AMDG || Kingswell. Join 5,000+ readers and get rich slow with timeless lessons from Warren Buffett, Charlie Munger, and other legendary thinkers.

How to get URL link on X (Twitter) App

Before we get started, please do me a favor and subscribe (for free) to Kingswell for more coverage of the Berkshire AGM.

Before we get started, please do me a favor and subscribe (for free) to Kingswell for more coverage of the Berkshire AGM.

Before we get started, please do me a favor and subscribe (for free) to Kingswell for more coverage of the Berkshire AGM.

Before we get started, please do me a favor and subscribe (for free) to Kingswell for more coverage of the Berkshire AGM.

Between 1977 and 1990, Lynch earned a mind-blowing 29.2% annual return with Fidelity's Magellan Fund — transforming the fund from a small afterthought into a world-famous moneymaker.

Between 1977 and 1990, Lynch earned a mind-blowing 29.2% annual return with Fidelity's Magellan Fund — transforming the fund from a small afterthought into a world-famous moneymaker.

In 2019, Buffett helped finance Occidental's pricy acquisition of Anadarko.

In 2019, Buffett helped finance Occidental's pricy acquisition of Anadarko.

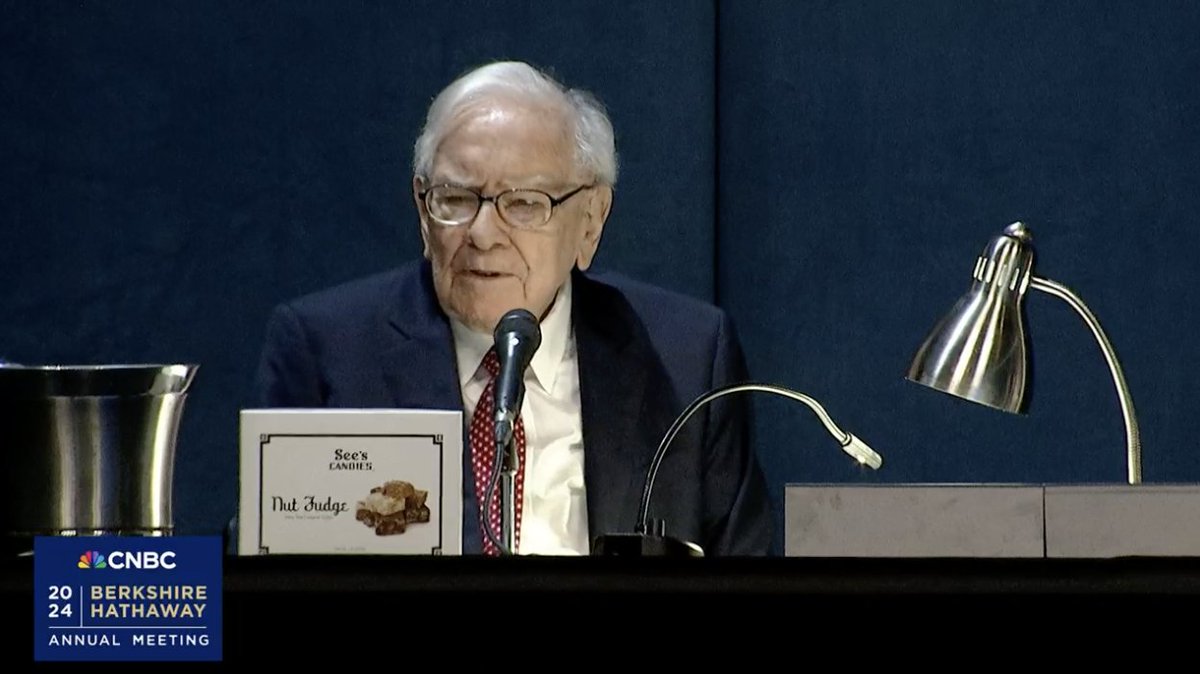

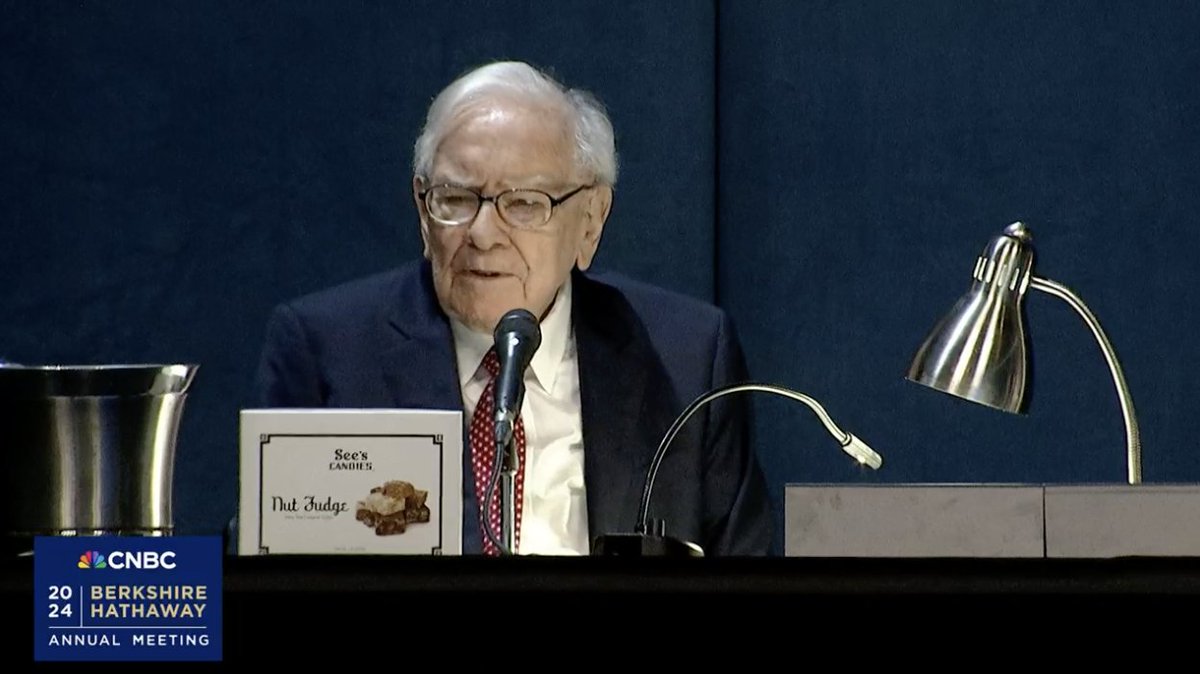

"The majority of our businesses will report lower earnings this year than last year," Buffett said.

"The majority of our businesses will report lower earnings this year than last year," Buffett said.

(1) When asked about banks, Munger took the middle road.

(1) When asked about banks, Munger took the middle road.

“The world is not transformed from one day to the next,” Train writes.

“The world is not transformed from one day to the next,” Train writes.