How to get URL link on X (Twitter) App

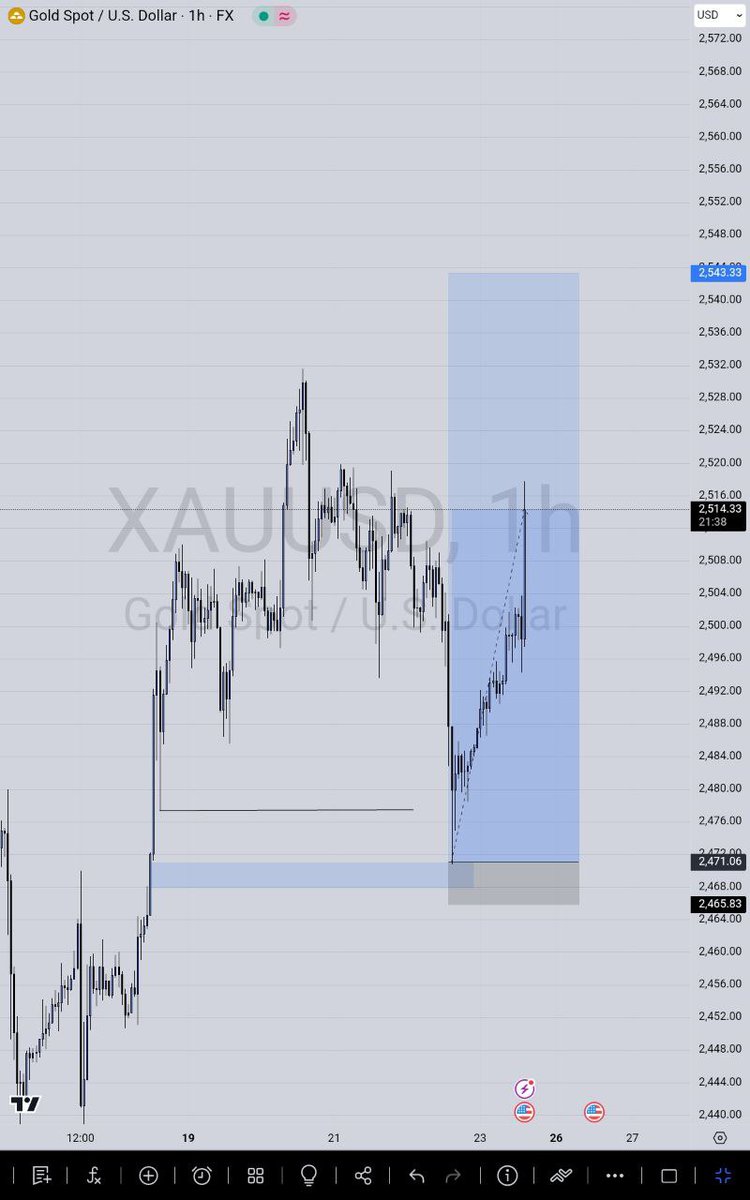

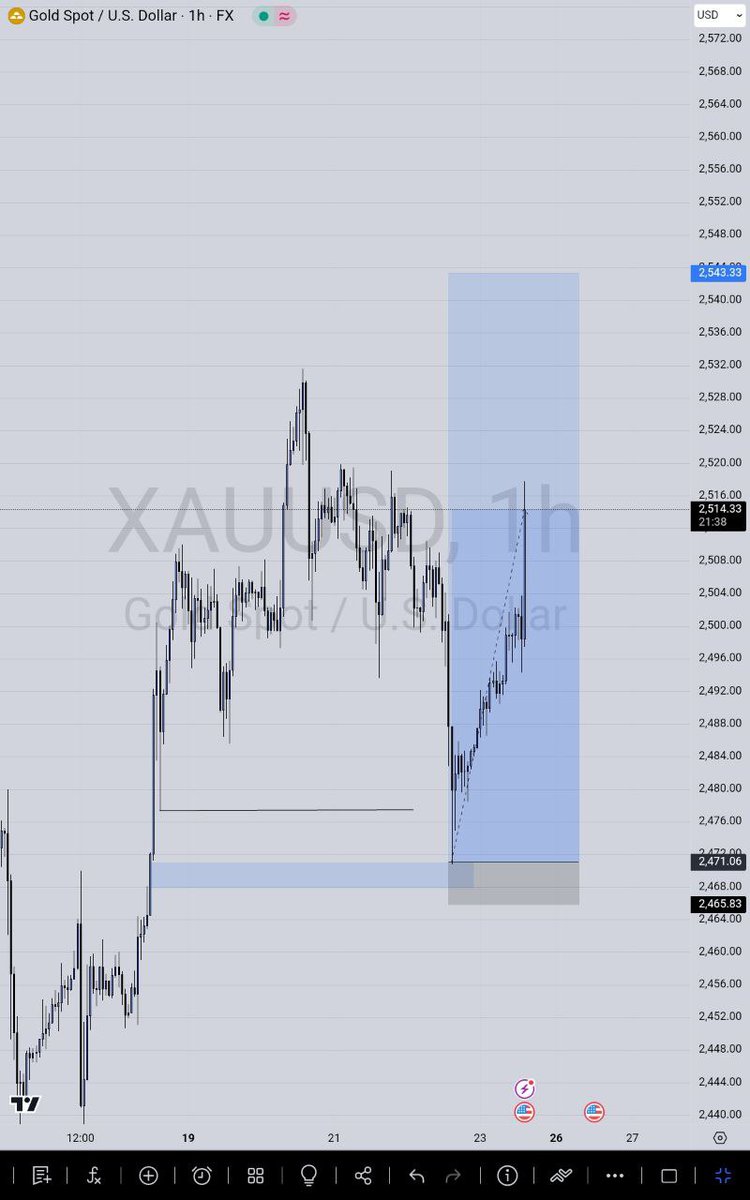

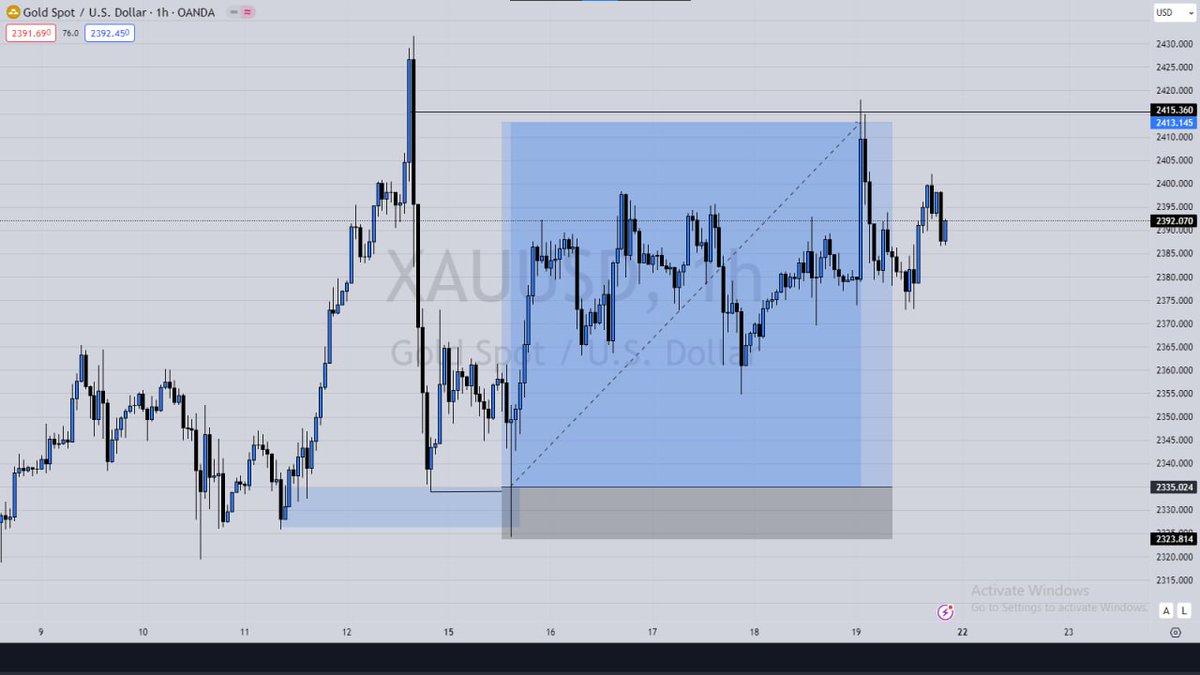

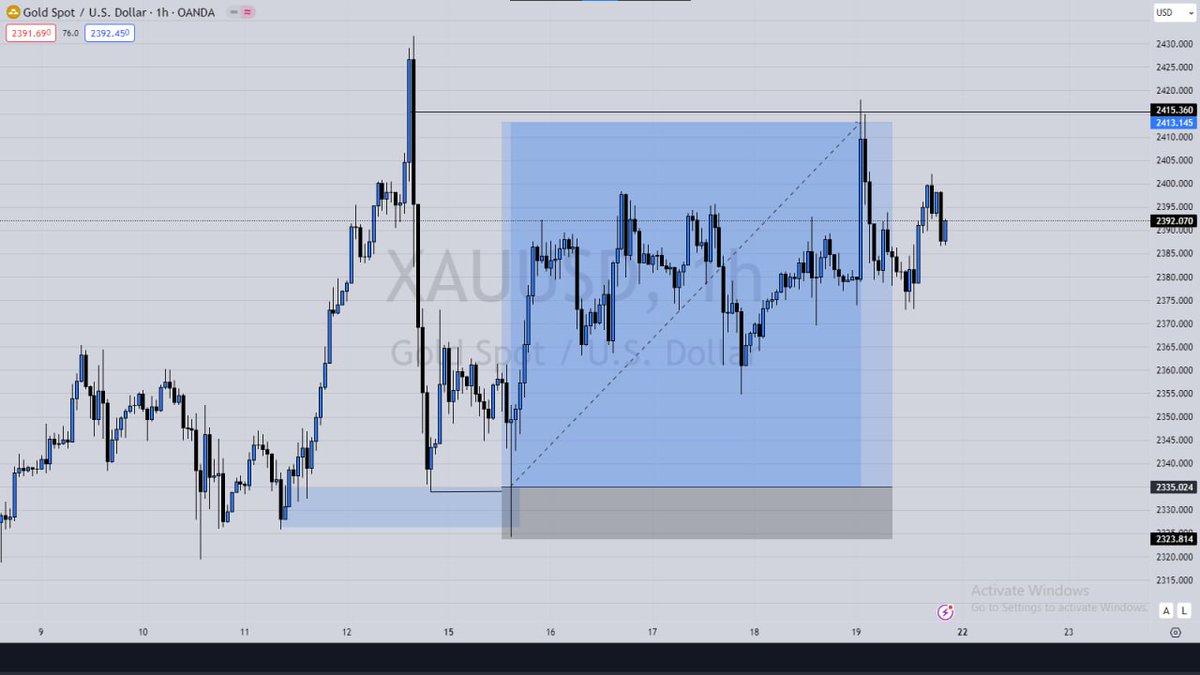

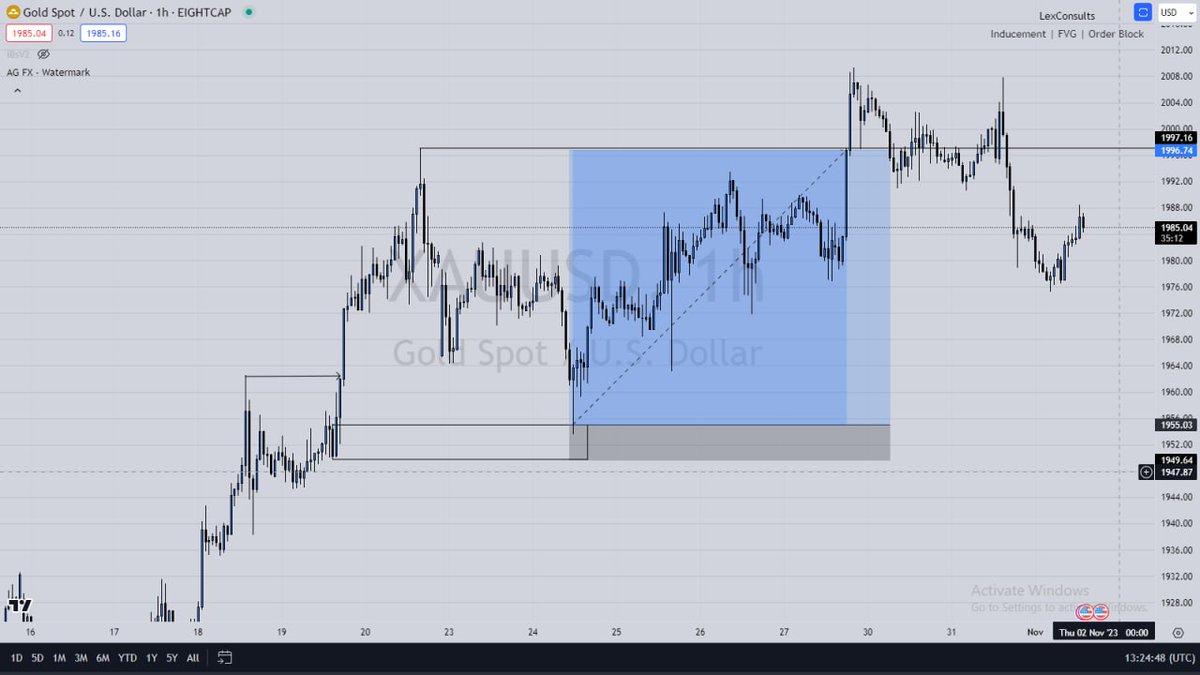

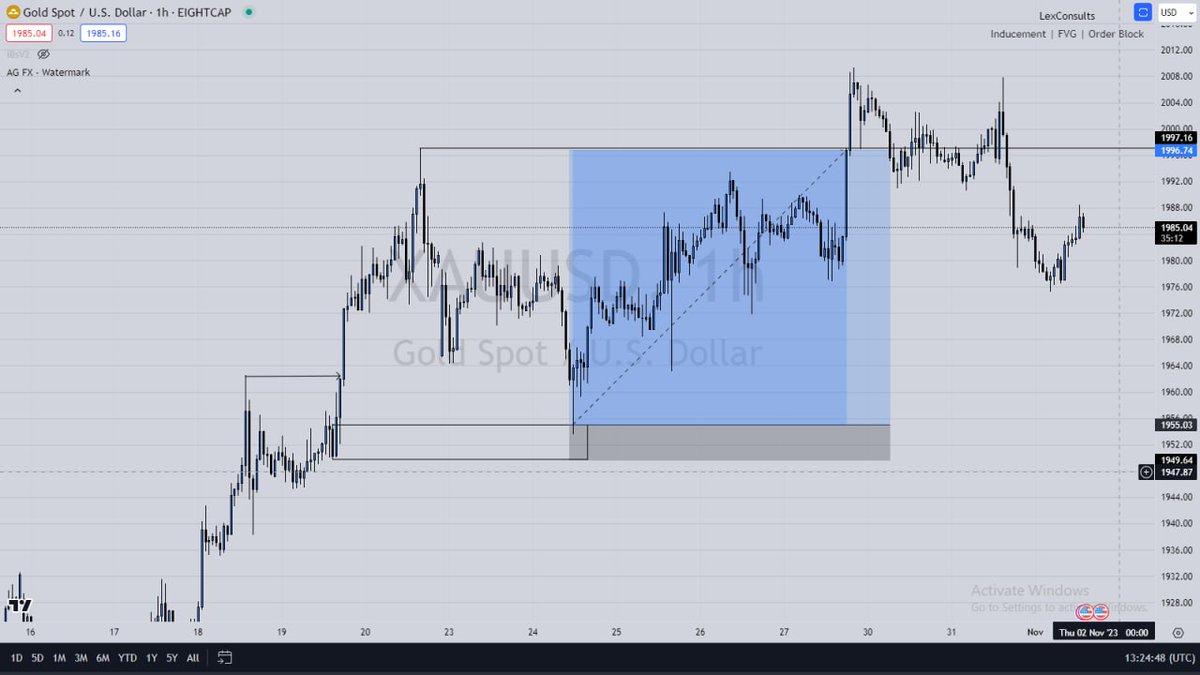

Always use the FVG that's close to your inducement (liquidity), that means your execution should be after an inducement (liquidity) is taken.

Always use the FVG that's close to your inducement (liquidity), that means your execution should be after an inducement (liquidity) is taken. https://x.com/lex_consults/status/1724774250366570953?t=NOdXibONUDR066JeeMwpNQ&s=19

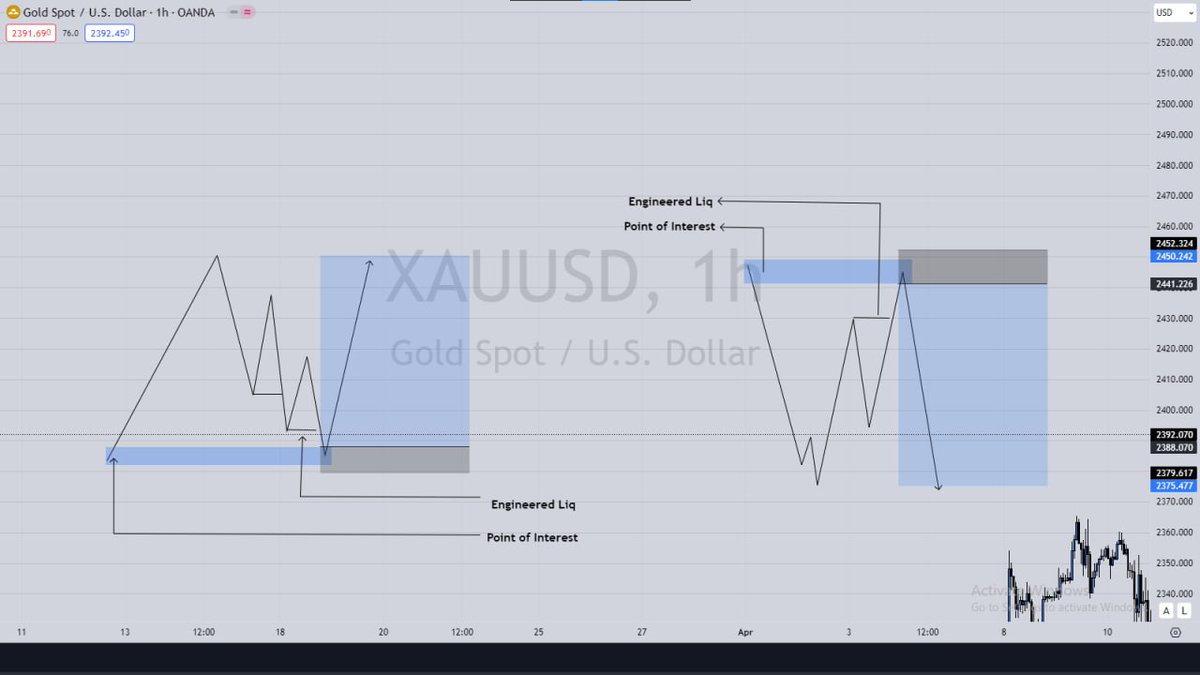

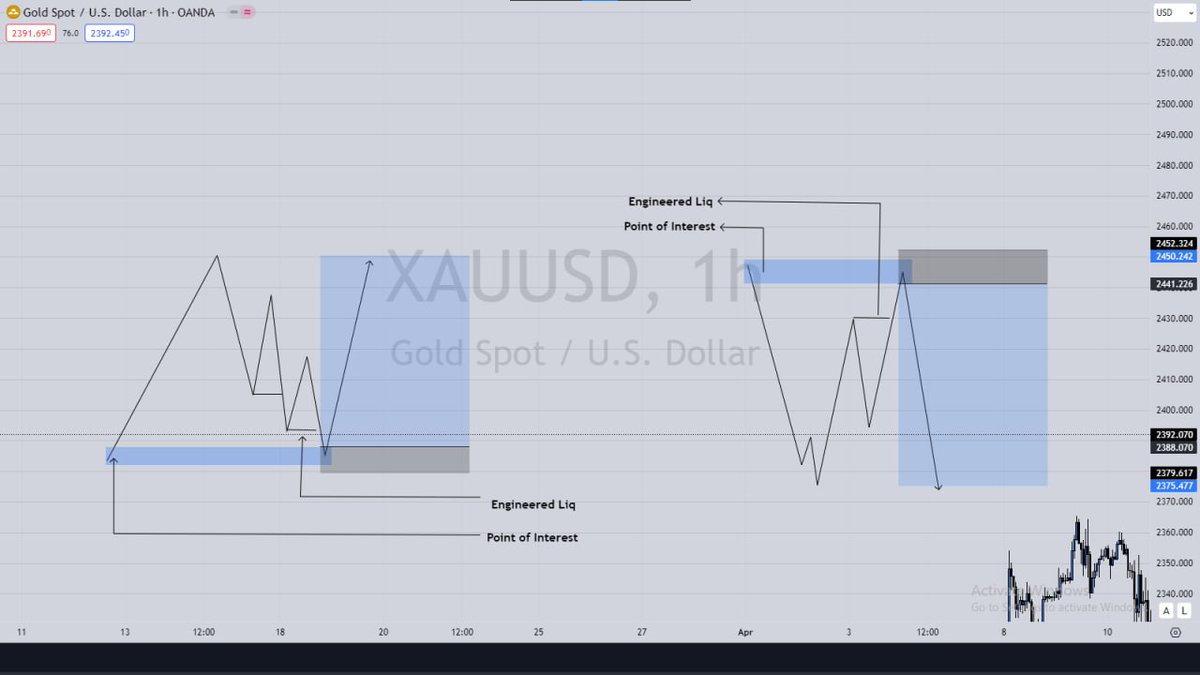

Price either engineers liquidity close to your point of interest

Price either engineers liquidity close to your point of interest

Most new traders who trades liquidity usually ask what if there is no inducement close to an entry is the entry still valid? Yes! It's possible that a point of interest is still valid without an inducement.

Most new traders who trades liquidity usually ask what if there is no inducement close to an entry is the entry still valid? Yes! It's possible that a point of interest is still valid without an inducement.

Yes! I know that there's nothin like the perfect POI as far as probabilities of technical analysis is concerned, but here is an unveiled secret that can help you choose the order blocks with the highest probability as a trader.

Yes! I know that there's nothin like the perfect POI as far as probabilities of technical analysis is concerned, but here is an unveiled secret that can help you choose the order blocks with the highest probability as a trader.

Most profitable Traders using SMC to trade the market understands Inducement and how it works, by this they always look out for inducement close to their point of interests to give their poi a higher probability of playing out.

Most profitable Traders using SMC to trade the market understands Inducement and how it works, by this they always look out for inducement close to their point of interests to give their poi a higher probability of playing out.

What is a Fair Value Gap? A fair value gap (FVG) is a term used to describe the areas of inefficiencies/imbalances of the price of an asset in the market. These inefficiencies can be caused by buying/selling aggressiveness, price usually reacts from them when revisited.

What is a Fair Value Gap? A fair value gap (FVG) is a term used to describe the areas of inefficiencies/imbalances of the price of an asset in the market. These inefficiencies can be caused by buying/selling aggressiveness, price usually reacts from them when revisited.

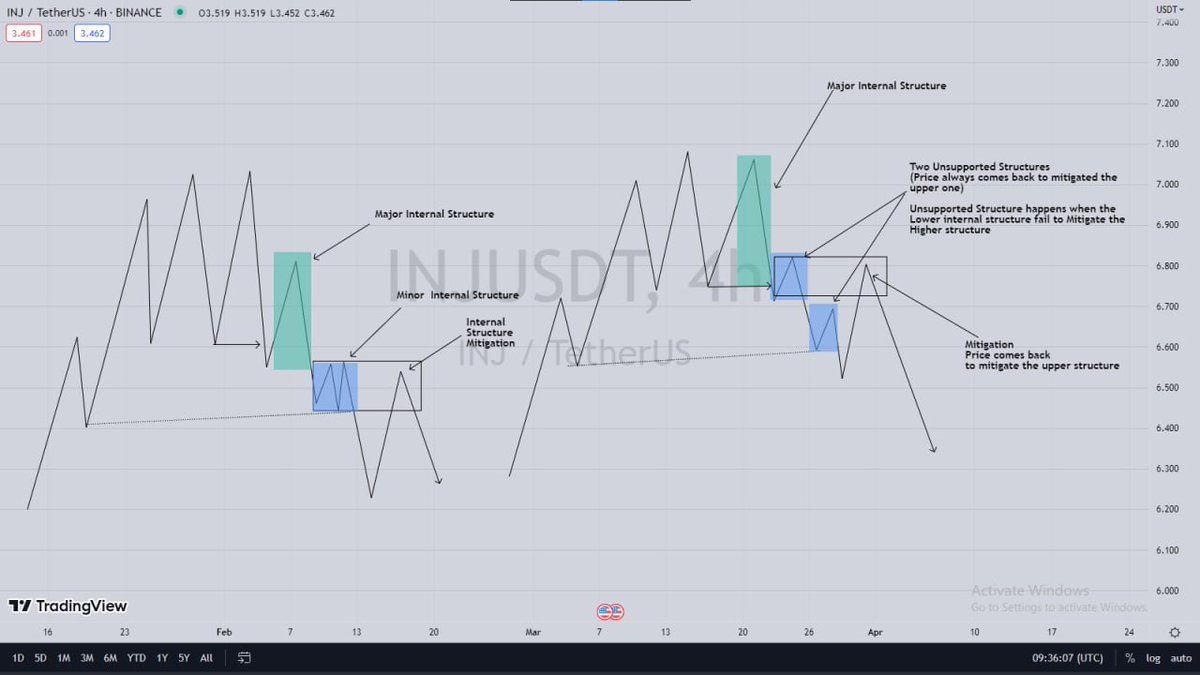

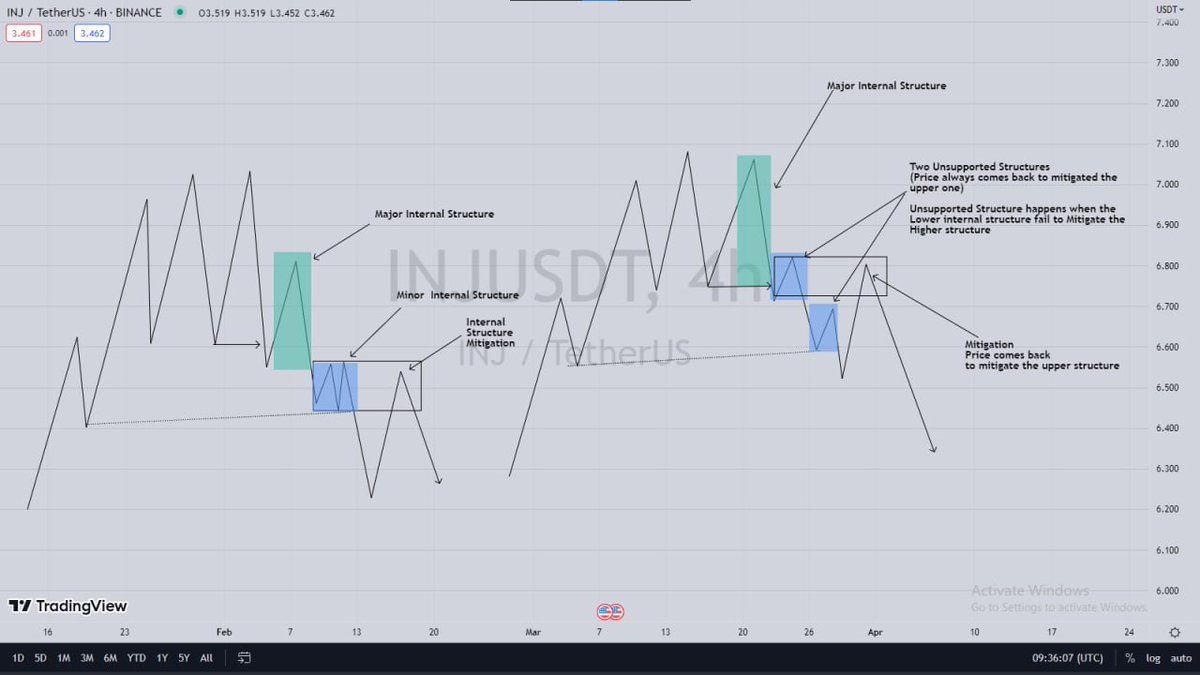

Sometimes your stop loss hits and price starts moving your way, some times a fellow trader will tell you that your stop loss is his entry & it actually plays out, sometimes you're seeing two structures in one place wondering which to choose.

Sometimes your stop loss hits and price starts moving your way, some times a fellow trader will tell you that your stop loss is his entry & it actually plays out, sometimes you're seeing two structures in one place wondering which to choose.

First, this continuation entry model I learnt it by studying @neehyeehwah charts, I've traded the model and it has printed massively for me and so it's good that I share it with y'all.

First, this continuation entry model I learnt it by studying @neehyeehwah charts, I've traded the model and it has printed massively for me and so it's good that I share it with y'all.

Few months ago I wrote a thread about this Structure, Liquidity & Entry (SLE) entry model & how it increased my win rate and how it contributed a whole lot to passing my prop firm accounts.

Few months ago I wrote a thread about this Structure, Liquidity & Entry (SLE) entry model & how it increased my win rate and how it contributed a whole lot to passing my prop firm accounts.

Many of us have heard some profitable traders talking about "Structure, liquidity & entry (SLE,)", as much as it sounds complicated it is not complicated at all, in this th~read I'll show you a good example of SLE entry model that can boost your win rate with time.

Many of us have heard some profitable traders talking about "Structure, liquidity & entry (SLE,)", as much as it sounds complicated it is not complicated at all, in this th~read I'll show you a good example of SLE entry model that can boost your win rate with time.

First of all what is CHoCH? CHoCH simply means 'change of character' it is a break of structure that causes a change in the sentiment/movement of a trend from bearish to bullish and vice versa

First of all what is CHoCH? CHoCH simply means 'change of character' it is a break of structure that causes a change in the sentiment/movement of a trend from bearish to bullish and vice versa

PRINCIPLES OF ACCOUNT MANAGEMENT by @neehyeehwah

PRINCIPLES OF ACCOUNT MANAGEMENT by @neehyeehwah https://twitter.com/neehyeehwah/status/1639588343288672262?t=ai2K9zaax1Gp69f5qpcrRQ&s=19

People will often say "The trend is your friend, don't fight against it" but not many people understands what a trend really is, an understanding of a trend will help you trade the market better and to know the possible directions to face per time.

People will often say "The trend is your friend, don't fight against it" but not many people understands what a trend really is, an understanding of a trend will help you trade the market better and to know the possible directions to face per time.

IBSV2 Indicator by @Techriztm

IBSV2 Indicator by @Techriztmhttps://twitter.com/Techriztm/status/1608752299383607298?t=WLTQEiHT3NBO5Md7G-9-Tg&s=19

Here's a scenario where $BTC used the first model: where price forms one minor internal structure before the break of Liquidity

Here's a scenario where $BTC used the first model: where price forms one minor internal structure before the break of Liquidity