How to get URL link on X (Twitter) App

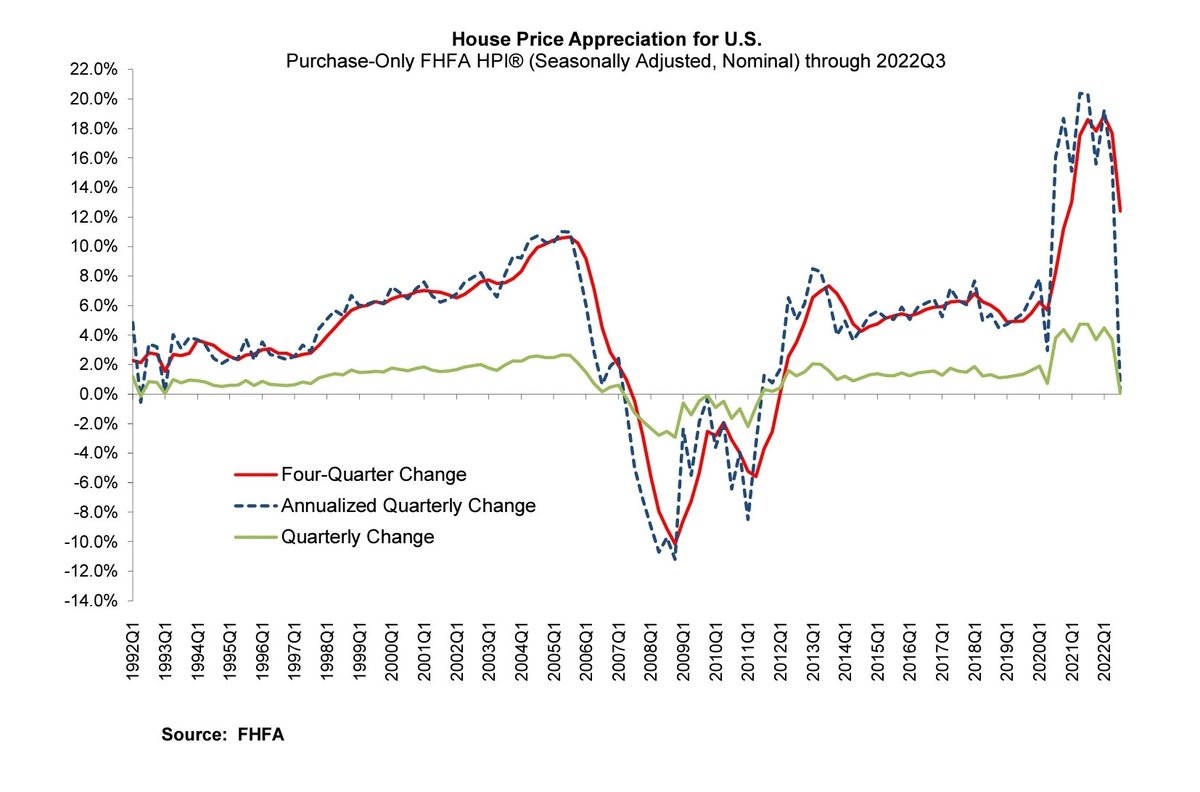

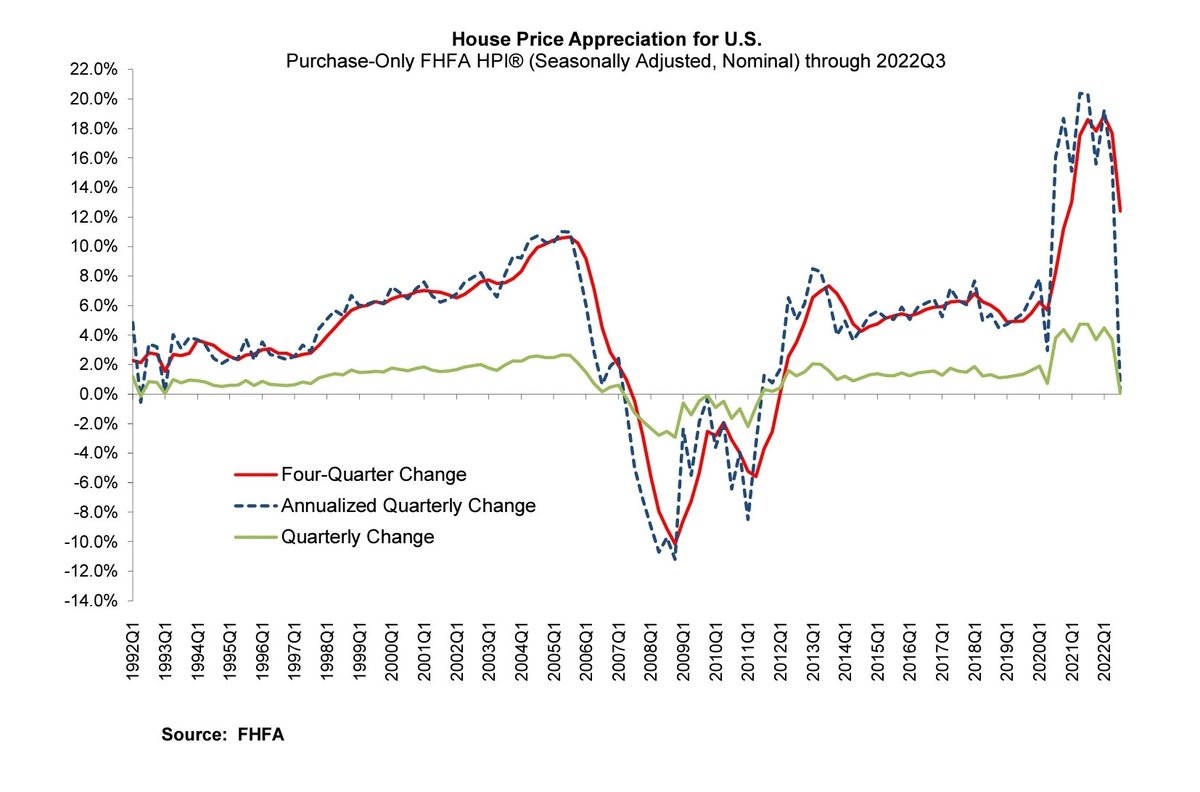

First, whether or not a 5-10% decline in house prices would be modest or not is context specific. In a normal environment a 5-10% drop would probably be more than modest.

First, whether or not a 5-10% decline in house prices would be modest or not is context specific. In a normal environment a 5-10% drop would probably be more than modest.

during COVID in spring of 2020, applications also fell 40% but came roaring back in short order

during COVID in spring of 2020, applications also fell 40% but came roaring back in short order

I caculated the undersupply by comparing the current homeowner/renter vacancy rate (very low) to its historical average

I caculated the undersupply by comparing the current homeowner/renter vacancy rate (very low) to its historical average

...income growth has been slightly faster in LA, but not by much

...income growth has been slightly faster in LA, but not by much

If you follow me, you've seen me do a chart like that for weekly home purchase mortgage applications, which pick up related trend (not all home sales get mortgages)

If you follow me, you've seen me do a chart like that for weekly home purchase mortgage applications, which pick up related trend (not all home sales get mortgages)

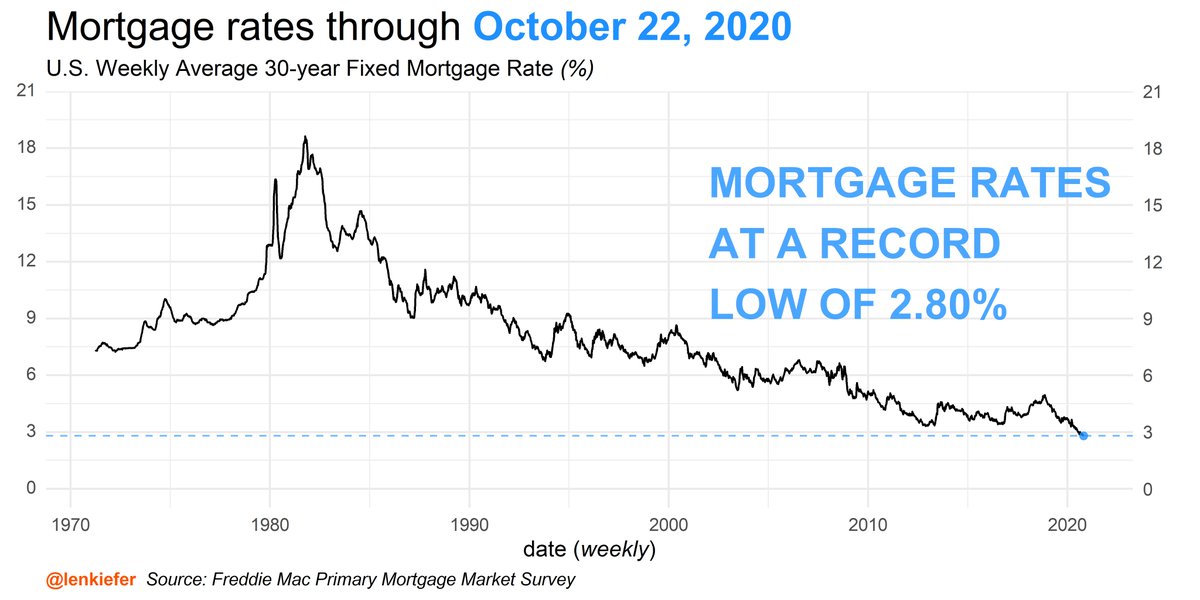

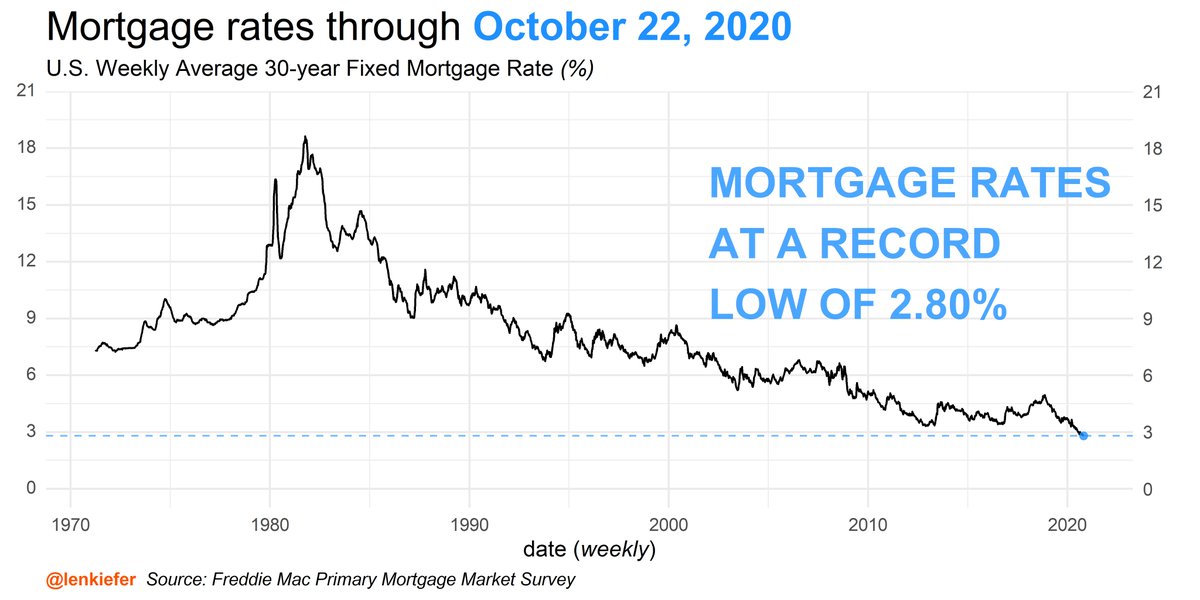

rates almost reached 5% in November of 2018 and since have been on a steady decline

rates almost reached 5% in November of 2018 and since have been on a steady decline

hold on, wait.

hold on, wait.