Personal CFO serving top performers in technology, small business, and crypto • Instructor of Financial Planning & Tax @ UCLAExt • V’s Dad • Tweets ≠ Advice

How to get URL link on X (Twitter) App

When DeepSeek hit the headlines this year, NVIDIA lost ~$590B in a day...the biggest single day wipeout of market cap ever.

When DeepSeek hit the headlines this year, NVIDIA lost ~$590B in a day...the biggest single day wipeout of market cap ever.

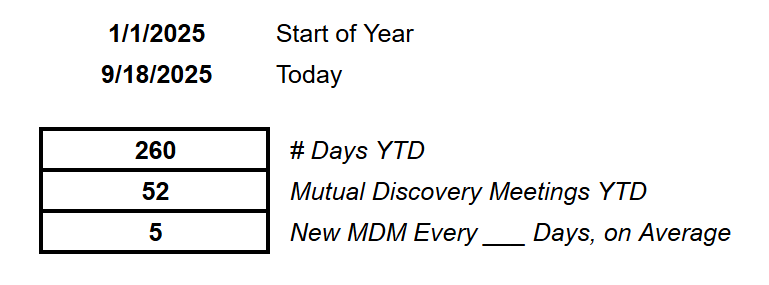

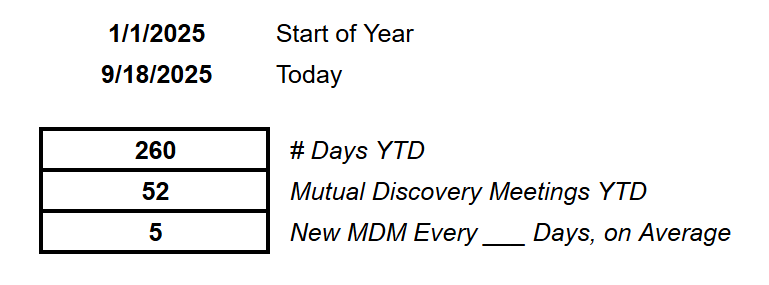

When I started out in financial planning, my income was capped.

When I started out in financial planning, my income was capped.

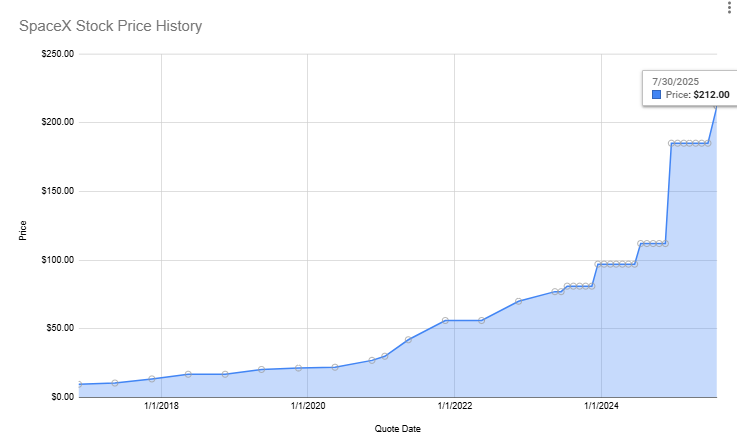

@SpaceX @SpaceX's current tender offer deadline is today.

@SpaceX @SpaceX's current tender offer deadline is today.

1. A quick refresher: What is an IPO?

1. A quick refresher: What is an IPO?

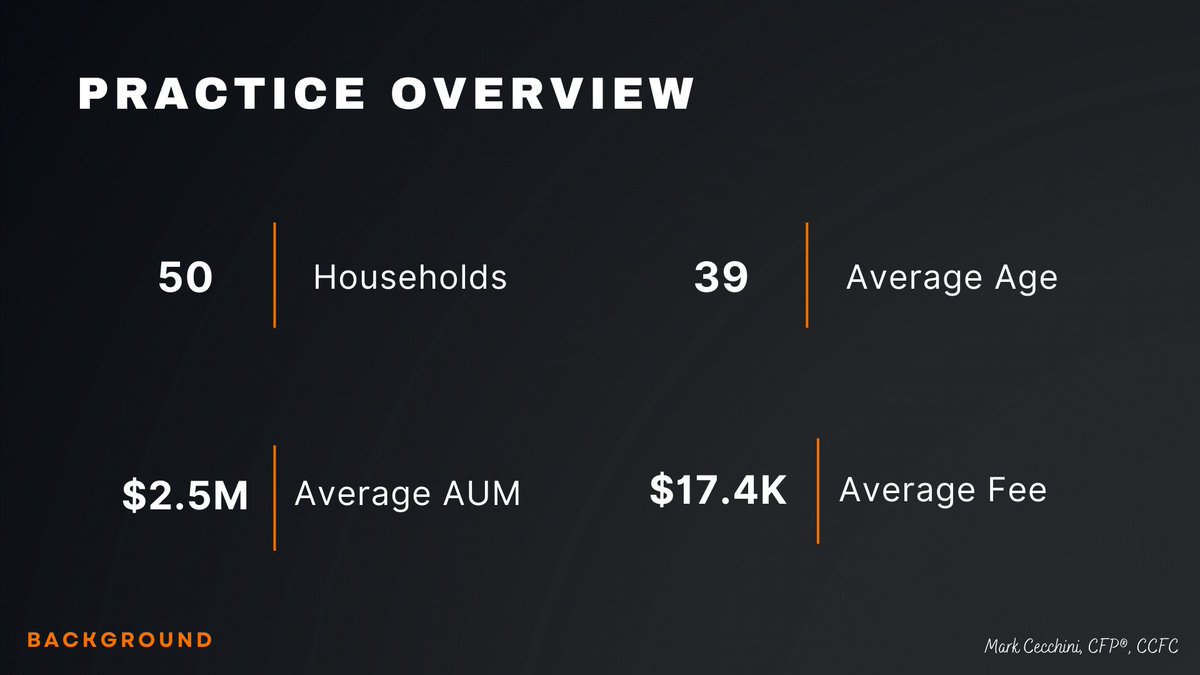

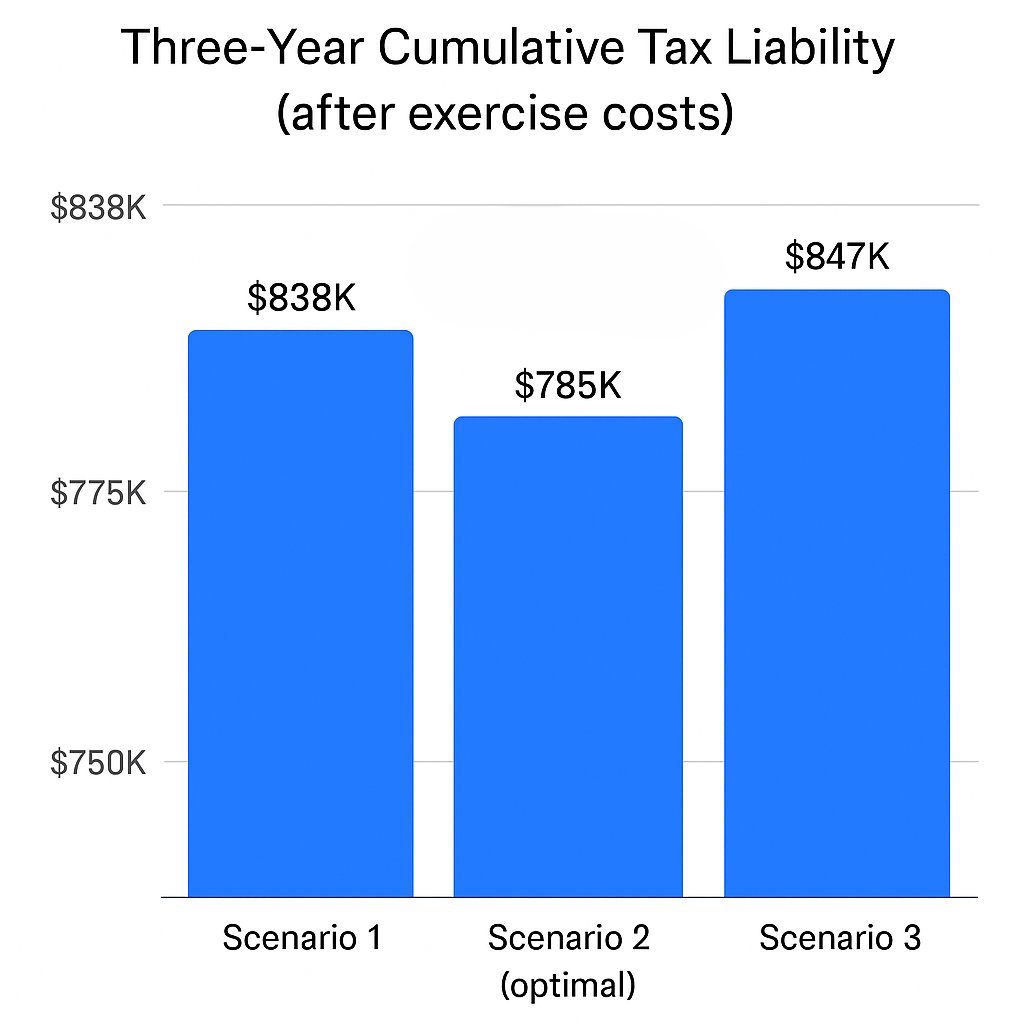

If you think this is a fantasy tax loophole and never happens in real life, think again.

If you think this is a fantasy tax loophole and never happens in real life, think again.

https://twitter.com/881486490/status/1803413088537882896