Modular infrastructure for permissionless LRT creation and curation.

//ALM acc: @mellowalm

How to get URL link on X (Twitter) App

2/ Read the full article, or dive in right here!

2/ Read the full article, or dive in right here!

You can also view the total up-to-date points for a single LRT on its dedicated page 👀

You can also view the total up-to-date points for a single LRT on its dedicated page 👀

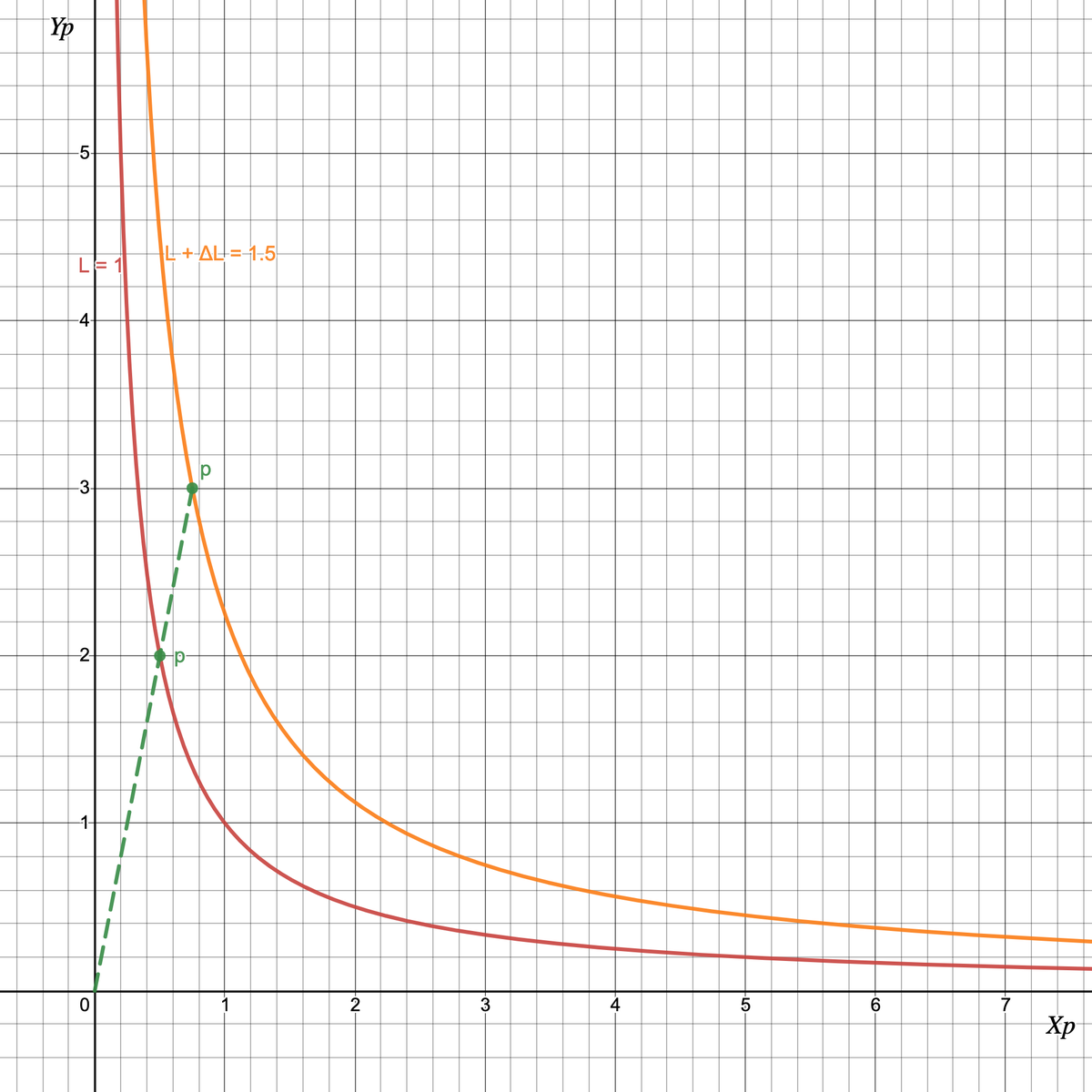

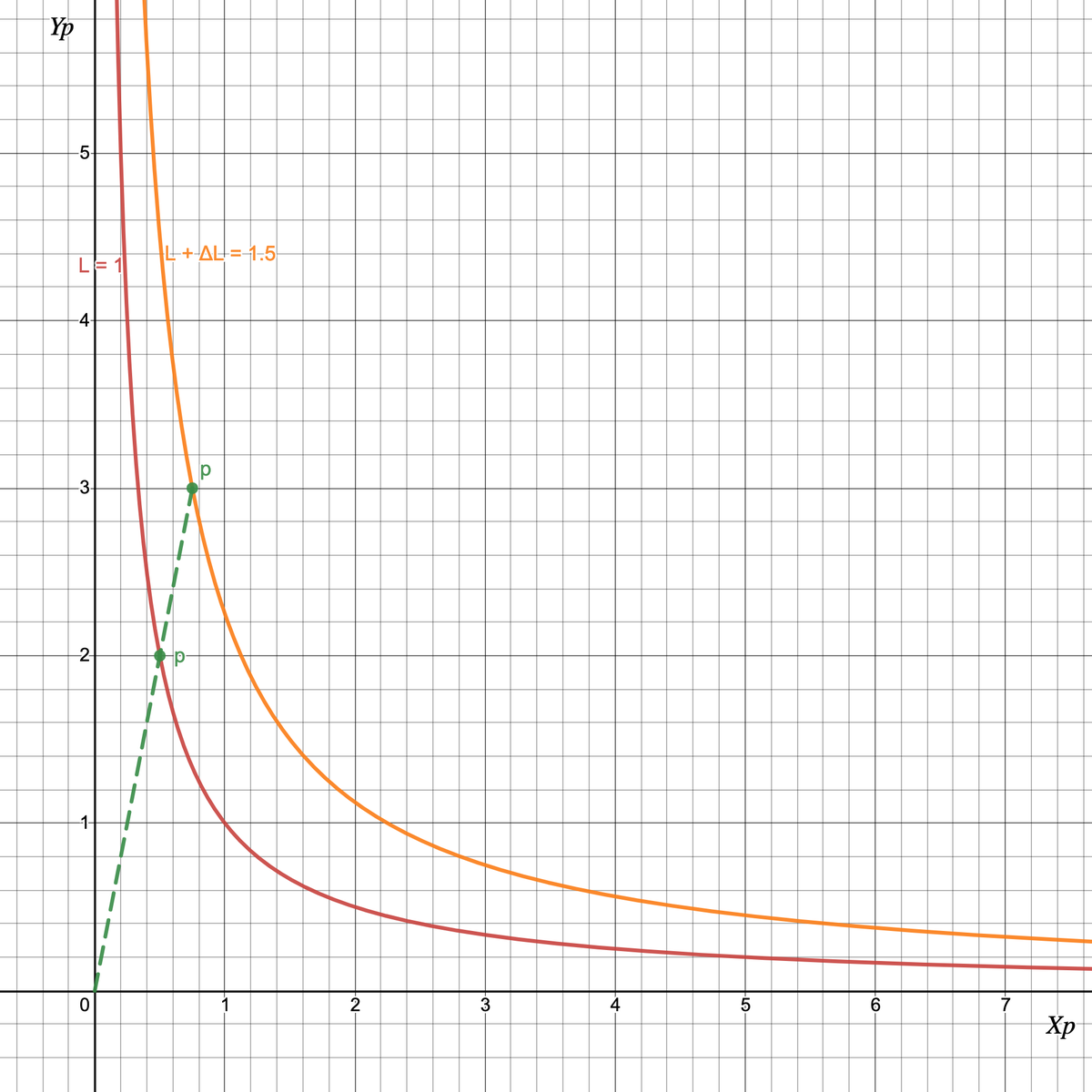

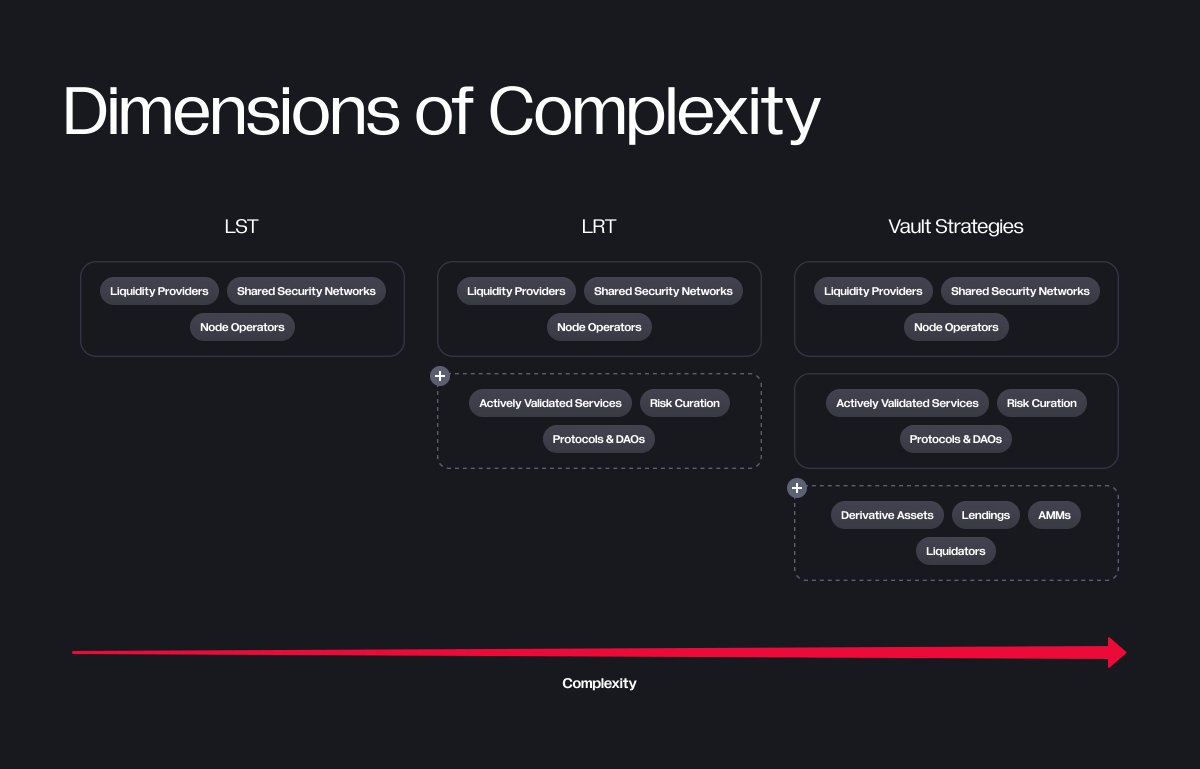

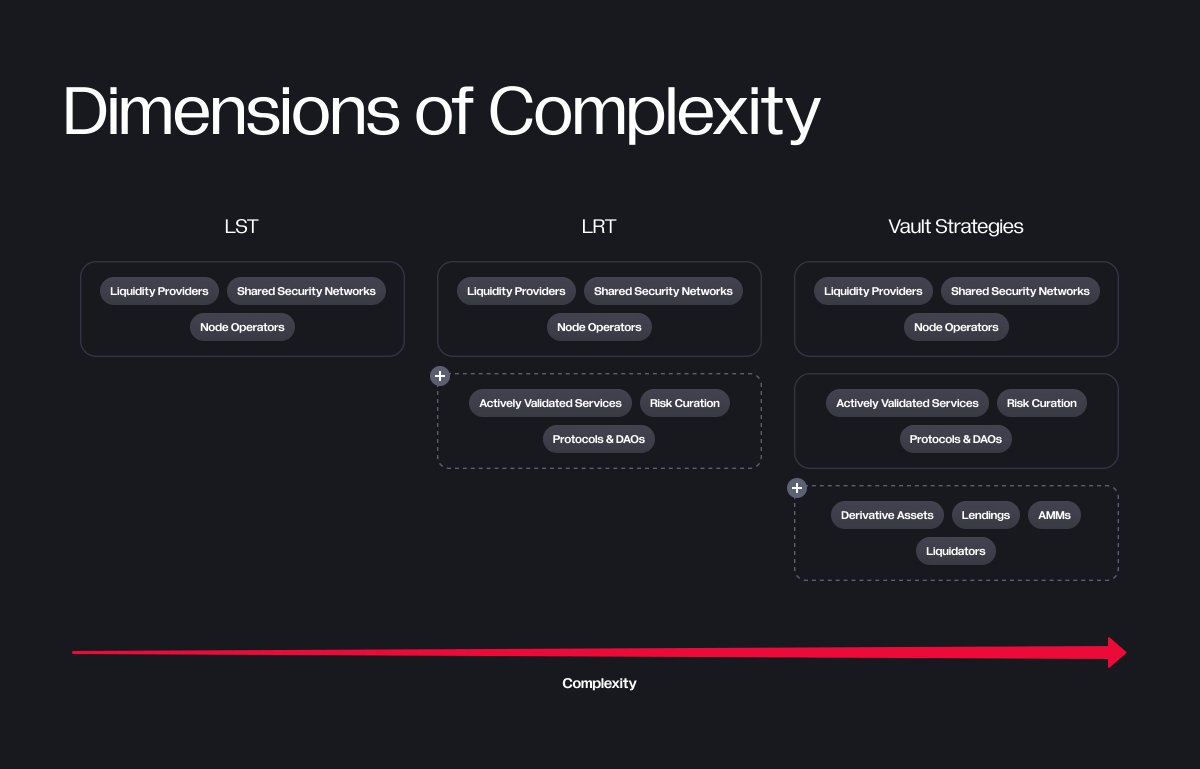

Some might want pooled risks in favor of higher yields, some would benefit from complete risk isolation. The goal is to create a level playing field where all the modular pieces can be plug-and-play both for networks and for their operators. That's what Mellow is about.

Some might want pooled risks in favor of higher yields, some would benefit from complete risk isolation. The goal is to create a level playing field where all the modular pieces can be plug-and-play both for networks and for their operators. That's what Mellow is about.

Renzo is one of the biggest restaking projects with over $3 billion in liquid restaking TVL.

Renzo is one of the biggest restaking projects with over $3 billion in liquid restaking TVL.

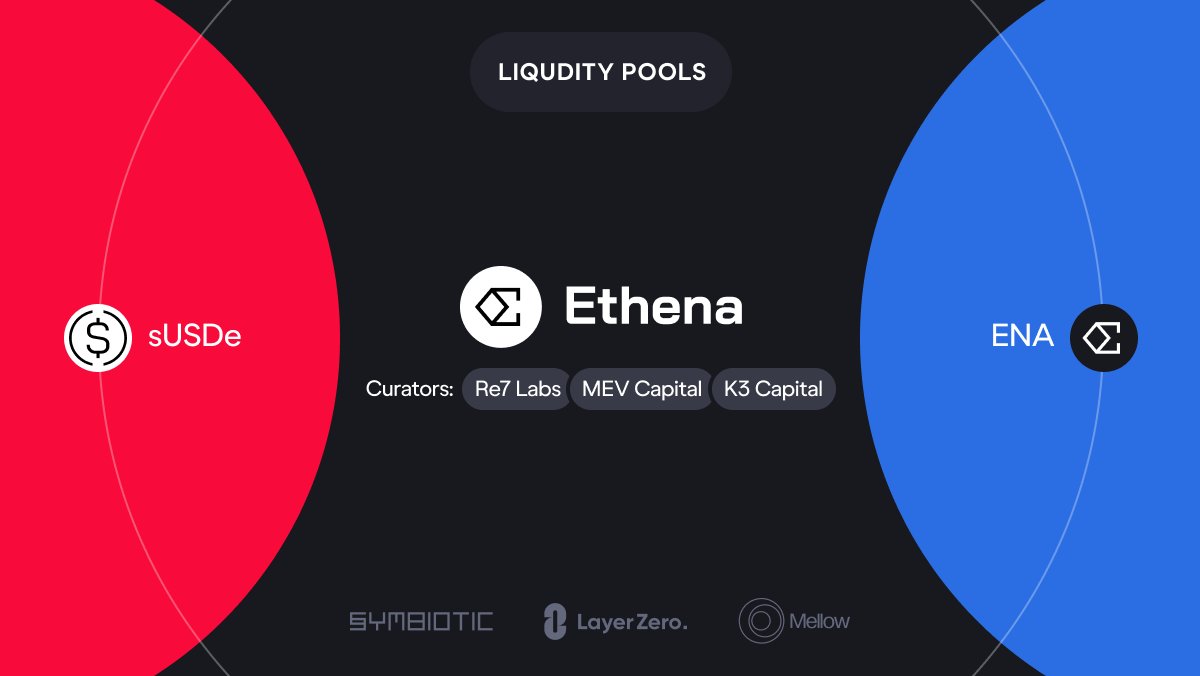

@LayerZero_Labs @Re7Capital @MEVCapital @k3_capital Now you can get rewards for staking $ENA in Mellow:

@LayerZero_Labs @Re7Capital @MEVCapital @k3_capital Now you can get rewards for staking $ENA in Mellow:

Pendle’s permissionless yield-trading protocol allows users to execute various yield-management and points-management strategies. Depending on whether you want fixed rates or points instead, you can choose from PTs, YTs, or even LPing with your Mellow LRTs.

Pendle’s permissionless yield-trading protocol allows users to execute various yield-management and points-management strategies. Depending on whether you want fixed rates or points instead, you can choose from PTs, YTs, or even LPing with your Mellow LRTs.

@spectra_finance is an EVM-centric protocol for interest rate derivatives with an easy-to-use flagship app. Their protocol is permissionless, meaning its services are entirely open for public use.

@spectra_finance is an EVM-centric protocol for interest rate derivatives with an easy-to-use flagship app. Their protocol is permissionless, meaning its services are entirely open for public use.

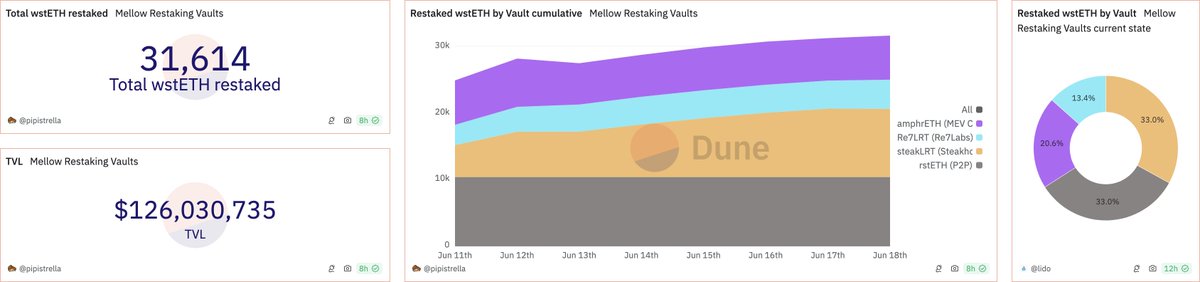

On July 11, Mellow launched with its first 4 curators: @SteakhouseFi @P2Pvalidator @Re7Capital @MEVCapital.

On July 11, Mellow launched with its first 4 curators: @SteakhouseFi @P2Pvalidator @Re7Capital @MEVCapital.

There are 400 possible positions of a chessboard after 1 move of white and black, and over 318 billion after four moves 🤯

There are 400 possible positions of a chessboard after 1 move of white and black, and over 318 billion after four moves 🤯

What's important to know about P2P? 🤔 Basically:

What's important to know about P2P? 🤔 Basically:https://twitter.com/1036942890340151296/status/1778388967940902972

That's why Mellow modular infrastructure is the perfect fit for different risk-adjusted models. Some like it raw, some like it medium, and it's up to risk curators and LPs to find the balance.

That's why Mellow modular infrastructure is the perfect fit for different risk-adjusted models. Some like it raw, some like it medium, and it's up to risk curators and LPs to find the balance.

And we're super excited to work with leading angels, builders and industry big brains👀🧠

And we're super excited to work with leading angels, builders and industry big brains👀🧠