Portfolio Manager of The Free Markets ETF ( $FMKT ), The ATAC Credit Rotation ETF ( $JOJO ), & The ATAC Rotation Fund ( $ATACX )

17 subscribers

How to get URL link on X (Twitter) App

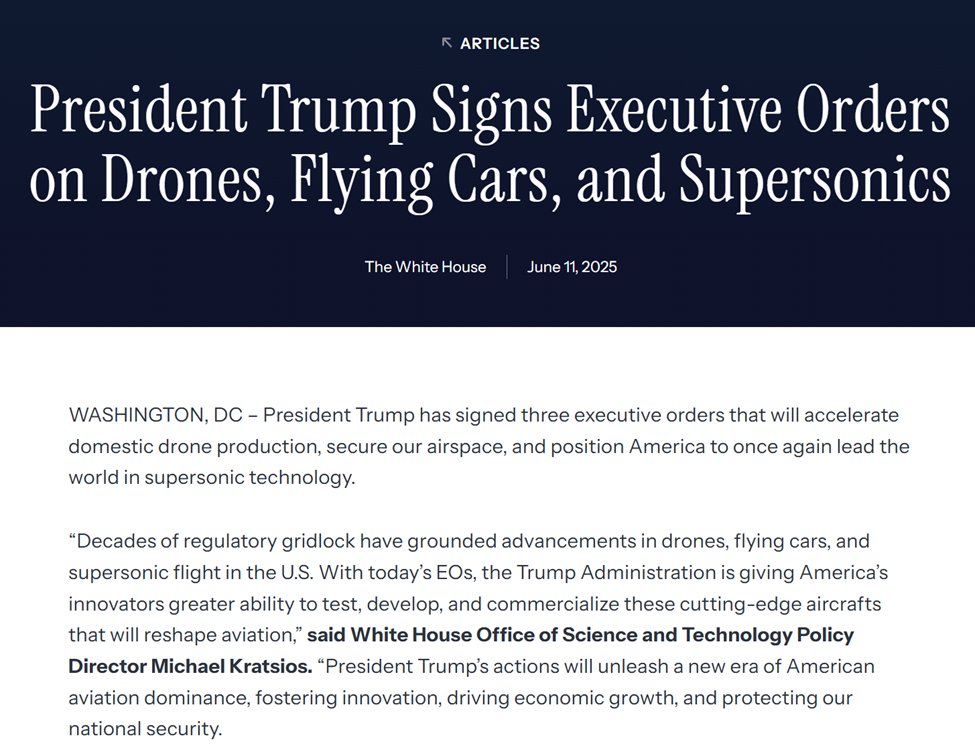

$FMKT's proprietary R2Q AI system scans policy databases in real-time to identify companies poised to benefit from regulatory shifts. Our AI flagged $ACHR given Trump’s recent executive order which impacts companies involves in drones, flying cars, and supersonic flight. (2/10)

$FMKT's proprietary R2Q AI system scans policy databases in real-time to identify companies poised to benefit from regulatory shifts. Our AI flagged $ACHR given Trump’s recent executive order which impacts companies involves in drones, flying cars, and supersonic flight. (2/10)

What if we told you regulation costs American businesses $2.1 TRILLION annually? That’s ~$15,000 per household. As these burdens lift, companies can unlock unprecedented value. $FMKT is your vehicle to capture this transformation. (2/10)

What if we told you regulation costs American businesses $2.1 TRILLION annually? That’s ~$15,000 per household. As these burdens lift, companies can unlock unprecedented value. $FMKT is your vehicle to capture this transformation. (2/10)

First, allow me to clarify that all of my rules-based Funds are separate from my research (The Lead-Lag Report).

First, allow me to clarify that all of my rules-based Funds are separate from my research (The Lead-Lag Report).

First, allow me to clarify that all of my rules-based Funds are separate from my research (The Lead-Lag Report).

First, allow me to clarify that all of my rules-based Funds are separate from my research (The Lead-Lag Report).

1/ First - why?

1/ First - why?

1/ This ancient Ayurvedic herb has been used for centuries to promote overall health and well-being. Let's explore how it can support your intermittent fasting goals, especially for OMAD and multi-day fasts.

1/ This ancient Ayurvedic herb has been used for centuries to promote overall health and well-being. Let's explore how it can support your intermittent fasting goals, especially for OMAD and multi-day fasts.

1/ Omega-3s, particularly EPA and DHA, are essential fatty acids that support overall health. They're crucial for brain function, heart health, and reducing inflammation.

1/ Omega-3s, particularly EPA and DHA, are essential fatty acids that support overall health. They're crucial for brain function, heart health, and reducing inflammation.

1/ Acetyl L-Carnitine (ALC) enhances fat metabolism by shuttling fatty acids into mitochondria for energy production. During fasting, this process is amplified, potentially boosting weight loss efforts. Studies show ALC supplementation can increase fat oxidation by up to 22%

1/ Acetyl L-Carnitine (ALC) enhances fat metabolism by shuttling fatty acids into mitochondria for energy production. During fasting, this process is amplified, potentially boosting weight loss efforts. Studies show ALC supplementation can increase fat oxidation by up to 22%

1/ First, let's understand the ADP Employment Change. It's a measure of non-farm private employment changes based on payroll data from ADP. It's a significant barometer of the overall economic health💼📈

1/ First, let's understand the ADP Employment Change. It's a measure of non-farm private employment changes based on payroll data from ADP. It's a significant barometer of the overall economic health💼📈

1/ First, let's understand the numbers: CPI YoY is at 3.24%, down from 3.70% last month and 7.75% last year. In simpler terms, prices are rising, but at a slower pace than previously.

1/ First, let's understand the numbers: CPI YoY is at 3.24%, down from 3.70% last month and 7.75% last year. In simpler terms, prices are rising, but at a slower pace than previously.

1/ I said this before, and I'm saying it again.

1/ I said this before, and I'm saying it again.