Investor. // Building @contrary, @Contrary_Res // Former Index, Coatue, TCV // Husband, Father, Christian @ch_jesuschrist

6 subscribers

How to get URL link on X (Twitter) App

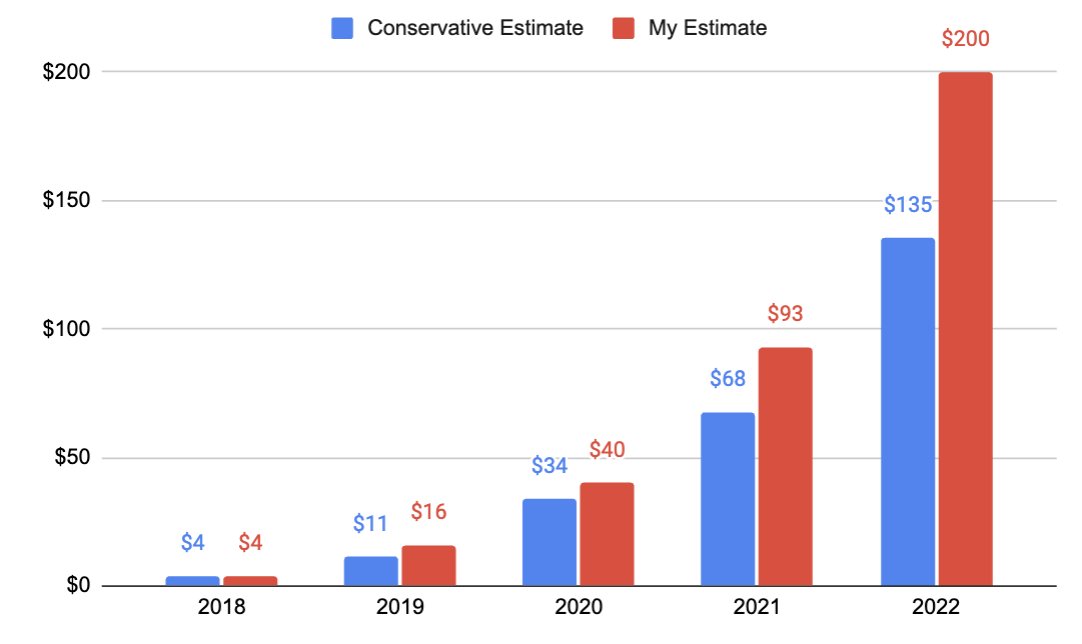

https://twitter.com/NYSE/status/1950911576115958100Now, I realize that six years ago I nailed the price and the year perfectly, so its hard to believe. But I have receipts this time.

https://x.com/VCBrags/status/1571969599641653249

The Master and His Emissary: The Divided Brain and the Making of the Western World by Iain McGilchrist

The Master and His Emissary: The Divided Brain and the Making of the Western World by Iain McGilchrist

The first important reality is that for most of these companies, any valuation mark from 2020 - 2021 aren't just one of many data points. They're IRRELEVANT data points.

The first important reality is that for most of these companies, any valuation mark from 2020 - 2021 aren't just one of many data points. They're IRRELEVANT data points.https://twitter.com/bgurley/status/1520111745091706880?s=20

Bob Iger joined Disney, after the acquisition of ABC, where he was previously the President of the company.

Bob Iger joined Disney, after the acquisition of ABC, where he was previously the President of the company.

First, it's important to note that (1) these are dramatically different businesses, and (2) they have plenty of moving parts to their business beyond gross margin.

First, it's important to note that (1) these are dramatically different businesses, and (2) they have plenty of moving parts to their business beyond gross margin.https://twitter.com/david_perell/status/1274438917110943744?s=20&t=d2-h9NDTDdefV_PQXdkuJA

https://twitter.com/lessin/status/1471601729334497282

https://twitter.com/agazdecki/status/1443016426311196673?s=20

https://twitter.com/walshgb/status/1284198716686176257?s=20^^^ @jkostecki_rei @Lennystokes13 @moseskagan @MattLasky @EdelkopfYossi @MikeBotkin_ @bradleyjohnson2 @laughridge @ChrisJBakke @sweatystartup @TihoBrkan @EstateRanger @RE_Tax_Impact