How to get URL link on X (Twitter) App

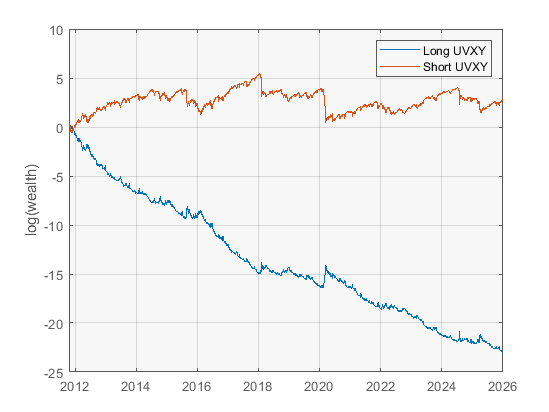

You can make the trade look much better than it is by plotting the collapse in your log(wealth) from being long, but that doesn't mean shorting it is a good idea, as you can see from the red line in my chart. That's volatility drag baby!

You can make the trade look much better than it is by plotting the collapse in your log(wealth) from being long, but that doesn't mean shorting it is a good idea, as you can see from the red line in my chart. That's volatility drag baby!

https://twitter.com/abetrade/status/2002340873170772192I do find it funny that the discussion gets framed as “retail vs quant” or sometimes “discretionary vs quant” which is not the framing I use at all.

I think 4-5 people got this exactly right, and a few more had answers along the right lines but didn't mention some key detail. This is the first definitely correct answer that I saw -

I think 4-5 people got this exactly right, and a few more had answers along the right lines but didn't mention some key detail. This is the first definitely correct answer that I saw - https://x.com/QuantCretin/status/1884914808077558054

https://twitter.com/__paleologo/status/1796327148996923642In quant firms, proprietary signal research can uncover new, idiosyncratic alphas (which causes firms to decorrelate). But over time these ideas diffuse (researchers and PMs move between firms and take ideas with them) which causes them to correlate and crowd into the same names.

https://twitter.com/lex_investing/status/1790724775993594162It's pretty easy to figure out, since the net returns are listed along with the fund size at the end of year year, so we can approximately know how much capital was allowed to remain within the fund and how much was returned.

https://twitter.com/macrocephalopod/status/1764385249377583333Intuitively that seems mispriced, but how can we sharpen that up a bit? Let's convert it to a derivative contract. The bet (from Peter's pov) is equivalent to paying $100,000 to buy a contract that pays out $120,000 if BTC/USD hits 100k.

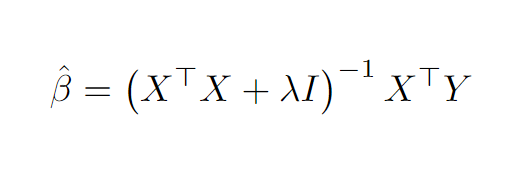

If you've normalized the columns of X so that the diagonal of X'*X are all 1s, then there's a nice interpretation of this - ridge regression both shrinks X'*X toward the identity matrix (ignoring correlations between features) and shrinks coefficients by a factor of 1+lambda

If you've normalized the columns of X so that the diagonal of X'*X are all 1s, then there's a nice interpretation of this - ridge regression both shrinks X'*X toward the identity matrix (ignoring correlations between features) and shrinks coefficients by a factor of 1+lambda

We were long this name for a while (a little unusual - the holding period for this strategy is around a day) and here I've normalized our dollar position by dividing by our max pos. We won't buy any more when this ratio is above 1, and we start selling when it's above 1.15ish

We were long this name for a while (a little unusual - the holding period for this strategy is around a day) and here I've normalized our dollar position by dividing by our max pos. We won't buy any more when this ratio is above 1, and we start selling when it's above 1.15ish

The quantities are all rescaled/renormalized btw, they don't tell you anything about the answer.

The quantities are all rescaled/renormalized btw, they don't tell you anything about the answer.

https://twitter.com/deleteevelyn/status/1661051744887906306Guadalajara

https://twitter.com/chameleon_jeff/status/1642198518319452160Another great trick is on exchanges that allow users to put stop loss orders directly in the matching engine. If you know what to look for you can identify these and it can be a strong signal that the price is going to move a *lot* once it hits a certain level.

https://twitter.com/kayfabed/status/1436496883518693376

https://twitter.com/quant_arb/status/1633639047070359554How does it work? You pay a fee to take the "FTMO challenge" which is a 30 day period where you trade an FX account. The fee varies depending on account size, from $155 for a $10k account to over $1000 for a $200k account.

https://twitter.com/robertgriker/status/1626604226792103936

Oh my god it’s even more meta than I realised, he sells online courses which coach you to build your own online coaching course.

Oh my god it’s even more meta than I realised, he sells online courses which coach you to build your own online coaching course.