I shall now therefore humbly propose my own thoughts, which I hope will not be liable to the least objection.

https://t.co/NuC25VaSff

43 subscribers

How to get URL link on X (Twitter) App

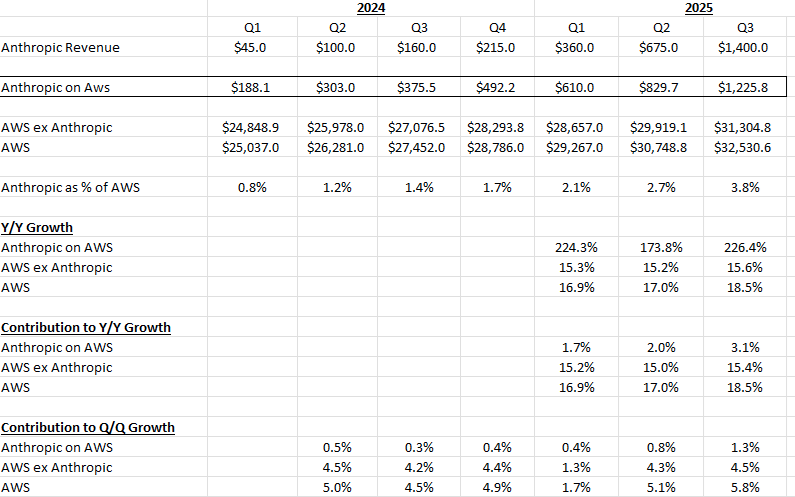

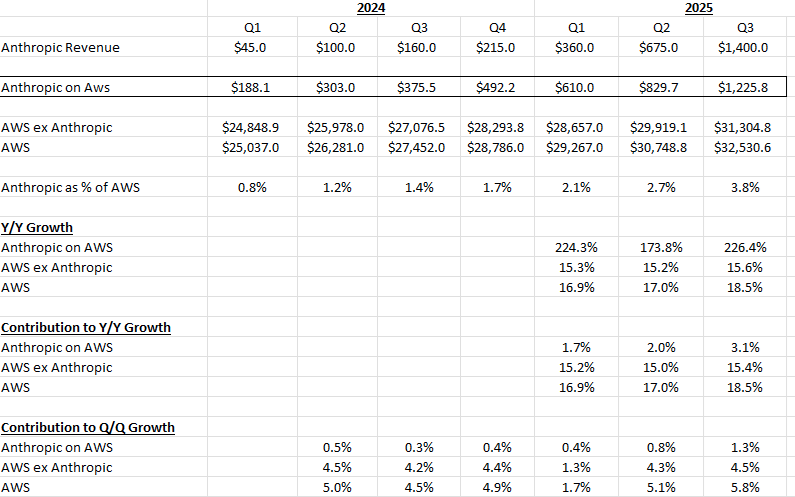

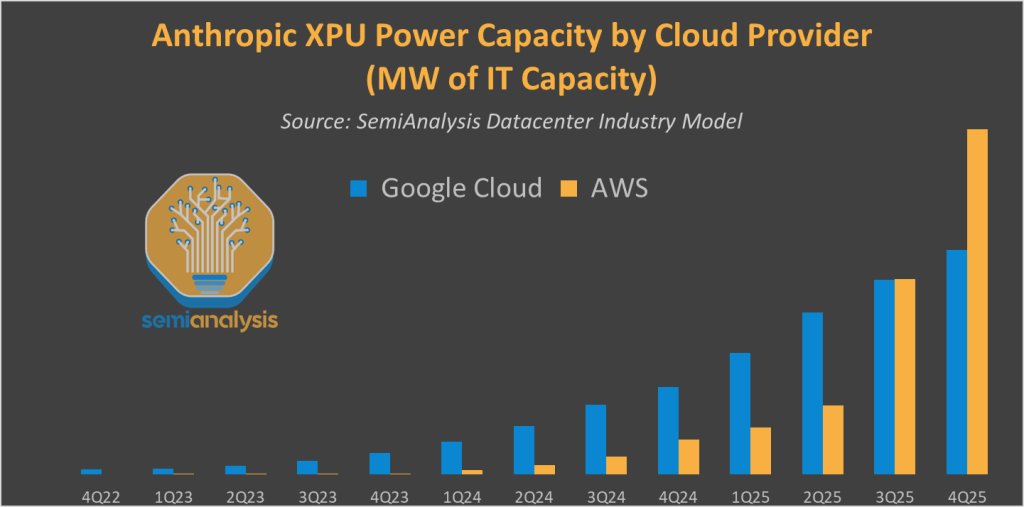

There are reasons for skepticism. Semianalysis showed that GCP was providing significantly more MWs to Anthropic than AWS up until this quarter, making the 2024 nums almost entirely reliant on training.

There are reasons for skepticism. Semianalysis showed that GCP was providing significantly more MWs to Anthropic than AWS up until this quarter, making the 2024 nums almost entirely reliant on training.

"Based on these estimates, Google is assuming around 180T AI text queries (both input and output) and 15T AI image queries. This is a staggering figure, as there are around 11T web search queries per year right now worldwide. Stated differently, Google’s AI capex assumes a market that is 15x-20x larger than the web search market by 2026"

"Based on these estimates, Google is assuming around 180T AI text queries (both input and output) and 15T AI image queries. This is a staggering figure, as there are around 11T web search queries per year right now worldwide. Stated differently, Google’s AI capex assumes a market that is 15x-20x larger than the web search market by 2026"

And then the Azure and Windows slides both have develop custom silicon chips as long term drivers. We knew that this was the case, but just interesting to see them highlight other co's successes and set goals for it.

And then the Azure and Windows slides both have develop custom silicon chips as long term drivers. We knew that this was the case, but just interesting to see them highlight other co's successes and set goals for it.

Great chart contextualizing Messi and Ronaldo’s goal scoring

Great chart contextualizing Messi and Ronaldo’s goal scoring

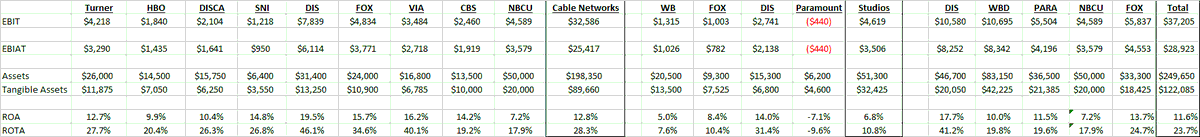

To start, I disaggregated 2016 media co's into Cable Nets and Studio to the extent possible. What you can see is that the Cable Nets earned extraordinary returns on tangible assets. These were amazing biz. Studios ex DIS were not nearly as good. On the right are the consolidated.

To start, I disaggregated 2016 media co's into Cable Nets and Studio to the extent possible. What you can see is that the Cable Nets earned extraordinary returns on tangible assets. These were amazing biz. Studios ex DIS were not nearly as good. On the right are the consolidated.

https://twitter.com/Jason/status/1649422446339006479I have yelled this into the wind for years, Twitter does not have a monetization problem. They monetize at a high level all things considered given their total lack of direct response. Instead they have a user issue. They are trying to "solve" if that's the word, the wrong issue.

Gorton also reiterates his view that financial crises are all about short term debt, and in this case the short term debt at root of the crisis was uninsured deposits. Says moral hazard is not a thing. And is very very worried about stablecoins.

Gorton also reiterates his view that financial crises are all about short term debt, and in this case the short term debt at root of the crisis was uninsured deposits. Says moral hazard is not a thing. And is very very worried about stablecoins.

https://twitter.com/crampell/status/1640374330721796097the government spent a bunch of money to prop up the economy and bridge households through a pandemic and... consumers don't remember getting the money or not losing jobs... but do remember the inflation that resulted. fascinating and has meaningful political ramifications IMO.

Zuck "early analysis of performance data suggests engineers who joined in-person and transferred to remote or remained in-person performed better than people who joined remotely... engineers earlier in their career perform better when work in-person at least three days a week"

Zuck "early analysis of performance data suggests engineers who joined in-person and transferred to remote or remained in-person performed better than people who joined remotely... engineers earlier in their career perform better when work in-person at least three days a week"

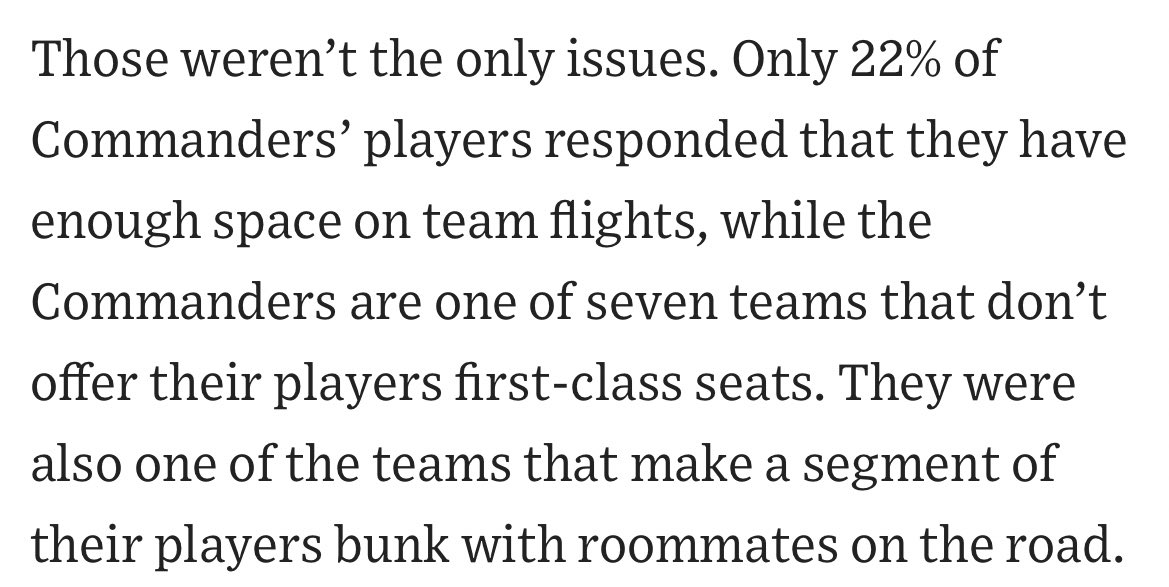

Life imitates Major League:

Life imitates Major League:

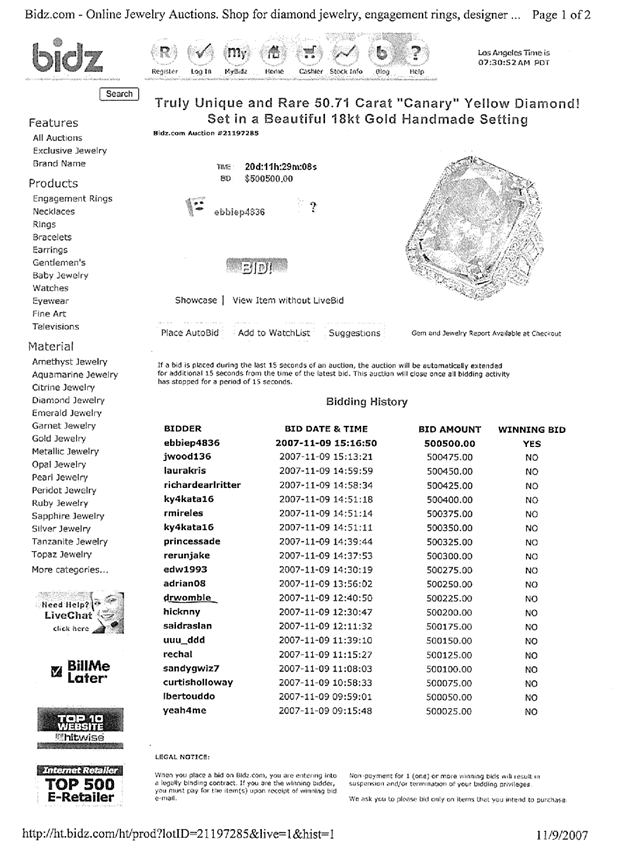

https://twitter.com/CapitalCap1tal/status/1628934815272644609Apparently there were tens of people willing to bid half a million dollars site unseen for a total unicorn of a stone