GP @HumbaVC ($250k-$1m checks in deep tech + critical sectors). Co-founder @SusaVentures. 🦍

Prev: Caltech; 2nd engineer at LinkedIn; Google

4 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/rrhoover/status/15580713177562480672/ Most LPs want time to build trust & a relationship w/you. They rarely FOMO in. So build relationships early, even w/LPs that won't invest yet.

https://twitter.com/_KarenHao/status/13523514478039654412/ The argument is that wealth shouldn't have so much influence over innovation. But that's backwards. Most big innovations wouldn't exist w/o $ incentives -- which lead to wealth. What fraction of stuff we use was created by companies vs. govts, non-profits, etc? I'd wager 95+%.

https://twitter.com/HorsleyBridge/status/657288489331855360

https://twitter.com/BullyEsq/status/12313018013554360322/ As a reminder, in the US you're an accredited investor if you make $200k/year for two years (or $300k jointly with a spouse) OR if your net worth, excluding your primary residence, is $1m or more. You have to be accredited to invest in startups, hedge funds, etc.

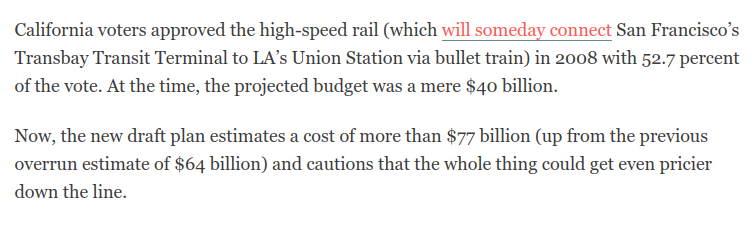

https://twitter.com/sfchronicle/status/1202197711170215936

https://twitter.com/SusaVentures/status/11457639480057118722/ Some history: we started @SusaVentures in 2013. We were a team of friends that hadn't directly worked together and hadn't worked in venture capital. We began investing as an angel group, loved working w/each other and w/amazing founders, and decided to formally start a fund.

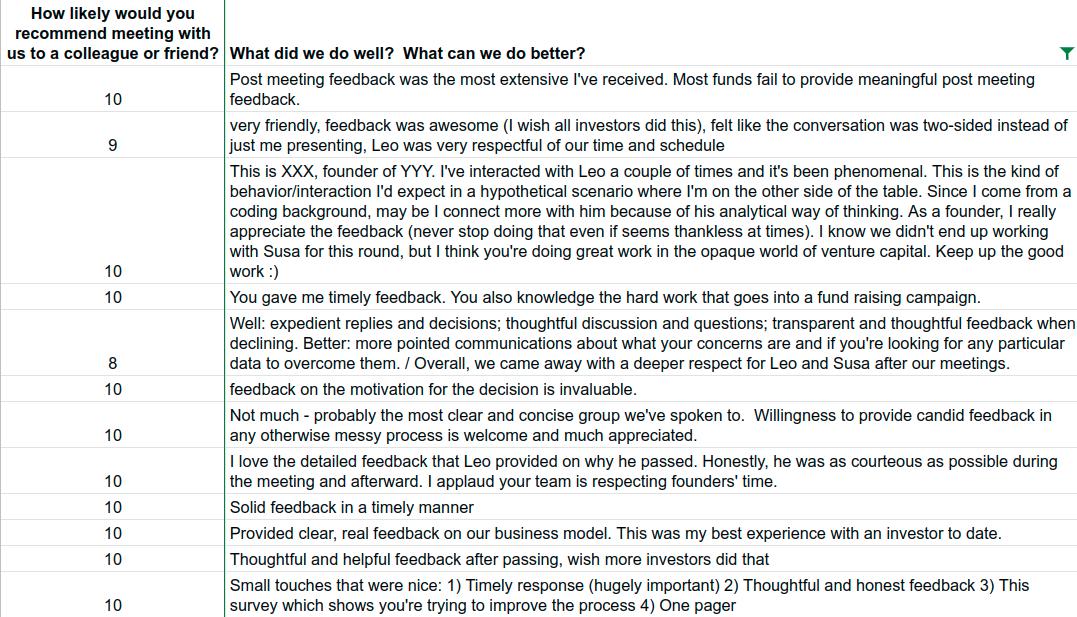

https://twitter.com/semil/status/11429102457876889602/ FWIW I try to always offer detailed feedback when I pass, and I do it without asking for permission first. This is counter to most advice I got when starting my career as a VC.