All decisions made on the basis of incoming data and the balance of risks | Author of "In This Economy?” | KylaScanlonTeam@unitedtalent.com

2 subscribers

How to get URL link on X (Twitter) App

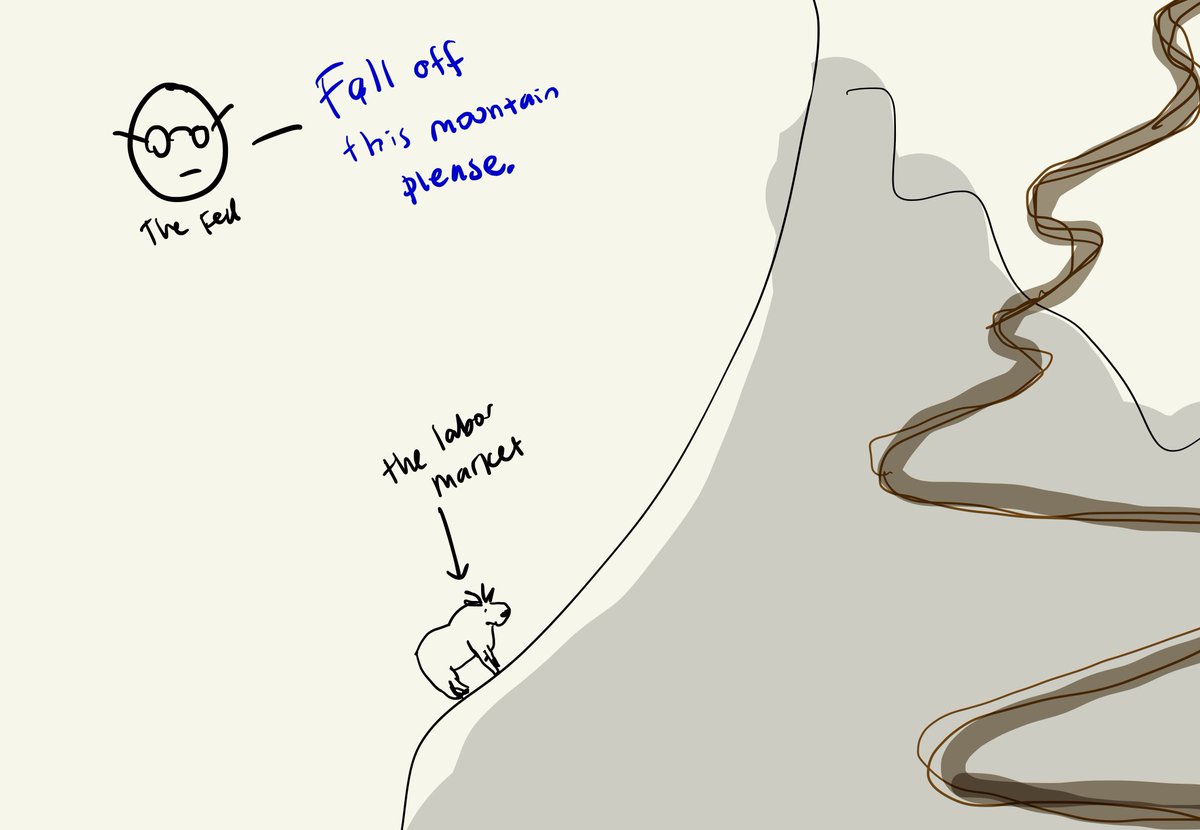

Full piece here kyla.substack.com/p/the-fed-is-h…

Full piece here kyla.substack.com/p/the-fed-is-h…

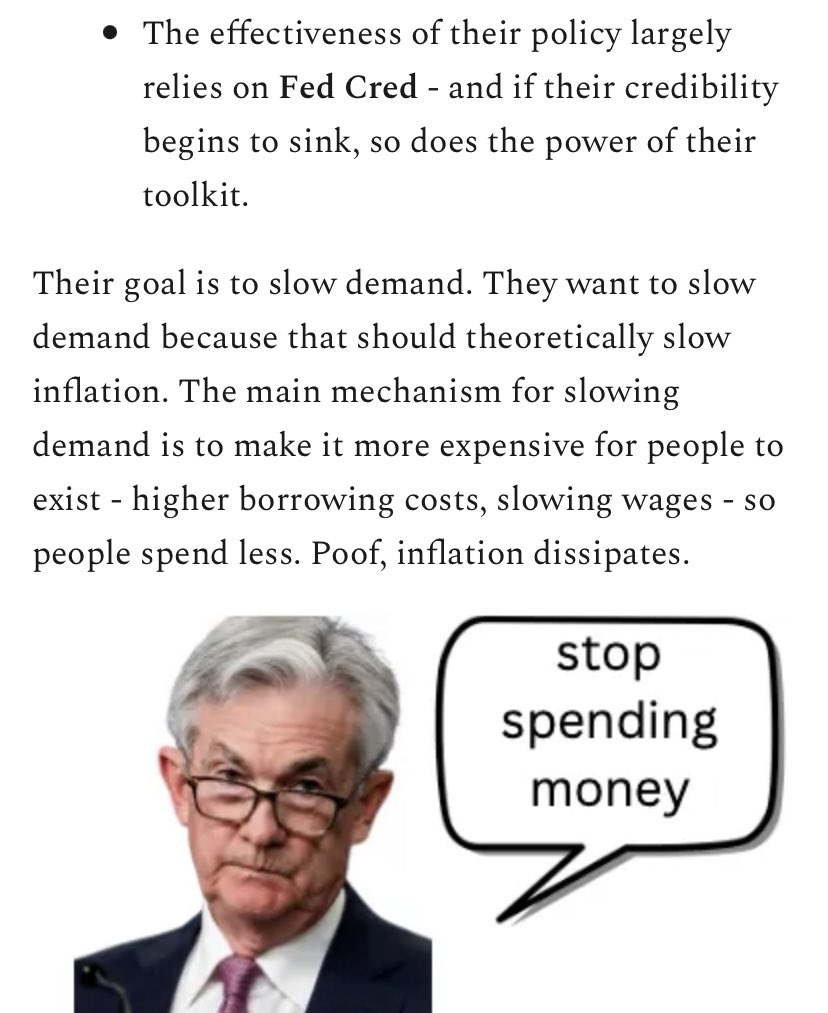

Full article here kyla.substack.com/p/the-fedconomy

Full article here kyla.substack.com/p/the-fedconomy

https://twitter.com/seyitaylor/status/1536492439816503296?s=20&t=XkQSKjmg_FWABlBOdWT6oA

United States: Russia chose to invade and has inflicted suffering on Ukraine and its own citizens. It has violated international law and the UN charter. There are attacks on kindergartens and orphanages.

United States: Russia chose to invade and has inflicted suffering on Ukraine and its own citizens. It has violated international law and the UN charter. There are attacks on kindergartens and orphanages.

Sending more forces to Germany, not sending forces to Ukraine but "defending NATO allies"

Sending more forces to Germany, not sending forces to Ukraine but "defending NATO allies"

Putin on RT

Putin on RT

#1 Geopolitics

#1 Geopolitics

"By the 1920s, economists were becoming aware of the growing role of mortgage finance in the American economy... “What does it mean that the number of mortgages on homes is increasing?” wondered census analysts in 1923. “Does it mean growing wealth or growing poverty?""

"By the 1920s, economists were becoming aware of the growing role of mortgage finance in the American economy... “What does it mean that the number of mortgages on homes is increasing?” wondered census analysts in 1923. “Does it mean growing wealth or growing poverty?""

"They’ve built an enormous network of fulfillment centers and have a $20+ bn annual R&D budget that only costs ~1.2% of its value."

"They’ve built an enormous network of fulfillment centers and have a $20+ bn annual R&D budget that only costs ~1.2% of its value."

https://twitter.com/AP/status/1414398108394479619?s=20

1/Disclaimer: I am not an RRP expert - this is my attempt (🚧) at an explanation.

1/Disclaimer: I am not an RRP expert - this is my attempt (🚧) at an explanation.

https://twitter.com/EricRWeinstein/status/1309916813979918336