Buying monopolies, compounding forever. 🏰👔NFA

15% off stock research → https://t.co/HSOoLpIVrU

How to get URL link on X (Twitter) App

1/ The Business Model & Portfolio

1/ The Business Model & Portfolio

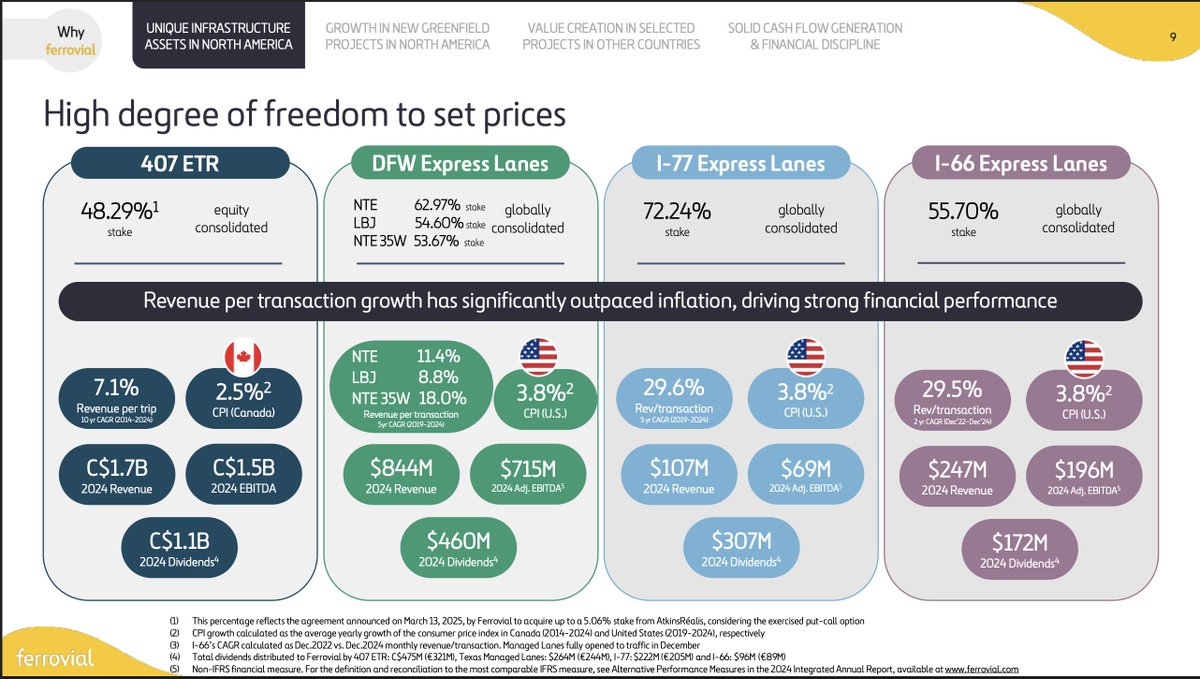

1. Toll Roads (Highways)

1. Toll Roads (Highways)

What They Do

What They Do

$BAM:

$BAM: