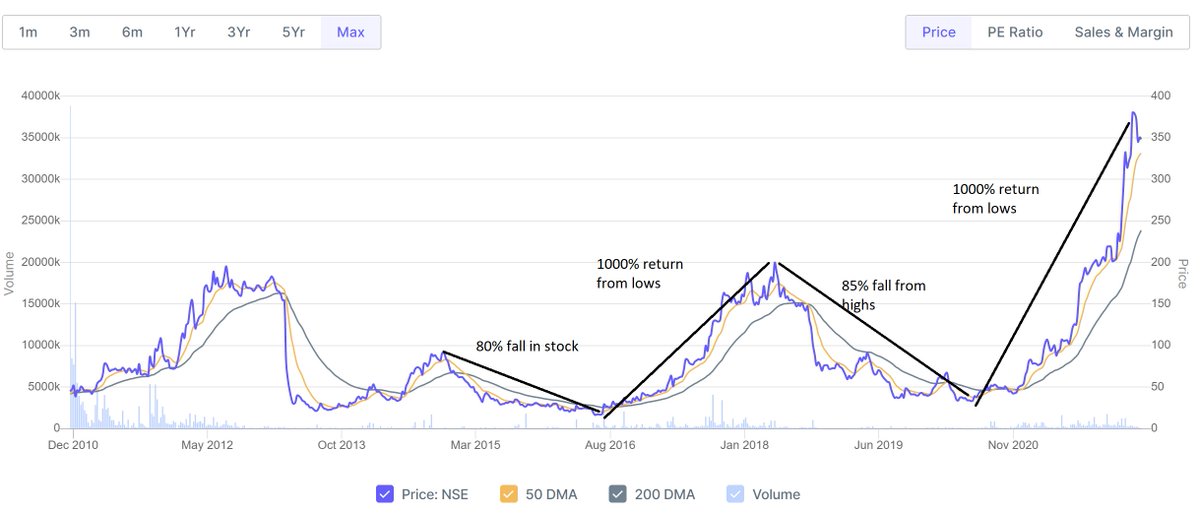

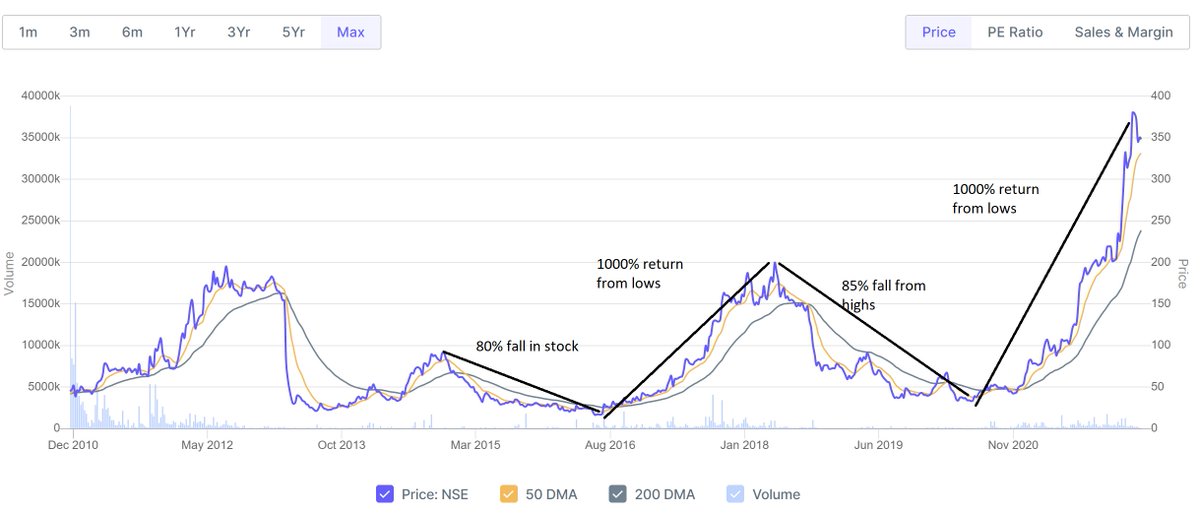

So, in general, how does a stock deliver good returns?

So, in general, how does a stock deliver good returns?

The CNG ecosystem is rapidly expanding in India

The CNG ecosystem is rapidly expanding in India