Investor, consultant, editor in chief, interested in mega trends, energy, mining, tech - The more I learn, the more I realize how much I don‘t know. DYODD.

How to get URL link on X (Twitter) App

In Q2 2025, Newmont produced 1,478 million ounces of gold. Gold production was down 4%, but this was in line with the forecast due to the sale of non-core assets (see the sales of Tier-2 mines to e.g. Discovery Silver, Orla Mining) in order to focus on Newmont's Tier-1 portfolio.

In Q2 2025, Newmont produced 1,478 million ounces of gold. Gold production was down 4%, but this was in line with the forecast due to the sale of non-core assets (see the sales of Tier-2 mines to e.g. Discovery Silver, Orla Mining) in order to focus on Newmont's Tier-1 portfolio.

Newmont's attributable gold production increased 4% to 1.67 million ounces from the prior quarter primarily due to higher production at Cerro Negro.

Newmont's attributable gold production increased 4% to 1.67 million ounces from the prior quarter primarily due to higher production at Cerro Negro.

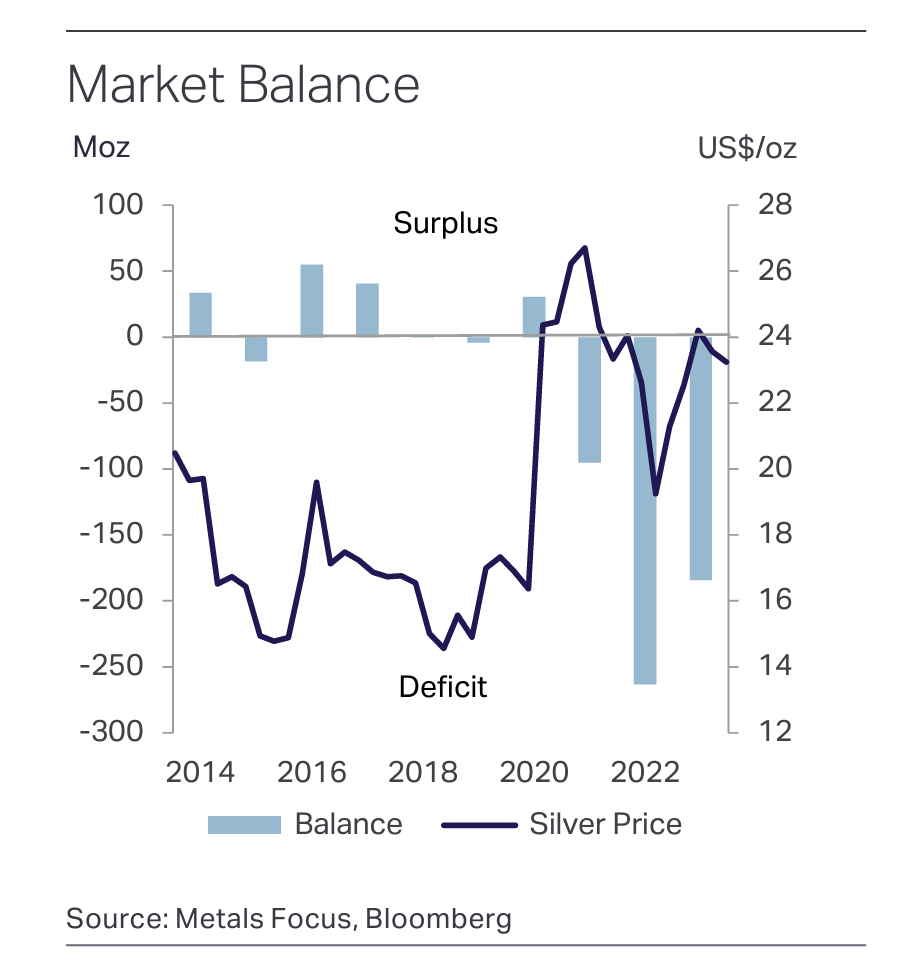

Another massive shortfall: The #silver market balance was again deeply negative in 2023. Global silver demand exceeded global silver supply by more than 180 million ounces. It was the second largest silver deficit of the past decade.

Another massive shortfall: The #silver market balance was again deeply negative in 2023. Global silver demand exceeded global silver supply by more than 180 million ounces. It was the second largest silver deficit of the past decade.

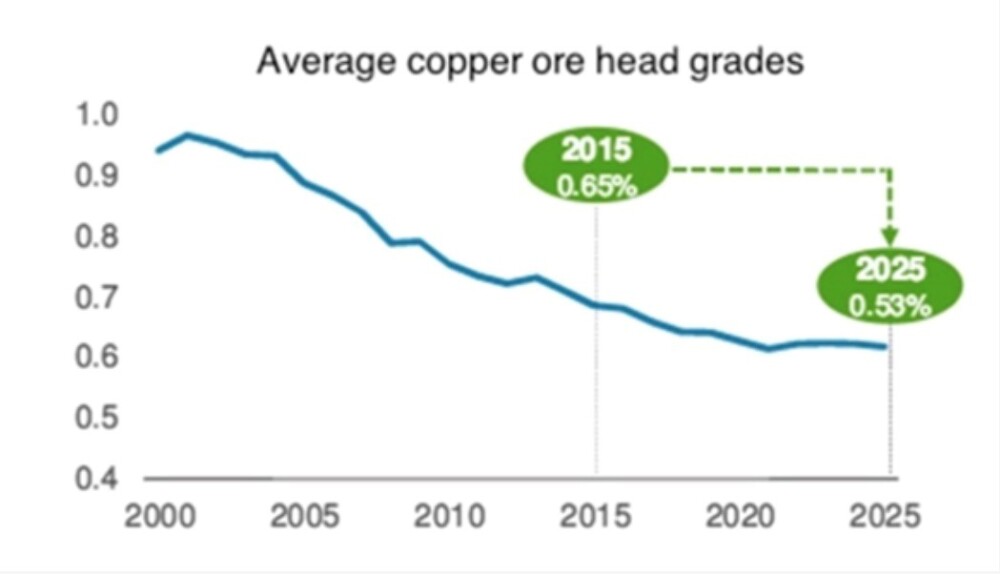

Big challenge: Copper mine grades have been declining for a long time and are still declining. #copper

Big challenge: Copper mine grades have been declining for a long time and are still declining. #copper

BHP, the world's largest raw materials group from Australia, is planning to increase its capital expenditure significantly to USD 10 billion per year. This is a significant increase in CAPEX. In recent years, BHP's total annual capital expenditure has typically been in the range of $6-7 billion.

BHP, the world's largest raw materials group from Australia, is planning to increase its capital expenditure significantly to USD 10 billion per year. This is a significant increase in CAPEX. In recent years, BHP's total annual capital expenditure has typically been in the range of $6-7 billion.

China, the world's largest copper producing and processing country, is struggling on its own.

China, the world's largest copper producing and processing country, is struggling on its own.

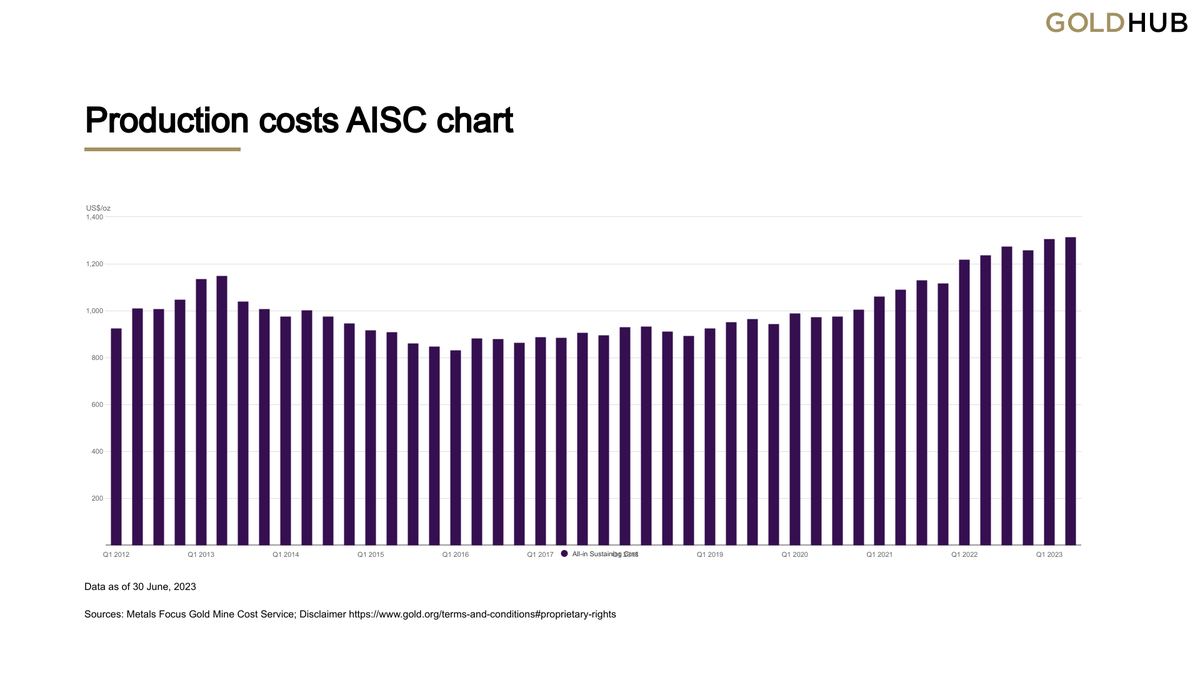

How are the All-In Sustaining Costs (AISC) calculated? Take a look at the list below. You will also see that AISC does not include all of a gold producer's costs. Details here: gold.org/download/file/…

How are the All-In Sustaining Costs (AISC) calculated? Take a look at the list below. You will also see that AISC does not include all of a gold producer's costs. Details here: gold.org/download/file/…

Cost Inflation

Cost Inflation

The largest mines dominate in negative production trend

The largest mines dominate in negative production trend