How to get URL link on X (Twitter) App

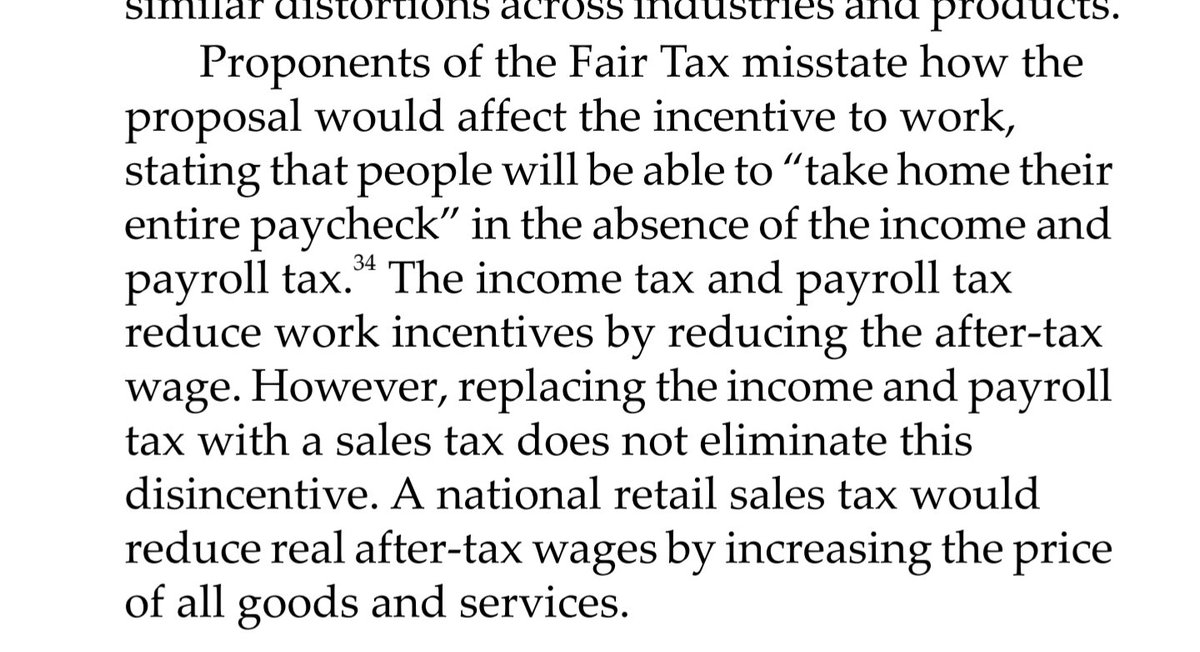

https://twitter.com/kevin_b_b6/status/1855275131179770245These pro tariffs arguments are getting worse and worse.

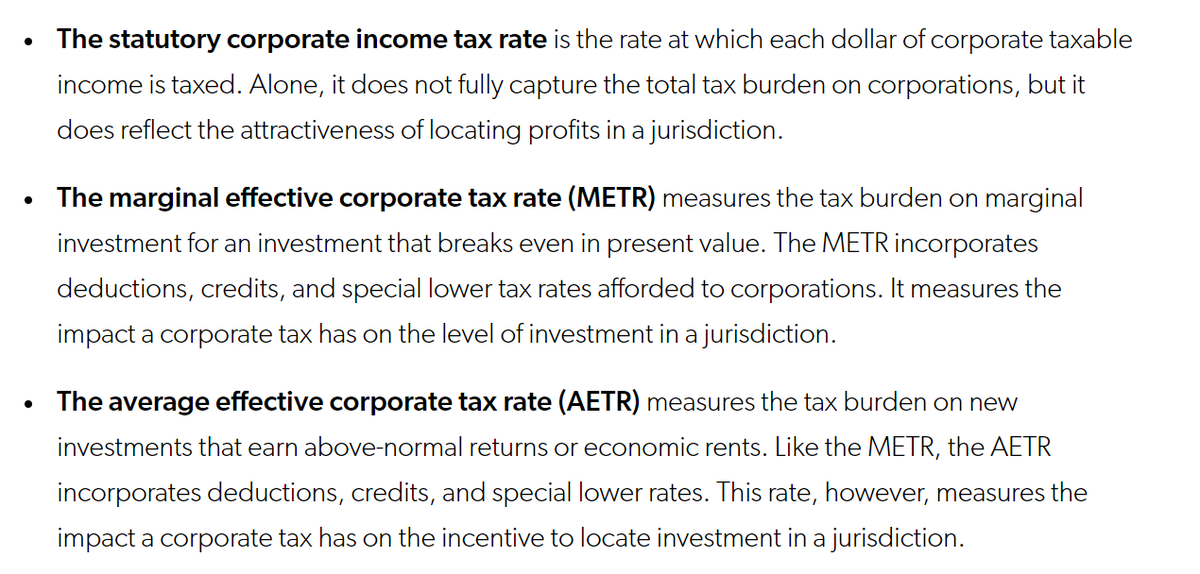

https://twitter.com/kpomerleau/status/1442877737241178115I think Marc is right and I definitely overstated my point.

https://twitter.com/MarcGoldwein/status/1442890574219005958?s=20

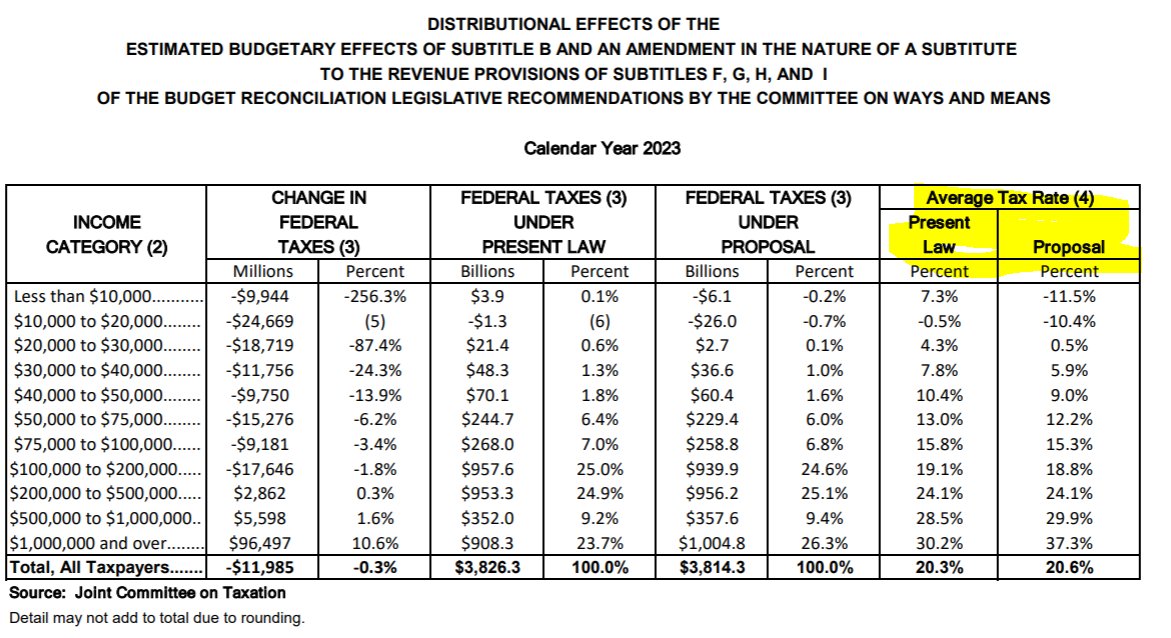

https://twitter.com/jctgov/status/1437816357198913538Given temporary nature of some major proposals (the CTC expansion, primarily), the impact on low- and middle-income households depends on the year.

https://twitter.com/mattyglesias/status/1357672764040220673I think it's correct to say: enacting a child allowance in isolation would have little impact on work incentives.

https://twitter.com/kpomerleau/status/1324035870979166210I think the conventional wisdom is right: Much of Biden's tax plan is not going anywhere with a Republican Senate.

https://twitter.com/lydiadepillis/status/1030483935346794496Put this into a little context.