Critical and sarcastic thinker. Graduate from the school of life. Always learning. Never financial or investment advice.

2 subscribers

How to get URL link on X (Twitter) App

BT Group (which owns EE): UK's biggest telco by market share 33%.

BT Group (which owns EE): UK's biggest telco by market share 33%.

Elon Musk has a history of overpromising moonshot tech.

Elon Musk has a history of overpromising moonshot tech. https://x.com/kingtutcap/status/1815881716395040883

Last January, @AbelAvellan published a letter after the AT&T, Verizon, Google deal.

Last January, @AbelAvellan published a letter after the AT&T, Verizon, Google deal.

In July 23, $DGNS announced their merger with Cvent, a leading enterprise event technology provider. The transaction values Cvent at an enterprise value of $5.3B.

In July 23, $DGNS announced their merger with Cvent, a leading enterprise event technology provider. The transaction values Cvent at an enterprise value of $5.3B.

Amazon Marketplace sellers moved more than $300 billion of product in 2020. That would make Amazon Marketplace the 42nd-largest economy in the world ranked by GDP.

Amazon Marketplace sellers moved more than $300 billion of product in 2020. That would make Amazon Marketplace the 42nd-largest economy in the world ranked by GDP.

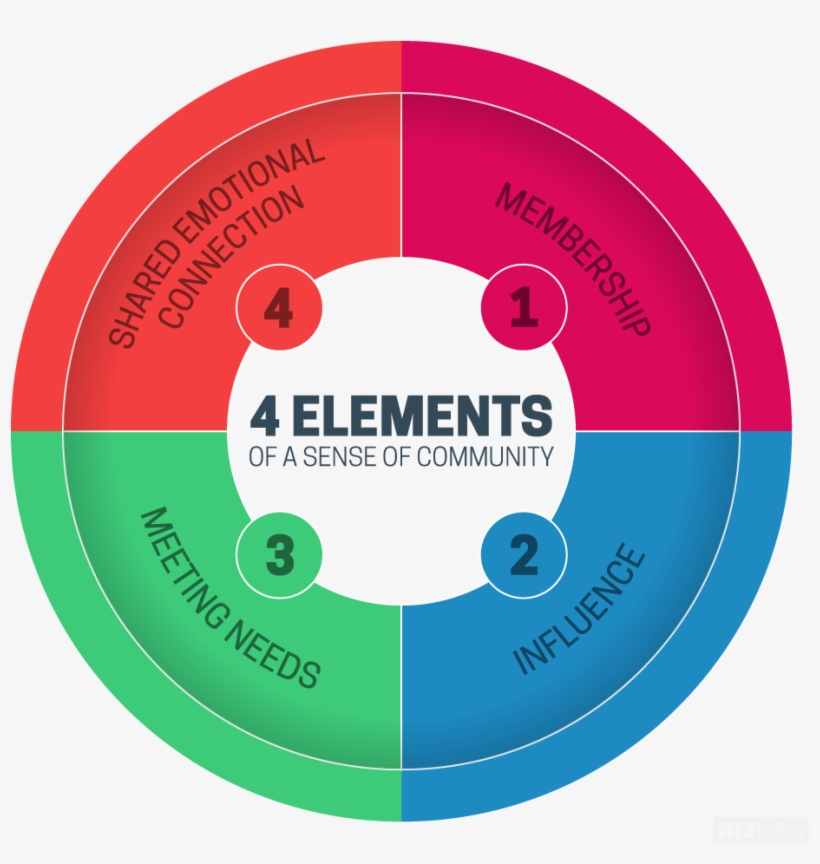

First off, what defines a community?

First off, what defines a community?

- First things first, Babylon is nothing close to $CLOV

- First things first, Babylon is nothing close to $CLOV

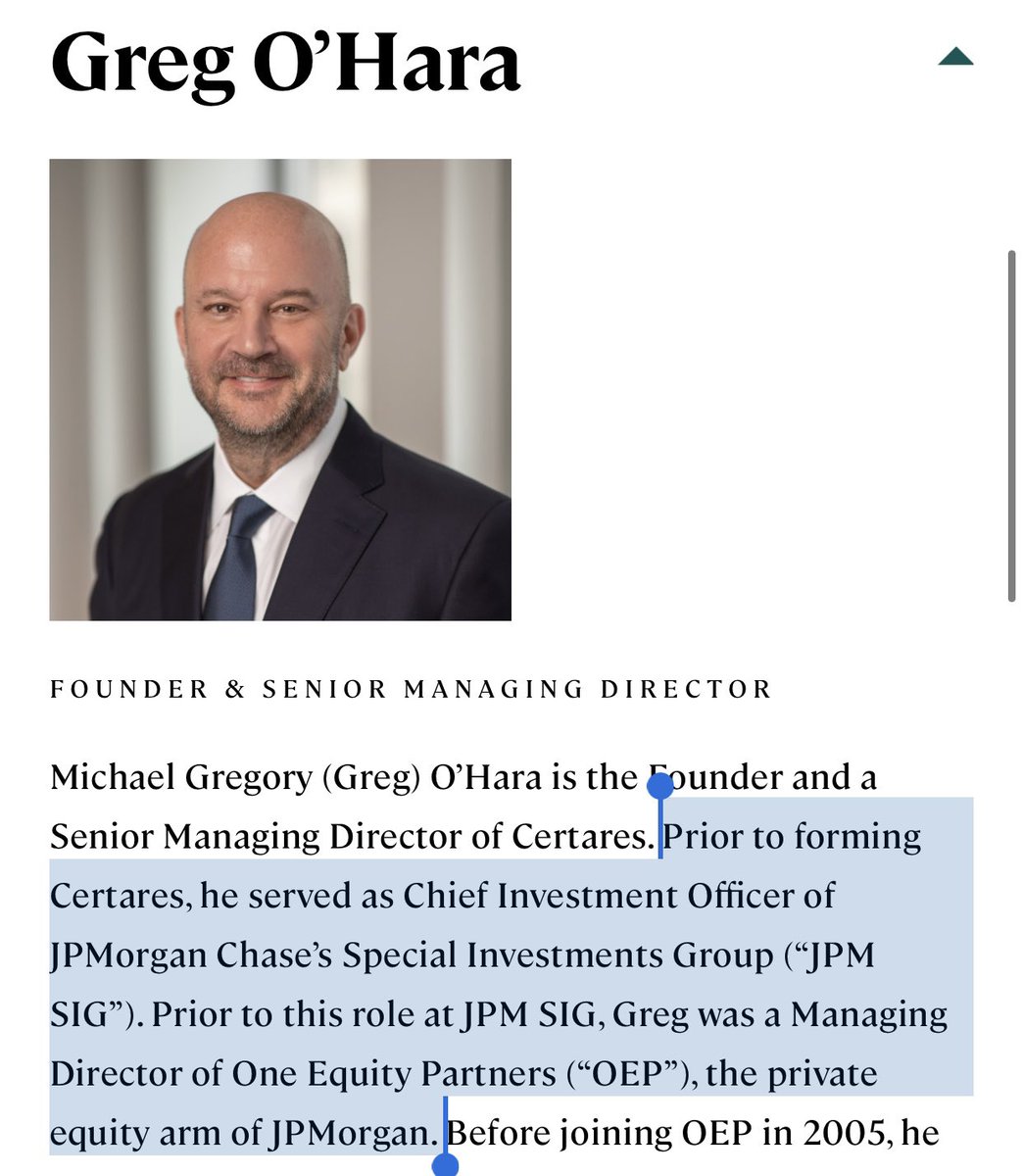

$AVAN is looking for a European target with a strong US/International nexus.

$AVAN is looking for a European target with a strong US/International nexus.

I've covered Alexander Tamas from a previous $VYGG

I've covered Alexander Tamas from a previous $VYGG https://twitter.com/kingtutspacs/status/1360678359139840008?s=20

https://twitter.com/SPACHawk/status/1338914100370419712?s=20

https://twitter.com/lowrytom/status/1362079049523290112The more I read, the more I like.

https://twitter.com/PaulByrne66/status/1329827376117800966

Ok maybe this catches your attention $GOAC

Ok maybe this catches your attention $GOAC

VY Capital is a VC firm founded by Alexander Tamas.

VY Capital is a VC firm founded by Alexander Tamas.

$SNPR/@VoltaCharging customers

$SNPR/@VoltaCharging customers

MSI are aiming to promote digitalization that will contribute to improving customer experience.

MSI are aiming to promote digitalization that will contribute to improving customer experience.

Hippo was founded in 2015 by Assaf Wand, an ex-McKinsey consultant and Eyal Navon, serial entreprenuer and software engineer.

Hippo was founded in 2015 by Assaf Wand, an ex-McKinsey consultant and Eyal Navon, serial entreprenuer and software engineer.

https://twitter.com/TradeWithAlerts/status/1357352983885922306?s=20