How to get URL link on X (Twitter) App

It says that many a times, we are the one standing between a wealthy and our mediocre life 😊

It says that many a times, we are the one standing between a wealthy and our mediocre life 😊

One needs at least one subjective piece of the puzzle to put it together: an individual’s acceptance to risk.

One needs at least one subjective piece of the puzzle to put it together: an individual’s acceptance to risk.

Science says we express our emotions in the same six ways. Many believe that when a trader is successful, he trades without emotions.

Science says we express our emotions in the same six ways. Many believe that when a trader is successful, he trades without emotions.

.. growing, then we are now the problem. We are not responsible for our traumas but we are responsible for breaking the cycle and not hurting the people that love us.

.. growing, then we are now the problem. We are not responsible for our traumas but we are responsible for breaking the cycle and not hurting the people that love us.

https://twitter.com/madan_kumar/status/1559540334832472064

1. He cannot be a teacher only. His primary occupation must be trading (albeit a consistently successful trade).

1. He cannot be a teacher only. His primary occupation must be trading (albeit a consistently successful trade).

Think about this...Before we embark on a road trip, i always wash my car (along with filling my tires with air and the tank with petrol). Not only is a clean machine more pleasing to the eyes, but a clean windshield is more transparent to the eyes 😅

Think about this...Before we embark on a road trip, i always wash my car (along with filling my tires with air and the tank with petrol). Not only is a clean machine more pleasing to the eyes, but a clean windshield is more transparent to the eyes 😅

Usually, traders have inflated ego. Who does not want to tell a great/big story? They tell how grt they are & how they just breezed through the hurdles of trading😊

Usually, traders have inflated ego. Who does not want to tell a great/big story? They tell how grt they are & how they just breezed through the hurdles of trading😊

Identifying these TA patterns is a big conundrum by itself. No question about it.

Identifying these TA patterns is a big conundrum by itself. No question about it.

There are 3 parts in bringing about a change in our behavior -

There are 3 parts in bringing about a change in our behavior -

Being realistic about

Being realistic about

1. Many folks talk about the right attitude for getting successful in the markets. Why that 'right' attitude is needed?

1. Many folks talk about the right attitude for getting successful in the markets. Why that 'right' attitude is needed?

Even when it is a relatively minor point like what shower-gel/shampoo to buy, many of us will clutch to our opinions like a dog with a bone.

Even when it is a relatively minor point like what shower-gel/shampoo to buy, many of us will clutch to our opinions like a dog with a bone.

When one gets stopped out of a trade, it is just 'exiting' the trade right? True but there are certain follow-up Qs that can arise in a trader's mind

When one gets stopped out of a trade, it is just 'exiting' the trade right? True but there are certain follow-up Qs that can arise in a trader's mind

I would like to call myself as a trader rather than restricting to mere terms like option 'Buyer' or 'Seller'

I would like to call myself as a trader rather than restricting to mere terms like option 'Buyer' or 'Seller'

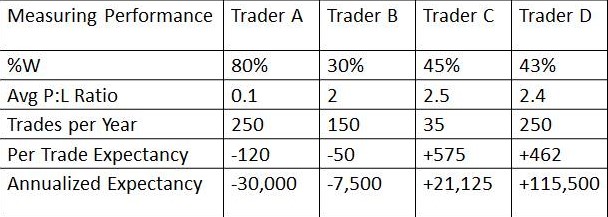

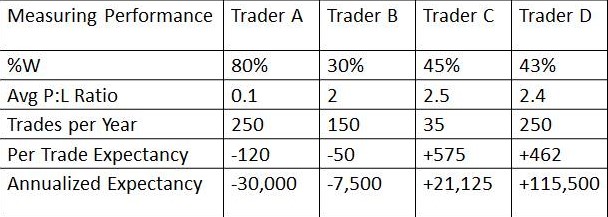

Expectancy of 0.2 means that we make 20 paise for every rupee we risk.

Expectancy of 0.2 means that we make 20 paise for every rupee we risk.

1. Do we have a stoploss?

1. Do we have a stoploss?

Lets assume that we are doing white water rafting in Ladakh/Manali or Grand Canyon 😊

Lets assume that we are doing white water rafting in Ladakh/Manali or Grand Canyon 😊

If we really think about it hard, trading is just a 'waiting' game. Most of trading involves only waiting. Nothing beyond that.

If we really think about it hard, trading is just a 'waiting' game. Most of trading involves only waiting. Nothing beyond that.

Trading seminars/books are not helping much in changing this thought process as most of them focus on the holy-grail entry method

Trading seminars/books are not helping much in changing this thought process as most of them focus on the holy-grail entry method