Apple / tech analysis. Founder/author https://t.co/lPSav2ULYE (@AboveAvalon) and https://t.co/aUaEhWriFN (@InsideOrchard). Check out my new show: @AvalonPod.

How to get URL link on X (Twitter) App

The odds of Musk leading a hostile takeover of Twitter went up when he turned down Twitter's board seat offer. Twitter was looking to control Musk and not have him grow his Twitter holdings beyond 14.9% of shares. Musk realized what Twitter was trying to do.

The odds of Musk leading a hostile takeover of Twitter went up when he turned down Twitter's board seat offer. Twitter was looking to control Musk and not have him grow his Twitter holdings beyond 14.9% of shares. Musk realized what Twitter was trying to do.

https://twitter.com/wsanchez/status/1502429045916459009With a timer, you often need to know how much time is remaining periodically through the timer.

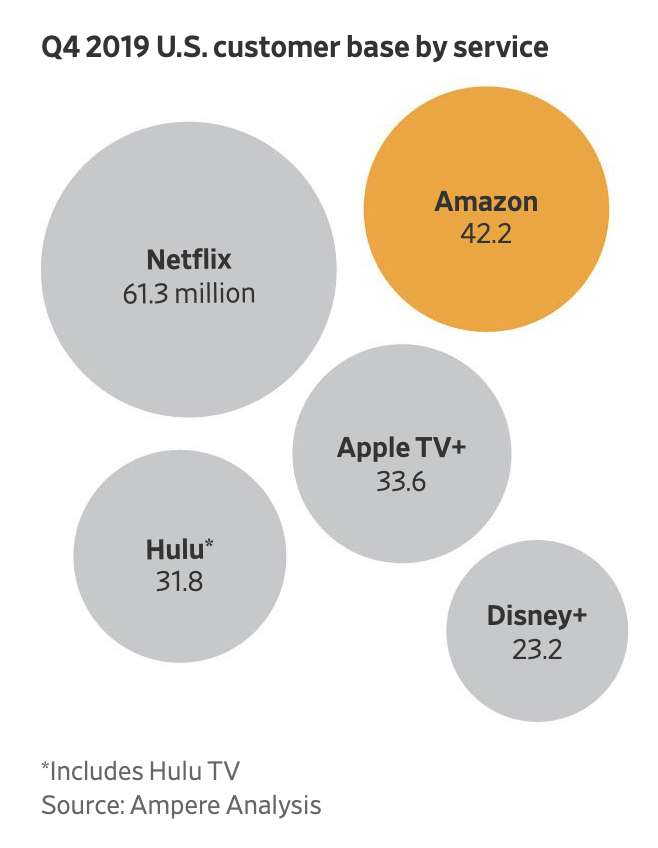

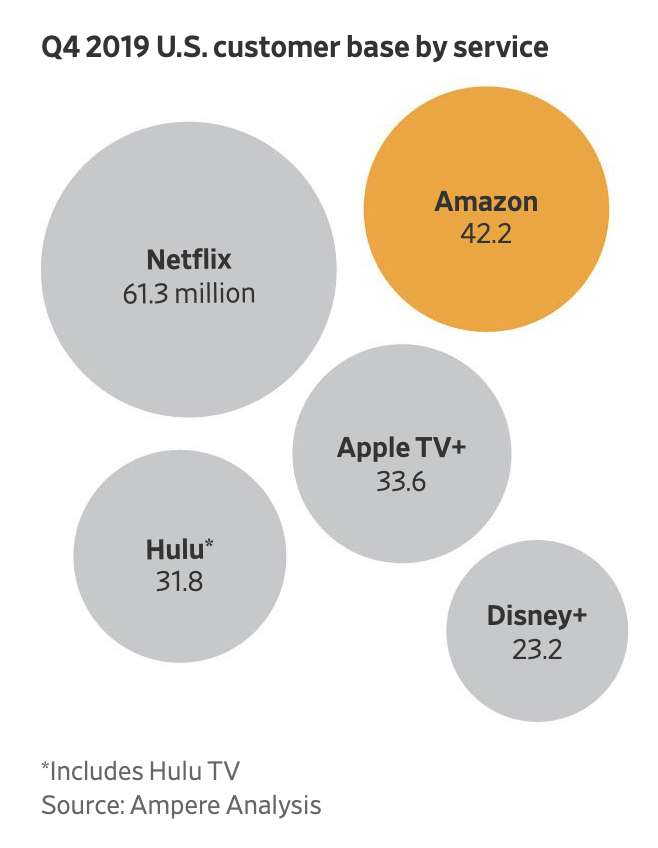

2 / We now have articles like the following (screenshot attached). This is how false narratives and misinformation spread. Notice how this 34 million subscriber number has seemingly taken on a life of its own. A closer look is needed to see what is actually going on here.

2 / We now have articles like the following (screenshot attached). This is how false narratives and misinformation spread. Notice how this 34 million subscriber number has seemingly taken on a life of its own. A closer look is needed to see what is actually going on here.