How to get URL link on X (Twitter) App

https://x.com/mcopelov/status/1354080164767027200

https://twitter.com/Acyn/status/1827713035018153997I guess it's fine if the journalistic purpose here is to then write, "JD Vance lies about tariffs." But that's almost certainly not what's going on here, & we'll almost certainly get future articles about the <debate> over tariffs, tax cuts, etc.

https://twitter.com/mcopelov/status/1562140087051341824Another is that the media has shown little interest in seriously covering the details, complexities, tradeoffs, or consequences of Biden's foreign policies, as illustrated by its utterly shameful behavior during the 🇦🇫 withdrawal & 👇now re: peace & war:

https://x.com/mcopelov/status/1822012390747119850

https://twitter.com/atrupar/status/1821730651977945228No one could possibly have predicted that the Trump press conference would turn out this way, or that we'd see entirely different standards requested of the Democrats when it comes to answering questions, offering policy specifics, & all the other things.

https://x.com/mcopelov/status/1821551232542019821

https://twitter.com/DKThomp/status/1816136084297773155

We could have avoided the deeply parochial story about 🇺🇸 inflation by following the freely-available monthly-data that @OECD puts out, which showed that Joe Biden & US fiscal policy were not remotely the main culprit. We knew that way back in 2022-23.

We could have avoided the deeply parochial story about 🇺🇸 inflation by following the freely-available monthly-data that @OECD puts out, which showed that Joe Biden & US fiscal policy were not remotely the main culprit. We knew that way back in 2022-23.https://x.com/mcopelov/status/1646338809410494464

https://twitter.com/atrupar/status/1809953674564718708Yes Biden’s age is a serious issue and he should probably step down. No, that’s not the main issue & it’s not the central problem facing the Republic. It’s just the easy thing to talk about because the other thing is so awful.

https://twitter.com/mcopelov/status/1809669740748562513

https://twitter.com/drvolts/status/1809324556684787874I don’t think Biden can stem the damage at this point, & he should probably step aside for Harris. Again, we could’ve discussed that a year ago, except for The Narrative™️. But folks didn’t want to do that, so I’m having a hard time taking their Fierce Urgency seriously now.

https://twitter.com/mcopelov/status/1808176362668106106

https://x.com/mcopelov/status/1244703486467551234?s=46&t=7vPh8b6DX37CeaMwRWTycg

https://twitter.com/mark_dow/status/1804515894934262162Not a single one of these men, Ferguson included, has been asked to explain why they signed this ridiculous letter. They just keep getting platformed as serious people, because apparently nothing matters.

https://twitter.com/mcopelov/status/1244708057852059649

https://twitter.com/JamesSurowiecki/status/1787171187564417288Signs you might be a far right authoritarian party (#2664):

https://x.com/brianklaas/status/1796289488450101593

https://twitter.com/elerianm/status/1786022287629566205

I am perfectly open to the possibility that people are Suffering From Inflation™️ & angry because they are being forced to curtail spending & consumption due to falling real wages/income. It's just that, month after month after month, there's ~no data to support this argument.

I am perfectly open to the possibility that people are Suffering From Inflation™️ & angry because they are being forced to curtail spending & consumption due to falling real wages/income. It's just that, month after month after month, there's ~no data to support this argument.

https://x.com/mcopelov/status/1778851474757628286?s=46&t=7vPh8b6DX37CeaMwRWTycg

https://twitter.com/BenjySarlin/status/1778816295644869076And, of course, it’s not actually all that big a difference anyway, despite it being everyone’s favorite talking point

https://twitter.com/MaxKennerly/status/1778848294266957848

https://twitter.com/gabelenz/status/1766463415059386848Prominent Dem Senators/governors could have challenged Biden, as McCarthy/RFK did in 1968 & TK did in 1980. They chose not to do so. Prominent GOPers did challenge Trump & got crushed. We should give voters credit for their choices & believe them when they tell us who they want.

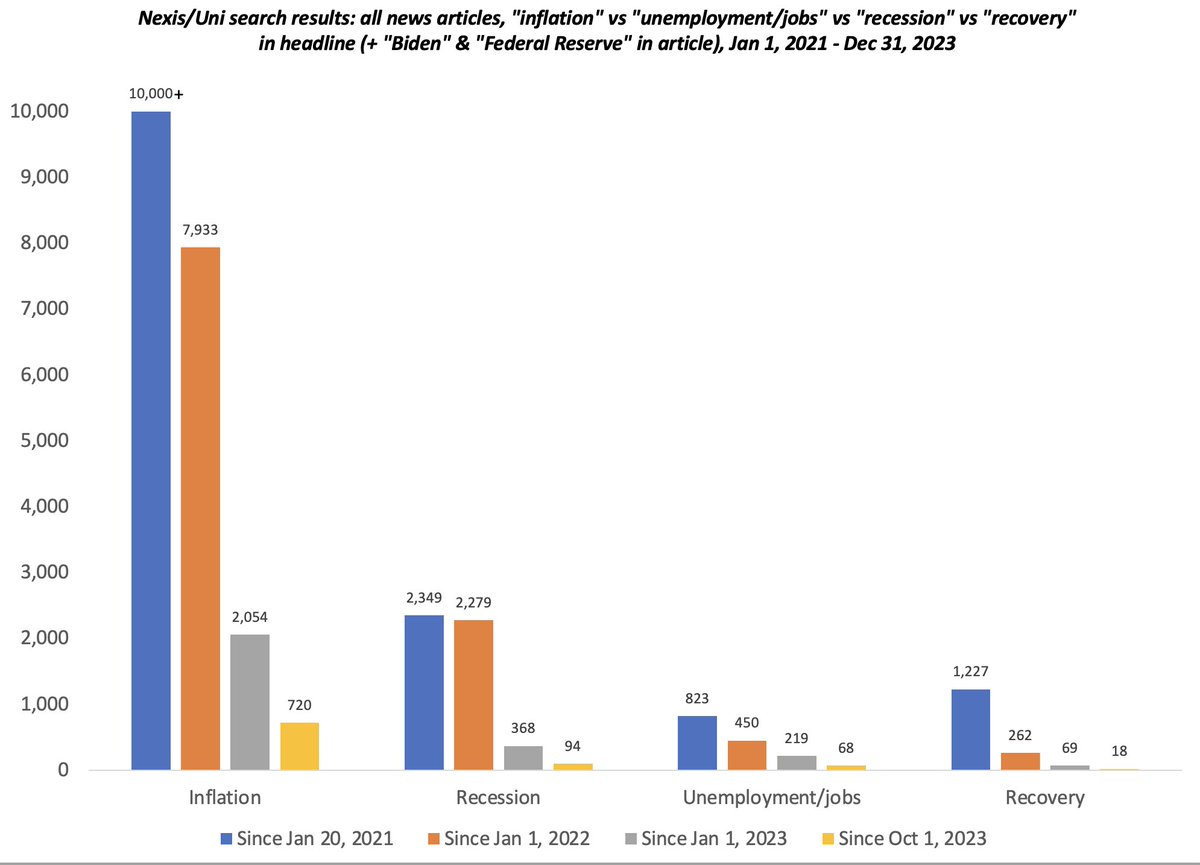

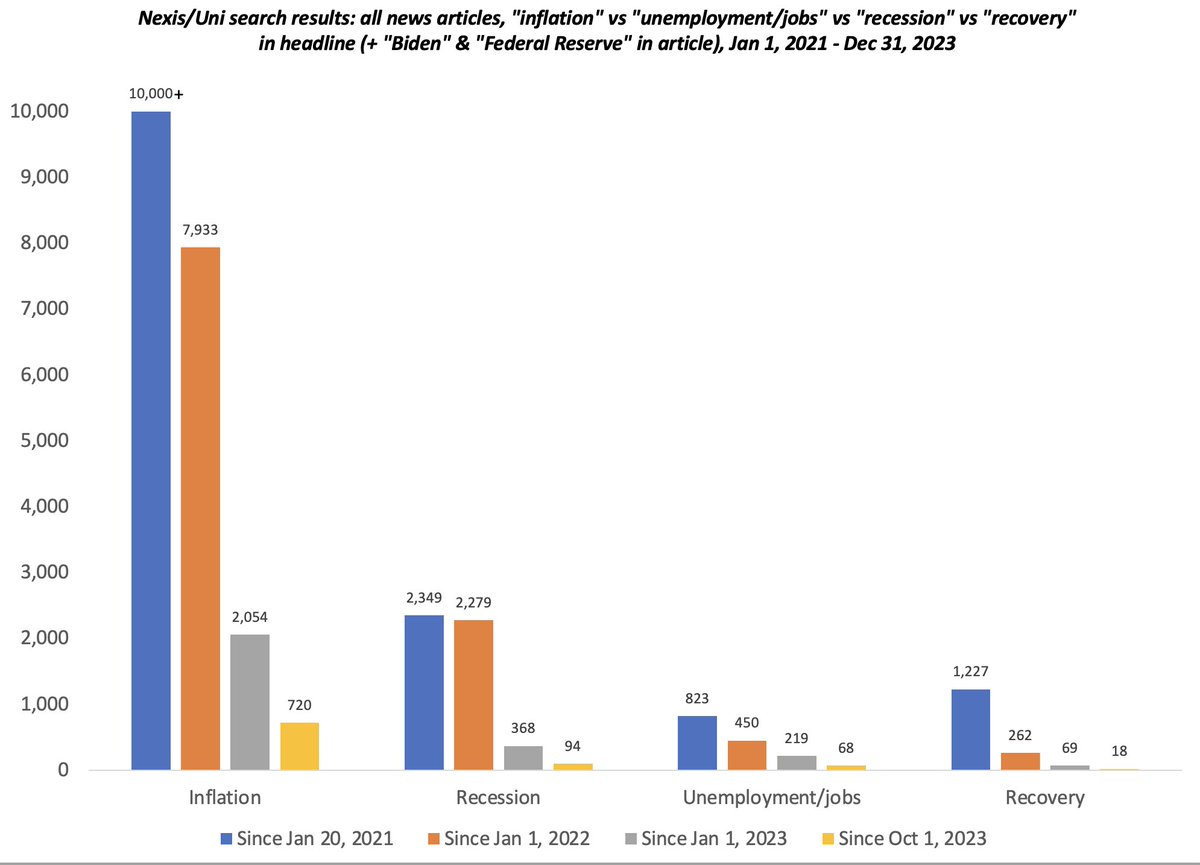

One can argue the tone's shifted, & that's likely true on inflation & recession since Oct, but framing even the good economic news through the lenses of inflation/recession still shapes public opinion. And the near total lack of coverage of the unprecedented recovery is shocking.

One can argue the tone's shifted, & that's likely true on inflation & recession since Oct, but framing even the good economic news through the lenses of inflation/recession still shapes public opinion. And the near total lack of coverage of the unprecedented recovery is shocking.

https://twitter.com/BloombergTV/status/1669500470560260096Politics. Politics, I tell you!

https://twitter.com/mcopelov/status/1669528398811545602

https://twitter.com/mcopelov/status/1512312609638334468?s=46&t=7vPh8b6DX37CeaMwRWTycg

https://twitter.com/jasonfurman/status/1669683338133622784Once again, the key takeaway here is that the story you were told for 2 years about 🇺🇸 fiscal policy being the main cause of inflation - & 🇪🇺 being supporting evidence - was a deeply parochial one that could have been avoided by tracking the freely available cross-national data.

https://twitter.com/mcopelov/status/1646331937282469889

https://twitter.com/IvoHDaalder/status/1669053495767359520It will still be states, climate change edition

https://twitter.com/PObbard/status/1669171495711518720?s=20

https://twitter.com/mcopelov/status/1644800769969758210?s=20)

https://twitter.com/mcopelov/status/1666453919600373761?s=20)

https://twitter.com/jasonfurman/status/1666528690103111692Lots of folks seem to be arguing 2. I don't know anyone serious who's claiming 1 is "easy." And again, the asymmetry of the concern about getting quickly back to 2% starkly constrasts with the notable lack thereof during a decade of undershooting.

https://twitter.com/mcopelov/status/1655626545686360077?s=20

https://twitter.com/mcopelov/status/1580176744795238405?s=46&t=7vPh8b6DX37CeaMwRWTycg

https://twitter.com/zachdcarter/status/1666449303244623879

This view is how we undershot the inflation target for most of a decade

This view is how we undershot the inflation target for most of a decade https://twitter.com/mcopelov/status/1655626545686360077

https://twitter.com/matthewstoller/status/1666098667537977344

Re: Clinton: The idea that the late 1990s was a time for the country issuing the global reserve currency to run a budget <surplus> given <gestures at interest rates, global capital flows & decades of public underinvestment in everything> was just mind-boggling fiscal malfeasance.

Re: Clinton: The idea that the late 1990s was a time for the country issuing the global reserve currency to run a budget <surplus> given <gestures at interest rates, global capital flows & decades of public underinvestment in everything> was just mind-boggling fiscal malfeasance.

https://twitter.com/mcopelov/status/1657895658601295874?s=46&t=7vPh8b6DX37CeaMwRWTycg

https://twitter.com/lhsummers/status/1666038482748203010Yes, we should have a serious convo about debt, deficits, taxes, & spending. But if the same dire predictions made with debt/GDP at 40%, 60%, & 80% keep not happening, & 🇺🇸/world interest rates keep doing 👇, we need a different frame for understanding actual fiscal constraints.

https://twitter.com/mcopelov/status/1664628868836098049?s=20

https://twitter.com/PaulGoldman1/status/1665774245522161665

In re:

In re: https://twitter.com/mcopelov/status/1332224336728649729

https://twitter.com/michaelxpettis/status/1650874293147041793We're in the midst of a National Conversation™️ about how the country issuing the global reserve currency is on the brink of a debt crisis (

https://twitter.com/mcopelov/status/1649524605177012225?s=20), & panicking about 🇨🇳 taking over the world, when its debt burdens are far less sustainable than ours. It vexes me.