VC at https://t.co/uqjRTzPylx

https://t.co/F8MJ4G0LIL

Investor. Fintech. Saas.

How to get URL link on X (Twitter) App

Okay, this mn, bn and all in INR context confuses me and this confused me even more!

Okay, this mn, bn and all in INR context confuses me and this confused me even more!

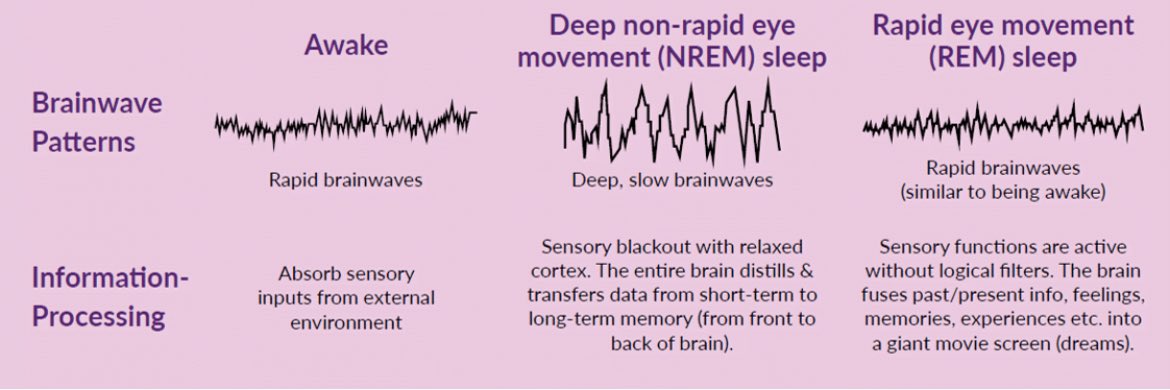

https://twitter.com/marginalideas/status/1735688069561581717The sheer disruption caused by even one day of bad sleep is enough to put you into state which is worse than a pre-diabetic one. It impacts both physical as well as emotional well being.

2. So do Bench press, Dumbell presses for chest. Bent over rows and Lat pull downs for Back, Squats and Hip thrusts for legs and glutes, Shoulders presses and lateral flys for shoulders. If you do only these, you are 90% sorted when it comes to workouts.

2. So do Bench press, Dumbell presses for chest. Bent over rows and Lat pull downs for Back, Squats and Hip thrusts for legs and glutes, Shoulders presses and lateral flys for shoulders. If you do only these, you are 90% sorted when it comes to workouts.

..that really got under my skin. I think I was in 7th then and had just learnt English (We started english in class 5th then). It was a difficult read lead me to buy Oxford dictionary (the Concise version - Had money only for that. I got to meet him some time later on...

..that really got under my skin. I think I was in 7th then and had just learnt English (We started english in class 5th then). It was a difficult read lead me to buy Oxford dictionary (the Concise version - Had money only for that. I got to meet him some time later on...

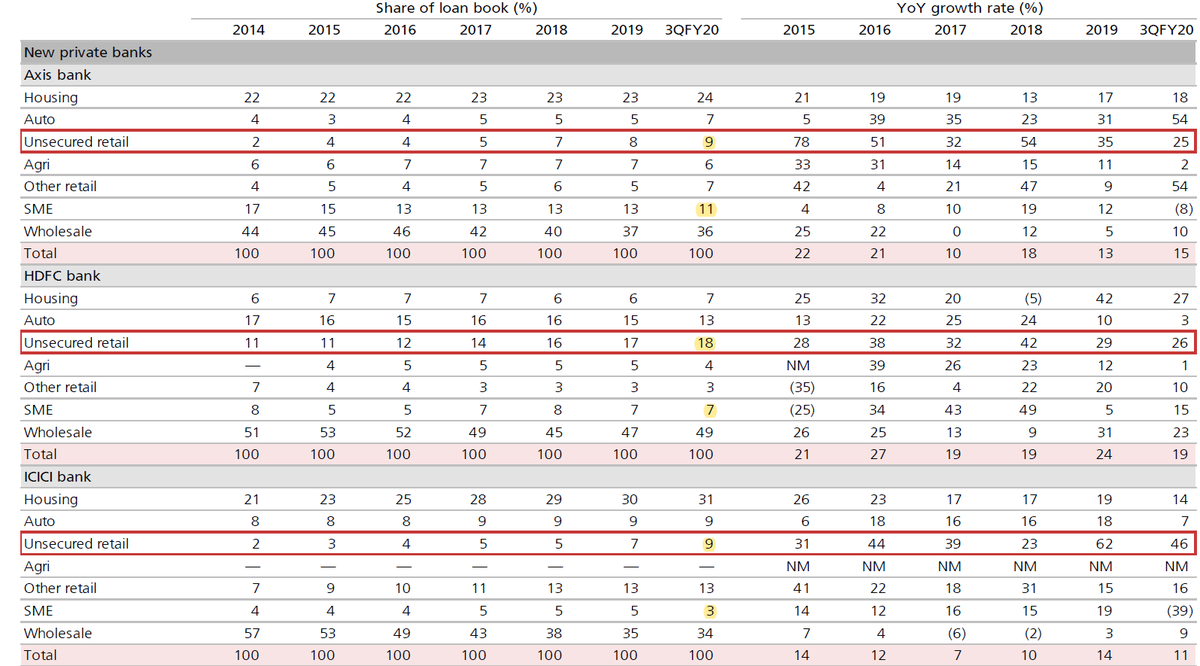

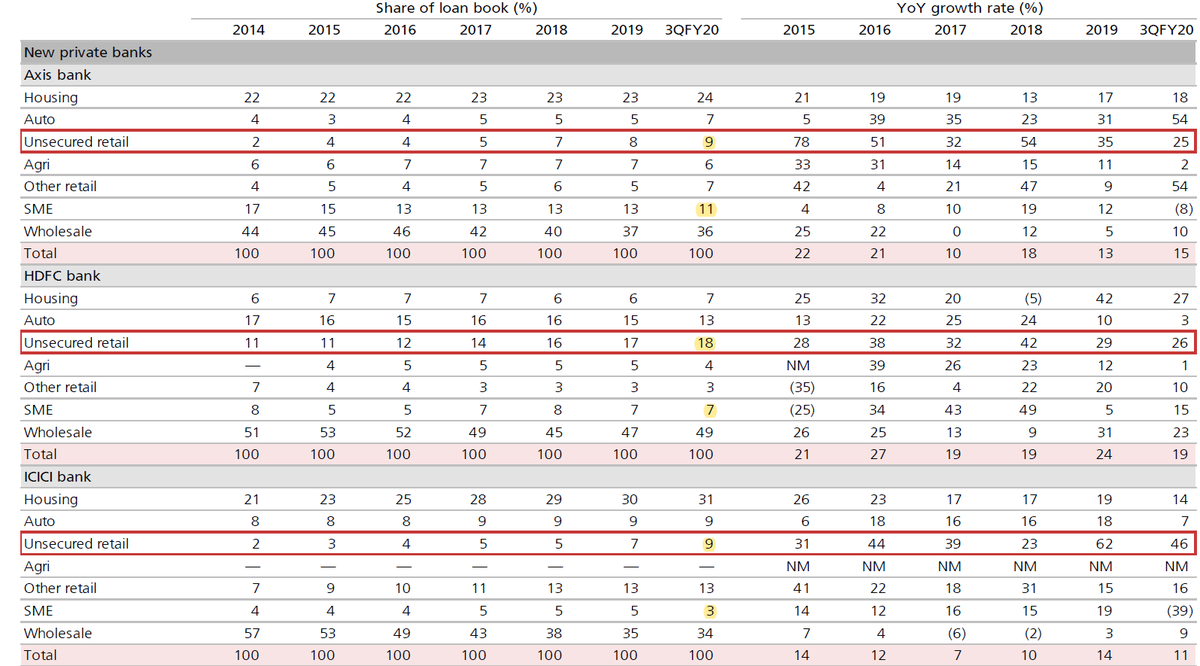

City union bank looks to be in tight situation with ~50% of loan book from SMEs. DCB is faring better than my expectations.

City union bank looks to be in tight situation with ~50% of loan book from SMEs. DCB is faring better than my expectations.

1. One of the most important assertions of the author is that “Things go wrong more often than they go right”. Failure is the common outcome of any business venture and this doesn’t necessarily have to be frauds. Good, smart people fail. And one of the key reasons is they fail...

1. One of the most important assertions of the author is that “Things go wrong more often than they go right”. Failure is the common outcome of any business venture and this doesn’t necessarily have to be frauds. Good, smart people fail. And one of the key reasons is they fail...

1. In Short, HDFC bank has not done anything unique. Doing very ordinary things in ordinary ways with extraordinary execution and redefining the distinction between real risks and perceived risks are what make HDFC bank different from the rest.

1. In Short, HDFC bank has not done anything unique. Doing very ordinary things in ordinary ways with extraordinary execution and redefining the distinction between real risks and perceived risks are what make HDFC bank different from the rest.