Princeton postdoctoral researcher. China, tech, industrial policy, US-China competition, manufacturing, geopolitics — Newsletter: https://t.co/hqYC3okzn9

How to get URL link on X (Twitter) App

Really interesting piece by @AlastairJMarsh for Bloomberg: bloomberg.com/news/articles/…

Really interesting piece by @AlastairJMarsh for Bloomberg: bloomberg.com/news/articles/…

China tops the country rankings once again:

China tops the country rankings once again:

The underlying chart comes from here:

The underlying chart comes from here:

2/ Take solar panels. Chinese firms make a lot of solar panels very cheaply. These solar panels aren't just accumulating in a warehouse. They're being bought by customers in China and around the world.

2/ Take solar panels. Chinese firms make a lot of solar panels very cheaply. These solar panels aren't just accumulating in a warehouse. They're being bought by customers in China and around the world.

https://twitter.com/ft/status/18982325454409033992/ With Europe, China has been saying that Europe should be involved in Ukraine negotiations. China has also offered lifting multiple sanctions for every sanction lifted by the EU.

Much of BYD’s overseas expansion is in response to rising tariffs. Brazil has set rising tariffs on imported EVs. Turkey announced 40% extra tariffs on Chinese EVs. Hungary offers BYD a way around EU tariffs.

Much of BYD’s overseas expansion is in response to rising tariffs. Brazil has set rising tariffs on imported EVs. Turkey announced 40% extra tariffs on Chinese EVs. Hungary offers BYD a way around EU tariffs.

The paper looks at 328 prefecture cities in China from 2010 to 2023. The paper uses a classic staggered DID approach to show that EVs as a share of new and used car sales increased more in cities that got a high-speed rail line compared to cities that didn’t.

The paper looks at 328 prefecture cities in China from 2010 to 2023. The paper uses a classic staggered DID approach to show that EVs as a share of new and used car sales increased more in cities that got a high-speed rail line compared to cities that didn’t.

1/ An executive from Canada’s Nortel called China’s telecom market a “gold mine” in the 1980s because China was completely reliant on foreign equipment.

1/ An executive from Canada’s Nortel called China’s telecom market a “gold mine” in the 1980s because China was completely reliant on foreign equipment.

An example is spot-welding robots. Outside Japan, welder’s unions might be against these robots which replace their jobs.

An example is spot-welding robots. Outside Japan, welder’s unions might be against these robots which replace their jobs.

Some Chinese auto parts suppliers like EV battery makers are also moving production overseas.

Some Chinese auto parts suppliers like EV battery makers are also moving production overseas.

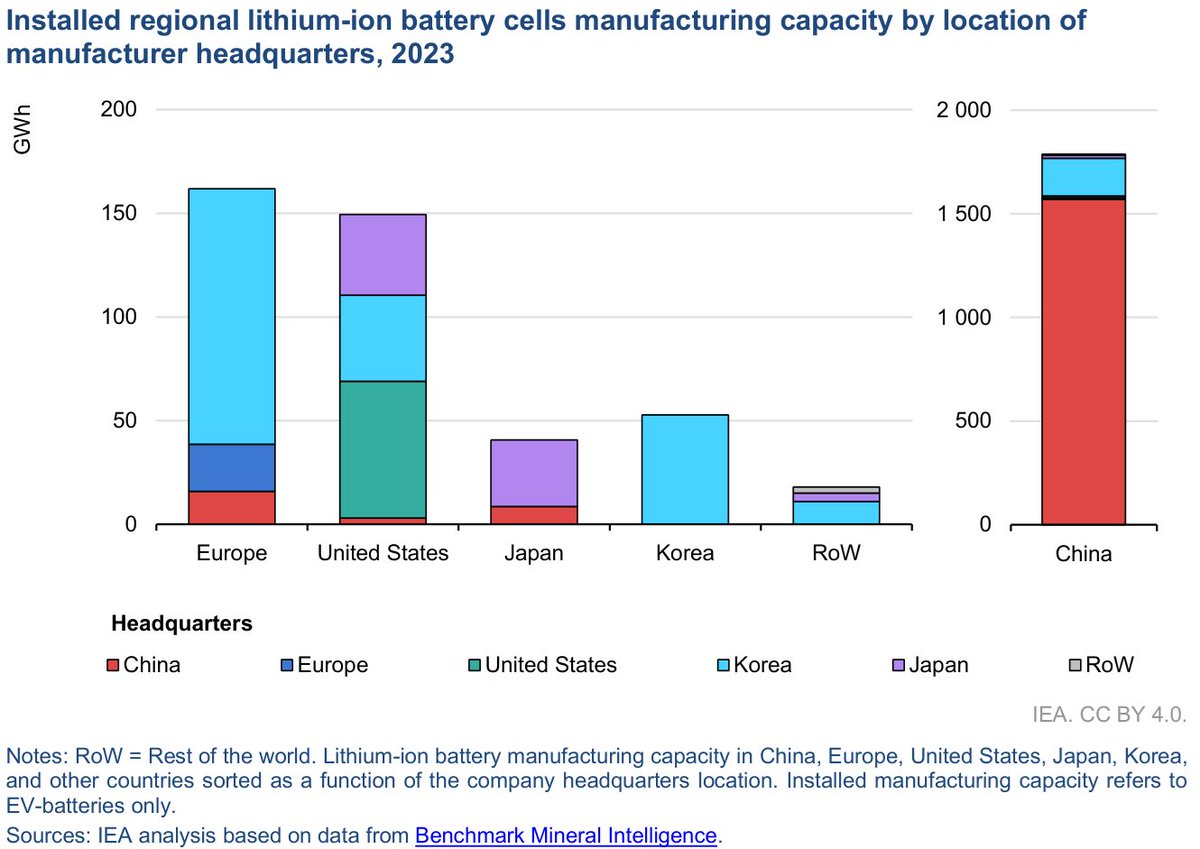

China has 10x the lithium-ion battery cell manufacturing capacity as Europe or the US. And it's mostly Chinese firms: BYD, CATL, and Gotion make up over 50%.

China has 10x the lithium-ion battery cell manufacturing capacity as Europe or the US. And it's mostly Chinese firms: BYD, CATL, and Gotion make up over 50%.

The Nature Index is straightforward and transparent. Here’s the methodology:

The Nature Index is straightforward and transparent. Here’s the methodology:

Ford's Transit Connect vans are cargo vans that would normally be subject to the 25% "chicken tax" on cargo vehicle imports. But they're made with rear seats to qualify as passenger vans for import. Then the rear seats are ripped out.

Ford's Transit Connect vans are cargo vans that would normally be subject to the 25% "chicken tax" on cargo vehicle imports. But they're made with rear seats to qualify as passenger vans for import. Then the rear seats are ripped out.

In the 1980s, in addition to “voluntary” export quotas, the US put pressure on Japanese automakers to move production to the US. Honda was the first, opening a plant in Ohio in 1982, followed quickly by Toyota and Nissan.

In the 1980s, in addition to “voluntary” export quotas, the US put pressure on Japanese automakers to move production to the US. Honda was the first, opening a plant in Ohio in 1982, followed quickly by Toyota and Nissan.

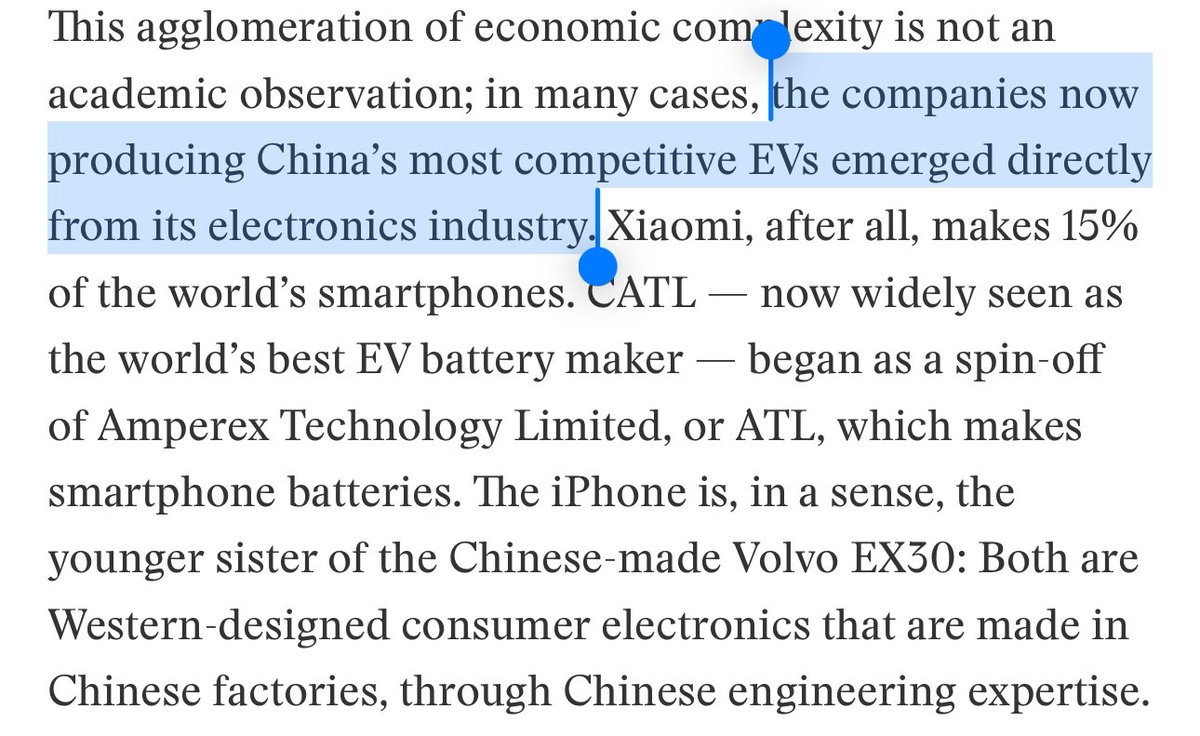

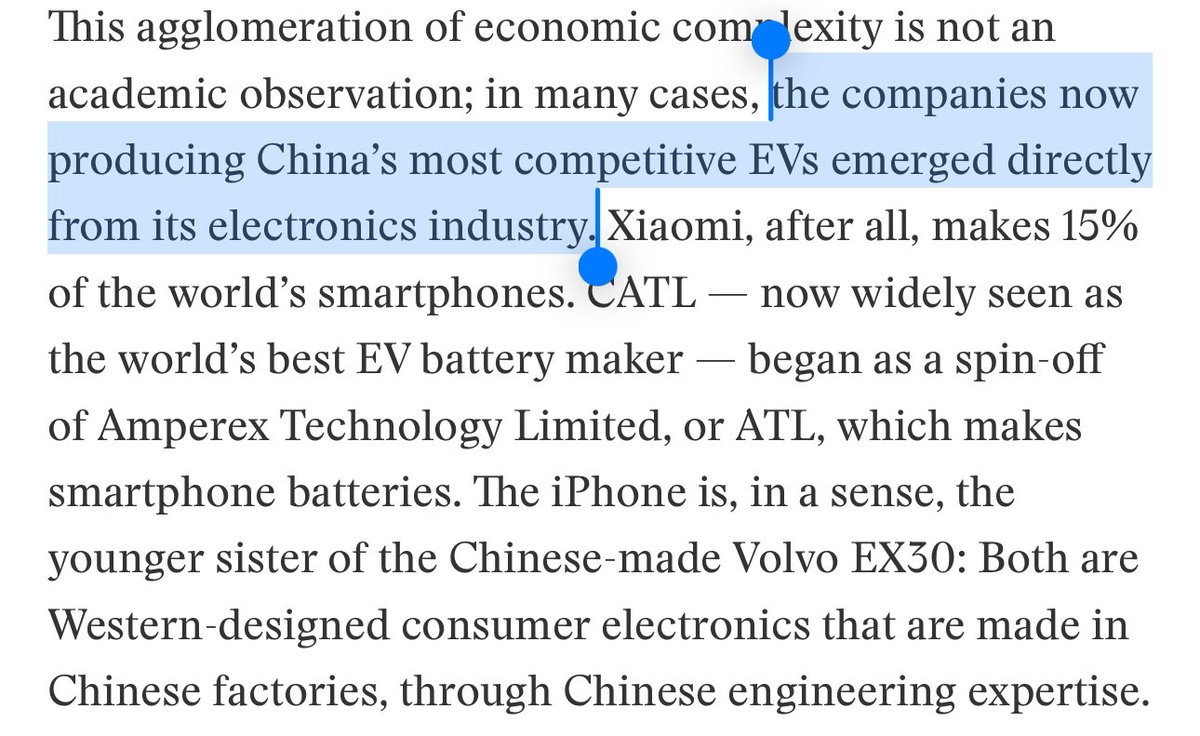

Many of the Chinese suppliers to Apple I discussed in my High Capacity piece overlap with the EV industry.

Many of the Chinese suppliers to Apple I discussed in my High Capacity piece overlap with the EV industry.

https://twitter.com/FT/status/1786055297053671621

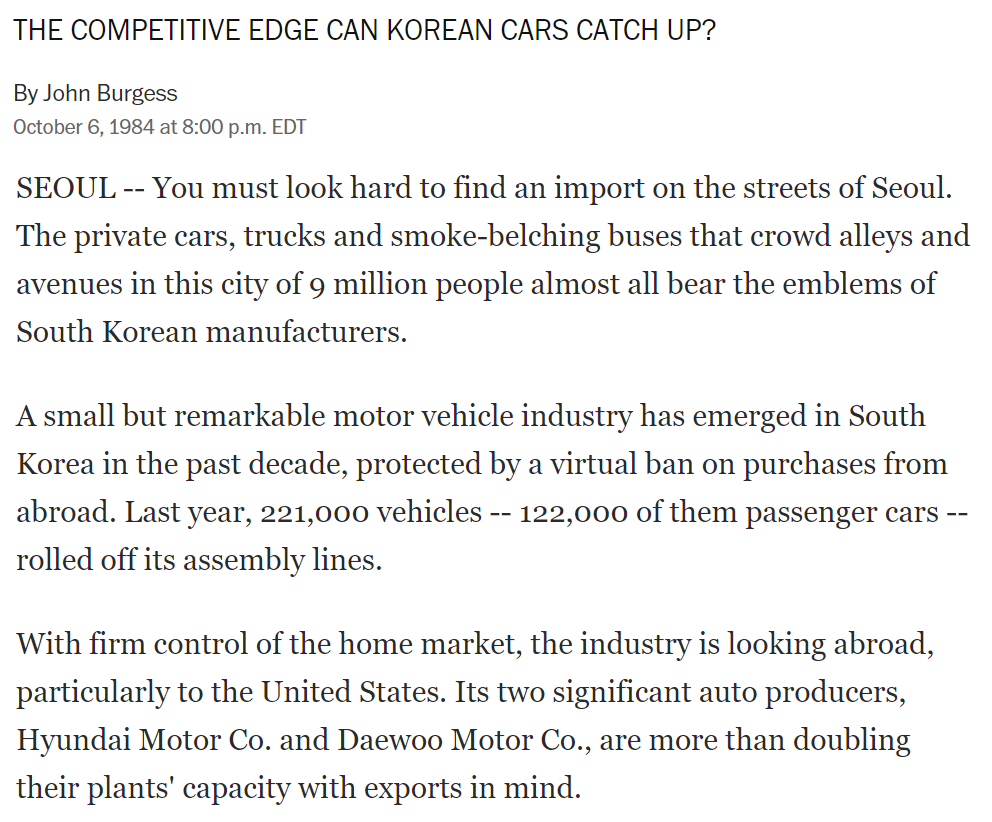

The 1984 Washington Post article about South Korea's plans to export cars to the US market shows how tightly the country controlled its auto imports:

The 1984 Washington Post article about South Korea's plans to export cars to the US market shows how tightly the country controlled its auto imports:

Some backstory: This project came about while I was studying China’s high-speed rail program. I noticed the same SOEs showing up, and I noticed they had nearly identical subsidiaries. Then I started to notice a similar industrial structure in other key sectors.

Some backstory: This project came about while I was studying China’s high-speed rail program. I noticed the same SOEs showing up, and I noticed they had nearly identical subsidiaries. Then I started to notice a similar industrial structure in other key sectors.